sitox/iStock via Getty Images

Natural Gas Services Group, Inc. (NYSE:NGS) recently noted that investments in high horsepower equipment could bring seven times more sales than the company’s average rental rate. If we also assume expansion into new markets in the United States and overseas, I believe that future free cash flow will likely justify more stock price than the current price mark. I see some risks from new regulatory pressures and shifts in crude oil demand. With that, the downside risk does not seem large.

Natural Gas Services: Higher Horsepower Equipment Could Make The Company’s Revenue Spike Up

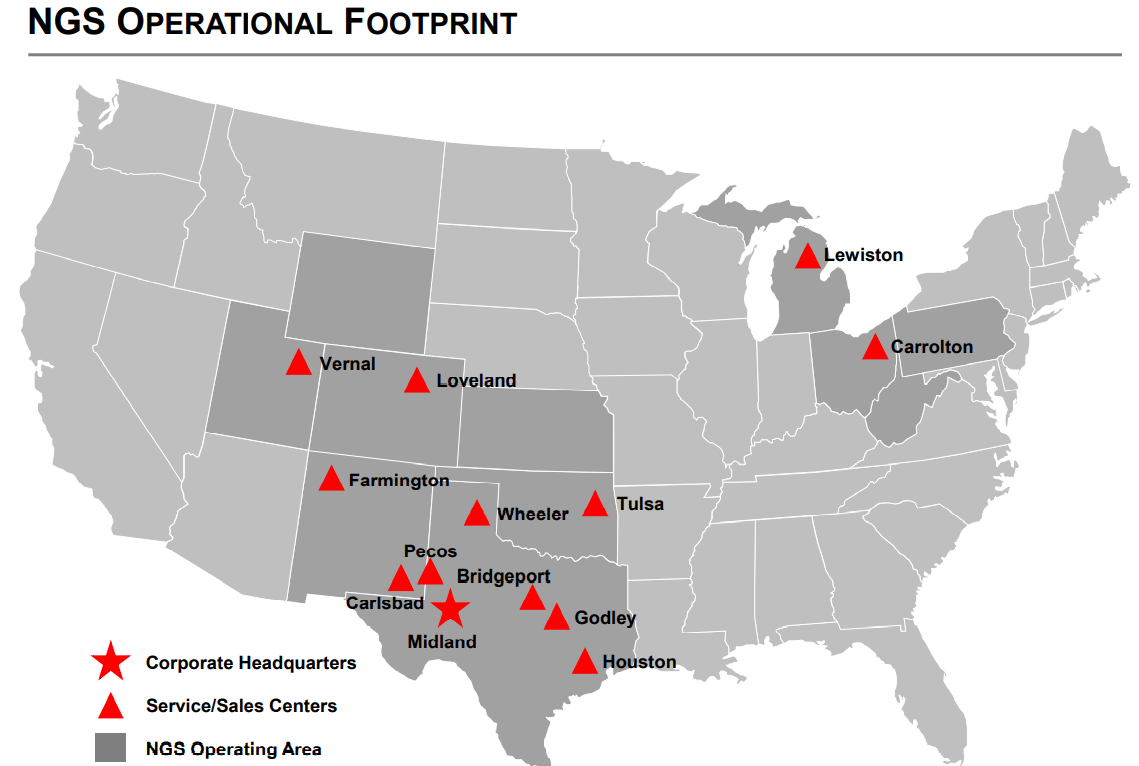

With fabrication facilities located in Tulsa, Oklahoma, and Texas, NGS offers gas compression equipment and services to the energy, oil, and natural gas production and plant facilities. The company operates in a significant number of states.

IR Presentation

NGS signs outsourcing contracts for six to 24 months, which helps clients reduce their compressor downtime and operating expenses as well as produce a higher volume of oil and gas. Keep in mind that in the oil and gas industry, the greater the equipment run time, the larger the revenue. Thanks to NG, operators don’t have to lose time for changing their equipment that often.

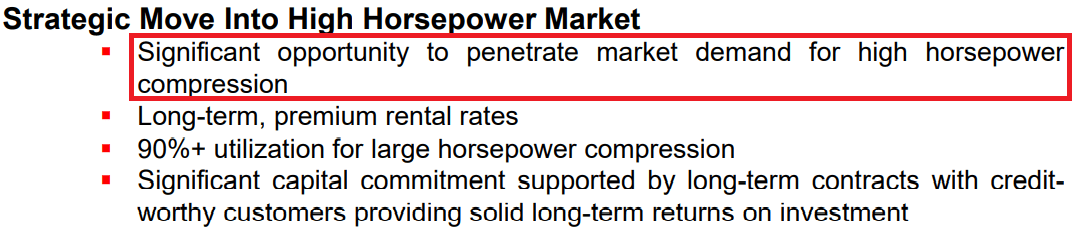

In my view, it is a great time to review NGS’ business prospects. Keep in mind that management recently noted its intention to make relevant investments in the high horsepower market, which will likely offer premium rental rates thanks to more percentage of utilization.

IR Presentation

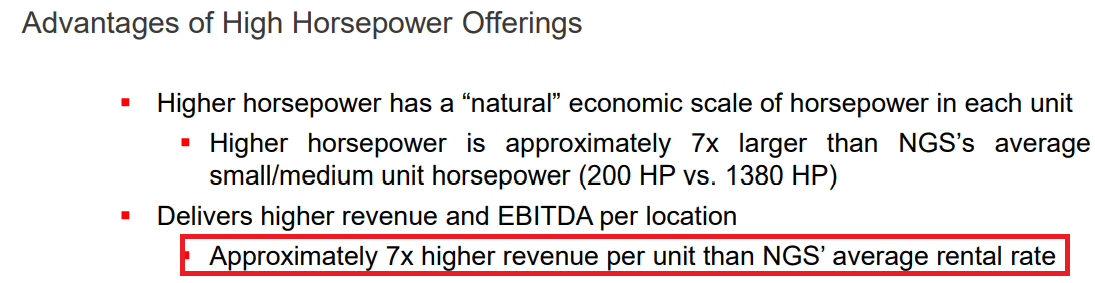

In a recent presentation, NGS noted that high horsepower equipment could offer seven times more sales than the company’s average rental rate. In theory, larger investments in this market will likely bring more revenue growth:

IR Presentation

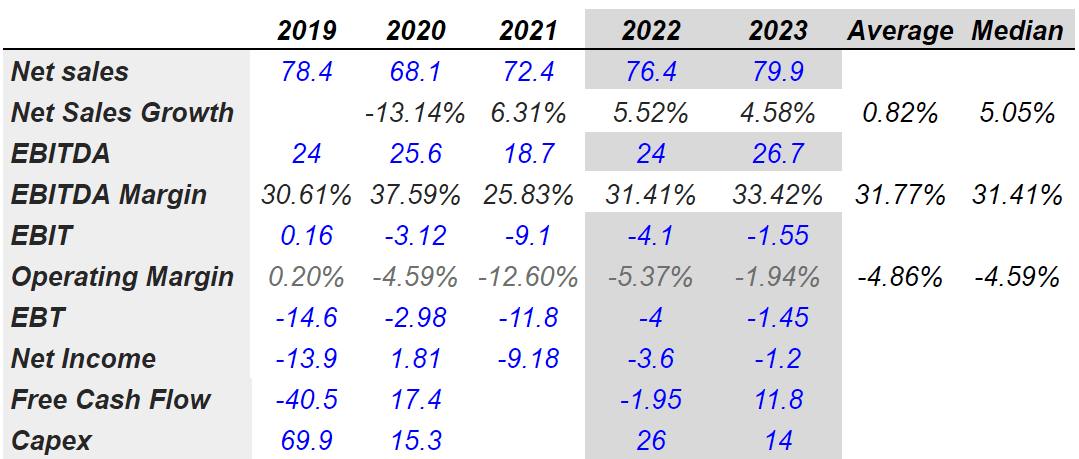

Analysts Expect Sales Growth Close To 4%-5% And An EBITDA Margin Of 31%

I believe that most analysts are expecting great results for 2022 and 2023. Using the net revenue from 2020 and 2021 and the forecasts for 2023, the median sales growth is close to 5%, and the average is equal to 0.8%. Estimates also include stable EBITDA margin of 31%. As I saw in the past, NGS does not report positive net income because the depreciation and amortization is substantial. However, when we add back the D&A, the result turns positive.

marketscreener.com

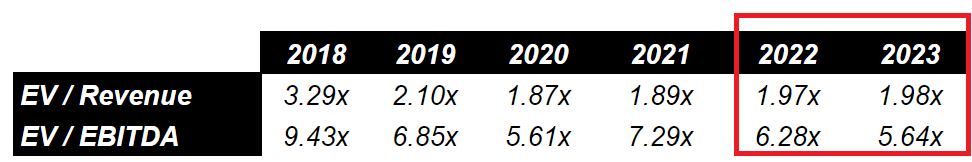

Given the expected increase in revenue, EBITDA, and growing free cash flow margins, I believe that NGS is about to become cheap in the next two years. Estimates include an EV/EBITDA close to 5x-6x, which is below the valuation of other competitors.

marketscreener.com

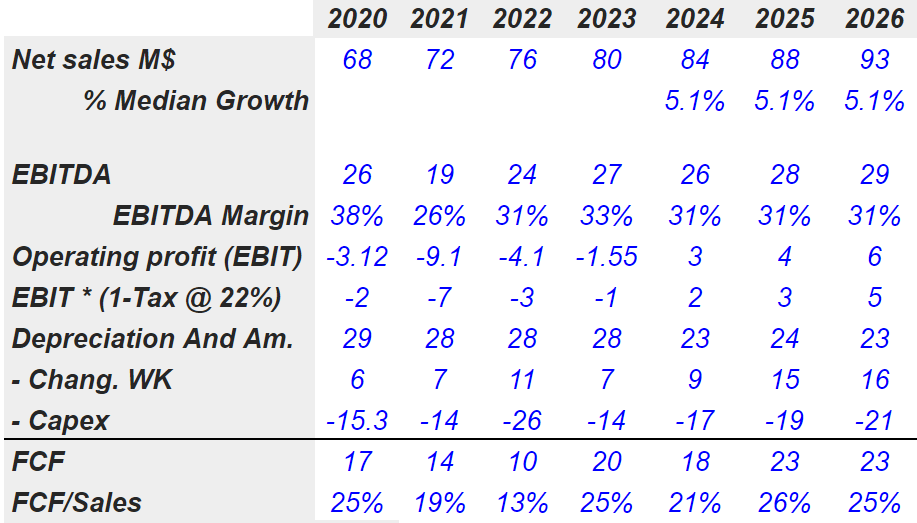

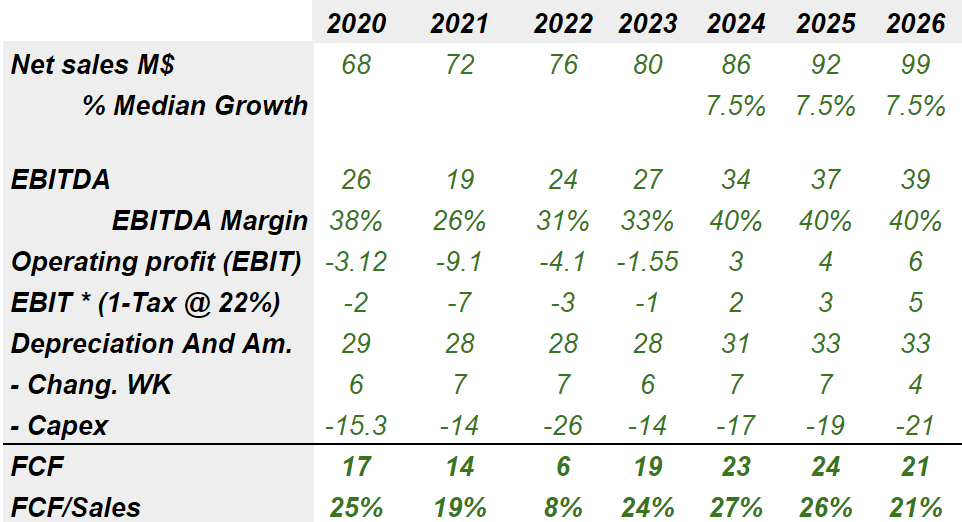

Base Case Scenario: Unconventional Natural Gas And Oil Production

Under the base case scenario, I expect NGS to focus more on clients related to unconventional natural gas and oil production. These clients will likely require more compression tools than other clients. In addition, we are talking about land-based production and very low risk. Besides, I also expect successful movement into horsepower of more than 400 HP, and perhaps certain new opportunities in midstream oil and gas. With the gas compressor market expected to grow at a CAGR of 5%, I assumed approximately the same sales growth for NGS from 2024 to 2026:

Gas compressor market size exceeded USD 3 billion in 2020 and is estimated to expand at over 5% CAGR between 2021 and 2027. The industry shipments are set to cross 283,263 units by 2027. Favorable trends associated with oil & gas sector will augment the industry growth. Source: Positive Displacement Gas Compressor Market Size

Under this case scenario, I also assumed an EBITDA margin of 31%, which is close to the median EBITDA margin seen in the past. Also, with an effective tax rate of 22%, depreciation and amortization around $29-$23 million, and capex close to $14-$21 million, the free cash flow will likely grow from $10 million in 2022 to $23 million in 2026.

YC

Like other analysts, I assumed a weighted average cost of capital of 14%, which appears, in my view, sufficiently conservative. I also included a terminal value of 7x as I saw that the median multiple in the industry is close to 7x. The company does not have a lot of debt, so the equity valuation is larger than the implied enterprise value. The implied price should be equal to $12.

YC

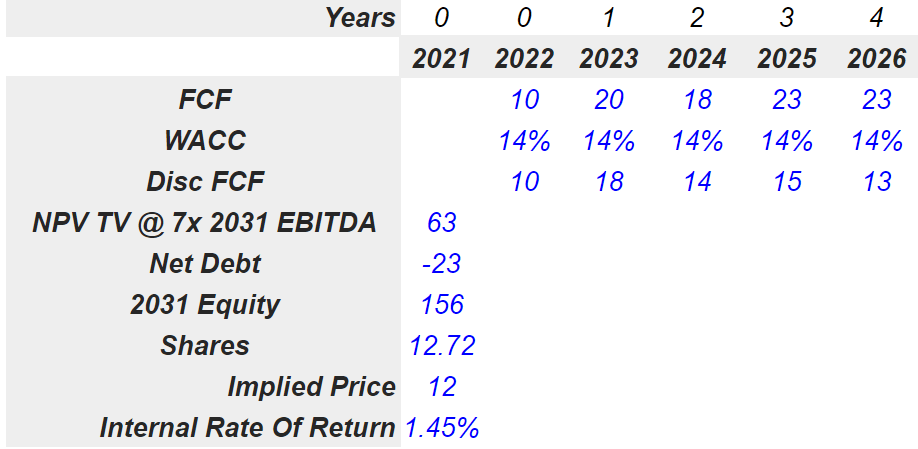

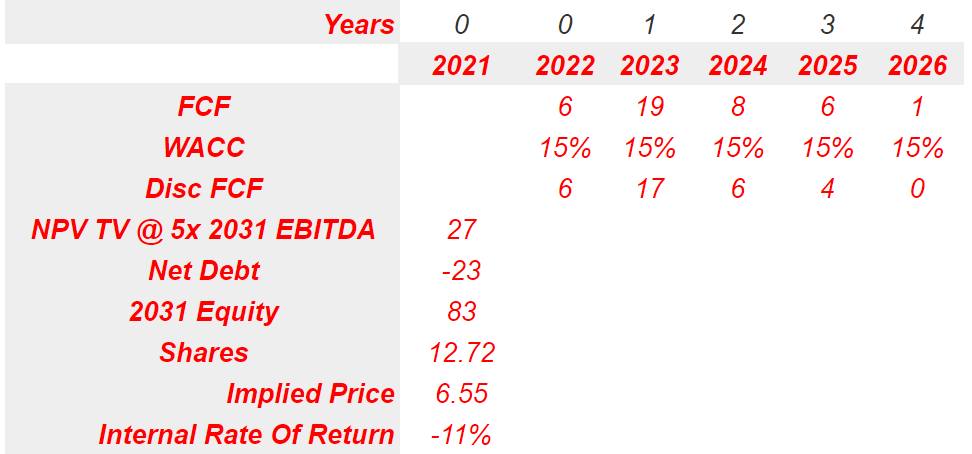

Worst Case Scenario

Changes in the price and demand of oil and gas could lead to less utilization rates for the company’s equipment. Besides, NGS may also receive less net revenue from services given to clients. Even if the company signs long contracts, a decline in the activity in the oil and gas industry will likely lead to less revenue growth:

Our rental contracts are generally short-term, and oil and natural gas companies tend to respond quickly to upward or downward changes in prices. Any prolonged reduction in drilling and production activities historically has reduced our compressor sales and materially eroded both rental pricing and utilization rates for our equipment and services and adversely affects our financial results. As a result of any such prolonged reductions, we may suffer losses, be unable to make necessary capital expenditures and be unable to meet our financial obligations. Source: 10-k

Politicians may try to modify the legislation related to hydraulic fracturing. Even if they don’t ban this engineering option, regulatory changes may make it less profitable. As a result, NGS may lose some of its clients, or management may have to reduce its prices:

From time to time, for example, legislation has been proposed in Congress to amend the federal Safe Drinking Water Act (“SDWA”) to require federal permitting of hydraulic fracturing and the disclosure of chemicals used in the hydraulic fracturing process. Further, the EPA completed a study finding that hydraulic fracturing could potentially harm drinking water resources under adverse circumstances such as injection directly into groundwater or into production wells lacking mechanical integrity. Source: 10-k

Under the previous conditions, I would expect lower sales growth than in the base case scenario. I assumed sales growth of 0.5%, an EBITDA margin close to 25%, and depreciation and amortization between $15 million and $30 million. Also, with capital expenditures around $15 million, the free cash flow will likely decline from almost $20 million in 2023 to around $1 million in 2026.

YC

With a conservative weighted average cost of capital of 15% and an EV/EBITDA multiple of 5x, I obtained an equity valuation close to $85 million. The implied result is equal to $6.55.

