fatido

This article was coproduced with Cappuccino Finance.

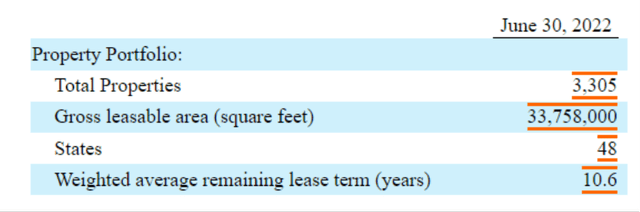

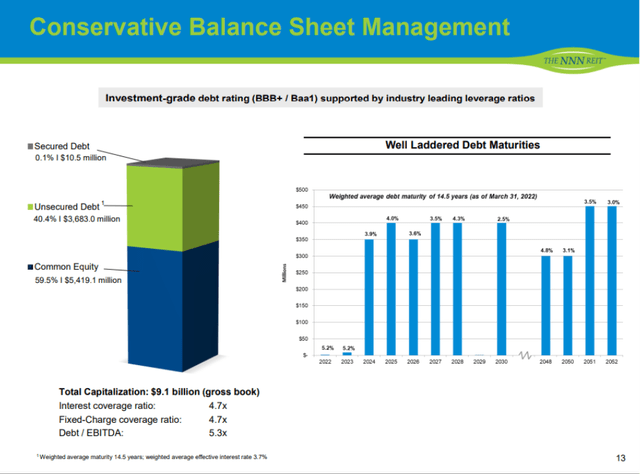

National Retail Properties (NYSE:NNN) is a fully-integrated REIT that acquires, owns, and invests in real estate property that’s leased to retail tenants. They have a very strong portfolio that is diversified geographically and across business lines.

NNN operates over 3,300 properties with more than 33 million square feet of leasable area. Their top tenants include household names such as 7-Eleven, Camping World, LA Fitness, and Dave & Buster’s.

NNN SEC Filings

NNN continues to acquire new properties and redevelop existing assets to increase their value, and this is reflected in steadily expanding revenue. In the past five years, their revenue has grown at 5.88% per year.

Their AFFO and dividend has also increased along the way (32-year consecutive years of dividend growth). They have been maintaining a healthy portfolio with 99.2% current occupancy, and 25-year average annual total return has been 11.6%.

NNN SEC Filings

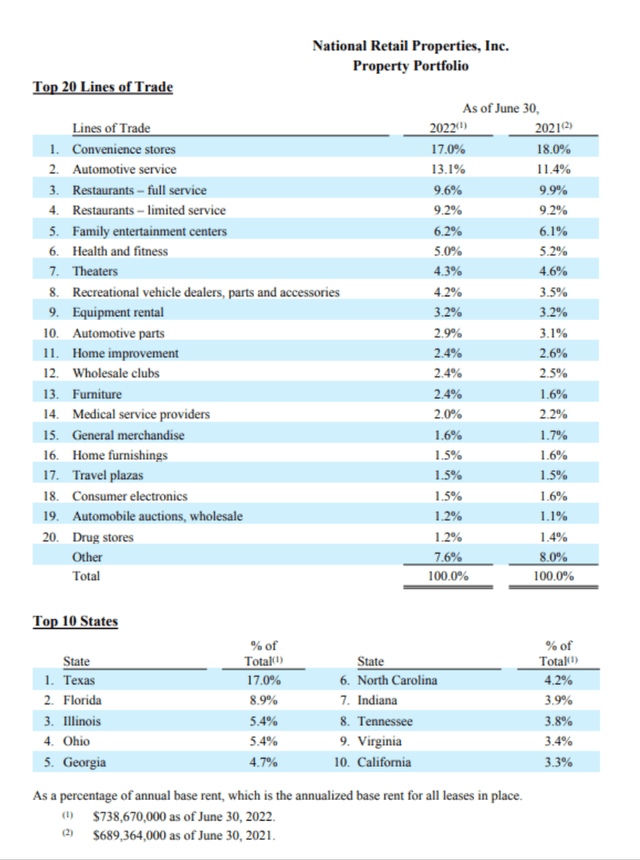

NNN maintains a geographically diversified presence, which greatly reduces the risk of the asset portfolio. Their assets are well spread across the Mid-West, South, Southeast, and Northeast, along with a smaller presence in the West and Rocky Mountain regions.

