da-kuk/iStock via Getty Images

Natural gas prices have been on a steady uptrend since the start of the year. May contracts are now trading at $5.5+ and there are valid bull arguments to be made that natural gas prices will move higher this summer.

For starters, Europe’s natural gas situation will only worsen. Russia is now demanding that gas exports be paid in Ruble. Germany has already responded that it won’t be blackmailed.

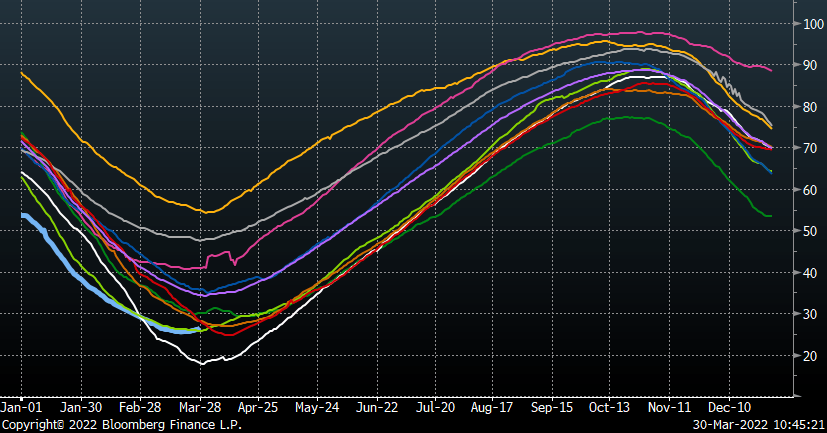

Bloomberg

You can see that Europe’s gas storage is expected to finish the winter season near multi-year lows. Without adequate Russian gas supplies this injection season, there’s a very real possibility that Europe will finish injection season at the lowest storage level ever. As a result, the marginal pull on US LNG gas exports will be so high as to start influencing US gas pricing.

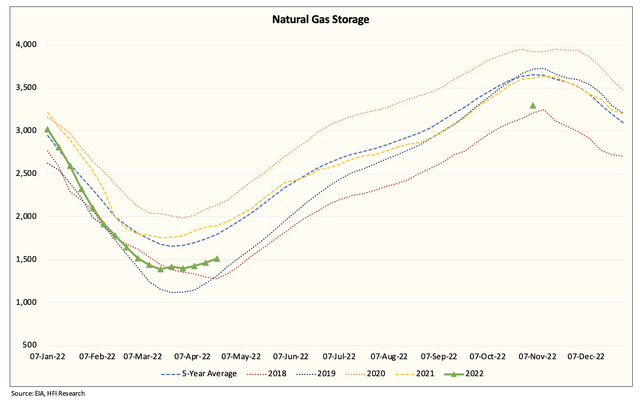

Now in the past, there’s the tendency for US natural gas to decouple because it’s landlocked, so to speak. But when you throw in low absolute storage levels in the US, disciplined production, and higher structural demand, US natural gas all of a sudden doesn’t look so landlocked anymore.

At the current supply/demand, we estimate EOS to be ~3.3 Tcf. This assumes a normal summer. If this summer is anything close to the one we saw in 2018, then we are looking at sub-3 Tcf.

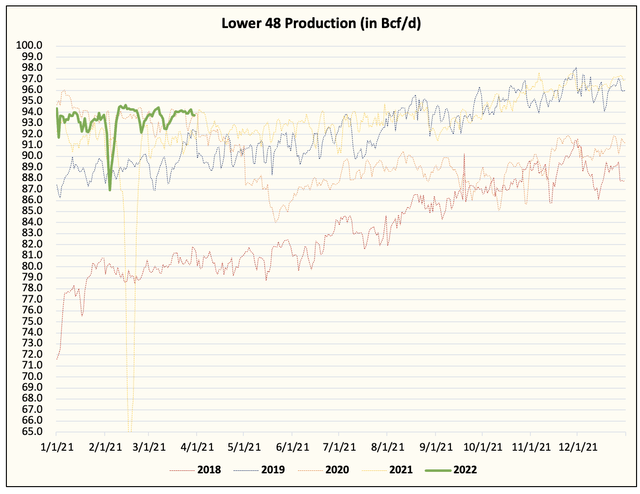

Another critical variable to this year’s price movement will be the response in Lower 48 gas production. At the moment, we’re seeing production averaging ~94 Bcf/d. Anything shy of ~97 Bcf/d average throughout the injection season implies our EOS estimate will fall short. Yes, we need to increase production to ~97 Bcf/d in order to get storage to reach ~3.3 Tcf. This is a tall task given how disciplined Northeast gas producers have already communicated.

All of this brings us to the inevitable conclusion that if this summer proves to be hotter than normal, the idea that natural gas prices in the US will somehow be constrained will need to be thrown out the window. Traders will fear a lack of gas in the storage scenario come November, and pricing may get out of whack.

In terms of how you would play this, we think the safest and easiest way is to remain long a name like Antero Resources (AR). By being long AR, you are in a situation of heads, you win, and tails, you win. If production does ramp and prices don’t skyrocket, you still win because the current implied valuation suggests AR will make a fistful of money even if Henry Hub stays above $3.5/MMBtu. But if pricing goes berserk, then you get the upside from escalating prices.

Again, heads, you win, tails, you win.

Either way, the situation in Europe is likely to worsen before it gets better. The real reckoning is this upcoming winter, which will likely make the natural gas volatility we saw in Europe last year child’s play. US gas prices will likely get dragged along this time around. If US shale doesn’t bailout this US this year, then it’s a rude awakening for prices this summer.

Be the first to comment