Caziopeia/E+ via Getty Images

Investment thesis

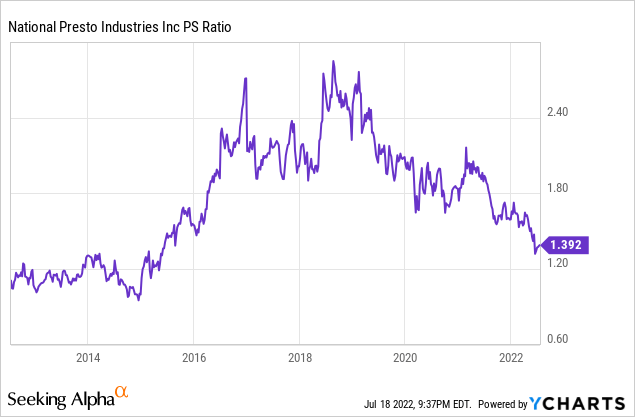

In January 2021, I wrote an article about National Presto Industries (NYSE:NPK) where I concluded that the pandemic was going to be a turning point in relation to sales, which had been in continuous decline for a decade, as many families considered updating their home appliances due to mandatory lockdowns, making them buy more of their products. The company also made strong efforts to build the safety products segment, which should ultimately help the company stabilize sales, although the segment still represents a marginal part of the company and is generating losses. Still, the share price seemed too high as the recent increase in the P/S ratio was not being accompanied by increased margins while the cash payout ratio reached levels that made the special dividends paid in recent years unsustainable due to decreasing cash from operations in 2020.

Certainly, the coronavirus pandemic crisis helped the company as net sales increased by 14.3% in 2020, although the increase in 2021 was only 0.89% compared to 2020 and the first quarter of 2022 was somewhat disastrous. Nevertheless, the backlog of the defense segment has significantly increased during 2021, which anticipates a significant rise in sales in the next few years. Despite this good news that suggests that the company is recovering some of the ground lost in recent years, profit margins have been seriously affected by current macroeconomic events: supply chain issues, rising raw material, energy, and transport costs, and labor shortages. This has caused a sharp drop in the share price of ~25% since I wrote the last article, but a very flexible dividend policy along with non-existent debt put the company in a very advantageous position to survive these headwinds. Furthermore, the Defense segment, which is poised to grow significantly, traditionally enjoyed much wider margins than the company’s overall operations, so margins should improve in the short term.

For this reason, I believe that the current macroeconomic events, which I strongly believe are temporary, present an opportunity for investors interested in acquiring shares at a reasonable price, especially long-term dividend investors. In this sense, the price of shares now looks much more reasonable compared to January 2021, so it seems that it is a good time to consider adding this company to relatively conservative dividend portfolios.

A brief overview of the company

National Presto Industries is a designer, manufacturer, and distributor of small electrical appliances, weapon ammunition, cartridge cases, precision mechanical and electro-mechanical assemblies, detonators, booster pellets, release cartridges, lead azide, and other military energetic devices and materials, as well as innovative safety technology for organizations and individuals. The company was founded in 1905 and insiders own a whopping 28.26% of the company’s shares, which means that the management actively participates as shareholders. Currently, the market cap stands at ~$470 million, making it a small-cap company.

National Presto Industries products (Gopresto.com/product)

The company’s operations are divided into three main segments: the Housewares/Small Appliance segment, which provided 33% of consolidated sales in 2021, the Defense segment, which provided 66% of sales in 2021, and the Safety segment, whose sales were marginal in 2021 at 0.1% as the company is still building it through two startup companies: Rusoh, Inc., which manufactures fire extinguishers, and OneEvent Technologies, Inc., which designs systems for early warnings to avoid significant losses.

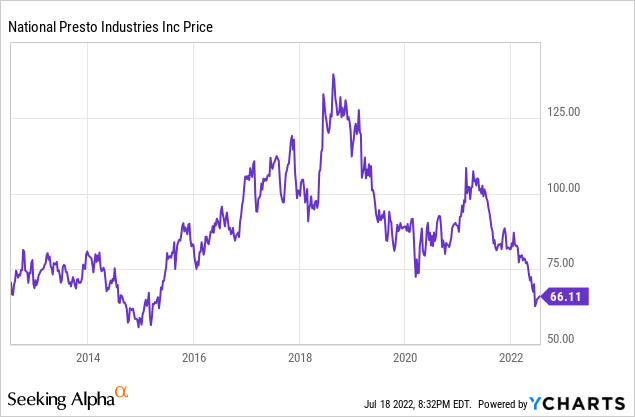

Currently, shares are trading at $66.11, which represents a 24.39% decline since the last article I wrote and a 52.55% decline from all-time highs of $139.35 on August 21, 2018. This price has broken the psychological barrier created after the coronavirus pandemic crash back in 2020, so I think it is very important to consider the possibility of acquiring shares for the long term at this point, especially considering the company usually pays very juicy special dividends.

Net sales keep growing as the backlog increased significantly

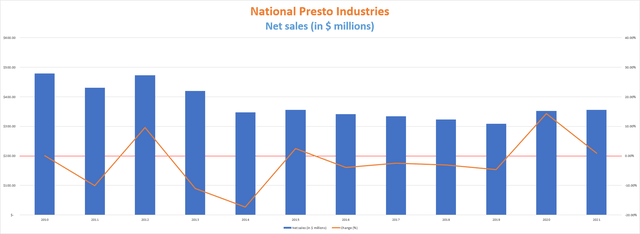

Net sales have experienced a continuous decline over the last decade, partly as a result of an overly generous distribution of dividends that limited a more active policy of mergers and acquisitions and expansions. Luckily for the company, the coronavirus pandemic crisis represented a turning point as net sales increased by 14.3% year over year in 2020 due to increased demand from people updating their homes and kitchens during mandatory lockdowns.

In 2021, the increase was marginal at 0.89%, although this meant that the increase in sales experienced in 2020 managed to be sustained during 2021. The problem came during the first quarter of 2022, when the company reported a net sales decline of 25.02% compared to the same quarter of 2021, which suggested the loss of all the ground gained during the pandemic, on top of the current issue of tighter margins.

The backlog of the defense segment increased by 43.9% in 2021 to $460.8 million, and these are expected to be translated into sales in an 18 to 36-month period. This increase is much higher than the increase of 3.17% year over year during 2020 for the segment. Net sales in the Housewares/Small Appliance segment declined by 1.5% in 2021 after an increase of 16.62% in 2020, but it was offset by an increase of 2% year over year in the Defense segment.

In this sense, the decline in the share price experienced in the last year has caused the PS ratio to plummet as sales are showing serious difficulties to be increased in a sustainable way. The PS ratio currently stands at 1.392, which means the company generates $0.71 in sales for each dollar held in shares, annually.

In this sense, we now have two simultaneous headwinds for National Presto: decreasing net sales in the short term, and tighter profit margins, which means that these limited sales are not being translated into cash from operations as easily as in the past due to increased cost of goods sold.

Margins are temporarily depressed and it is not known until when, but we have some clues

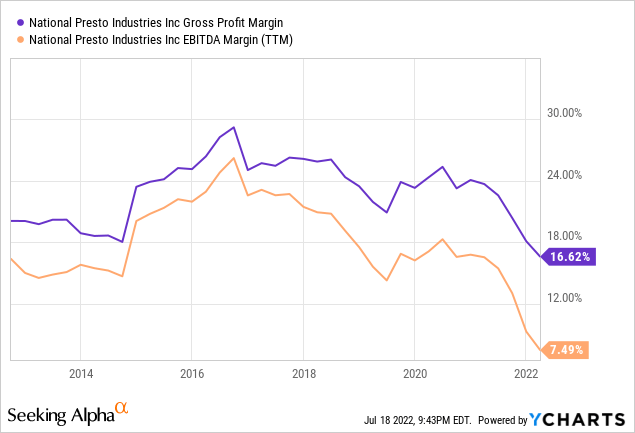

The company has historically enjoyed very healthy profit margins, but the coronavirus pandemic and the subsequent rise in the cost of raw materials, transportation, and energy, as well as supply chain issues and labor shortages experienced around the world, have taken a toll on the company’s ability to convert sales into actual cash. And now, the war between Russia and Ukraine is further complicating the threads that build trade relations around the globe.

Furthermore, the fact that margins for the first quarter of 2022 were lower than the trailing twelve months’ suggests that these difficulties are still getting worse as of recently. Continuing in this line, gross profit margins of 15.98% during the first quarter of 2022 are slightly lower than the trailing twelve months’ gross profit margins of 16.62%, and EBITDA margins of 6.25% during the quarter are also slightly lower than EBITDA margins of 7.69% during the last twelve months.

Still, we should keep in mind that such a drop in margins is relatively justified given that the world is currently facing high rates of inflation, and many consumer-focused companies like National Presto haven’t had enough time to pass on the increase in costs to customers as a result of persistent inflation. For this reason, I believe that once inflation eases, the discrepancy between the final price of the company’s products and the cost of producing them will widen again.

Furthermore, and taking 2021 as a reference, the Defense segment returned gross profit margins of 25.55%, much higher than the 8.60% reported in the Housewares / Small Appliance segment. Therefore, the increase in the backlog in the Defense segment during 2021 could translate into significant improvements in the margins of the company’s operations as a whole in the medium term.

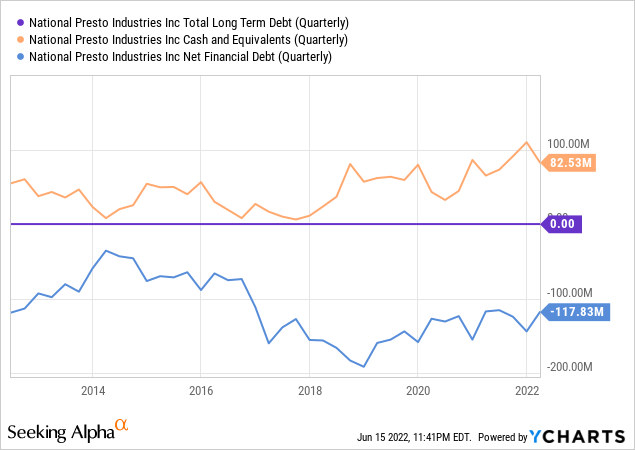

The company remains debt-free

One of the company’s strongest points is that it enjoys a negative net debt thanks to the non-existence of debt. Despite all the setbacks that are currently hitting the company’s operations, the risk of bankruptcy or serious problems is greatly reduced thanks to the fact that it does not have to face the payment of interest on any debt.

In addition, the company has over $80 million of cash on hand, so it still has reserves to continue facing headwinds while investing in growth initiatives. It is very difficult today to find such established companies with negative net debt, and this maximizes the possibilities of expansion of any company while minimizing its risks in difficult times like the present.

The dividend policy is very flexible

It is very important to understand the company’s dividend policy, which is strongly influenced by the high exposure of the management to the stock, before investing if we intend to have a dividend stream. The company usually pays a fixed dividend of $1 per year plus a special dividend which is variable depending on the results of the company’s annual operations.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Total dividend (fixed + special) | $5.05 | $4.05 | $5.05 | $5.50 | $6 | $6 | $6 | $6.25 | $4.50 |

In February 2022, the management announced a special dividend of $3.50 per share in addition to maintaining the regular dividend of $1. This represents a significant reduction compared to recent years, but a necessary move due to the high cash payout ratio experienced during 2019, 2020, and 2021.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in $ millions) | $73.21 | $46.28 | $44.56 | $52.96 | $39.94 | $9.58 | $40.97 | $34.69 |

| Dividends paid (in $ millions) | $34.95 | $28.11 | $35.16 | $38.41 | $41.99 | $42.09 | $42.17 | $44.08 |

| Cash payout ratio | 47.74% | 60.75% | 78.90% | 72.52% | 105.13% | 439.18% | 102.93% | 127.08% |

In this sense, cash from operations has been not enough to cover dividend expenses for four years in a row, which has pushed management to be a little more conservative when declaring the special dividend for 2022. This shows how convenient it is to have a flexible dividend policy where excess profits are added to a small regular dividend.

It is important to note that the special dividend will likely remain lower than usual for as long as the current headwinds persist, and this is why I consider that National Presto is a bet for long-term dividend investors, rather than short-term yield seekers.

Risks worth mentioning

The company’s sales have suffered during the first quarter of 2022, which suggests that the growth experienced in 2020 and 2021 has actually been temporary. Even so, the significant increase of 43.9% in the backlog in the Defense segment should translate into an increase in sales in the medium term.

In addition to the limitation in sales growth, we must take into account that the company has lost a lot of capacity to convert said sales into actual cash. Luckily, the Defense segment comes to the rescue as it historically enjoyed wider margins than the Housewares / Small Appliance segment. Therefore, the increase in sales in this segment due to increased backlogs will very likely represent a breath of fresh air for the company’s operations, which will greatly increase its resistance to current headwinds related mainly to the current high inflation rates.

I would also like to mention that during the last 4 years, the cash payout ratio (the amount of cash from operations used to pay dividends) has been above 100%, so investors should not expect special dividends as high as in previous years in the short and medium-term. At the moment, the company enjoys positive cash on hand, but in the long term, it is unsustainable to continue paying the special dividends that investors are used to. Even so, it is very likely, if we take into account the dividends paid in the last decade, that there will continue to be special dividends in the coming years, although these will almost certainly be smaller than in the past, something that has already begun to happen in 2022.

Conclusion

It is very important to know what an investor is exposed to when purchasing National Presto shares. In the first place, the company has a long history behind it and the management has a large portion of the shares, which should build confidence among investors. But on the other hand, the current situation is quite delicate.

The management seems to have a new opportunity to grow sales, which have fallen again after the boost from mandatory lockdowns during the coronavirus crisis in 2020 and part of 2021. In this sense, hopes now lie with the Defense segment, which is experiencing a very significant backlog spike. This is very important for the future of the company as the Defense segment historically enjoyed wider margins than the traditional Housewares / Small Appliance segment. This means that the company has a great opportunity to offset current headwinds related to labor shortages and increased production costs while increasing its sales.

For these reasons, and considering that the price has continued to decline, I believe that National Presto currently trades at attractive prices for long-term dividend investors compared to January 2021.

Be the first to comment