Michael Derrer Fuchs/iStock Editorial via Getty Images

The market is selling-off, including broadly considered safe-haven stocks such as Apple (AAPL), Microsoft (MSFT) and Google (GOOG) (GOOGL). So, where can investors hide? In the current market and macro environment, it might be a good advice to look at strong consumer brands in the food industry. These companies have proven to be relatively resilient in recessionary environments and can offset inflationary pressures on brand equity driven pricing power. Given this assessment, Nestlé (OTCPK:NSRGY) (OTCPK:NSRGF) stands out as particularly attractive. Based on a residual earnings valuation, I initiate with a HOLD recommendation and set a $117/share target price.

About Nestlé

Ranked as 79th in Fortune’s 500 companies Nestlé is the world’s largest food conglomerate. The Company’s product line, sold under more than 2,000 brands, includes milk, chocolate, coffee, confectionery, bottled water, creamer, food seasoning and also pet foods. Nestlé, one of the leading food and drinks companies, produces more than 2,000 brands including the world’s leading coffee brand Nescafé and Nespresso, Coffee Mate, Nesquik, Nido, Kit-Kat chocolates, Haagen-Dazs ice cream, Purina pet food, DiGiorno pizza, and Perrier bottled water. To give more reference about Nestlé’s size, the company employs more than 300,000 workers, has a market capitalization of approximately $300 billion and enjoys sales trending towards $100 billion.

Nestlé is headquartered in Switzerland but operates globally. In fact, Nestlé accounts three major geographical operations: America with approximately 45% of total sales; Europe, Middle East, and North Africa with about 30%; and Asia and Africa with 25%.

Nestle Website

A solid stock to invest

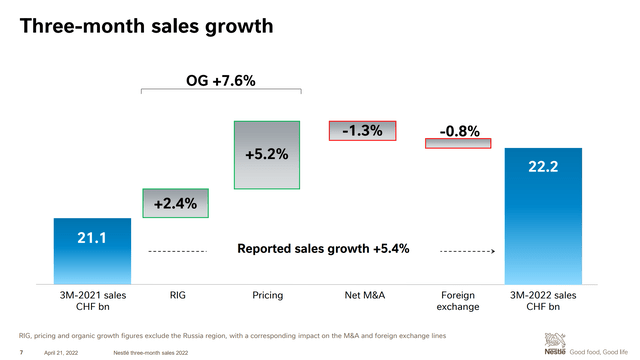

The thesis for investing in Nestlé is based on solid operational and financial performance, including revenue growth and value accumulation. In Q1 2022, the company has proven to successfully deliver even in challenging market and macro-environments, as the company was able to offset inflationary pressures on higher pricing (5.2%) and slightly increased volume (2.4%). That said, the company also confirmed full year guidance and anchored organic sales growth at 5% and operating profit margins between 17% and 17.5%.

Also, in the past Nestlé has delivered solid revenue growth and value accumulation with little volatility. From 2018 to 2021, Nestlé increased revenues from $93.8 billion to $95.7 billion, implying a 3-year CAGR approximately equal to nominal GDP growth. Respectively, over the same period EBITDA increased from $18.9 billion (20% margin) to 20.1 billion (21% margin). However, as the company gradually increased investments for M&A and international expansion, Nestlé’s revenue decreased from $11.8 billion to $9.8 billion. Nestlé’s balance sheet appears solid. As of Q1 2022, the company holds $15.4 billion of cash and cash equivalents and records $50.3 billion of total debt.

How analysts see Nestlé

Analysts expect Nestlé’s revenue and earnings to grow attractively for the next few years. Consensus estimates as available on the Bloomberg Terminal indicate revenues for 2022, 2023 and 2024 of $94.4 billion, $99.41 billion, and $103.99 billion respectively, representing a 3-year CAGR approximately in line with nominal GDP growth. Respectively, EPS is estimated at $4.78, $5.20, and $5.61. Investors may appreciate that there is not much volatility in revenue or earnings. In fact, Nestlé is poised and expected for steady revenue growth and value accumulation.

Residual Earnings Valuation

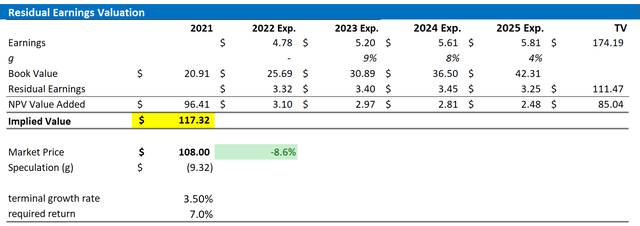

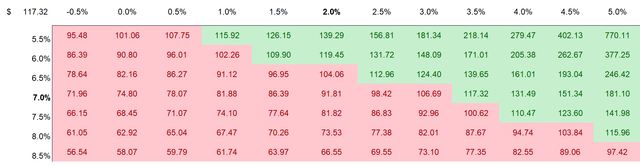

If analyst consensus is right, what would be a fair valuation for Nestlé? To value the company, I have constructed a Residual Earnings framework based on the analyst consensus forecast for EPS till 2024, a WACC of 7% and a TV growth rate equal to expected nominal GDP growth at 3.5%. I feel these estimates are very reasonable to anchor a valuation, if not conservative. If, however, investors want to consider a different scenario, I have also enclosed a sensitivity analysis based on varying WACC and TV growth combination. For reference, red cells imply an overvaluation, while green cells imply an undervaluation as compared to Nestlé’s current valuation.

Based on the above assumptions, my valuation estimates a fair share price of $117.32/share, implying an approximate 9% upside potential based on accounting fundamentals.

Analyst Consensus; Author’s Calculation Analyst Consensus; Author’s Calculation

Risks

Nestlé is arguably quite low risk given the company’s non-cyclical exposure and strong brand equity. Moreover, the company has proven earnings resiliency even in challenging macro-environments. I argue that the company’s strong global presence, scale and brand portfolio provide a solid competitive moat. But investors should note the low/average business growth of Nestlé. But still, in the past 10 years, the company has outperformed the broad market, as the Eurostoxx 50 is up 67% vs Nestlé’s increase of 120%. As a main earnings headwind, investors should monitor currency exposure and international geopolitical tensions.

Conclusion

I like Nestlé. The stock offers no 1,000% anytime soon, meaning at the company’s current growth, it would take decades to compound the investment by x10. But Nestlé could be a solid investment given the current market environment, as NSRGY investors are very likely to outperform both inflation and the broad market. Does anybody expect more in this market? I initiate with a HOLD recommendation and set a $117/share target price.

Be the first to comment