Top states like Texas, Florida, and Illinois represent 17%, 9%, and 5%, respectively. This diversified portfolio offers exposure to high growth regions while also reducing the overall risk and volatility.

NNN Investor Presentation

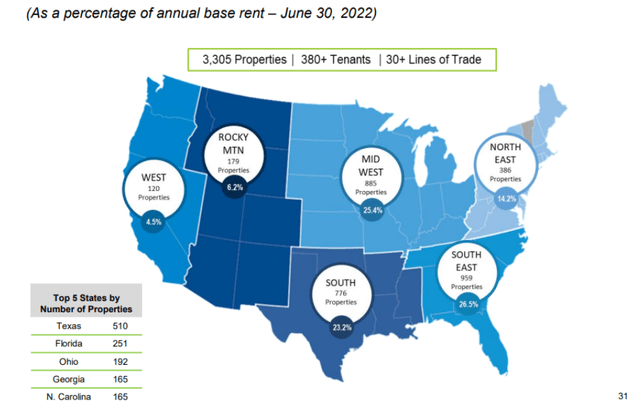

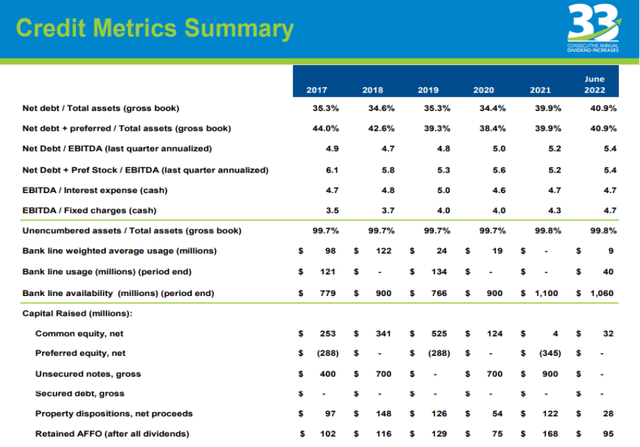

Strong Balance Sheet and Portfolio Stability

With a strategy focused on long-term growth and conservative balance sheet management, NNN has built a very strong balance sheet and stable asset portfolio.

Looking at their debt maturity schedule, it’s well spread out until 2050s. There’s no significant maturity until 2024, and each year’s debt maturity is less than $500 M. The weighted average debt maturity is a nice, long 14.5 years.

Other ratios also confirm that NNN is doing a great job at managing leverage. Interest coverage ratio of 4.7x, Fixed-Charge coverage ratio of 4.7x, and Debt/EBITDA ratio of 5.3x all indicate that they’re more than capable of servicing their debt.

NNN Investor Presentation

NNN Investor Presentation

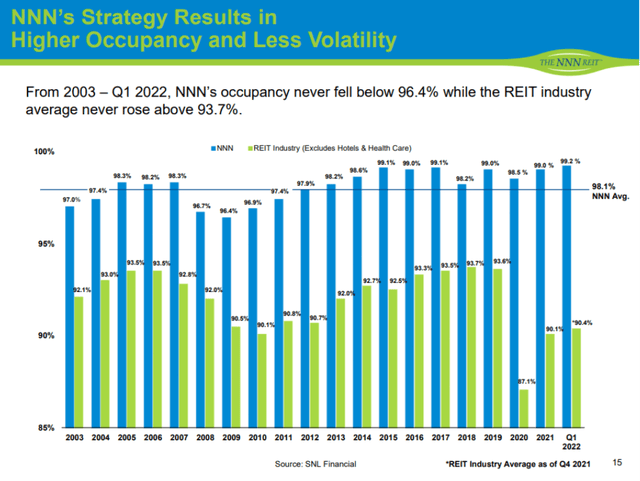

NNN deploys a simple strategy that has been consistently delivering strong results over the past several decades.

