Eoneren/E+ via Getty Images

It is my firm belief that 80% of money managers can’t outperform the S&P 500 index over time due primarily to the fees they charge their clients. Each and every individual person intent on having the happiest retirement possible could and should take charge of their retirement portfolios and invest in simple index/mutual funds and/or a balanced portfolio like the one I have set up to maximize returns over decades of performance. My ratios and distributions are based on my book – Investing Better Than A Money Manager: The Rise Of Retail Investing.

Past Performance

Here is briefly how my portfolio evolved from its inception when I became more of an active investor in 2014 in the market until now. Notice, I spent several years before 2014 putting some funds into the market now and then at random as I finished school and got married and started a family etc., which I didn’t really follow or record.

| Year | Welsh Portfolio | S&P 500 |

| 2014 | $77,053 | |

| 2015 | $81,233 | -0.81% |

| 2016 | $91,494 | 9.64% |

| 2017 | $142,363 | 19.38% |

| 2018 | $162,607 | -6.29% |

| 2019 | $230,093 | 29.01% |

| 2020 | $316,104 | 16.28% |

| 2021 | $402,037 | 27.04% |

Contributions

Contributions make up a vital component of your portfolio, especially when you are starting out, as they are the building blocks of tax advantaged savings for retirement. The more money you have, the more concern you should have with taxes. This is why when you start out investing, you should try to add to accounts like IRAs ASAP instead of putting the money into regular taxable investment accounts.

|

Contributions |

HSA |

IRAs |

401K |

|

Jan 2022 |

$0 |

$0 |

$0 |

|

Feb 2022 |

$0 |

$0 |

$500 |

|

Mar 2022 |

$0 |

$0 |

$3,760.44 |

|

YTD CONTRIBUTIONS |

$0 |

$0 |

$4,260.44 |

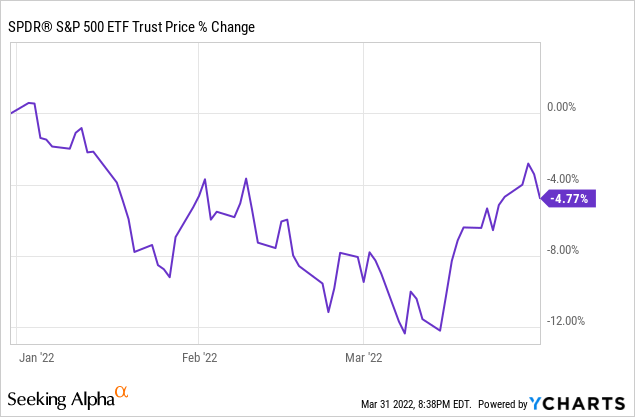

Here is how my portfolio is performing compared to the SPDR S&P 500 Trust (NYSEARCA:SPY) over the beginning of 2022.

|

Fund |

SPY |

Welsh |

Welsh Minus Contributions |

|

% Gain Jan 2022 |

-5.32% |

-8.12% |

-8.12% |

|

% Gain Feb 2022 |

-3.62% |

-0.88% |

-10.15% |

|

% Gain Mar 2022 |

3.59% |

3.3% |

2.3% |

|

YTD GAINS |

-4.77% |

-5.95% |

-7.00% |

Regular contributions to your retirement portfolio help your portfolio to grow even on less than ideal months where you fail to outperform the S&P 500. Not every month will be a winner, but regular contributions can help make anyone’s performance look great over time.

My portfolio is divided up to start 2022 at around 73% stocks and around 27% mutual and index funds with the goal to increase stocks to over 80% of my portfolio over time. Due to the recent Russian invasion of Ukraine, I have sold off a bunch of my international stocks for now as domestic is the safest place to play while things play out globally at this time. My current setup has swayed to 93% domestic exposure and 7% international. I have about 2.6% of my portfolio in bond mutual funds so that I know how they work and to have at least a little exposure to this sector over time. I plan to have bonds be a very small portion of my portfolio up to right around age 65. Diversification lifts my whole portfolio’s returns over time, so finding the best stocks in every sector is a goal for me each and every year. Here are some of the main changes since my last portfolio article in February of 2022.

|

Welsh Portfolio |

Stocks |

Index/Mutual Funds |

Bonds |

Domestic |

International |

|

Jan 2022 |

73% |

27% |

2.6% |

82% |

18% |

|

Feb 2022 |

74% |

26% |

2.6% |

93% |

7% |

|

Mar 2022 |

74% |

26% |

2.4% |

94% |

6% |

Here are the details of my personal ~$378K portfolio then, based on values of approximately $40K, $400K, and $4 million broken down by sectors with brief descriptions of each stock in each sector. The best thing about my portfolio setup is that it is scalable so that people interested in following a similar path can set up their portfolios to follow my path no matter how small or large their holdings are. With fee-free trading and the advent of fractional shares, investors are more capable than ever in setting up amazing portfolios even when starting from scratch.

The Information Technology Sector

Aim = 18% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

QCOM |

$960 |

$9,600 |

$96,000 |

|

DELL |

$280 |

$2,800 |

$28,000 |

|

VMW |

$270 |

$2,700 |

$27,000 |

|

% Portfolio |

5.4% |

1. QUALCOMM (NASDAQ:QCOM) is a major technology solutions provider for companies like Apple (AAPL) and will be an integral part of upcoming transformational secular revolutions like 5G. I always like to have at least one chip company in my portfolio at all times.

ACPS = $61.92

2. Dell (NYSE:DELL) is a legacy holding which continues to aggressively seek M&A opportunities like the value acquisition of the $67B EMC deal and the spin-off of the hybrid cloud giant VMware (NYSE:VMW) at the end of October 2021 which it formerly owned ~80% of the stock of. Michael Dell is a shareholder winner through and through, and following in his stock footpaths I think is a good long-term decision. The VMware spinoff should allow Dell to deleverage significantly while allowing it the free cash flow to hit its remaining debt burden opportunistically before Michael Dell moves on to his next future M&A opportunity.

ACPS = $21.52

3. VMware: I acquired VMware as a spin-off from Dell. At this time, I’m undecided if I want to maintain both positions or have one position based either in Dell or switch from that legacy holding all into VMware. I will figure this out later in 2022 when I do my annual IRA contributions.

ACPS = $51.57

The Health Care Sector

Aim = 15% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

ARWR |

$2,750 |

$27,500 |

$275,000 |

|

MDT |

$440 |

$4,400 |

$44,000 |

|

PFE |

$420 |

$4,200 |

$42,000 |

|

SMMT |

$690 |

$6,900 |

$69,000 |

|

BIIB |

$1,890 |

$18,900 |

$189,000 |

|

% Portfolio |

22.1% |

4. Arrowhead Pharmaceuticals (NASDAQ:ARWR) is my 2nd largest individual stock position as an RNAi juggernaut entering key Phase 2 and 3 trials in 2022. A lovely balance sheet with key partnerships with Janssen (NYSE:JNJ), Amgen (NASDAQ:AMGN), Takeda (NYSE:TAK), Horizon (NASDAQ:HZNP), and a new ~$1 Billion licensing deal in November of 2021 with GlaxoSmithKline (GSK) significantly de-risk its TRiM platform as it continues to expand into additional cell types. Amgen continues to slowly progress Olpasiran (AMG 890), its collaboration candidate with Arrowhead along with a successful Janssen update in November 2021 on JNJ-3989 for hepatitis B virus. Takeda will help co-develop and co-commercialize Arrowhead’s lead candidate ARO-AAT preparing Arrowhead for independent commercialization of its wholly owned candidates while it continues to find partners for new candidates like the recently revealed ARO-XDH with Horizon. Arrowhead partnered with GlaxoSmithKline for its NASH candidate ARO-HSD, proving once again its TRiM platform is in big demand as it continues to expand its pipeline so fast that it can’t progress all of its candidates by itself as a smaller sub $10 billion company.

A setback in its ARO-ENaC candidate led to a tremendous buying opportunity in the stock in 2021 which is still in effect in my opinion. ARO-ENaC is neither the company’s lead product nor a very important one in Arrowhead’s ever growing pipeline of candidates. Investors should get an update on Arrowhead’s pulmonary plans when it hosts its upcoming Pulmonary R&D day on May 26, 2022.

I used the ARO-ENaC debacle to expand my shares of Arrowhead from 410 shares up to 530 shares. I expanded my shares in Arrowhead again in January of 2022 by buying an additional 70 shares bring my total up to 600 shares. Baby steps on this conviction stock for me as I continue to add shares as the company continues to sit around 52-week lows even as it successfully continues to expand and advance its marvelous pipeline.

ACPS = $48.16

5. Medtronic (NYSE:MDT): Health care device maker that I think has significant upside from COVID-19 variants for years to come. Hospitals will need the best equipment companies like Medtronic provides as health issues from COVID-19 could and seem poised to persist for years.

ACPS = $83.13

6. Pfizer (NYSE:PFE): A healthcare behemoth with a big stake in the fight against COVID-19. Seems like a great potential long-term winner at a great value compared to some of its peers.

ACPS = $35.86

7. Summit Therapeutics (NASDAQ:SMMT) did a very suspicious move in August of 2021 by combining its two Phase 3 blinded pivotal trials for its ridinilazole candidate for clostridioides difficile into one study. This was doable as both studies were at ~ 50% enrollment but were apparently not enrolling fast enough for management’s liking. However, in September 2021, investors found out that this change in the study was not pre-approved by the FDA, so the trial results won’t be enough for the FDA moving forward.

On top of all this, Summit investors found out in late December of 2021 that the company’s data results for its ridinilazole candidate didn’t meet all of the hoped for primary endpoints, resulting in another deep drop in the company’s share price.

Did a massive stock buy in January of 2022 as it settled around $2.00 a share. Went from 850 shares up to 2,850 shares as I think the stocks upside is attractive now again. With its ability to raise cash on will with Rights Offerings backed by company Chairman and CEO billionaire Robert W. Duggan, with a 70+% ownership of the company, downside risk is markedly mitigated in my opinion. The postponement of the latest rights offering means something newsworthy could be coming in the near future that was not compatible with a rights offering at this time. The company should be fine cash wise until it can do its next rights offering after whatever coming potential news passes.

Mr. Duggan has successfully sold companies in the past for huge profits and new ownership stakes by companies like Polar Capital Holdings PLC. could result in a massive upside swing in the company’s stock if the incoming news is beneficial to stockholders. Time will tell.

ACPS = $3.51

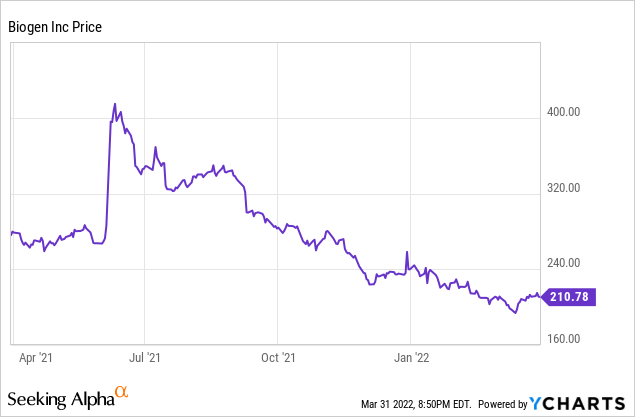

8. Biogen (BIIB) I purchased Biogen as a trade for an upcoming catalyst. The Centers for Medicare and Medicaid Services (CMS) is scheduled to make a coverage determination on Aduhelm by April 11th. Biogen just posed new data from a long-term Phase 3 Alzheimer’s therapy study for Aduhelm in mid-March 2022 which helps support its thesis that trials do indeed lead to “significant reductions” in amyloid-beta plaques and plasma p-tau181. These reductions led to lower clinical decline in patients compared to control groups. Don’t underestimate patient advocacy groups and millions of dollars in local advertising spending which have stepped up their efforts for a favorable decision on Aduhelm as there are still no other approved medications better than Aduhelm for Alzheimer’s disease. Back in January of 2022, the CMS proposed to severely restrict access to drugs like Aduhelm with a final determination scheduled for April 11th. Considering the pop that Biogen experienced on official FDA approval for Aduhelm, which I made a pretty penny on, and the lows the stock currently sits at, I believe the upside potential of the stock far outweighs additional downside risk.

Twitter Post from Author (twitter.com)

Biogen also dropped the price of Aduhelm in half last December so pricing is much more favorable for Medicare and Medicaid spending then it originally was. My plan is to sell most or all of my shares of Biogen soon after this catalyst passes.

ACPS = $200.28

The Communication Services Sector

Aim = 15% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

DIS |

$1,500 |

$15,000 |

$150,000 |

|

GOOGL |

$830 |

$8,300 |

$83,000 |

|

FB |

$2,550 |

$25,500 |

$255,000 |

|

RBLX |

$690 |

$6,900 |

$69,000 |

|

% Portfolio |

19.8% |

9. Disney (NYSE:DIS) will crush Netflix (NASDAQ:NFLX) in growth over the coming decades in my opinion as its streaming platform continues to grow by leaps and bounds. Forever stock for me as I am looking now to add cheap shares again if I get additional incoming funds after boosting my Apple stock position. Was a pretty tough month for Disney and rival Netflix to start the year for sure though.

ACPS = $171.78

10. Alphabet (GOOG) (NASDAQ:GOOGL): One of the FAANG names producing amazing results as always. I have a decent amount of exposure to the FAANG names with my mutual funds, but it is hard to have too much of these juggernauts.

ACPS = $2,335.36

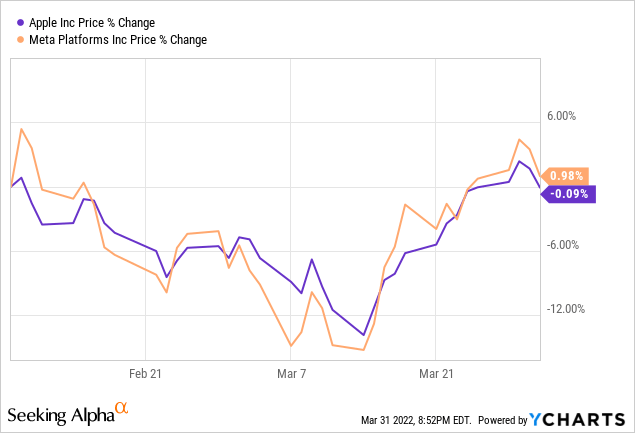

11. Meta (FB) was my largest and most memorable move in February of 2022 as I sold my top conviction stock in Apple to purchase the ~40% drop in former market darling Facebook. With Apple and Alphabet as already large parts of my portfolio I couldn’t really justify having Facebook also in my portfolio as I want to own FAANG stocks but not just be a FAANG ETF per se. The massive selloff in Facebook though created an opening that I could not resist so buying into that crash and burn meant having to sell either Apple or Google stock really to keep my other positions. Having seen Facebook recover amazingly from past sell-offs meant that I was looking for a larger bet which meant the easiest path was to sell my Apple stock. Years from now I see Facebook doubling in value from its current market value far quicker than Apple at its recent highs which led me to a necessary move in my opinion. The obvious play potentially for me is when Facebook recovers enough over the next year or two to where it is more appropriately valued to past valuations, to sell Facebook to buy back my Apple stock again with an even larger position. Or, of course, I might just like Facebook better at that time and toss Apple out as a former darling and completely move on from it.

I am not concerned about Meta’s nosedive because most of the concerns seem obvious to me. Competition is heating up from companies like TikTok and Meta is changing as we speak to adapt its platform to what users are now demanding resulting in a short term margin hit during the conversion. Investments in future technology like the Metaverse will be expensive and take a decade or more to potentially bear real fruit. This not a surprise to me as a big believer in the Metaverse. It very likely will be a big part of the future but it will take lots of time and money to get there with companies like Meta hopefully leading the way.

Everyone loves to hate Facebook but everyone uses it and it is a money creating machine and that fact will not change one iota from this most recent crash. Mark Zuckerberg is a visionary whose big bets in the past have created majestic shareholder returns. Sign me up for a 40%-50% discount any day of the week and twice on Sunday. Finally here’s a graph comparing Apple’s and Meta’s performance over time since I bought and sold them on February 8th 2022.

ACPS = $222.00

12. Roblox (NYSE:RBLX) is a teen gaming platform that came public through a direct listing in March of 2021. My hope was that it did not come out of the gate as hot as earlier IPOs DoorDash (NYSE:DASH) and Airbnb (NASDAQ:ABNB), which were too expensive for investing in for me personally when they first premiered. I was very happy to get in at the IPO price of $64 a share when it premiered for a large holding in my portfolio. I always try to have an eye on what younger generations are loving and this platform is expanding and growing phenomenally. Also note that Facebook at the end of October 2021 announced that it is changing its name to Meta Platforms Inc. to embrace the future of the Metaverse that is central to what Roblox is. Give me one of the originators and pioneers in the space any day personally over Facebook and its social concerns. Willing to build my Roblox position over time as it could be a game changer if the Metaverse becomes as big as Facebook believes it will be.

Doubled my position in Roblox in January of 2022 as I dropped a lot of sector weight with my Apple stock sale. Expanding my exposure to the Metaverse is a no brainer for me as a believer in its potential over the coming decades. I will be expanding this position more especially at these prices before I start rebuilding my Apple position again.

ACPS = $57.20

Sold: World Wrestling Entertainment (WWE) was sold as I needed funds for my Biogen trade. I had too much exposure to this sector with the addition of Meta (FB) and Roblox (RBLX) shares over the past couple of months so decided to exit WWE to make some room for now at least.

The Financial Sector

Aim = 15% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

GBTC |

$4,120 |

$41,200 |

$412,000 |

|

HSBC |

$250 |

$2,500 |

$25,000 |

|

% Portfolio |

15.6% |

13. Bitcoin (OTC:GBTC) (BTC-USD) is digital gold in my opinion and the future of finance as a potential bedfellow to or eventual replacement of not only the U.S. dollar, but to all fiat money in the coming decades. I plan on holding Bitcoin stock for the next 20+ years and to very rarely if ever sell shares, so month to month performance means little to me at this point. I plan on it being a long-term top 3 stock position in my portfolio at all times and would consider adding to my giant position if the coin drops below the $25K level as I just added more shares of Grayscale Bitcoin Trust stock in November of 2021.

Bitcoin’s rally in March has allowed it to recoup its losses over 2022 helping my portfolio beat the S&P 500 in March. Where Bitcoin goes from here is anyone’s guess but I’m long as always with no plans to sell for decades.

ACPS = $31.46

14. HSBC Bank (NYSE:HSBC) is a legacy holding that might finally see some upside if the United Kingdom can ever get Brexit resolved and new trade opportunities sorted out. That of course, might be a big if. Looks to be a stock on the chopping block when I do my IRA contributions for 2022.

ACPS = $48.91

The Consumer Discretionary Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

TSCO |

$700 |

$7,000 |

$70,000 |

|

DKNG |

$480 |

$4,800 |

$48,000 |

|

RIVN |

$370 |

$3,700 |

$37,000 |

|

% Portfolio |

5.5% |

15. Tractor Supply Company (NASDAQ:TSCO) quietly continues to perform as one of the best companies in retail mostly immune to Amazon’s dominance. Its acquisition of Petsense makes a lot of sense now, especially with the explosive growth of everything pet in the wake of COVID-19.

ACPS = $79.76

16. DraftKings (DKNG) is a stock that has a bright future in my estimation as a leader in online gambling and sports betting. A difficult market with consolidation eventually needed means lots of headwinds such as promotional activity as each company tries to gobble up market share especially in newly legalized states. However, its massive drop from recent highs as a leader in the space led me to finally buy into the narrative as the stock at this price is just too cheap to ignore. Regular position to start with more to be added if possible in future months.

ACPS = $17.37

17. Rivian Automotive (RIVN) was my big purchase towards the end of 2021 as I had been waiting for this IPO throughout 2021. I tried to get in at around the IPO’s initial ~$80 offer price but was not able to get any shares then as it started out at about $115 a share. Being patient a couple days didn’t improve my odds much, so I decided to bite the bullet and buy shares at the higher price. Sometimes you have to pay more for what you want, but I got the position I wanted and am happy now to sit on it. Added a few more shares of Rivian in March and hopefully add a few more in the coming months as well at these prices to get my dollar cost average down.

ACPS = $99.63

The Consumer Staples Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

PG |

$580 |

$5,800 |

$58,000 |

|

PEP |

$530 |

$5,300 |

$53,000 |

|

GIS |

$670 |

$6,700 |

$67,000 |

|

% Portfolio |

6.3% |

18. Procter & Gamble (NYSE:PG) is a legacy holding that sports a decent growing dividend along with many best in class brands like Olay, Head & Shoulders, Dawn, and Charmin. Always nice to have some stalwarts for the upcoming recessions and depressions.

ACPS = $92.59

19. PepsiCo (NASDAQ:PEP) is a phenomenal drink company with brands like Pepsi-Cola, Gatorade, and Tropicana along with amazing growth in the snack category with Frito-Lay that, in my mind, sets it apart from competitors like Coke (NYSE:KO).

ACPS = $106.77

20. General Mills (NYSE:GIS) is a legacy holding for me with a great dividend that experienced a huge turnaround during COVID-19 with its brands, including its $8B acquisition of Blue Buffalo in 2018. Its former debt concerns have mostly evaporated as it has shored up its balance sheet and continues to benefit from the stay-at-home movement. However, recent inflation concerns and cost issues have put a damper on the stock in the near term as COVID variants continue to arise and supply disruptions persist.

ACPS = $59.84

The Industrials Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

|

J |

$1,230 |

$12,300 |

$123,000 |

|

|

SPCE |

$370 |

$3,700 |

$37,000 |

|

|

% Portfolio |

5.7% |

21. Jacobs Engineering (NYSE:J) is a legacy holding I have loved for years. A long-time no-debt company that makes super-smart acquisitions. It now has very low-debt and initiated a small dividend which it should be able to grow annually over the coming years like it did in January of 2022 by 10%. Its focus on carbon neutrality and diversity in its workforce makes it a prime target for the younger generation. Jacobs could also experience sustained tailwinds for years due to Biden’s infrastructure and spending bills.

ACPS = $68.41

22. Virgin Galactic (SPCE) looks ripe and tasty for another re-entrance at its current price. I love Virgin Galactic’s volatility as I have made good money in the past buying low and selling high. Commercial space flight for Virgin Galactic looks probable for the end of 2022, so I don’t mind getting in now as I hope to potentially build the position over 2022, especially if it stays around $10 a share.

ACPS = $13.21

The Materials Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

CLF |

$320 |

$3,200 |

$32,000 |

|

WEAT |

$880 |

$8,800 |

$88,000 |

|

% Portfolio |

4.3% |

23. Cleveland-Cliffs (NYSE:CLF) is an Iron Range stock that acquired AK Steel at the end of 2019 and, more recently, announced the acquisition of ArcelorMittal (NYSE:MT) in late 2020 in a deal valued at $3.3B. Cleveland-Cliffs is well on its way to becoming a fully integrated steelmaker. A bipartisan or reconciliation infrastructure bill or two should do wonders for the iron and steel markets in the coming years as they continue cashing in on amazing pricing amid high demand. Sold a chunk of my Cleveland-Cliffs in March 2022 to buy some wheat futures due to the war between Ukraine and Russia. Think wheat has a lot of room to run over the next year or two with a double up very possible so had to make room in this sector for the new position.

ACPS = $24.46

24. Teucrium Wheat ETF (WEAT) With the war between Russia and Ukraine in full swing, I feel the need to take a position in wheat futures as Russia and Ukraine account for ~25%-30% of the world’s wheat production. Planting should be occurring around now and for the next couple of months meaning that there might be a very significant shortage of wheat over the next year or two causing a potential spike in wheat futures if the rest of the world cannot adapt in time. It also doesn’t help that Russia seems to be targeting grain storage in Ukraine, but of course, this is wartime info. I put a nice large bet on wheat with plans to add to it in the coming months if prices continue to hover around my average cost with plans to sell parts of the trade on any rapid and significant moves up. A move of current share prices to ~$18 a share would lead me to sell around 50% of my holdings with a move to ~$25 a share causing me to sell ~75% or more of my holdings.

ACPS = $11.23

The Energy Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

PBR |

$370 |

$3,700 |

$37,000 |

|

HAL |

$600 |

$6,000 |

$60,000 |

|

USO |

$2,220 |

$22,200 |

$222,000 |

|

% Portfolio |

11.3% |

25. Petrobras (NYSE:PBR) is a Brazil-based oil play with lots of potential if it can get past its scandal-ridden past. Unfortunately, Brazil President Bolsonaro recently named General Joaquim Silva e Luna to replace CEO Roberto Castello Branco, resulting in a huge crisis of faith in the company in its latest scandal. With that scandal now in the past, Petrobras should be able to benefit nicely from high oil prices that continue to climb. At least it is doing a great job eliminating debt, which means it could be a long-term winner regardless of politics on its current course. With energy and oil prices climbing to highs not seen in years, stocks like Petrobras, with its phenomenal dividend, could result in a great portfolio boost over the coming years if the oil and natural gas market stay elevated. Of course, with elevated oil prices, President Bolsonaro has officially removed Joaquim Silva e Luna in March of 2022 so the circus continues in full swing. With oil prices as high as they are there was minimal effect on Petrobras’s share price as it will continue to make huge profits even with the political craziness.

I sold 87.5% of my Petrobras holdings in February to bet on the more explosive upside of the United States Oil Fund (USO) after Russia invaded Ukraine. I now think $150 oil at some point over the summer and possibly beyond has a lot higher chance of repeatedly happening and I wanted to make a bigger bet with a more volatile oil stock in this situation. Not sure at this time if Petrobras will continue to be a small holding over the coming years or if it will be worth building the position back up again.

ACPS = $10.88

26. Halliburton (NYSE:HAL) is a U.S.-based oil service company that dominates services in the North American market. Small position with no real plans to expand even though it has been on fire to start 2022.

ACPS = $36.48

27. United States Oil Fund is a fund based on futures contracts for oil delivery. It is a higher volatility play on oil prices as sudden increases or decreases in oil prices will be immediately seen in this stock whereas traditional oil companies won’t see that great of move in their stock prices as it takes months for oil prices to impact quarterly earnings reports. Long USO here is a play on oil for whatever reason going up and over $120 a barrel in the short term or potentially even to shock levels like $150 or above. $200 a barrel levels are even possible if the world goes to war or major oil disruptions hit the market for whatever reason coinciding with a high demand summer driving season.

ACPS = $66.11

The Utility Sector

Aim = 5% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

| DUK | $330 | $3,300 | $33,000 |

|

% Portfolio |

1.2% |

28. Duke Energy Corporation (DUK) Love Duke’s market position and its attractive ~4% dividend. Great to own a stock like Duke that I can sell at the next drop of a hat especially with the market in turmoil for the foreseeable future. Always try to have a reserve ready for future opportunities. Small position again for me as I wait for the Biogen catalyst to play out.

ACPS = $106.43

The Real Estate Sector

Aim = 3% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

AMT |

$780 |

$7,800 |

$78,000 |

|

% Portfolio |

2.8% |

29. American Tower (NYSE:AMT) is a premier U.S. cell phone tower company aggressively expanding globally across a few more continents. 5G evolution could be a lucrative tailwind for years to come. Can’t think of a reason to add another real estate play, so I just plan to keep adding to this holding over time.

ACPS = $111.38

Bonds (2% of my Stock holdings)

This asset class is currently satisfied by my mutual fund holdings.

My top 10 Holdings and Percentage of my Portfolio

|

Stock |

Sector |

% Portfolio |

|

Bitcoin |

Financials |

10.8% |

|

Arrowhead |

Health Care |

7.1% |

|

Meta |

Communications Services |

6.6% |

|

USO |

Energy |

5.8% |

|

Biogen |

Health Care |

5.0% |

| Disney |

Communications Services |

4.0% |

|

Jacobs |

Industrials |

3.2% |

|

QUALCOMM |

Info. Tech |

2.5% |

|

WEAT |

Materials |

2.3% |

|

Communications Services |

2.2% |

|

|

Total % of Portfolio |

~48.5% |

Stock Watch List: Stocks I am looking to add to my portfolio or add shares to in the coming months potentially.

1. Apple: I will be looking to start a position in Apple again if it drops around the $150 or lower mark. I think there is a more than fair chance that China decides to start messing with Taiwan in the next couple of years which might create a terrific opportunity to buy Apple stock from Apple’s China exposure. I’m fine being patient though as I hope Meta rebounds nicely from its previous earnings obliteration.

2. A new informational technology position besides Apple.

Staying diversified across all sectors of the economy while making larger bets on your favorite stocks is a great way not only to potentially beat the market, but also have fun doing it. Stocks are one of the best ways to build wealth for retirement, and everyone should have the opportunity to share in the success of the best companies the world has to offer. Best of luck on another productive and lucrative year in 2022.

Be the first to comment