Tim Boyle/Getty Images News

Nestle (OTCPK:NSRGY) reported revenues of CHF 87.1 billion in 2021, up 3.3% YoY from CHF 84.3 billion the previous year. Organic sales growth reached 7.5% in 2021, its highest level in more than a decade, a noteworthy performance considering supply chain challenges during the year. Growth was split evenly between developed and developing markets. Nestle’s stellar organic sales growth outpaced rival Unilever (UL) who reported organic sales growth of 4.5% in 2021.

Nestlé’s 2021 organic sales growth was driven by Coffee, Pet Care, and Nestlé Health Science, the latter two of which delivered double digit organic revenue growth during the year (12.7% organic sales growth for PetCare and 13.5% for Nestle Health Science) while organic growth for Coffee was just slightly less at 9.7%.

All three of these segments offer tremendous growth opportunities in the medium term. There has been a noticeable increase in pet adoptions around the world fueling opportunities across the entire pet care industry from pet food, pet grooming, and pet insurance. This presents a step up in demand for pet products in the coming years.

The pandemic hit home the importance of good health and strong immunity helped drive demand for products centered around health and nutrition. Google Trends data shows a 500% increase in worldwide searches related to food and drink for immunity since the start of the pandemic. There is growing evidence that pandemic-induced health-conscious consumer habits are expected to remain post pandemic.

Covid boosted at-home coffee consumption as lockdowns forced people to work from home. Although lockdowns have been lifted and while some companies are calling their employees back to office, many others are shifting to flexible working arrangements which should contribute to at-home coffee consumption going forward. Out of home coffee consumption which includes cafe’s, and restaurants accounts for about 25% of global coffee consumption.

Continued portfolio realignment to support revenue growth and profitability

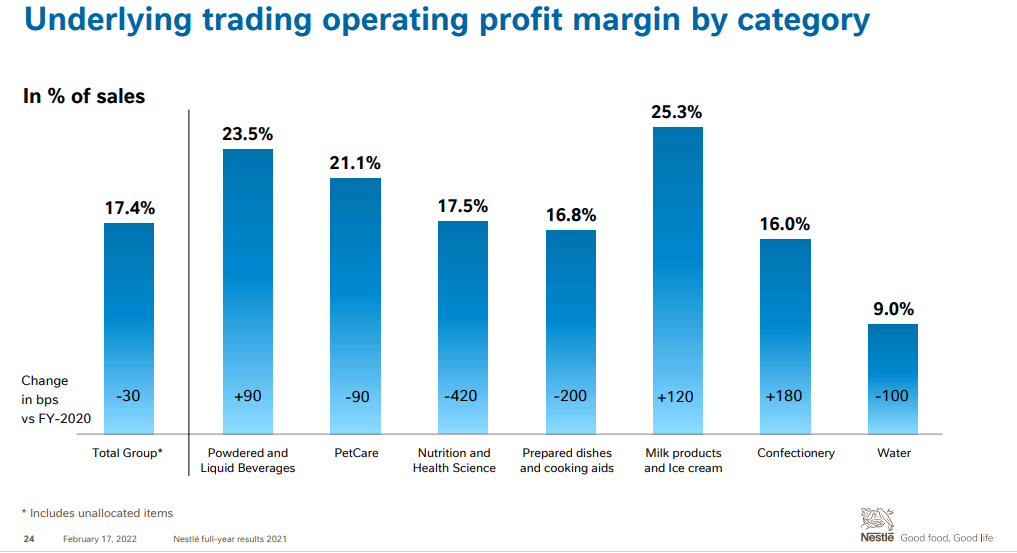

Nestlé has been realigning its portfolio, selling off underperformers while acquiring businesses with better growth prospects, helping improve revenue growth and profitability. Following the divestment of its U.S. ice creams business to Froneri in 2019, and its Chinese peanut milk and canned rice porridge business Yinlu in 2020, Nestle reported a 120 basis point increase in operating margins for its Milk Products and Ice Cream business segment. Meanwhile, Nestle’s reported revenue growth of 3.3% in 2021, is a slight uptick compared to previous years.

Nestle YoY revenue growth

|

FY 2021 |

3.3% |

|

FY 2020 |

-8.8% |

|

FY 2019 |

1.2% |

|

FY 2018 |

2% |

Nestle is continuing its portfolio realignment efforts with the food giant selling off its Nestlé Waters North America business for USD 4.3 billion as part of the company’s efforts to sharpen its water portfolio. Although the bottled water market is growing, competition is stiff with grocery store brands increasingly taking share. Moreover, consumers have also been voicing concerns about plastic waste and the segment has had to suffer from complaints from water advocates for years. The water brands unloaded through the deal include Ice Mountain, Poland Spring, Deer Park, Ozarka, Zephyrhills, Arrowhead, Pure Life, and Splash. The deal does not include Nestlé’s premium international water brands Perrier, S. Pellegrino, and Aqua Panna. Nestle’s water business, its lowest-margin business segment, reported a 100 basis point drop in operating margins in 2021 driven by higher freight and commodity costs. Nestle expects to continue transforming this business going forward.

Nestle

Source: Nestle Investor Presentation

Strategic investments in innovation, high growth categories, and geographies

Nestlé Health Sciences is pushing further into the vitamins, minerals, and supplements opportunity, again through a combination of organic and inorganic growth strategies. Last August, Nestlé Healthy Sciences acquired the core brands of The Bountiful Company from private equity firm KKR. Brands acquired include Nature’s Bounty® (Supplement including vitamins, minerals, fish oil, protein powders), Solgar® (vitamins), Osteo Bi-Flex® (joint health supplements), Puritan’s Pride® (vitamins, minerals, herbs), Ester-C® (vitamin C), and Sundown® (vitamins and minerals). The acquired brands generated over USD 1 billion in sales with an EBITDA margin of over 18.3%. Nestlé expects synergies to lift the brands’ EBITDA margin by 2024.

This February Nestle acquired a majority stake in protein powder maker Orgain – the leading plant-based protein powder, and leading organic nutritional protein ready-to-drink shake in the U.S.

Nestlé’s plant-based foods segment continues to deliver delicious returns with 16.8% organic sales growth recorded in 2021 reaching more than USD 860 billion. The company continues to invest heavily to expand this category, through new product launches, geographic expansion and strategic investments. Noteworthy is that rather than colliding head on with first movers such as Beyond Meat (BYND) and Impossible Foods in standard fake meat products such as burgers, patties and chicken chunks, Nestlé has opted for a differentiation strategy focusing on specialties such as tuna and shrimp. Building on the popularity of its vegan tuna (“Vuna”), last October Nestlé added vegan egg (“vEGGie”) and faux shrimp (“Garden Gourmet Vrimp”) to its Garden Gourmet label. Both of these products were developed using proprietary technologies in under a year.

Last November, Nestlé led a USD 4 million investment round in California-based faux chicken startup Sundial Foods whose fake chicken complete with skin, meat, and bones, is touted as going “beyond meat”. Nestlé’ is also working with Israeli cultured meat startup Future Meat Technologies to explore lab made meat products.

Further capitalizing on the plant-based trend, Nestle is extending its product range to include plant-based versions of popular products such as KitKat, and Milo. This February, Nestle launched a soy-based version of its Milo malt drink in Thailand, and in mid-2021 launched its first vegan KitKat product which replaces the milk with a rice-based alternative.

Continued product improvements and rebranding efforts have helped POS and frozen meals record 10% organic sales growth.

Margins

Gross margins were impacted in 2021, dropping from 49.1% in 2020 to 47.8% in 2021, driven by input cost inflation and pricing action delays (prices were increased only in the latter half of the year so the impact of such increases may show up in 2022); 2% of Nestlé’s 2021 organic sales growth of 7.5% came from price increases. Nestlé upped prices by 3.1% in the last quarter of 2021 to counter rising cost inflation, after a 2.1% price hike in Q3. Nestlé expects broadly stable operating margins this year as it sticks with price increases to counter cost inflation, along with the implementation of other levers such as cost management, and product mix optimization of product mix.

Financials

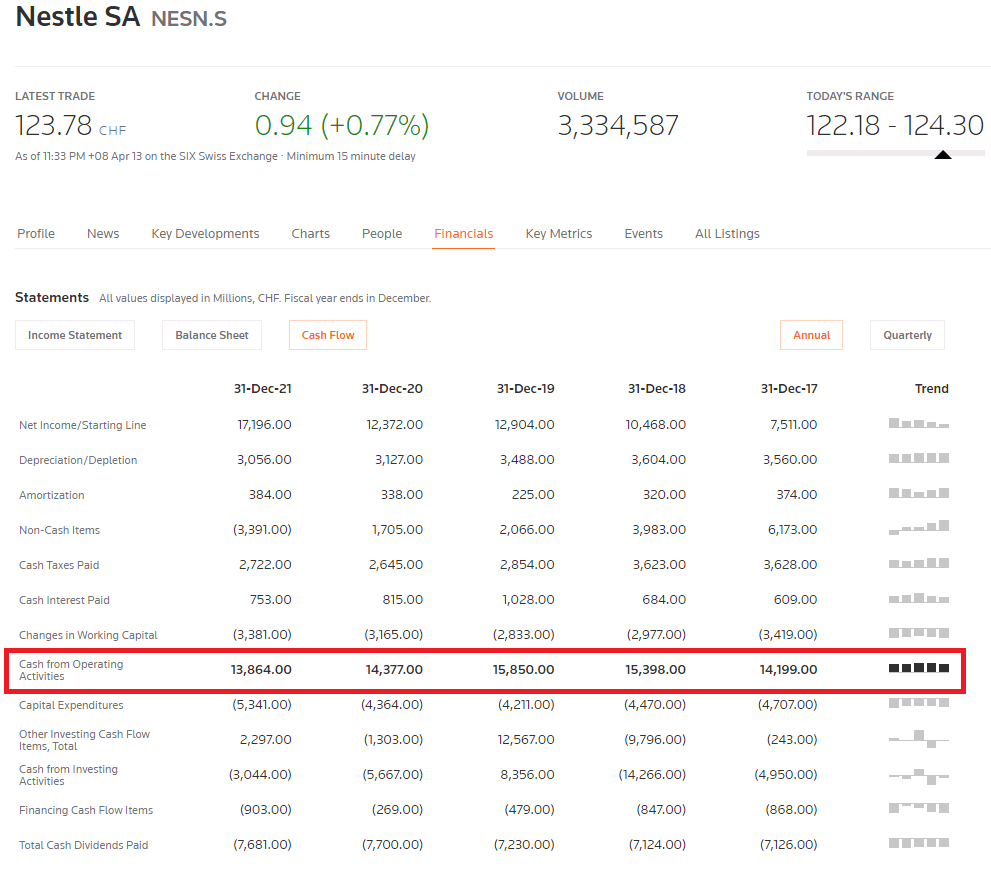

Operating cash flows continued their downward trend in 2021, reaching CHF 13.8 billion from CHF 14.3 billion the previous year. The decline was largely due to temporarily higher inventory levels – a defensive measure against supply chain bottlenecks during the year, partially offset through improvements in payables.

Reuters

Source: Reuters

Nestle’s profitability metrics are better than rival Unilever in some areas, but not so in others. Nestle however has a considerably better debt profile, which could give the company more flexibility to drive growth through acquisitions. Like Nestle, Unilever too is on the hunt for acquisitions, particularly in the promising health and supplements sector, with the company making a bid for GSK’s consumer healthcare business this year. However, the company’s already high debt burden appears to be among other reasons getting in the way, with rating agency Fitch saying Unilever could risk a downgrade with the purchase of GSK, or “any other large target”, due to an enormous debt pile post-acquisition. There have been speculations that Unilever may sell off a big chunk of its food division to finance the purchase while keeping its debt pile under control, a move which would leave Nestle an undisputed food leader. Nestle, not as heavily indebted as Unilever, has reportedly hinted at the possibility of pursuing acquisitions, including “a big deal” as part of their growth efforts.

|

FY 2021 |

||

|

Gross margin % |

47.8% |

42.3% |

|

Operating margin % |

13.4% |

16.5% |

|

Net margin % |

9.8% |

12.6% |

|

Return on assets % |

6.5% |

9.3% |

|

Long term debt / equity % |

68.6% |

132.2% |

|

Total debt / total equity % |

87.6% |

173.4% |

Summary

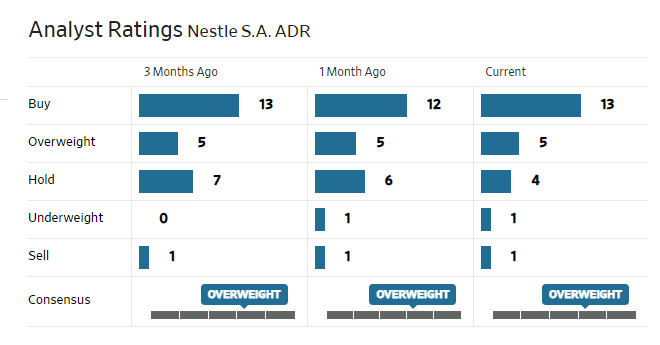

Food giant Nestle’s ongoing portfolio transformation, continued investments in innovation, strategic acquisitions, and high growth categories and markets are positives that could support Nestle’s continued revenue and profit growth. Furthermore, the company boasts broad diversification across geographic regions and product categories, and strong financials. With a P/E of 26, the company is considerably more expensive than peers such as Unilever (P/E 16) and Kellogg (P/E 16.7). While some may be of the view Nestle is overvalued and may prefer to wait for a better entry point, others may argue that is the price to pay for a quality market leader with solid financials and good prospects. Nestle currently has no short interest and analysts are largely bullish on the stock.

WSJ

Source: WSJ

Be the first to comment