PashaIgnatov/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

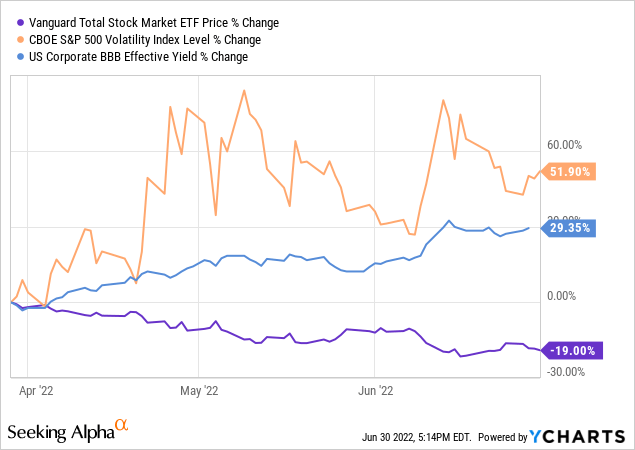

The above does NOT spell success for most Put writers, even ones like me that employ a conservative strategy in selecting the strike prices to execute trades against. The S&P 500 Index had its worst yearly start since 1970! The second quarter saw almost half my Cash Secured Puts get assigned, even with my 10+% safety margins. It was my first really bad quarter since the COVID crash. Sparks this time were interest rates and the worsening inflation expectations. Of course, the strikes used on the Covered Calls were way OTM at expiration too.

For those new to options trading, some recommended reading:

A time not worth repeating

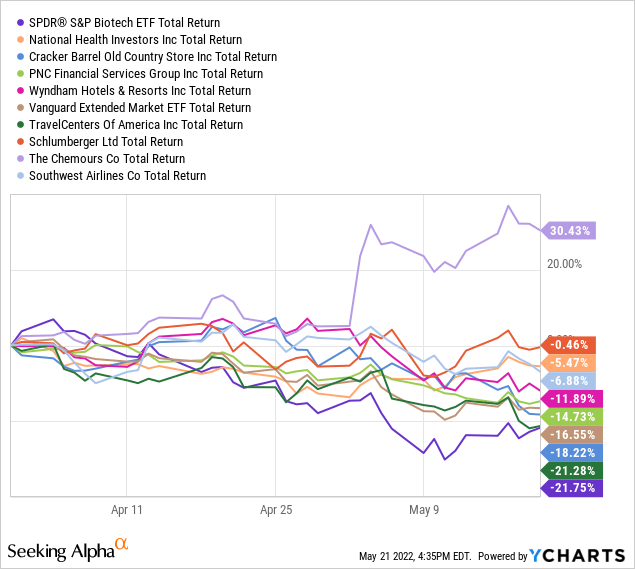

Not since the COVID crash have I experienced such bad months as May and June of this year. To illustrate, the next chart shows how my May contract stocks performed from the end of March, when many were written, until May 20th, when all but the Southwest Airlines (LUV) options expired OTM.

My usual strike choice is 10% OTM. The only stock that dropped more than that during the above timeframe and was not assigned was the TravelCenters of America (TA), which due to strikes available, was written with 25% protection, otherwise, it would have been assigned. As for timing, a week later, three of the four Puts would have expired OTM, and the last cut the ITM amount by 80%.

Going long

My average contract is open for less than five weeks, but when the VIX spiked as war broke out, by early March, I wrote contracts on five stocks that won’t expire until June (3) or July (2) and have an average potential ROI over 17%, though some recovery will be needed as all but one was ITM at the end of June. The premiums received more than met the goal for each month even before opening additional ones as I rolled the May, then June contracts.

Author’s note: For all the option trades I will cover, I use an annualized ROI for one reason: trade comparison. The shorter the option trade was open, the harder it would be to duplicate those trades over 12 months to achieve that ROI.

Previous and new Covered Call stocks

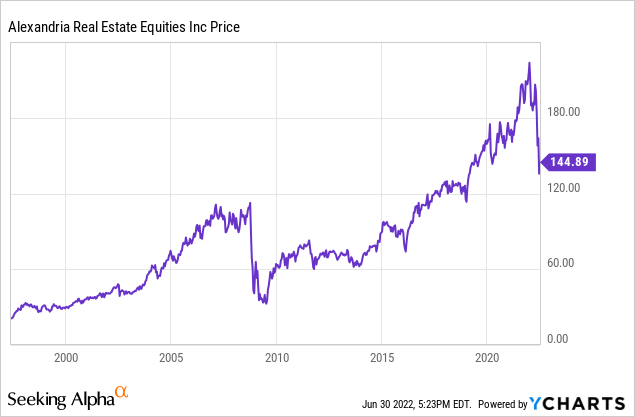

Alexandria Real Estate Equities (ARE): ARE is a REIT focused on life science, technology, and ag-tech campuses in AAA innovation cluster locations. I wrote 2 JUL $175 when ARE was at $192 and stabilizing in early March. After rallying above $200 by April, it has been downhill since and I was assigned 1 contract early, the day after ARE went ex-div. Unless there is a big rally, the other contract will get assigned by 7/15/22. My breakeven price is about $168 so I might write some Covers above that, but I view ARE as a good long-term holding. Keeping means less free cash to write other Puts against but ARE’s 3% yield helps offset that.

The last correction for ARE of this magnitude was during the 2007-09 GFC.

Cracker Barrel Old Country Store (CBRL): My longest-running Covered Call position should have called except for my being too greedy. Due to premiums and dividends, my breakeven price is near $120, yet I kept writing new CCs at $130 or more. I was also using the strategy of writing one Put each month for extra downside protection to enhance the possible exiting ROI. After working for ten months, it failed in May ($105 strike) as CBRL closed below $100, a price CBRL hadn’t seen since coming off its COVID bottom when their stores were closed. The JUN Covered Calls expired OTM by a wide margin as CBRL closed below $90. ROIs on the two Covered trades averaged 13%; the OTM PUT had a 28% ROI due to its one-week life span.

Despite watching the news and reading the WSJ, I just didn’t appreciate the headwinds that had come back (or never left entirely): food costs, higher labor rates, employee shortages, and higher gas prices, which especially hits a company where many stores are dependent on travelers. CBRL is my lesson on the risk of getting too greedy when assigned in terms of exiting. I could have gotten out at a price $50 higher! At least CBRL provides a 5% yield at this price level. Currently, used strikes will result in exiting at a loss if assigned.

ONEOK (OKE): This Natural Gas stock has been in my Put writing process for a long time, but this was the first assignment. I even went deeper for extra protection, but OKE dropped $12/share since the late-April trade execution. Unlike some of the other recent assignments, OKE provides a 7% yield and narrow strike prices where exiting at a profit should be achievable. With one of the LNG export terminals down due to a fire, pipeline volumes might get affected in the next quarter. I am writing very tight Calls against this stock.

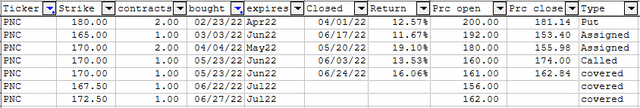

PNC Financial Services Group (PNC): The 2 May $170 Puts were my 10th set of Puts written against PNC over the past year, with the first one using a $142 strike, the highest a $190 for the Feb ’22s. From a peak of $222, PNC closed below $156 on May’s expiration, netting me 200 shares. I was able to sell 100 shares by writing a $170 Call, which yielded an ROI of 13.53% and a profitable exit. Back in February, I went long selling a JUN $165 Put. While this price had not been breached since early 2021, June’s reaction to inflation and a 75bps FED rate hike pushed it down to $153, pushing me back up to 200 shares. I had one PNC Put not assigned, which also shows how date selection matters. On 5/23/22, I wrote 2 $170 Puts that expired three weeks apart. One was assigned, the other close OTM with a ROI of 16.06%. Option activity for 2Q:

Author’s XLS

Southwest Airlines (LUV): Another stock I have been using for years, though not my first assignment on LUV. I tried writing JUN $44 Puts expiring in 10 days with LUV at $46. Like most stocks, it collapsed, LUV to $40, and I was assigned 500 shares. With the weakness, I wrote 7/1/22 Call options with a $42 strike and later 3 7/1/22 $34 Puts. If they were called, I would exit at a small profit; continued weakness would mean owning 800 shares with an average cost near $40. With weakness on the 30th, I closed out the Puts at a small profit versus taking the risk LUV would close below $34 the next day. That 17-day trade yielded a 24.8% ROI.

Wyndham Hotels & Resorts (WH): After sitting out this stock since last summer, the price looked like it had dipped enough to wade back in; it wasn’t but up to the last day, it appeared it would stay above the $77.50 strike on the May contracts. The one contract was assigned as WH closed at $74.62. I wrote an JUN $75 against this holding that yielded a 41% ROI, and have an AUG $75 Call open currently.

Vanguard Extended Market ETF (VXF): This one is different from the prior three as I was willing to add another 100 shares to the 300 already owned. My net cost is $146.46 as I was assigned against the MAY $148 strike. VXF hadn’t sold at this price in over 18 months, but we haven’t seen a quarter like this in a long time either. Occasionally, I do write Calls against part of this holding.

Other assignments

iShares MSCI Frontier and Select EM ETF (FM): This one I wrote Puts using the JUN $31 for 5 contracts to increase the shares I already held. My net cost is under $30 but FM closed near $27 when assigned. The ROI on the trade itself is 15%. Option writing on this ETF is hard so it’s unlikely I will try to enhance my return by writing Call options against it.

Covered Call activity

Besides the one picked up via assignments I want to exit, there are two where I am willing to exit all or part of my holdings. These I only write Covered Calls when the premiums on an exit strike price are acceptable, which isn’t always the case.

National Health Investors (NHI): I have owned 300 shares of NHI for years and have set $65 as my exit price. My May $65 were OTM at expiration as the market downdraft pulled NHI down from $60 to $56. Dividend yield plus option ROI equated to almost 11%. Due to the toughness to trade options on NHI, I use contracts that expire in two months.

SPDR S&P Biotech ETF (XBI): I own 300 shares via assignments, 100 of which I am okay having called above my cost. XBI got caught up in the Tech killing this quarter and now trades near its COVID low price. I wrote a May $106 Put when XBI was at $92 which earned a 7.77% ROI. Due to more price erosion, recent Covered Calls will result in a loss if called but this is one of the few I am trading in a taxable account. Most OTM strikes now executed allow for a 20% up movement.

Cash Secured Put Activity (not assigned)

Due to the high level of assignments and the cash tied down in those stocks, my expired CSP count is down.

PNC Financial Services Group (PNC): All the quarterly activity for PNC is listed above, but before those assignments started, I successfully wrote 2 APR $180 Puts that had a 12.57% ROI.

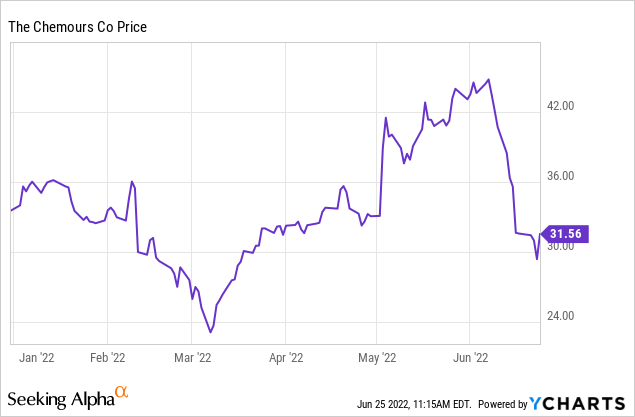

The Chemours Company (CC): Chemours is a spin-off of my former employer, so I am more aware of it than many stocks. Its wide price movements provide for high premiums to match that volatility.

After coming off its March low, I wrote 4 MAY $25 Puts. CC was at $32 at the time; closing at $40 at expiration. The ROI was 11.22% even with a 22% safety factor used.

TravelCenters of America (TA): I like the high returns on options TA provides but $5 strike spreads and low volume limit opportunities I am willing to take. I did execute a 4 contract trade on the MAY $30 Puts when TA returned to $40. As mentioned above, the extra-wide safety net paid off as the next available strike would have been assigned as TA closed at $33. The ROI was 16.85% even with the strike being 25% OTM when written.

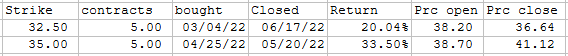

Schlumberger Limited (SLB): I have been writing options against SLB since COVID arrived. It has close strikes, high volume, weekly expirations, and tight bid/asks with decent volatility: what more could a CSP writer want? Here are my two successful PUT trades this quarter:

Author’s XLS

On July 1st, I picked up 300 shares on a $40 Put that expired ITM on that day.

Special situation CSP trades

Netflix (NFLX): Netflix had a big drop after reporting 1Q results and predicting a loss of 2m customers in the next quarter. I started looking at deep OTM options but held off as the “bottom” was constantly lowering. At the end of May, I sold 2 JUL $150 Puts while NFLX hung around the $195-200 area. Even with a 23% safety margin, an OTM finish will yield a 9.5% ROI.

Kohl’s (KSS): This is a play on the announced exclusion window for a bidder to evaluate Kohl’s and make bid for the company. Another bidder was placed on hold; others dropped out. A bid as low as $50 was expected, which the Board then might reject as they earlier declined a $60+ bid. The risk is no bid is made or it’s rejected. Based on the $50 estimate, I wrote 2 OCT $37.50 when KSS traded at $42. Any bid/close over $33 will result in a profit, with one over the strike resulting in a 32% ROI. That became less likely as KSS said takeover talks were canceled so a new bidder will be needed.

