AleksandarGeorgiev/E+ via Getty Images

Thesis

Nestlé S.A. (OTCPK:NSRGY, OTCPK:NSRGF) is another recession-resistant, quality name that provides investors an opportunity to own a steady growth name at a reasonable valuation. The company has a history of implementing shareholder-friendly policies, such as consistent dividend payouts and large scale buyback programs. We believe that the company’s strong brand names in household goods, food, and beverage sector create a substantial moat around the business, and will allow the business to have high pricing power to mitigation the impact of inflationary pressures. We believe that the stock at its current price presents a good value for the business.

Company Overview

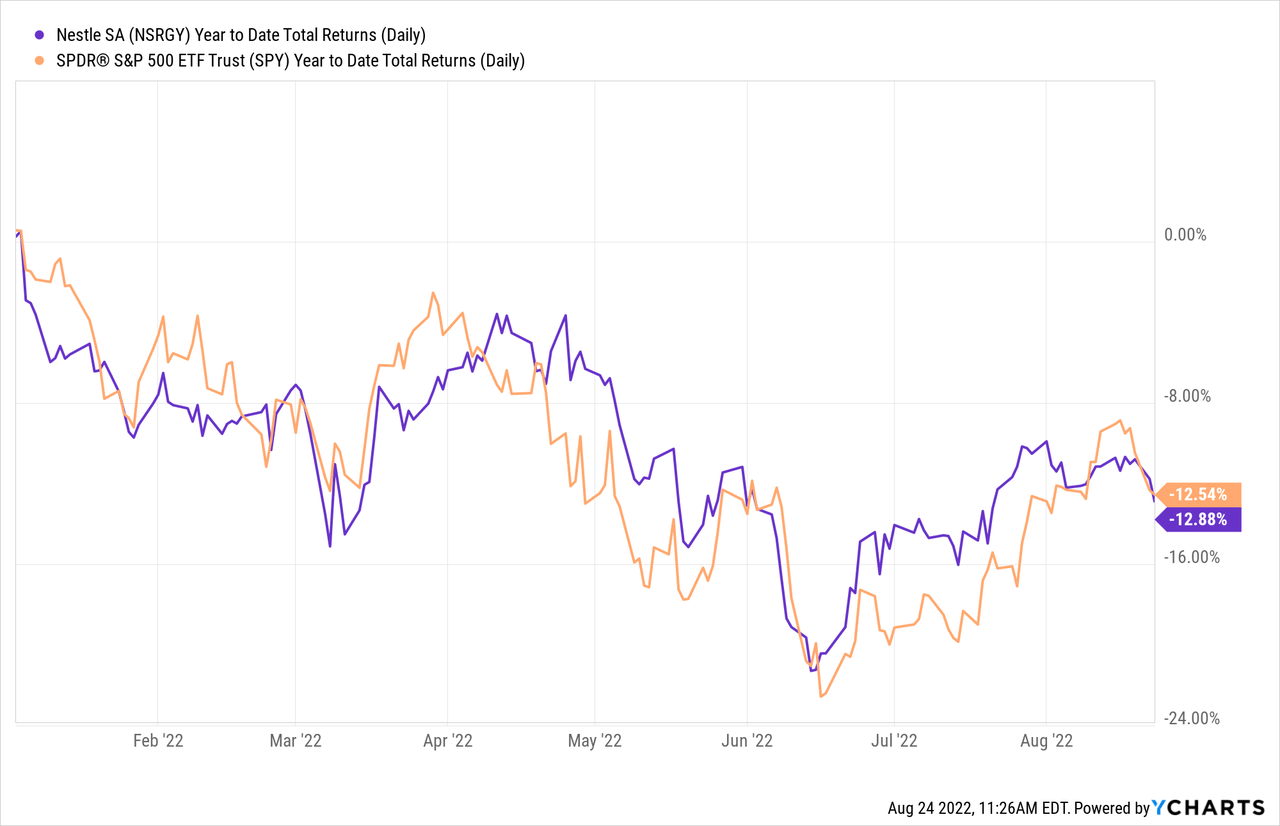

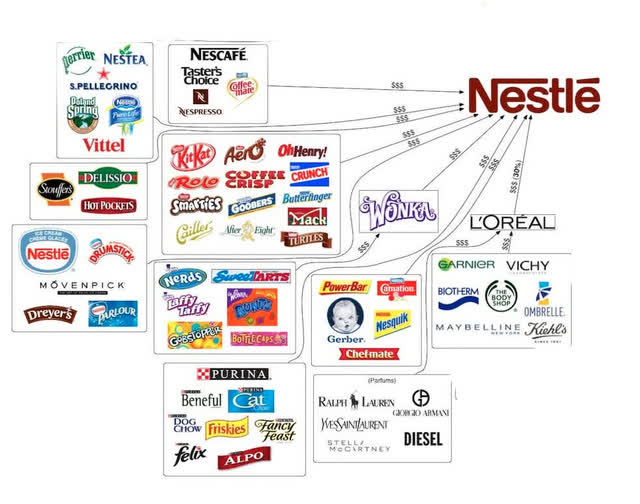

Nestlé S.A. is a Swiss food and drink conglomerate that operates numerous consumer brands, such as Perrier, Nespresso, Kit-Kat, Haagen-Dazs, and more. The company sells products in 12 categories, ranging from healthcare nutrition, baby food, drinks, pet food, and more. Nestlé S.A. also operates globally and has more than 2,000 brands all over the world, making this company one of the largest consumer discretionary company in the world. The company’s stock return YTD has closely tracked the S&P 500, as the stock returned -12.88% compared to S&P 500’s return of -12.54%.

Commitment to Shareholder Value

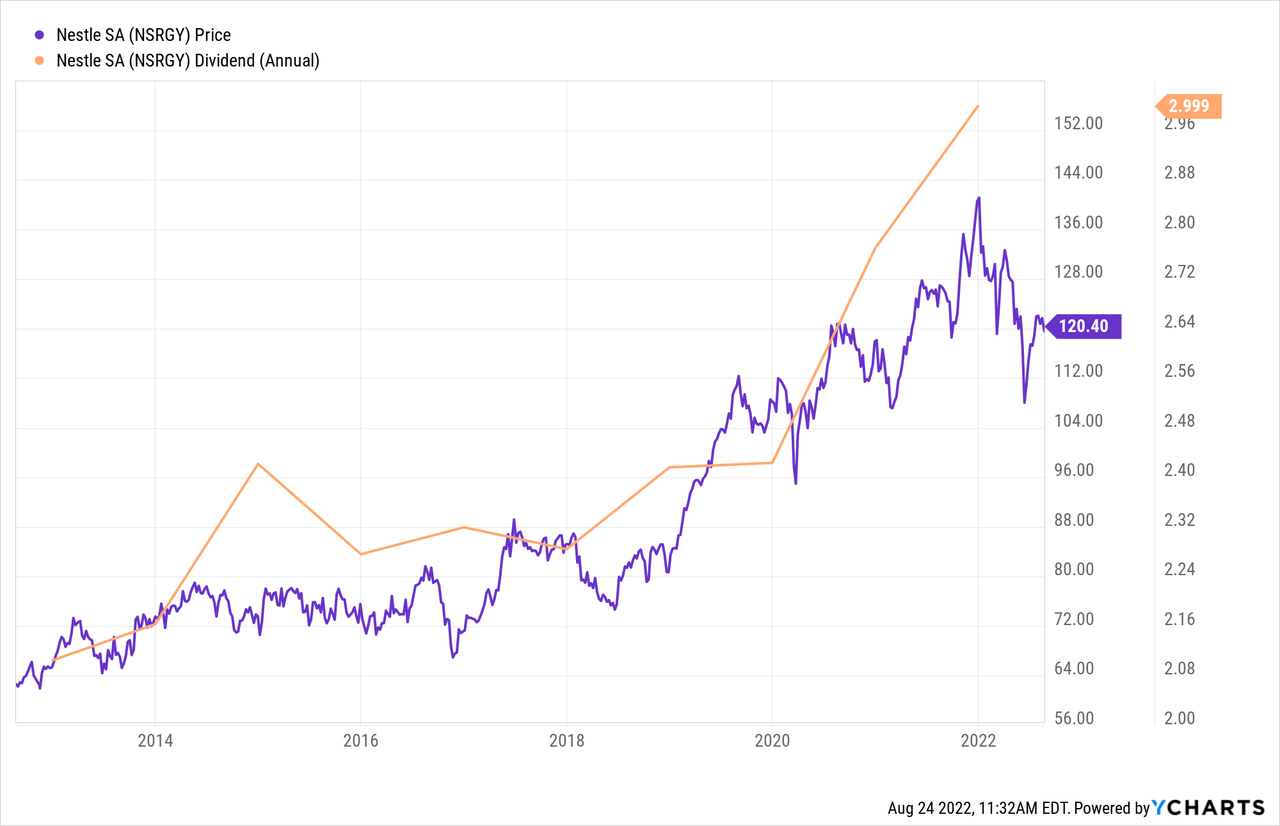

Nestlé S.A. has been a consistent dividend-paying company, recently paying out an annual dividend of $2.9673, which translates to a TTM 2.46% dividend yield. As seen below, the company’s annual dividend closely tracks the movements of the stock price, showing that management is committed to paying dividends in line with the financial performance of the business. As the stock price increases, investors can reasonably expect management to raise dividends as it has done before.

Furthermore, Nestlé has also implemented large stock buyback programs in the past, and most recently in last December, the company initiated a CHF 20 billion buyback program to be completed by December 2024. That’s a buyback program greater than 5% of its current market capitalization, and will likely provide a floor for the stock price.

Strong Brands and Moat

In this uncertain economic environment, it is important for investors to assess the strength of the business by analyzing competitive moats and make sure that the company can withstand major economic downturns and threat of new entrants. Nestlé S.A. has some of the most internationally recognizable brands in various consumer segments, and therefore the company’s strong brands will serve as substantial moats for the business. As seen below, the company operates numerous brands that are instantly recognizable.

