TU IS

Most investors will think of Microsoft (MSFT) as being a premier play on the growing influence of cloud computing. However, MSFT remains expensive despite its recent downturn. There are a number of players in this space, some with well-established track records that remain under the radar for most investors. This brings me to NetApp (NASDAQ:NTAP), which pays a far higher yield and trades at a much more attractive valuation. This article highlights why dividend growth investors may want to give NTAP a hard look, so let’s get started.

Why NTAP?

NetApp is a global cloud-led software company that enables its customers to lead with data-centric enterprise solutions. It provides systems, software, and cloud services that enable companies to run their applications optimally from data center to cloud, whether it be through public, private, or hybrid cloud environments.

NTAP boasts a strong portfolio of products that helps it compete in a number of areas, including All-flash storage, which is one of the hottest areas in storage right now and NTAP’s All Flash FAS systems are some of the best in the business. They offer industry-leading performance, scale, and density, and are perfect for demanding workloads such as artificial intelligence/machine learning, business analytics, databases, and virtual desktop infrastructure.

Moreover, NTAP’s Data Fabric solutions become increasingly important, as more and more companies move to a hybrid cloud approach, giving them flexibility. This software enables customers to manage, move, and protect data across any combination of on-premises, hybrid, or multi-cloud environments.

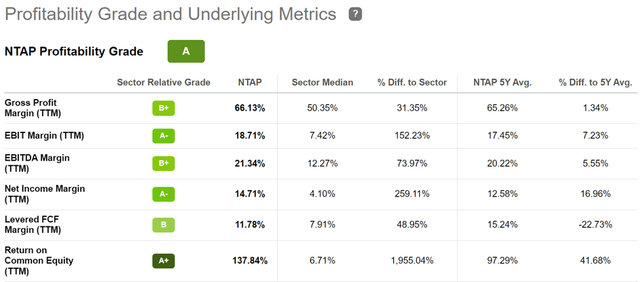

NTAP’s leading positions in its areas of expertise have enabled strong margins, resulting in an A score for profitability. As shown below, NTAP posts sector-leading EBITDA and Net Income Margins of 21% and 15%, respectively.

NTAP Profitability (Seeking Alpha)

Also, NTAP has been a serial repurchaser of its own shares, helping to enable a very strong return on equity. As shown below, it’s reduced an impressive 39% of its outstanding float over the past decade.

NTAP Shares Outstanding (Seeking Alpha)

Meanwhile, NTAP has demonstrated very strong growth in the current environment, with net revenues growing by 9% YoY (13% growth on a constant currency basis) to $1.59 billion in its fiscal Q1 FY23 (ended July 2022). Furthermore, the all important annual recurring revenue metric grew by a very strong 73% to $584 million, helping to ensure more stability of cash flows. Importantly, NTAP continues to be shareholder friendly, returning $460 million to shareholders in the form of share repurchases and dividends.

While NTAP is a high-quality business with strong positions in attractive areas, it’s not without risk. This includes stiff competition from the likes of Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) (GOOGL) in the cloud storage market. Include the potential for a turn in enterprise IT spending, as well as intensifying competition.

However, the story is not that simple, as many customers are turning to hybrid cloud environments (versus pure public), as this enables more control over their cloud environments than a traditional public cloud. This differentiation was noted by management during the recent conference call:

As organizations accelerate their data-driven digital and cloud transformations, our relevance grows. We are helping customers navigate disruption with a modern approach to hybrid multi-cloud infrastructure and data management.

The urgency to address these priorities increased with the COVID pandemic, and is further driven by the turbulent macro economy. Customers are searching for ways to reduce costs, improve flexibility, increase automation and accelerate application delivery in the public cloud, in their own data centers and in hybrid cloud environments. Our role in helping organizations achieve these transformation goals underpins our strategy and confidence in future growth.

Let me share with you a couple of examples how data intensive applications like AI drive demand for both our Public Cloud and Hybrid Cloud solutions. A global e-commerce company chose ONTAP AI for several AI workloads, including natural language processing, recommendation engines, and deep learning. Our ultra-high-performance storage, close partnership with NVIDIA and tight application integration were key to the win and the customer has realized better performance and reliability while reducing its operating costs and data center footprint.

Notably, NTAP maintains a strong BBB+ rated balance sheet, giving it the flexibility to reinvest in growth initiatives and continue share repurchases. It also currently yields 3%, and the dividend comes with a safe 37% payout ratio and a very impressive 21% 5-year CAGR and 9 years of consecutive growth.

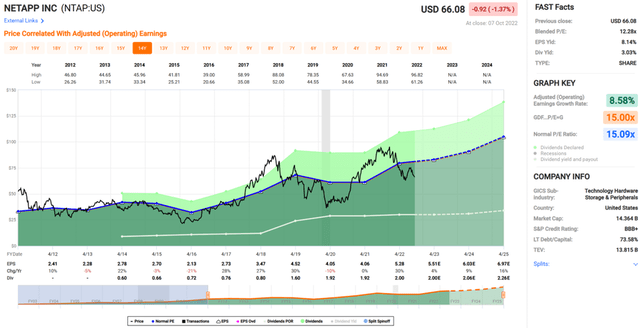

Given NTAP’s impressive growth even in an uncertain economic environment, I find the shares to be very attractively priced at $66 with a forward PE of just 12.0, sitting well below its normal PE of 15 over the past 12 years. Analysts have a consensus Buy rating on NTAP with an average price target of $89, which comes to a potential 38% one-year total return including the dividend.

NTAP Valuation (FAST Graphs)

Investor Takeaway

NTAP is a leading enterprise storage business with a strong track record and forward growth prospects. It also has a very shareholder friendly management team, demonstrated by its strong track record of share repurchases and consistent dividend growth. The recent downturn has made the shares attractively priced at just 12 times earnings, providing for significant upside potential in the near to medium term.

Be the first to comment