da-kuk/E+ via Getty Images

One great thing about the medical space is that it creates the opportunity for investors to buy into a firm that does well for investors while doing good for people and society more broadly. Not every industry offers that kind of prospects that could be considered a win-win. One small player in the medical space that focuses on X-ray technology, is Nano-X Imaging (NASDAQ:NNOX). As the company nears monetization, investors are certain to keep a watchful eye over the business and see how it performs. Fundamentally, the company does have some problems. But if the company truly is on the verge of monetizing itself, then that could create a tremendous amount of value for investors. Of course, as we approach that point, every update provided by management should be viewed as an opportunity to re-evaluate how the business is faring. And with management due to report financial results covering the final quarter of the firm’s 2021 fiscal year, there is no better time for a progress check.

Assessing Nano-X Imaging

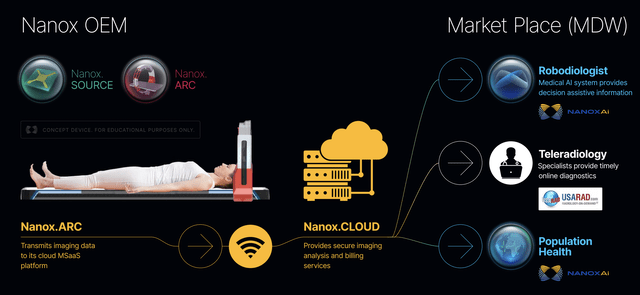

Before we dig into what investors should watch out for, we should first establish what it is exactly that Nano-X Imaging is working on. For starters, the company has been working for years, nearly nine in total, on developing a new X-ray source. This technology is based on a digital MEMs semiconductor cathode that management believes can achieve the same functionalities as traditional analog cathodes. At the same time, management believes that this technology will ultimately lower costs relative to what current medical imaging systems cost. From this methodology, management has created their core business offering called the Nanox.ARC. In short, this is an imaging device that performs an X-ray and that then can transmit that data to the firm’s cloud MSaaS platform. The company hopes to begin monetization this year with the goal of deploying about 15,000 of these units by the end of 2024.

Nano-X Imaging

Providing an imaging device is not the only thing Nano-X Imaging is working on. The company also has other offerings that it plans to provide. Due to both internal development as well as acquisitions, such as its recent merger with Zebra Medical Vision, a deep learning medical imaging analytics company, and of USARAD Holdings, a teleradiology business, the company has established a platform-oriented enterprise for investors to buy into. One of these offerings is known as the Nanox.SOURCE. Through this, management also intends to offer its medical imaging software to other imaging systems in exchange for licensing fees. Though it seems odd to me, the company plans to charge only a one-time fee upfront for this technology. Personally, aiming for a recurring revenue model would make a lot more sense.

Nano-X Imaging

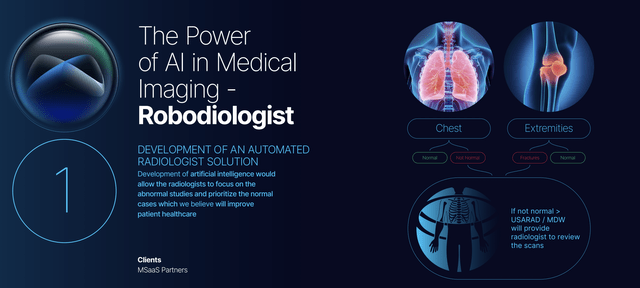

The company also has an offering called Nanox.Cloud. Once imaging data is sent to this cloud platform, it is then securely analyzed. This offering can also handle billing services. This imaging analysis is then aided by Robodiologist, which acts as a medical AI system that helps to provide decision assistive information. In short, the entire objective here is to use artificial intelligence and deep learning to find areas on an X-ray that are not normal. From there, the images, with the abnormal areas pointed out, are then assessed by specialists in the field. There are other aspects to the company as well, but the general idea here is that the value proposition is in the comprehensive platform management is seeking to create.

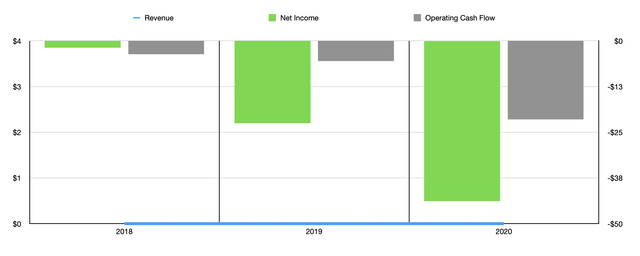

Author – SEC EDGAR Data

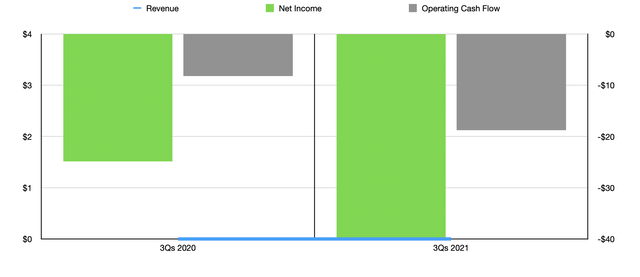

Of course, none of this is easy or cheap. The company has had to work hard for years in order to get where it is today. Financially, the picture has yet to pay off. The firm has not generated any revenue as of this writing. What’s more, net losses have mounted. In 2018, the company generated a net loss of just $1.91 million. This surged to $43.82 million in 2020. Operating cash flow went from a negative $3.67 million to a negative $21.49 million over that same window of time. Even covering data for the first nine months of 2021 shows continued costs for the business. Still no revenue, but the company has generated a loss during this time frame of $39.76 million. That compares to the $24.84 million loss generated the same time one year earlier. On top of this, operating cash flow in the first nine months of the year was negative to the tune of $18.8 million.

Author – SEC EDGAR Data

This is not to say that management has not seen any traction from its efforts. Already, the company boasts 8 FDA clearances. It also has 22 patents to its name. Through its partnerships, the company has also created a data repository with around 30 million patient records that include around 500 million images. This data covers a time span of over 10 years. All of this information is valuable because deep learning requires tremendous amounts of data in order to become efficient.

As we near the financial release for the final quarter of the company’s 2021 fiscal year, investors should be looking very closely at revenue. Currently, analysts are expecting the firm to generate sales of around $500,000. Any sort of revenue would mark a milestone for the company, though we will have to see to what extent that revenue comes from core operations versus something temporary in nature like consulting fees or a short-term licensing of technology. The other thing we need to look out for is profitability. At present, analysts are anticipating a loss per share for the quarter of $0.33. That would imply a net loss, given the 47.9 million shares the company currently has outstanding, of $15.81 million. If this comes to pass, it would take the company’s net loss for the year up to $55.57 million.

Naturally, we also need to be cognizant of the company’s liquidity. As of the end of its third quarter of its 2021 fiscal year, the company had cash in excess of debt of $177.34 million. This helps to make the company safer and cheaper in the grand scheme of things. We also need to be aware of the fact that a good portion of its losses are attributable to stock based compensation. While this is a true cost to shareholders in the form of dilution, no amount of share-based compensation will cause the company to go bankrupt. It truly is unclear what to expect in terms of cash flow. But investors should keep a watchful eye on that. As I mentioned already, the company has seen a net outflow of cash of $18.8 million in the first nine months of its 2021 fiscal year. If we annualize that, it would imply about $25.1 million in net outflows. Although cash outflows for the company have been worsening year after year as management gets closer to market, this annualized figure would imply multiple years of cash burn for the business. So that is a plus for shareholders.

Takeaway

Based on the data provided, I will say that Nano-X Imaging is an interesting business. Having said that, it really is a risky prospect at this time. Although the company has significant cash on hand and the firm is getting close to monetization, that’s only the start of other troubles. The company would need more cash in order to expand as well. If they can expand, the sky is the limit. After all, one source pegged the market opportunity for medical imaging at $33.7 billion in 2019, with a 5.1% annualized growth rate taking it to $43.3 billion by 2027. Either way, investors should view this as a risky proposition that could have a significant return or a significant loss, but with little in the way of middle ground. The good news is that with earnings coming up, we will get another glimpse behind the curtain that will tell us how well the company is progressing and how the risk profile of the business is changing as a result.

Be the first to comment