YC

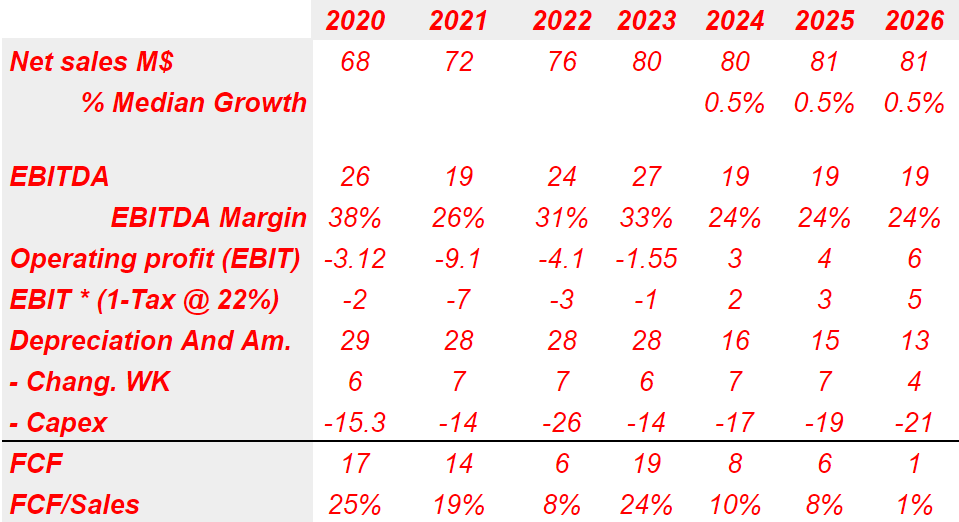

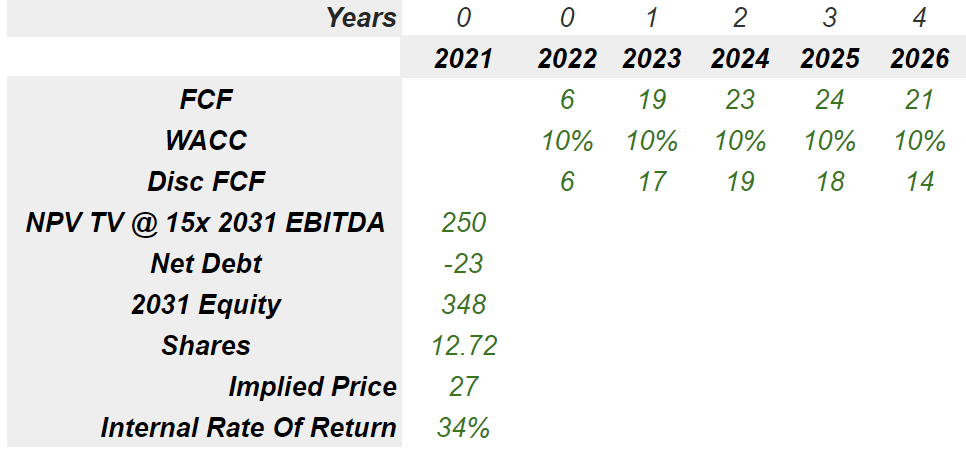

My Best Case Scenario Includes The Internationalization Of The Business

In the last annual report, NGS noted that other competitors have access to broader geographic dispersion. Well, under this scenario, I would assume that management practices an ambitious strategic plan, in which it tries to sign contracts with clients in new regions in the United States. Besides, in my view, if NGS decides to enter into new markets like Saudi Arabia, Latin America, or Europe, revenue growth will likely increase:

They may be better able to compete because of their broader geographic dispersion and ability to take advantage of international opportunities, the greater number of compressors in their fleet or their product and service diversity. As a result, we could lose customers and market share to those competitors. Source: 10-k

In this case scenario, I believe that a sales growth of 7.5% y/y from 2024 to 2026 is justified. I also assumed an EBITDA margin of 40% and an effective tax ratio of 22.5%. The results include free cash flow around $20 million from 2023 to 2026. The free cash flow margin could also increase to almost 25% in 2023.

YC

Given the fantastic results that NGS would deliver in this case scenario, I would expect a decline in the cost of equity. Thus, I assumed a weighted average cost of capital of 10%, which will likely imply an equity valuation close to $350 million, and an implied share price of $27.5:

YC

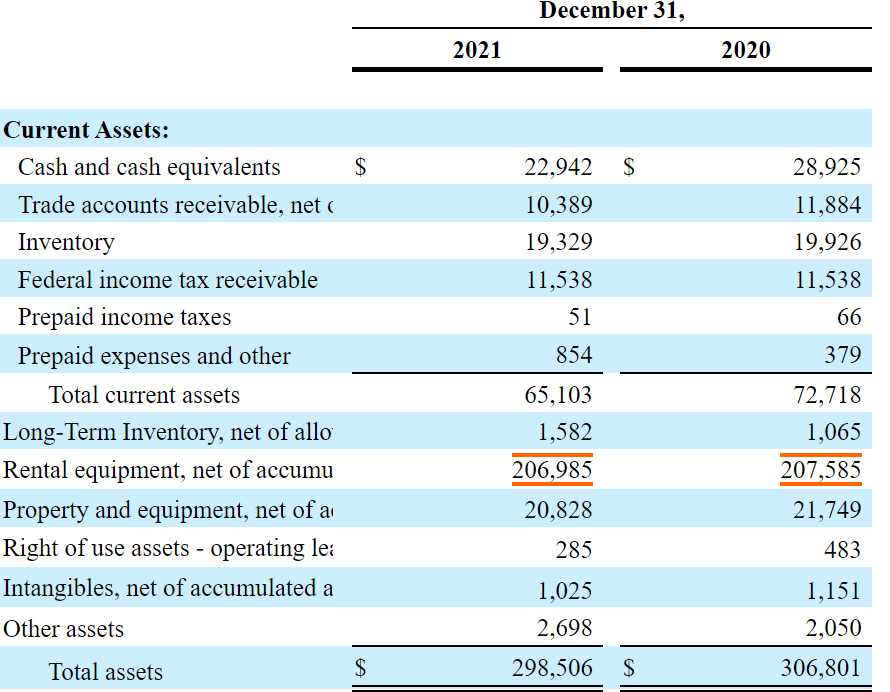

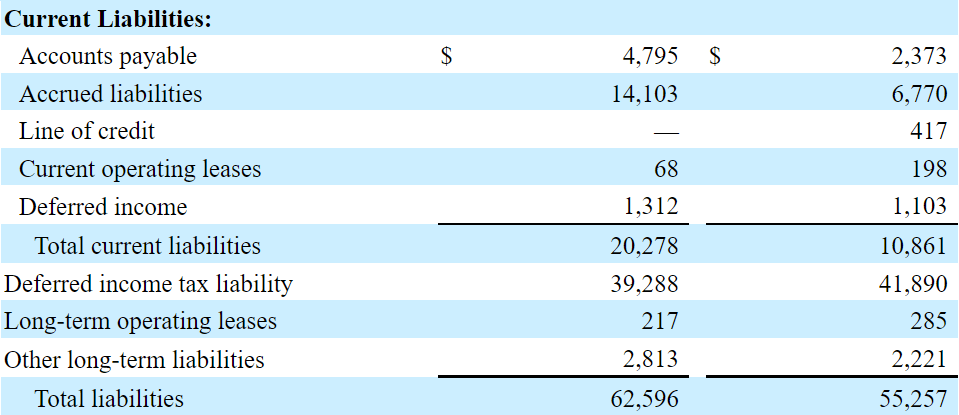

A Decent Amount Of Cash, And The Purchase Of Equipment Increased In 2021

With $22 million in cash, $298 million in total assets, and $62 million in total liabilities, the company’s financial health appears quite beneficial. I believe that NGS has sufficient liquidity to acquire more equipment in the near future.

10-k

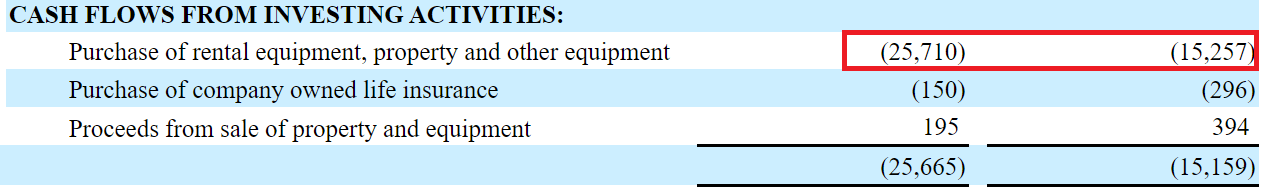

It is very relevant noting that NGS accelerated its purchase of equipment in 2021. In my view, management expects to enjoy a sweet period in the coming years, so it is trying to offer more rental equipment to clients:

10-k

With regards to the debt obligations, it is quite beneficial that management does not really need to talk to banks to finance its operations.

10-k

Conclusion

NGS reports significant opportunities of working with clients related to unconventional natural gas production. Management also claims that investments in high horsepower equipment could bring seven times more sales per unit than NGS’ average rental rate. I believe that if we assume potential expansion into new states and international expansion, revenue growth and free cash flow would justify higher stock price marks. I did identify several risks from new regulations and shifts in the demand for oil. With that, in my view, the upside potential appears more significant than the downside risk.

Be the first to comment