From frozen food classics like “Hot Pockets” to baby formula like “Gerber,” the company operates some of the most popular brands in the world. In addition, the Nestlé brand itself is worth nearly ~$20 billion and is the most valuable food brand. This level of brand value is extremely hard to replicate, and Nestlé will be able to leverage its brand value to support its business during economic downturns while upstarts will be forced to scale back its marketing spend and compete less effectively with conglomerates like Nestlé. Based on these factors, we believe that Nestlé is well-positioned against macroeconomic and competitive pressures.

Growth and Valuation

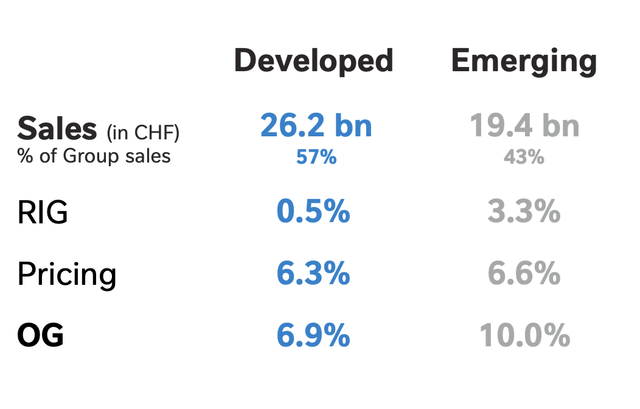

Nestlé S.A. recently reported its 1H 2022 results, and the results were generally positive, reporting strong growth in all segments. The company reported 6.9% sales growth in Developed Markets and a 10.0% sales growth in Emerging Markets. Management also guided that the operating profit margin will be around 17% for the year despite the cost pressures, as the company was able to pass on some of the costs along with price increases. Stable margins and an EPS growth of 8.1% are strong results for a company operating in an inflationary environment.

