Spencer Platt/Getty Images News

Main Thesis/Background

The purpose of this article is to evaluate the Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA) as an investment option at its current market price. This is a multi-state, closed-end fund with an objective “to provide current income exempt from regular federal income tax and the alternative minimum tax applicable to individuals by investing in an actively managed portfolio of tax-exempt municipal securities.”

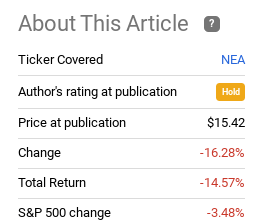

I have owned NEA, but consistently offered a neutral view on it throughout the second half of 2021. Simply, I saw limited upside and some interest rate risk that was too high for comfort. In hindsight, while fading my outlook for this fund was the right call, I should have been much more bearish. Munis as a whole, including NEA, have performed very poorly short-term. In fact, NEA is down almost 15% since I last reviewed it in early November:

Fund Performance (Seeking Alpha)

Looking ahead, I think this sharp sell-off offers an opportunity for buying. While the duration level is still quite high for the fund, meaning there is still plenty of interest rate risk, I think the bid price now is enough of a trade-off. NEA has reverted back to a large discount to NAV, the fund’s distribution remains well supported, and there is still the potential for tax increases in 2023. Ultimately, I think this is a lesson in buying what is currently unloved, and expect NEA to rebound going forward.

Munis Are Dropping – What Gives?

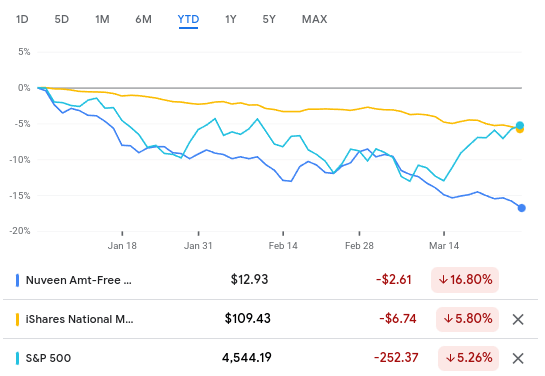

To begin, I want to provide some broader market context. As I mention above, I think munis, and NEA by extension, are a buy at these levels. However, I would be remiss if I did not take a moment to discuss recent performance. For holders of these assets, 2022 has been a painful experience. While stocks and the muni index are both down in 2022, funds like NEA are down by much more. This is where the downside of leverage comes into effect.

While a leveraged fund/product out-performs during the good times, when the trade goes the wrong way, the result is not a pleasant one. For perspective, the following graphic shows calendar returns for NEA, compared to the S&P 500 and the iShares National Muni Bond ETF (MUB) (which is a passive index for munis that can serve as a benchmark):

YTD Performance (Google Finance)

My thought here is that while it is easy to say that NEA is down because everything else is too, that only goes so far. We see that NEA has vastly under-performed non-leveraged options and equities, and that is primarily a result of this being an asset class investors are disproportionately fleeing right now. When a trade turns out of favor, leveraged funds are going to get the worst of it.

The only point to mention is that inflation in particular is driving some of this dynamic. As rates and yields rise, funds with leverage can get hit in two ways. One is the point above – that amplified exposure to a declining sector is going to lead to bigger losses. The second point is that as short-term rates increase, the cost of borrowing also rises. Funds like NEA rely on borrowing to purchase additional bonds for their portfolio (hence the amplified, leveraged exposure). When these costs increase, it is a net negative for the fund, all other things being equal, because the cost of managing this fund has increased.

Of course, some of that is balanced out because the idea is that NEA will be able to pick up higher-yielding bonds to replace maturing ones. But that can take time, while the impact of short-term borrowing costs is immediate. I bring this up because investors need to manage their expectations here. While I see some of this smoothing out for NEA in the second half of the year, if I am wrong, the downward trend will continue to be painful.

Inflation Is The Big Headwind

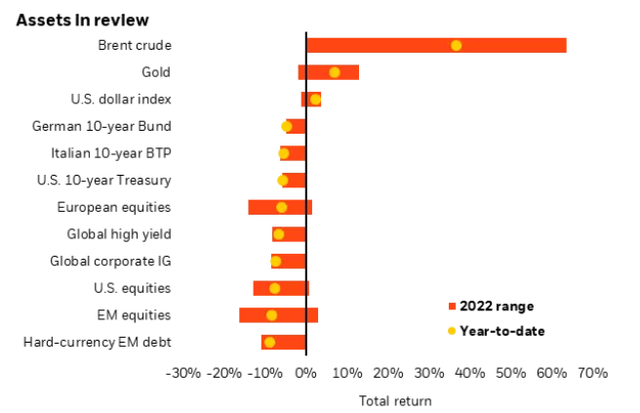

Expanding on the point above, we have to remember that inflation is a key reason why funds like NEA are seeing such poor returns. This is the catalyst behind yields rising and action by the Fed to raise its benchmark rate. Inflation has been pressuring fixed-income in particular, due to this sector having more interest rate sensitivity than other asset classes. While some market participants had hoped inflation would subside in 2022, that has absolutely not been the case so far. An environment with geopolitical risks, supply-chain disruptions, and rapid inflation, we have to understand that fixed-income as a whole is going to see pressure. In this environment, it is real assets, not bonds, that are going to outperform:

YTD Performance For Various Asset Classes (BlackRock)

This is another point to really comprehend before deciding to buy NEA, or any other interest rate sensitive fund. If inflation does not subside and macro-conditions do not change, NEA is not going to offer much in the way of return. The fund is very exposed to rising rates, with a duration level over 10 years:

Duration (Nuveen)

My personal take is that the second half of the year is finally going to be when we see cost pressures decrease. I think the recent spike in oil prices in particular is going to force governments to take more meaningful action to improve production, supply-chains, and overall output. If we see the supply side of the equation rise in critical areas like energy, materials, and other inputs, then inflation is bound to subside. Importantly, this is not going to be something that will happen overnight, but public and political pressure is getting greater by the day. I think the year ahead we will start to see more progress made on this front, helping to cushion against further pain in the fixed-income markets.

Pessimism Just Seems Too High To Me

Now, let us discuss some positives. As I noted at the beginning of this review I think NEA is a reasonable buy at these levels. Yet, so far I have only discussed some broader risks. So we want to understand the positives that help to balance these risks out. This is what will justify new positions here.

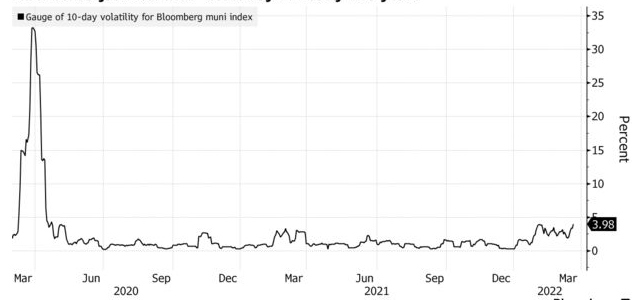

The first one I see is that pessimism on this sector is just too high. This is a contrarian view, and is an outlook that has served me well over my investing career. Simply, the time to buy a stock/sector/fund/theme is when it is unloved. When nobody else wants to touch it, that is when you can get “alpha”, as long as the longer term story is positive. With munis, I do believe that is the case. I think the credit backdrop and tax incentives for this sector are strong. Compounding this, we are seeing volatility and selling in the sector that is very uncommon when we consider historical precedents:

Muni Volatility (Bloomberg)

This in and of itself does not guarantee positive returns. But it does illustrate why NEA is down so much this year. Munis are simply seeing a sell-off that is very uncommon for the sector. This can continue for sure, but I don’t think it will, and I see readings like this as support for buying in. While it seems scary to buy during times of stress, that is often the most advantageous time to do so.

NEA Is Attractively Priced

Another positive point for NEA specifically is the fund’s valuation. This is typically a CEF that will trade at a discount to NAV, so simply seeing a discount is not enough to really declare it a buy. In fact, this was the reality back in November during my last review. NEA had a discount in the 2-4% range during Q4 last year, and I cautioned that it was still a “hold” anyway. This was because NEA typically trades at a discount wider than that rage. So while the discount looked attractive on the surface, the fund was still trading above its historical averages. Looking at the performance over the past 4-5 months, we see how that worked out.

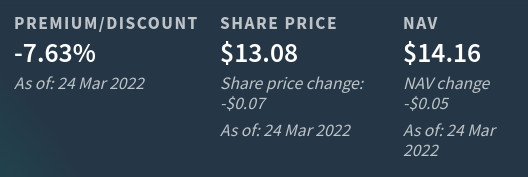

The good news here is that NEA no longer has that more expensive valuation. The fund has moved back into wider discount territory, with a market price that is almost 8% lower than the underlying value:

Valuation (Nuveen)

My thought here is we are back to a “buy” level in terms of valuation. NEA is below its 1-year average discount (which is around 4.6%). The fund is cheaper than normal, and looks especially cheap on the surface considering it is nearing a double-digit discount. With this valuation backdrop, I feel much more comfortable putting some cash into this option.

Munis Look Good Compared To Taxable Debt

The other bright side of the muni sell-off as a whole is that it has opened up a more attractive story compared to taxable bonds. When we consider buying munis, we should look at the after-tax yield compared to other IG options, such as treasuries or IG corporate bonds. While munis may have a lower absolute yield, the after-tax yield may be higher given their preferential treatment. As a result, investors who want quality assets at the best yield need to compare these sectors when deciding what to buy. For those in higher tax brackets, the advantage now rests with munis.

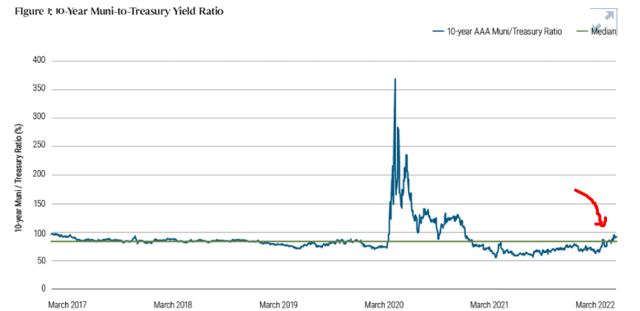

To see why, if we look at the longer term trending muni-to-U.S. Treasury yield ratios, we see that munis are now sitting with a yield above their historical average:

Muni to Treasury Yield Comparison (PIMCO)

This again offers support to a buy case. NEA is cheaper in isolation, but its relative valuation compared to a substitute like treasuries further supports this option. While treasuries and corporate bonds have also declined in 2022, munis have declined by more, and kept their yields intact. The result is a more competitive yield from munis, which makes the sector worth looking at.

Distribution Still Supported

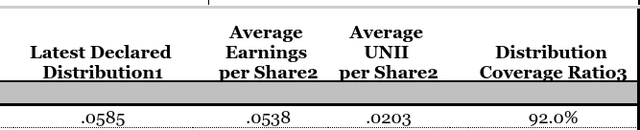

Another positive thought is the fund’s distribution continues to be supported by earnings. NEA has a yield over 5% now, which really looks good when we factor in tax benefits. Beyond that, this distribution level appears sustainable for now, with a coverage ratio at 92% and a positive UNII balance in the bank:

UNII Metrics (Nuveen)

My conclusion here is this helps cushion investors against a continued volatile market. While the share price may be in for most wild swings, the distribution appears solid. This offers investors a yield probably over 6%, assuming then have a tax rate in the mid-20% range or higher.

Therefore, while I will keep my eye on these metrics as I always do, they give me comfort for now.

NEA Remains Well-Rounded

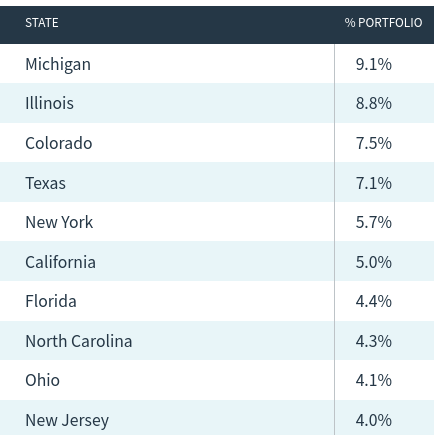

My last point will be brief, but speaks to NEA’s underlying holdings. While investors in munis tend to see many funds that are heavy in debt from California, New York, Illinois, and other high-tax jurisdictions, NEA provides more of a balance. This does not make the other funds “bad”, and honestly it is to be expected to some degree since those states issue the most muni debt across the country. But that makes remaining diversified a challenge. Those states have many state-specific options, and other broader funds still tend to have quite a bit of exposure there. NEA, by contrast, has Michigan as its top state by weighting, and Colorado, Tex, Florida, and North Carolina also come in near the top of the order:

State Weightings (Nuveen)

For me, I view this positively because finding a balanced fund like this can be a bit more of a challenge. While I personally have a positive outlook on New York and Cali debt at the moment, I like that this fund balances out some of my other muni holdings by having over-weight exposure to other states. As a North Carolina resident, finding a muni fund with over 4% exposure to NC bonds is actually a challenge, so this is another benefit.

Bottom line

Munis have not been the diversified portfolio one would have wanted so far this year. While I cautioned against getting too aggressive last year because of the inherent interest rate risk in the sector, I have been taken aback by just how negative the moves have been. Yes, I expected some pressure, but this downward march has been amplified to a level I will admit I did not anticipate. The bad news is the losses surely hurt. The good news is that this offers an opportunity to buy into a time-tested sector at much better prices.

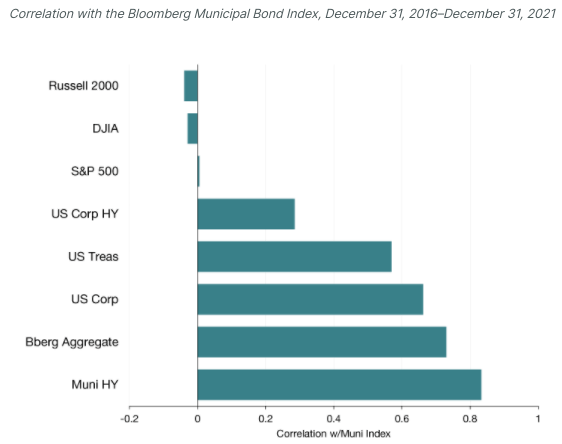

While a fund or sector can seem “cheap” and be a value trap, I do not believe that is the case with munis. The recent volatility in the sector seems to indicate some panic selling, given how it has diverged from historical norms. To me, that opens up merit for buying, as fear seems to be a bit too extreme. Of course, high inflation and a Fed rate hike cycle are going to limit positive returns. But I think most of the damage has been done short-term, and the after-tax yield nearing 6% for an IG fund like NEA has my interest. Further, munis remain weakly correlated to a host of other asset classes, increasing my desire to use them to round out my equity-heavy portfolio:

Correlations (Lord Abbett)

With all this in mind, I am going to start buying NEA again, with a target to ladder in over the next few weeks. With enough positives to balance out some macro headwinds, I would suggest readers give this idea some consideration at this time.

Be the first to comment