First, they utilize a net lease (tenants pay taxes, maintenance, and insurance) to generate a reliable income stream with low volatility.

Also, they selectively choose non-investment grade tenants for better pricing, higher rent growth, and the opportunity for tenant credit improvement. Lastly, they maintain a long-term perspective with 15–20-year initial leases, and don’t overreact to short-term market fluctuations.

Combining this well managed long-term strategy and robust balance sheet, they have been delivering stable and consistent growth.

Their profitability and stability are clearly demonstrated through 32 consecutive years of annual dividend increases (the third longest of all public REITs and 99% of all public companies), and 4.3% core FFO growth per share since 2016.

Also, their occupancy has never fallen below 96.4%, which is 3-4% higher than the REIT industry average.

NNN Investor Presentation

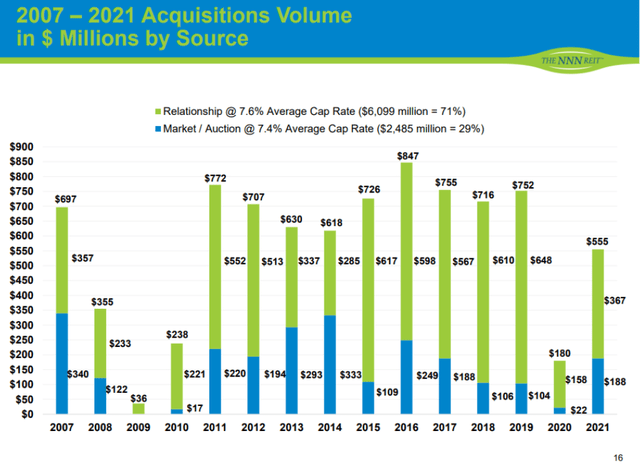

Growth Strategy

In order for a REIT to grow, the company must continually acquire new properties, redevelop existing properties, and opportunistically dispose of some properties. National Retail Properties is doing a great job at managing this deal flow.

They have been expanding their asset portfolio since 2007 with new acquisitions. Apart from unusual years during the financial crisis (2008-2010) or pandemic (2020), they have deployed $600 M or more annually on acquisitions.

NNN Investor Presentation

During the latest earnings call, management mentioned that they’re comfortably on track to meet or exceed their 2022 acquisition guidance of $600 M – $700 M. During 2Q 2022, they sold eight properties and raised about $8 M that will be used for new acquisitions.

During the first half of the year, they raised about $28 M through the sale of 18 properties. Based on their stable operation and strong balance sheet, I have little doubt that they will be able to achieve this 2022 goal and their long-term growth plan.

Solid Operation Results so far in 2022

National Retail Properties continued their consistent performance in 2022. They just announced ~4% increase in dividend and recorded 99.7% of occupancy. The core FFO was $0.79 per share for 2Q 022, which was up 12.9% compared to 2Q 2021.

The first six months core FFO was up 11.4%. With this strong operational performance and well managed capital deployment, management is expecting $180 M of free cash flow for 2022.

Based on the continuing strong performance so far this year, management raised their guidance for 2022 core FFO and AFFO. The core FFO per share guidance was raised from $3.01 – $3.08 per share to $3.07-$3.12 per share. Dividend payout ratio is at 66.9%, which means that the dividend is very well covered and safe.

This is outstanding news for shareholders and a great testament of the quality of their assets. I expect them to continue their excellent performance going forward.