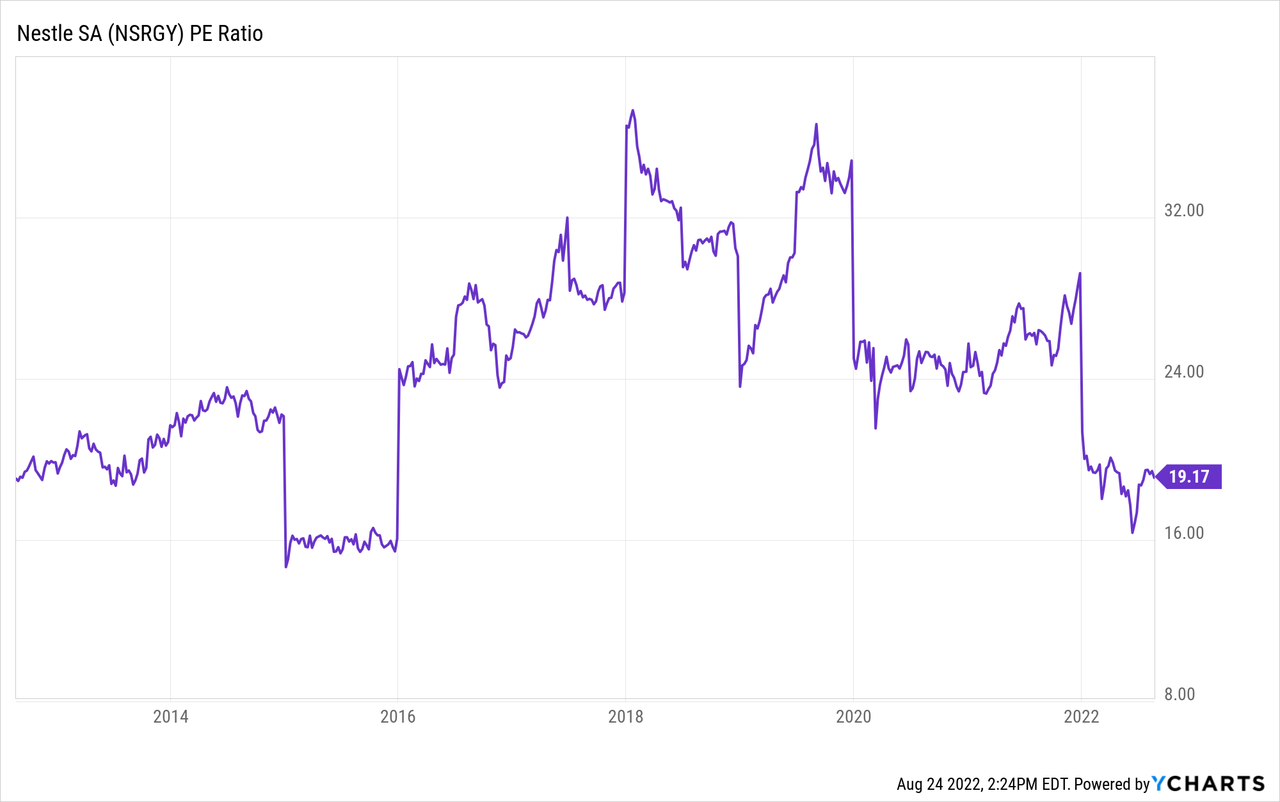

Nestlé S.A. is trading at the low range of its 10-year P/E range, trading at ~19x P/E multiple. This is likely due to the global recession worries, as investors are worried about the future earnings outlook. However, as discussed above, we believe that Nestlé S.A. will be well protected against adverse economic conditions and maintain a steady earnings and revenue growth. Through the five years between 2017 and 2021, Nestlé S.A. had an average P/E multiple of 26.8x which is 30% below the current valuation.

We believe that once economic conditions improve, Nestlé S.A. will once again trade at around a ~25x multiple, and based on current TTM net income, that means the stock should be a $400 billion market cap stock (compared to current market capitalization of $335 billion). In all, the current valuation should provide a reasonable entry point for investors.

Conclusion

Nestlé S.A. is a perfect investment option for investors who are looking for meaningful growth during an uncertain time. The company’s annual dividends and buyback program will protect shareholder value for the short-term future, and we believe the company’s diverse set of brands and steady business operations provide ample protection against economic risks stemming from inflation. The stock is trading at around its historical P/E multiple lows, and we believe that the current valuation makes it a good entry point to own the stock.

Be the first to comment