Altria (MO): Altria dropped 10% when it was rumored that the FDA would ban JUUL products from the US market. With the price stable the next day, I sold 4 SEP $40 Puts for $1.91. I looked at the $37.50 strike, my normal safety margin, but the extra premium (and MO’s yield) justified going tighter. Potential ROI is 20%. FDA did so rule, but a Court put it on hold.

I considered selling Puts on Twitter (TWTR), but decided the ROIs here were not worth the uncertainty Elon Musk kept alive.

Using CSPs as a CD

I did write a few CDs at over 1% in accounts I do not write options in. Our Joint account is our emergency cash buffer and autopay account, with some used to secure Put trades. I decided to Put some to work versus the .01% the broker pays by writing Puts against the SPDR S&P 500 Trust ETF (SPY) as they are one of the few ETFs with a quarter-end-expiration-date options. Since the goal was earning more than a 1-mo CD this time, I was able to use a $355 2Q Puts when SPY sold for $415, a 15+% safety margin. Of course, June’s swoon looks like it could actually break that so to minimize my loss risk, I bought one back at a small loss on the 22nd when SPY dipped below $370 and experienced several $9/day losses. While the option did close OTM, the lower risk of a big hit was worth the $142 closing cost. Estimated ROI would have been 3%; actual closer to .63%, still above 1-month CD.

Quarterly results

- 8 Put options were assigned ($3121 net premiums)

- 1 Call option was assigned ($69)

- 9 Covered Calls expired OTM ($1449)

- 13 Puts expired OTM ($3605)

- Quarterly ROI on trades: 13.2%

- Recaptured ROI: .01%

- Paper loss ROI: -28%

ROI is calculated by dividing the total premiums written by the $250,000 backing the Put trades and annualizing. Writing Covered Calls adding 2.3% to the ROI. The Recaptured ROI represents the market-value improvement on the assigned Calls from their strike price. The Paper loss listed represents how much the open assignments are above/below (net) their assigned strikes since 3/31/22 or assignment date.

CBRL represents almost 50% of the paper loss being carried forward. Three of the other four stocks assigned that I prefer to unload are close to their strikes, thus selling would recapture some of the current paper loss shown.

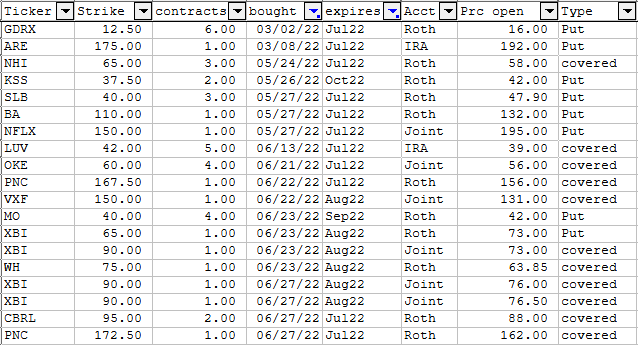

Open trades

Author’s XLS

I rolled the 7/1/22 LUV (OTM) and SLB (ITM) contracts out to 7/29/22 on the first to capture four extra trading days; my first rolls! I fully expect the GDRX and ARE to be assigned in July. Okay with LUV, PNC, and OKE getting called as the risk/return is better using CSPs on those stocks.

Portfolio strategy

Hopefully, my broker will start paying more on the cash I want to hold to pay bills and as part of my conservative in-retirement plan, making a CSP strategy more profitable. I tried to find a chart or data listing how many times stocks had a quarter as bad as the last one, where the S&P 500 Index experienced a 16% drop. I did find this drawdown data which is more useful in some senses:

Portfolio Visualizer

Using January as the starting point, the current drawdown is the 3rd worst since SPY started in 1993. The point being, even though my option strategy results were the worst since March/April of 2020, it would have been even worse if I had bought the stocks outright and did no option writing, Puts, or Calls. Some of the losses are still pending as the contracts expire in July; those results will be in my next quarterly review.

These quarterly results reminded me, and hopefully, readers who use a CSP strategy, of a few things:

- There is risk involved in using even a conservative CSP strategy. Others use a Spread Strategy to cap that risk.

- Taking assignments in hopes of recouping losses adds another source of risks as CBRL demonstrated. Things can get worse, even after one thinks that point was reached.

- While more volatility should equate to more income, risk of loss increases too. Add poor screening or getting greedy can dramatically increase those risks.

- Lastly, it reminded me that while upside is limited, downside moves not so much.

Be the first to comment