Alex Wong/Getty Images News

Current discussions about the Federal Reserve raising interest rates include the concern that the observed rates of inflation are greater than the nominal interest rates that are now being earned in the financial markets.

For example, the nominal yield on the five-year U.S. Treasury bill is currently around 2.30 percent.

The consumer price index that the Federal Reserve uses as its policy target is right around 5.0 percent.

So, the “real” interest rate is around a negative 2.7 percent.

Another way to look at this is to start off with the current nominal yield of 2.30 percent and subtract from it the current yield on Treasury Inflation Protected securities, (TIPs) which now are trading to yield a NEGATIVE 1.20 percent.

Here we can calculate the expected rate of inflation built into the nominal yield on the 5-year Treasury bill. In the current situation, the expected rate of inflation built into the nominal yield is 3.50 percent.

In terms of this kind of analysis, for a 5-year, risk-free security, investors are facing the fact that the real rate of return they are earning in the nominal yield market is somewhere in the NEGATIVE 1.2 percent to NEGATIVE 2.7 percent range.

Theoretically, these estimates are supposedly tied into the estimate of the expected real rate of growth of the economy.

But in the present situation, the real rate of growth in the U.S. economy is positive, and around 3.0 percent.

So, there seems to be quite a division here between the conceptual and the actual.

Foreign Flows Of Funds

I have discussed this situation many times over the past ten years because it is a very important issue and it tells us a lot about all the conditions of disequilibrium that exist within the economy, disjointed situations that the Federal Reserve is having to deal with.

What is happening here?

Well, it has been my belief that the reason rates exhibit the relationships they now do is that lots and lots of risk-averse foreign monies have been flowing into the United States in search of a safe haven.

As the global situation has become more discombobulated, risk-averse investors from around the world have decided that the best, safest place for them to place their funds is in the United States.

So, billions of dollars have come into the United States and upset the rate relationships that exist in U.S. markets.

My assumption is that the expected rate of inflation I calculate is still a good estimate of what the investment community believes.

As stated above, the current expectation for the 5-year horizon is 3.50 percent.

Historically, the expected real rate of economic growth for the United States has been around 2.00 percent, to take the low estimate.

Thus, to get the nominal yield we would add to the expected real rate of economic growth in the United States, the 2.0 percent, the expected rate of inflation, which we now estimate to be 3.5 percent.

Thus, under “more normal” circumstances, the nominal yield on the 5-year U.S. Treasury bill should be around 5.50 percent.

So, what’s going on here?

My answer to this question is that major amounts of foreign money from risk-averse investors have been placed in the U.S. given the world economic and political situation.

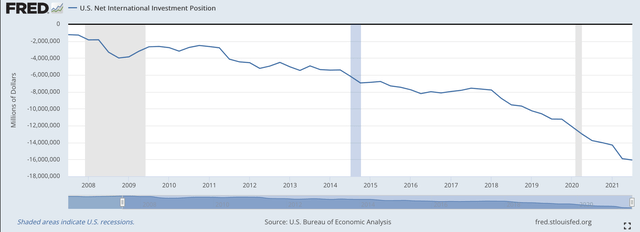

International Investments (Federal Reserve)

The current period of interest really began in the period called the Great Recession, which took place between December 2007 and June 2009.

Because of the international turmoil going on and the way that the Federal Reserve was reacting to this very severe recession, foreign investors really began to bring money into the United States.

This chart pictures the “net” foreign investment, the difference between what U.S. citizens invest “off-shore” and what foreign investors invest in the United States. Since there is more foreign investment in the United States than U.S. investment outside of the U.S. the number is a negative one and the more foreign investment in the U.S. exceeds U.S. investment elsewhere in the world, if greater flows come into the U.S. than go out, the number will become more negative.

As one can see, foreign investment in the U.S. picked up after the Great Recession and even accelerated as we got into the Covid-19 pandemic and the economic and financial upheavals that followed.

It is my belief that all this money coming into the United States distorted the interest rate relationships in the United States.

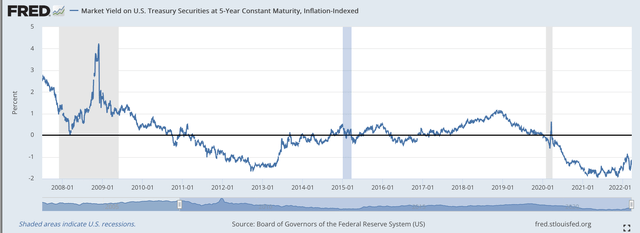

The most prominent one is the fact that the yield on TIPs became negative.

Yields on TIPs (Federal Reserve)

Here we see the movement of the yield on the 5-years TIPs. After the Great Recession ended, when foreign money was flowing into the U.S., the yield on the 5-year TIPs kept falling and became negative.

From the middle of 2013 and into 2014, the flow of foreign money into the U.S. eased off and the yield on the 5-year TIPs moved back above zero.

But then the spread of the Covid-19 pandemic hit in 2020 and the yield on the 5-year TIPs turned back into negative territory.

And, it has remained at a very low level as first the recession, then the concern with how major central banks were going to respond to the building inflation, and finally, the Russian invasion into Ukraine clouded the scene.

Problems

This situation is just one more disequilibrium that the Federal Reserve is going to have to deal with, sooner or later.

But how is this situation going to impact financial markets in the next three months, six months, year, or more?

Sometime, these foreign monies are going to be leaving the United States.

The yield on the TIPs will begin to rise.

And, the Fed will be facing a whole new financial market situation with a different interest rate structure.

Given the uncertainty that exists within the world these days, it is not highly likely that these risk-averse funds will start to move back off-shore in the very near future.

But what will these foreign investors respond to going forward and what will they do with their monies?

This is a whole, other scenario, a real result of radical uncertainty.

The outflow is going to happen sometime. But what will set it off? And, when?

It makes the picture different for the Fed. Nominal rates are low, not because of excessively lenient monetary policy. Nominal rates are low because of the unusual international flows of funds, a condition that has resulted because of all the uncertainty that exists within the world now.

This just adds to the pressure on Mr. Powell and the Federal Reserve to act so as to maintain the trust and confidence of the global investment community.

Be the first to comment