Petmal/iStock via Getty Images

This is not the first time that we deep-dived into Nel ASA (OTC:NLLSF) accounts. We already analyzed the Norwegian hydrogen player’s Q4 and Q1 past performance, providing a neutral rating. While our internal team is confident that hydrogen will be the future fuel, we were not optimistic about the company’s valuation (despite the fact that the EV/Net Sales multiple was lower than peers). So far, we were right.

Nel ASA: Juggling New Orders Whilst Wading Through The Cash Pile

On the positive news in the quarter, there was an announcement from the European Commission that might be very supportive within the sector. On the 15th of July, the EU authorized a €5.4bn fund to support Important Projects of Common European Interest. The IPCEI Hy2Tech is constituted of 41 projects and is a joint collaboration of 15 country members. This is going to be a positive catalyst within the electrolyzer sector in particular for Nel Asa and ITM Power Plc (OTCPK:ITMPF).

Q2 Results

In our last publication, in our bullet point summary, we said: revenues up, costs up, and cash up. When will this end? Plus, we emphasized how the company’s order book was solid. Looking at the company’s quarterly highlights we report the following:

- Top-line sales increased by 12% compared to the previous year-end quarter;

- EBITDA significantly declined (once again) and stood at NOK -197 million against the NOK -120 million achieved in the same period one year ago. More in detail, this was due to higher ramp-up costs, more headcounts and ongoing supply chain constraints. With the company’s latest announcement, we can only estimate future higher SG&A expenses;

- Cash on the balance sheet stood at NOK 3.646 billion versus 3.074 billion in Q2 2021. This was due to private placement proceeds which raised NOK 1.500 billion;

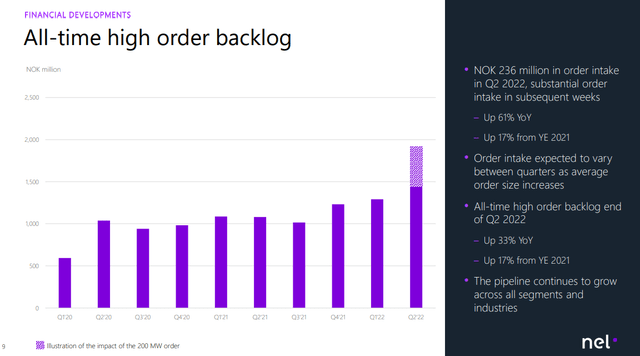

- Quarterly order intake was at NOK 236 million, bringing the total backlog at 1.439 billion (all-time record).

Nel ASA is still burning cash and unfortunately, the company missed consensus in both revenue line and EBITDA by 25% and 36%, respectively. Today, we are not surprised to see a negative price reaction.

Conclusion & Valuation

For the current Nel Asa investors and for our readers that would like to have exposure within the industry, we suggest diving deeper into Industrie De Nora’s recent IPO. Thanks to its water division, the Italian company is already profitable and its unique green hydrogen division has an early EBITDA breakeven compared to the sector. Concerning Nel ASA, we reaffirm our previous publication conclusion i.e. the company “has good product offerings and its order backlog is testament to this but until it can start converting these to significantly higher revenues, we are going to sit this one out”. The risk paragraph was included in our initiation of coverage. Regarding the valuation, we maintained a neutral rating at a price of NOK 15 per share. Nel is now trading in line with EV/Sales 2024 comps and we reinforce our neutral rating thanks to a DCF valuation with the following main input:

- WACC at 9%

- Long-term growth rate at 3%

- Operating profit margin at 13%

Be the first to comment