lorozco3D/iStock via Getty Images

In order to extend the rally in the stock market, we needed good news on the inflation front, and we needed the bond market to remain well-behaved. We got neither. The resulting declines late Thursday and early Friday came quickly, putting us back in a situation where a retest of the May lows seems likely.

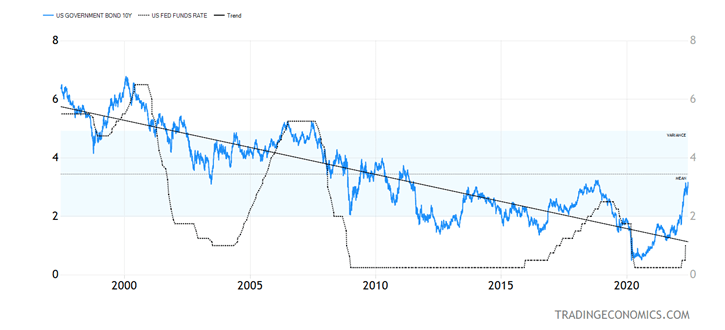

US Govt Bond Chart (Author)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

For the May lows to hold, we need to remain under 3.25% on the 10-year Treasury yield and for the inflation numbers – such as this morning’s Producer Price Index – to show some improvement.

In the last 40 years, the 10-year Treasury yield has never exceeded the highs from a prior Fed tightening cycle, which was 3.25% from 2018 in this case. Rising above 3.25% and staying above that level will likely pose a major problem for the stock market.

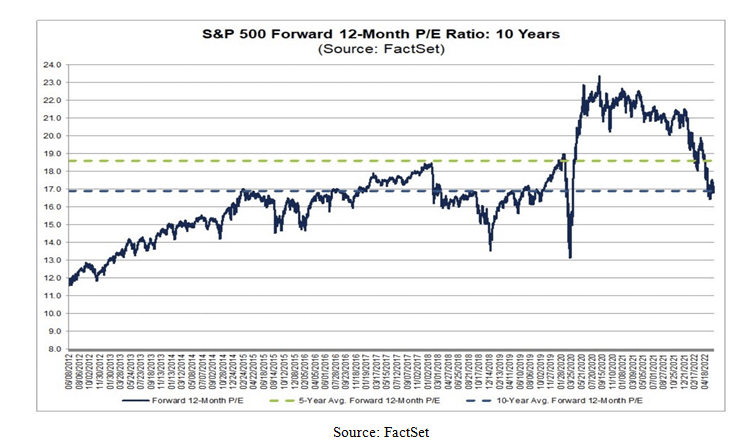

S&P 500 Forward Chart (Author)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The decline so far in 2022 has been about shrinking multiples while earnings have been rising. The S&P 500 went down from 22 times forward earnings to its 10-year average of 17, while EPS estimates have been rising.

The other recent year where earnings were going up while the stock market was going down was 2018, when the Fed, like now, was involved in QT. In other words, this decline is all about the Fed.

I do think it is possible that we saw the lows for the year in May, if the 10-year stays below 3.25% and if we see improvement on the inflation front. Good news from Ukraine would help too, although that looks unlikely at present.

We also don’t want to see oil spike above $130 per barrel, which is not out of the question in the middle of the seasonally strong summer period with all those Russian sanctions in place.

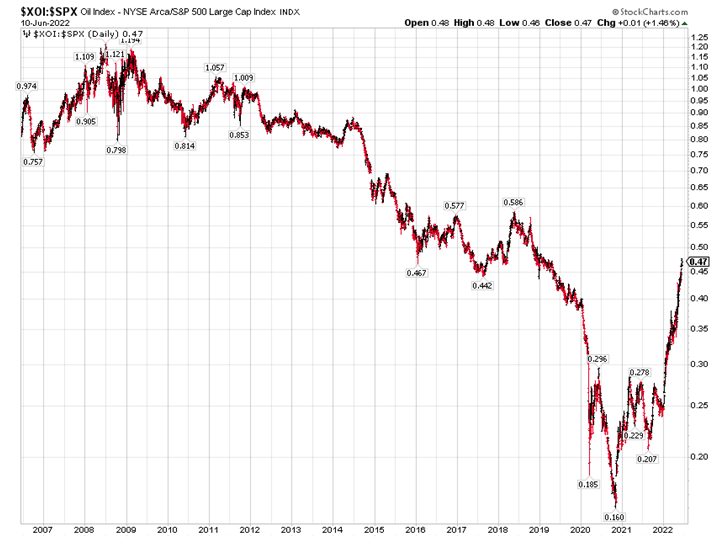

SPX Chart (Author)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

So far in 2022, the energy sector is approaching being up 50% while the broad market has sold off. In some respects, this is the revenge of the oils, as lack of investment in oil began as the oil price went negative in April 2020, causing demand to rebound much faster than supply, resulting in a price spike.

It is true that energy firms have many permits to drill on federal land, as the President likes to say, but drilling is only one step. Companies need feasibility studies, which don’t happen overnight, and those assets will not produce for months from now. In other words, permits to drill can be misleading statistics.

Gold May be Ready to Move

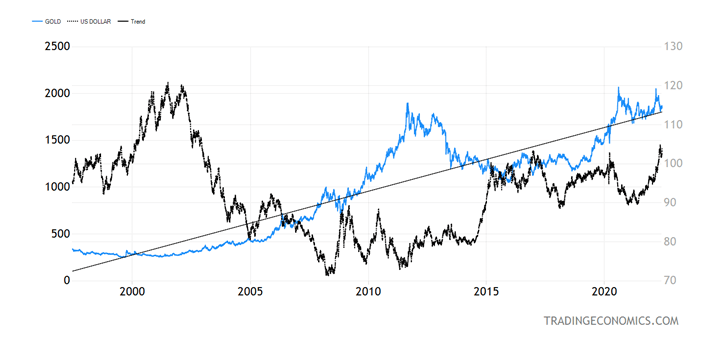

One reason why the gold price has not appreciated in 2022 has been the surge in the U.S. dollar and the rise in U.S. interest rates, so gold has not really fallen in terms of some other currencies. It just has not responded yet to the inflation surge in dollar terms. Gold prefers a weaker dollar and falling interest rates.

Gold Chart (Author)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The gold market is weird in the sense that it can go sideways for a while before it finds a catalyst to zoom higher, but over time gold tends to appreciate with rises in the CPI index. It just doesn’t do it in real-time.

I think that when inflation starts to trend lower and the Fed slows down, the dollar is likely to sell off and the gold price will move higher. That is likely to be in September or October. In the meantime, we need to monitor the situation for an earlier resolution of gold’s sideways action. I believe the next turn will be up.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment