kparis/E+ via Getty Images

This article was coproduced with Williams Equity Research (“WER”).

As we noted in Part I of this series (available here), publicly traded asset managers are a unique sector.

They tend to enjoy strong margins and, in many cases, permanent capital-generating, reliable, fee revenue. Plus, like real estate investment trusts ((REITs)), this category features incredible diversity that offers some instant protection worth evaluating.

As I said in Part I, many of my readers are becoming increasingly interest in asset managers. Like so many other investors, they’re seeking solutions to current market volatility and abject confusion.

“Investors appear skeptical that the Federal Reserve can avoid a bruising economic downturn amid sharp interest-rate hikes. Evaporating consumer confidence is feeding into concerns that the U.S. might tip into a recession.

“‘It seems the market is in this tug of war between on the one hand the hope that we are close to the peak in inflation and rates, and on the other hand the challenge of a slowing economy and potential recession,’ Emmanuel Cau, head of European equity strategy at Barclays Bank… said in an interview with Bloomberg TV. ‘Central banks are walking a very tight line and to a certain extent dictate the mood in the markets.’”

And that’s just one of many stories I can point to that say something about the growing trend toward safety in the stock market.

Now, you all know my very high opinion of REITs in that regard. But that hardly means I can’t see value elsewhere.

Appropriately diversifying our portfolios is important – exceptionally so. Hence, my starting this series.

In Part I, we covered five stocks, including BlackRock (BLK), T. Rowe Price (TROW), and Invesco (IVZ). They’re some of the best “asset-light” managers available, tending to focus on ETFs, mutual funds, and closed-end funds.

Today, we’re moving on to include peers with direct ownership in private equity, credit, real estate, or infrastructure.

Asset Manager Evaluation #1 (or #6): Blackstone Inc.

Blackstone Inc. (BX), which specializes in alternative investments, is #1 by assets under management (“AUM”): $915.5 billion as of the end of Q1.

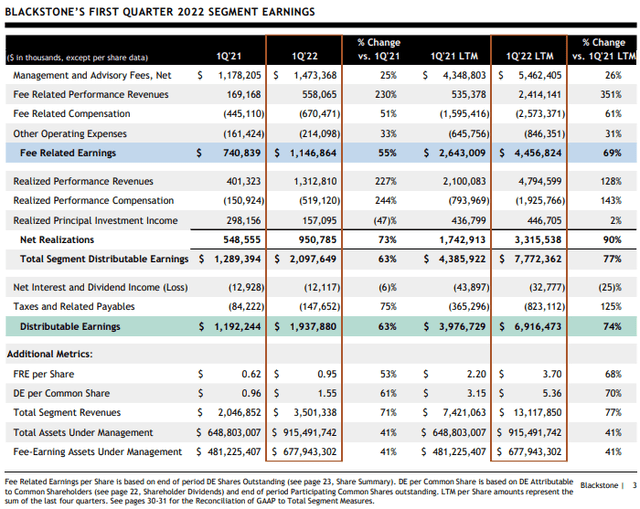

Blackstone’s earnings can be classified as one of two types…

First, there’s revenue generated by its investment management business minus cash compensation, benefits, and non-cash equity. This is known as fee-related earnings, which totaled $1.1 billion in Q1, or $0.95 per share.

And over the last 12 months, Blackstone generated FRE of $4.5 billion, or $3.70 per share. Think of this as the earnings generated from its base management fees minus the costs needed to obtain it.

This is where the second part comes in, known as incentive fees/carried interest. These are the performance fees Blackstone earns when certain hurdles are met.

Unlike the base management fees in FRE, these can be volatile and are dependent on how well Blackstone manages its clients’ assets.

Together, these fees are known as distributable earnings (“DE”). They amounted to total firm earnings of $1.9 billion, or $1.55 per share, for Q2.

That’s up 63% year-over-year.

Net accrued performance fees, which are earned but not yet paid, was $9.5 billion, or $7.94 per share – an 84% increase, which is clearly higher than Blackstone’s 41% year-over-year AUM growth.

Despite recent market weakness, this shows strong positive momentum in Blackstone’s profitability independent of AUM. See the “% Change vs. 1Q’21” column below to see what I mean…

(Source: Blackstone Q1 2022 Earnings Presentation)

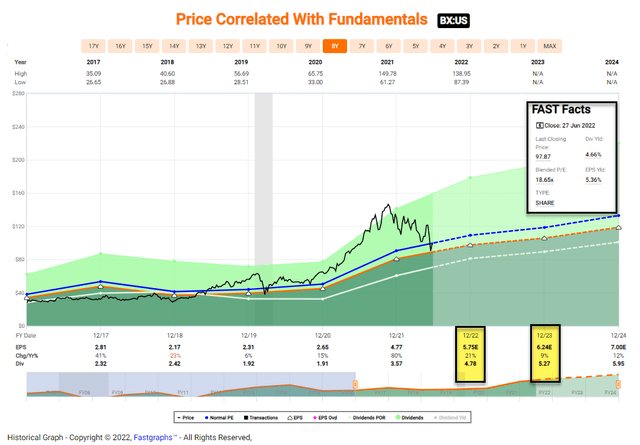

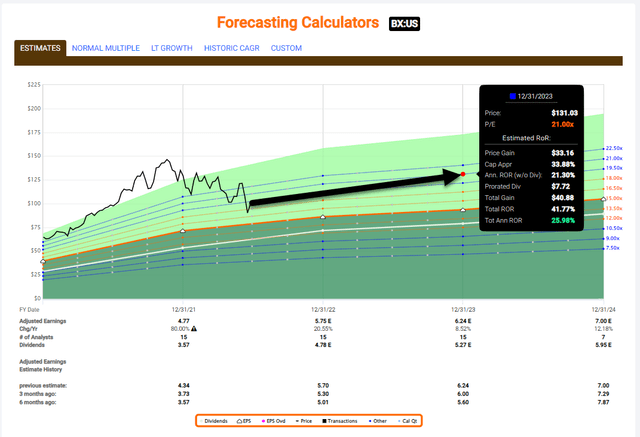

Current per-share projections on Blackstone’s annual forward earnings are $5.50-$5.75. And keep in mind that a significant portion of this is already “in the books” thanks to net accrued performance fees.

That puts Blackstone at a 17x forward earnings multiple… which would rise to about 19x-21x if the market were to drop an additional 15%-20%, as some fear it will.

Even then, though, Blackstone’s valuation would be extremely attractive given its:

- Existing financial situation

- Immense brand power

- Heavily diversified strategy (e.g., real estate, private equity, private credit, etc.).

Our 12-month price target on the 4.66%-yielding BX is $135 per share for a total return target around 45%. That’s far under its 52-week high of $149.76, so additional upside is certainly on the table.

(FAST Graphs)

Asset Manager Evaluation #2 (or #7): Cohen & Steers

Cohen & Steers, Inc.’s (CNS) $102.1 billion in AUM may be a small fraction of Blackstone’s… but it has an attractive business model and is very well-respected in many areas, including real estate.

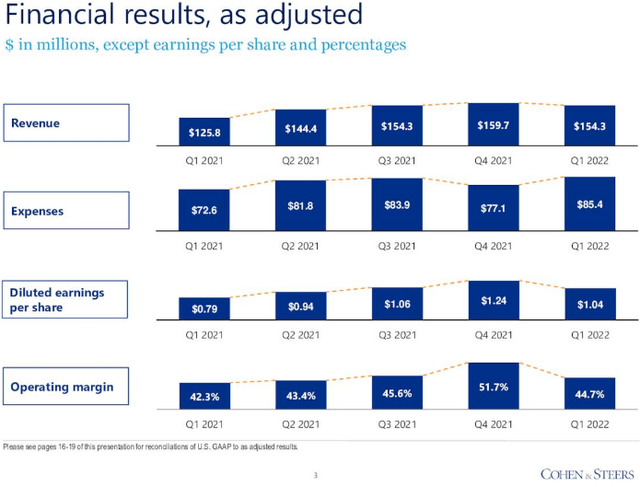

Cohen’s business did slow down in Q1, with net inflows of $765 million versus $1.8 billion in Q4-21. And diluted earnings per share (EPS) of $1.04 was down a meaningful $0.20.

Profitability remained strong, however, with an operating margin of 44.7%.

(Source: Cohen & Steers Q1 2022 Earnings Presentation)

In general, trends have been going in the right direction over the past five quarters… but less so since 2H-21. That’s partially because Cohen is much more heavily focused on real estate than its peers.

It has 46.3% of assets in U.S. real estate and another 19% in global/international real estate. (Note, though, that many other managers – including Blackstone – have larger real estate businesses despite being much more diversified.)

The remainder of those assets are mostly in preferred securities with single-digit exposure to global listed infrastructure.

Cohen’s net flows have declined from $3.8 billion in Q1-21 to $800 million in Q1-22. That’s despite its investment performance besting the market with 100% of total AUM outperforming on a 10-year basis with the shorter-term metrics almost as good.

On the fund side, 91% have a four- or five-star Morningstar rating.

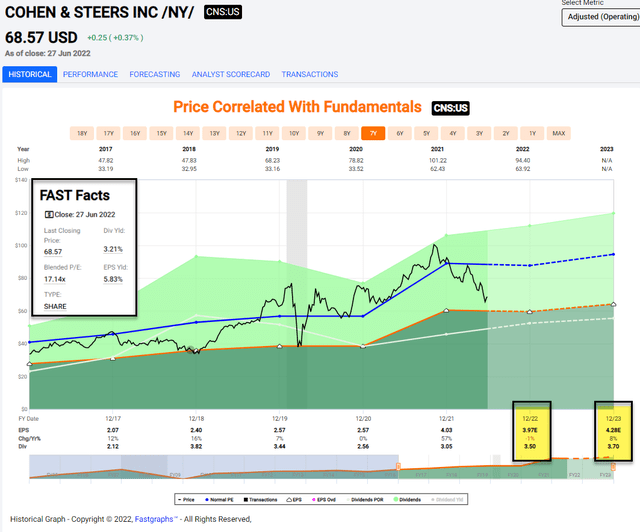

Cohen’s expected forward annual earnings are approximately $4 per share with a 17x forward multiple, just like Blackstone. Its growth profile, however, isn’t as compelling. And its 3.2% yield is good but not as great.

From a total return perspective, our $90 price target results in about 36%.

(FAST Graphs)

Asset Manager Evaluation #3 (or #8): KKR & Co.

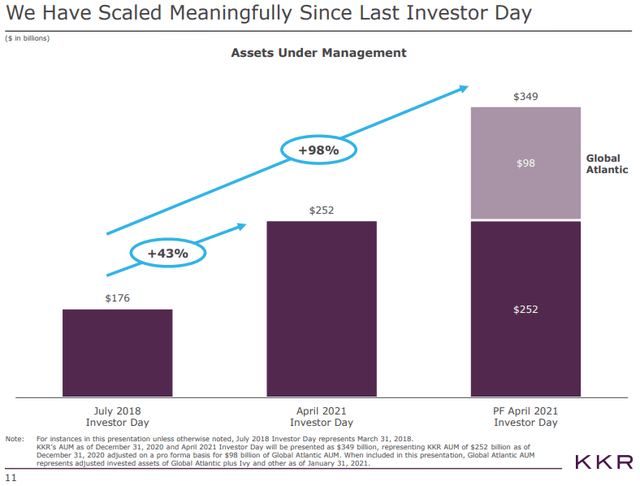

KKR & Co. Inc. (KKR) is a close cousin of Blackstone and is weighted similarly in private equity, real estate, private credit, and infrastructure. It’s also experienced similar progress on the capital raise and AUM fronts.

(Source: KKR Q1 2022 Investor Day)

That $349 billion likely declined in recent weeks, but not enough to offset the 98% increase since July 2018. In fact, we have data on that very subject…

The alternative asset class has grown at an 11% compound annual growth rate (“CAGR”) clip since 2004. That’s an impressive figure, but…

KKR’s AUM has grown at 22% – double the broader market.

More AUM means more income, all other things equal. And unlike REITs, business development companies (“BDCs”), and many other income rich businesses, KKR doesn’t need to issue shares to grow its portfolio.

Since 2015, its fees have increased at a 15% CAGR, with about half deriving from private equity. Credit, real assets, and hedge funds make up the rest in decreasing order.

A major differentiator between BX and KKR is the latter’s smaller exposure to real estate and larger exposure to private equity and hedge funds. It’s been doing private equity in the U.S. for 44 years now, 21 in Europe, and 14 in Asia.

Some might see KKR’s relatively light exposure to real estate and infrastructure as a negative. And today, it probably is.

But it’s a great potential growth engine for the future.

KKR expects to raise an additional $40 billion to $50 billion this year. Current markets might deflate that number a little, but it should remain a massive number, even for a firm with KKR’s scale.

From a financial perspective, KKR is anticipating at least $2 per share in FRE in 2022 with another $9.1 billion in total unrealized gains on its balance sheet. Its recent business combination with Global Atlantic and $98 billion in perpetual capital could easily drive further strong financial performance.

What about total earnings per share?

We and other third parties were targeting $4-$5 in after-tax DE by 2023 before the recent selloff. Today, it’s fair to say that might come down a little.

But remember, most of KKR’s assets are in illiquid vehicles that are assessed based on actual value – not what the stock market says on any given day.

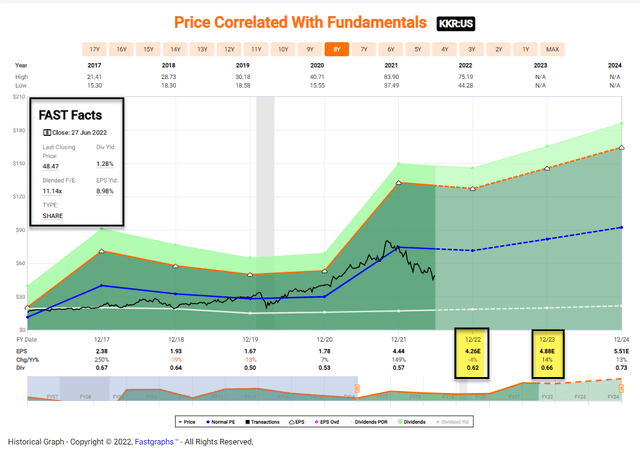

Obviously, that’s not the case with its stock price, which gives us the occasional bargain to act on. At around $49, it’s a marked discount compared to its $83.90 52-week high.

That’s pushed KKR’s earnings multiple down to 11.5x, making it one of the cheapest alternative asset managers around. (Apollo Management (APO) and Carlyle Group (CG) are even cheaper at 9.1x and 8.4x, respectively.) It’s significantly less expensive than the likes of:

Our 12-month price target for KKR is $69. Coupled with its 1.3% yield, this equates to about a 43% total return.

(FAST Graphs)

In Conclusion…

Blackstone’s heavily diversified business model makes it less sensitive to clearly declining private equity valuations compared to KKR. Its cash flow and portfolio growth is also heads and shoulders above Cohen & Steers.

We also like Blackstone’s deep integration in both the retail and institutional markets, which is easier said than done.

In addition, despite trading at a 30%-40% higher multiple than KKR, our total return target is slightly higher for Blackstone. And its nearly 5% yield is in another league compared to KKR’s modest 1.3%.

In short, Blackstone wins Part II.

(FAST Graphs – BX)

Next up: “My Quest For The Best Asset Manager 3.0,” which will look at:

- Blue Owl

- Ares Capital Management

- Brookfield Asset Management

- Apollo.

Stay tuned! There’s obviously more excellent analysis to come.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment