vm/E+ via Getty Images

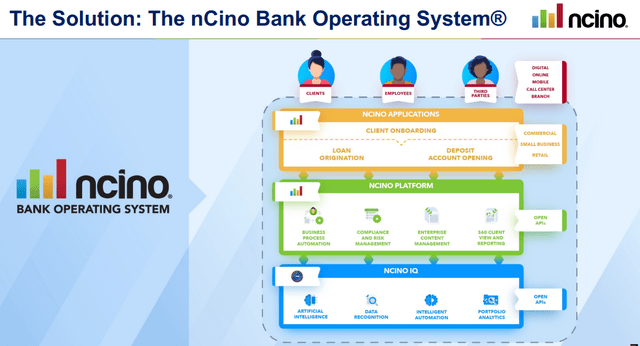

nCino Inc (NASDAQ:NCNO) offers a cloud-based software solution for financial institutions that covers everything from client onboarding, loan servicing, reporting, compliance, and related analytics. The attraction here is an end-to-end platform that replaces various legacy systems with a more efficient alternative that is seeing strong adoption by major banks and credit unions. Indeed, the company just reported its latest quarterly result highlighted by impressive operating trends and positive management guidance. While the stock has been volatile over the past year amid the broader market weakness in high-growth tech names, we are bullish on NCNO which benefits from several tailwinds into what could be a breakout year for the company.

source: company IR

NCNO Earnings Recap

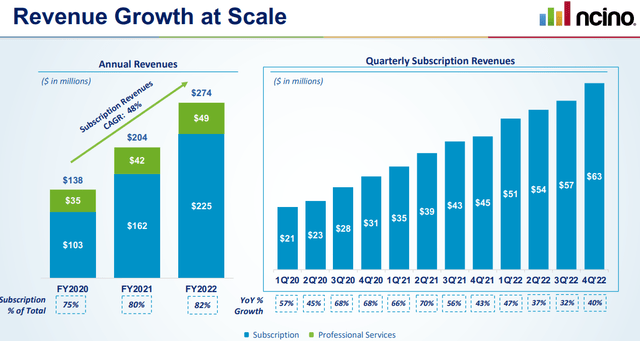

NCNO reported its Q4 earnings with a non-GAAP EPS loss of -$0.09, which was in-line with the market consensus. On the other hand, the revenue of $75 million climbing 32% year-over-year was a solid beat to the market estimate of $69 million. The result was also an acceleration from the 29% y/y growth rate in Q3. A big theme for Ncino has been its momentum in subscriptions which now represent 82% of the business. On this point, the growth of subscription revenues in Q4 at 40% y/y was the strongest since the last Q1.

source: company IR

For the full year, revenues reached $274 million, up 34% compared to fiscal 2021. The total gross margin reached 63%, up from 60% last year which was driven by the strength in subscriptions and customers adding on additional features. The negative non-GAAP operating margin at -6% for the year narrowed from -7% in fiscal 2021, and -15% in 2020 recognizing that the company continues to invest in growth.

Ncino ended the year with 1,775 total customers compared to 1,268 last year. Part of the boost includes the addition from the acquisition of “SimpleNexus“, a platform that expands the company’s reach into home mortgage lending tools. 47 customers are generating over $1 million in annual subscription revenue, which is up from 36 last year.

One of the headlines emerging out of the earnings report was an announcement that Wells Fargo & Co (WFC) was expanding its use of the core Ncino bank operating system. These are the types of customer wins that we interpret as demonstrating the company’s penetration in the sector and recognition by major clients of the value the platform generates. Separately, the company notes that four of the five largest Canadian banks are current customers while there is also an effort to expand internationally with new clients in countries like Germany, France, Spain, and Japan.

Ncino ended the year with $88 million in cash and equivalents against $33 million in long-term financial obligations. We view the balance sheet as stable in the near term but won’t be surprised if the company requires a secondary equity issuance over the next two years to beef up liquidity, in support of ongoing growth opportunities.

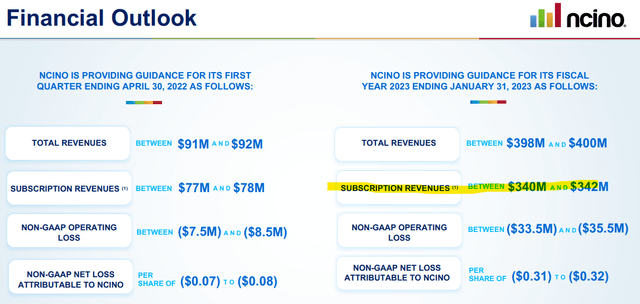

Management is guiding for total revenues to approach $400 million this year, representing an increase of 46% including the contribution from the SimpleNexus acquisition, or 27% y/y on an organic basis. For fiscal 2023, the company expects the EPS loss in a range between -$0.31 and -$0.32 which compares to -$0.20 in fiscal 2022. A large part of this loss is based on the investments being made to integrate SimpleNexus into the ecosystem.

source: company IR

NCNO Stock Price Forecast

It’s been a long road for NCNO since its 2020 IPO when shares debuted at $71, entering the market during a period of strong enthusiasm for fintech names. The story in the period since has been this gradual selloff, with the market pairing back some of the early enthusiasm in the context of the broader volatility, particularly among “high-growth and unprofitable” tech names.

Compared to a peak valuation for the stock near $9 billion in Q4 2020, the current level closer to $5 billion represents a deep discount for a growth story that, in our opinion, is as strong as ever. Within this niche of cloud-based banking operating platforms, Ncino stands out with a differentiated proposition and clear signs of early market leadership. The push into international markets signifies the next stage of high growth.

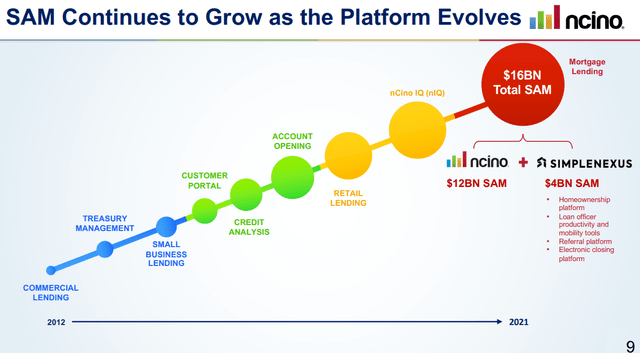

The company believes it operates within a $16 billion serviceable addressable market (SAM) implying a long-run way to gain market share considering its current revenue run rate. The SimpleNexus acquisition from last year is a game-changer because it sort of transforms the offering into a more complete point of sale and origination suite covering core banking product lines.

source: company IR

The company shares case studies of how different types of clients have implemented the system with success between greater efficiency, time savings, and improved compliance protocols. The way we are looking at Ncino, the platform should sell itself and represents an easy option for small and large financial institutions to upgrade internal systems towards the market standard in terms of interface and accessibility for employees.

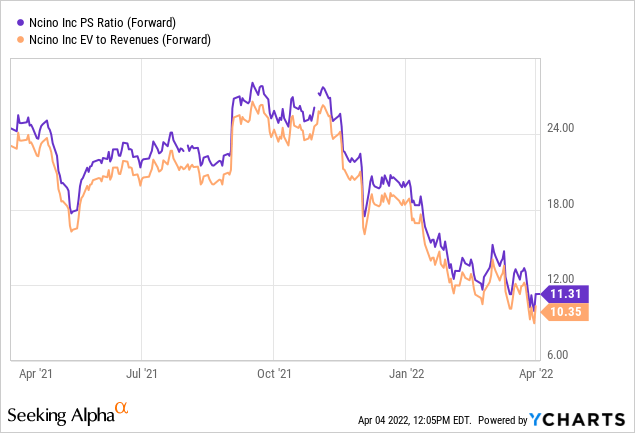

In terms of valuation, without current profitability, the metric we are looking at is the company’s sales multiple. NCNO trades at a forward price to sales ratio of 11x or EV to forward revenue of 10x considering the 2022 management revenue guidance. We believe this type of premium is justified and even attractive considering the growth momentum. The important point here is that the revenue growth rate took a leg higher this last quarter and the expansion into mortgage lending tools even broadens the market opportunity. This is a stock that traded with a sales multiple above 25x as recently as Q4 2021, and it’s fair to say that the selloff has helped balance what may have been stretched valuation at the highs while still leaving some upside potential.

Final Thoughts

There’s a lot to like about Ncino with very encouraging trends in the last quarter. The bullish angle here is that the company can continue to consolidate its market position as the standard in banking operations platforms. The ability to grow its customer base which carries cross-selling opportunities into more features opens the door for stronger earnings going forward. We believe the stock looks attractive at the current level of under $50.00 per share. A breakout higher here can open the door for a more sustained rally reversing the stock price decline of last year.

Seeking Alpha

As for the risks to watch, the company remains exposed to the broader macro outlook. A deterioration of the global growth environment is defined by a slowdown in consumer spending which would pressure the operating environment for its target customers and would likely limit the operating momentum over the near term.

We’d like to see some guidance regarding a roadmap to profitability and until it becomes clear Ncino can consistently generate positive cash flows, the expectation is for shares to remain volatile. Monitoring points include the trends in subscriptions as well as the financial margins.

Be the first to comment