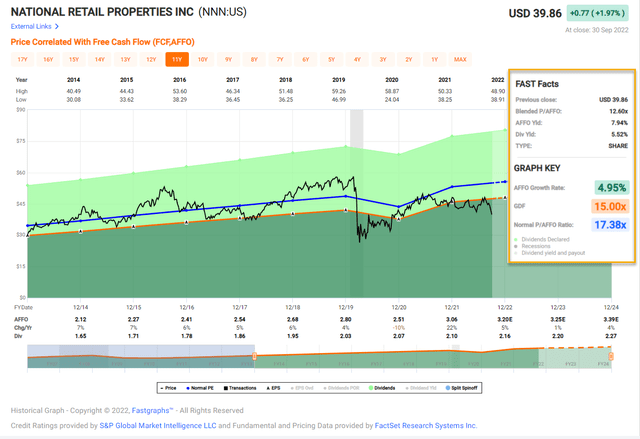

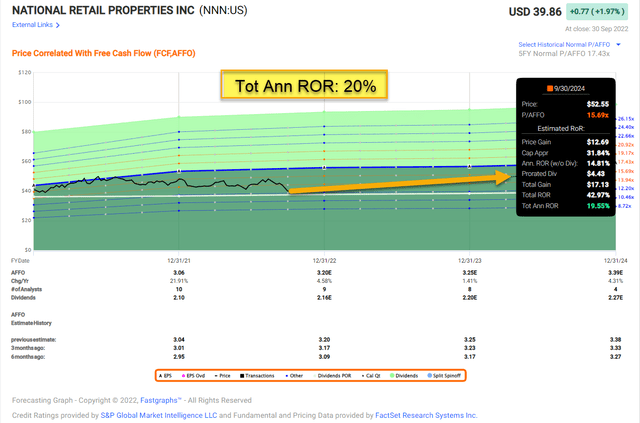

NNN Stock Valuation

The current valuation of NNN shows that the stock price is undervalued at this point. P/AFFO of 13.33x and P/FFO of 13.94x are significantly lower than their previous five-year averages. Also, both values are lower than the sector median.

FAST Graphs

Given their balance sheet, growth prospects, and track-record of success, I believe the market is clearly making a mistake on this stock.

The recent one-month drop of 14% was mainly caused by fears over recession and struggles in the real estate market and is an over-reaction by the market.

While it’s true that high inflation and interest rate hikes may trigger a recession and economic slowdown, NNN has a strong balance sheet and portfolio that can weather tougher times.

Also, National Retail Properties’ management has a long-term strategy and won’t make knee-jerk reactions. Therefore, I think the stock price is presenting a great opportunity for investors to buy some stock at a bargain price, while enjoying the solid dividend yield of 5.5%.

Risks

As many of us are aware, the likelihood of a recession is building. The core inflation gauge in August came in hotter than expected, and Federal Reserve will likely maintain a hawkish tone for the foreseeable future.

Consumer sentiment is deteriorating and may lead to reduced spending, which will hurt tenant performance. This in turn may impact renewal rate, occupancy rate, and the REIT’s overall performance. Also, activity in the commercial real estate market may slow due to higher interest rates.

Many of NNN’s tenants are non-investment grade companies, which means they carry a weaker balance sheet or shorter track record.

NNN uses diversification to reduce their overall tenant credit risk and achieve great growth, but the hawkish monetary policy and recessionary pressure may bring some financial hardship to their tenants and spill over into National Retail Properties’ performance.

Also, the pandemic era introduced booming demand for e-commerce and last-mile delivery. More and more people are ordering their food, toiletries, and general goods to get delivered to their front door.

This macro trend will put pressure on some of NNN’s tenants. Some of them may need to start delivery, a curbside pick-up service, or develop an online presence to compete. These higher business costs may impact their financial performance in the future.

Conclusion

National Retail Properties has been a great investment choice for dividend-seeking REIT investors for a long time. The numbers speak for themselves – 32 consecutive annual dividend increases, average annual total return of 11.6%, and strong occupancy rate of 99.2%.

All of these demonstrate the strength and quality of National Retail Properties. Their portfolio is diversified geographically, and their tenants were diversified across different industries. Also, their debt is well-managed, with an evenly laddered maturity schedule.

Given their ongoing investment in new properties, I expect National Retail Properties to continue to grow and keep raising their dividend. High inflation and a hawkish Federal Reserve monetary policy may put pressure on their tenants’ businesses and the commercial real estate market.

However, National Retail Properties has a strong balance sheet and portfolio, so I expect them to be able to handle the financial challenges of a recession.

Reflecting the negative sentiment in the market, I believe their stock price is undervalued. Their P/AFFO and P/FFO rations are below their historic levels, and this is presenting the opportunity for investors to grab their shares at a discounted price. A healthy dividend yield above 5% brings a great bonus as well.

FAST Graphs

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment