We Are

In contrast to the first half a year of 2022, July was a good month when it comes to stock returns. July was the best month in stock returns since November 2020 and although I like it when my portfolio is up, it also means that stocks that were very attractive last month are less attractive now. This month I made some changes in my portfolio and continued the repositioning. This led to higher than average transactions as I bought 9 stocks and sold 2.

For the people that have not read my previous articles: I am a 25-year-old investor from the Netherlands who is trying to start early so that I will have the option to retire early or at least earlier (the current retirement age is 67 in NL and is trending upwards). If you are interested in previous updates on my portfolio, you can find them here:

July Update

During July the stock market performed very well and has left bear market territory. It remains to be seen if this was a bear market rally or the start of a real recovery. However, investors should keep in mind that during the summer period a lot of people are on holiday and volume is significantly lower, which makes stocks a lot more volatile. Personally, I think we are merely in a bear market rally as most economic indicators still point to a recession. This does not mean that I am considering selling out as I still believe that time in the market beats timing the market.

In July my vacation started and although I spend approximately half of the time abroad I managed to add to my position and evaluate some of my positions. The evaluation led to 2 sales and 5 buys, which explains the relatively high number of transactions that I made during the month. During August I will most likely continue evaluating some of my positions (more on that later), even though I will spend some time in Houston.

Last month I also promised that I would write about the strategy that my investment group used for the investment competition of the student association. Our strategy focused on macroeconomics, low beta, and mergers and acquisitions. Macroeconomics was an important factor given the negative market sentiment and the fact that a lot was going on in the world. Due to this we bought shares in companies like Bunge (BG), Lockheed Martin (LMT), and had a position in Gold (GLDM). We used low beta as low beta stocks tend to outperform high beta stocks due to the low beta anomaly. Low beta was also important for the calculation of the returns as the association uses M² to calculate returns. Last but not least, we used mergers & acquisitions to our advantage. For example, we bought a position in VICI Properties (VICI) that was in the middle of acquiring MGP, which made it likely that the stock would be included in the S&P 500, while we also bought Vonage Holdings, which was in the midst of being acquired by Ericsson (ERIC). This strategy paid off for us as we came in the first position with an M² between 11 and 12% (almost double the return of the 2nd placed team). I expect to use some parts of the strategy in the future (such as merger arbitrage) in my own portfolio, but will first do this on a small scale.

Trophy of the investment competition (Author)

Transactions

Rules

|

Core |

Value |

Small-cap growth |

|

|

Buy |

|

||

|

Reconsider |

|

|

|

|

Sell |

|

1st of July

Aroundtown (OTCPK:AANNF) – Bought 83 shares for €3.01 each:

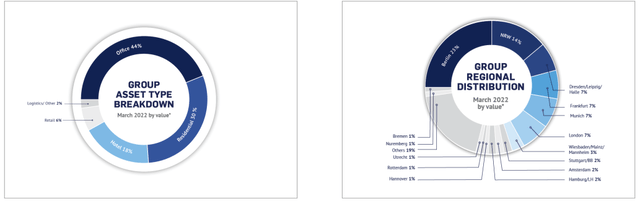

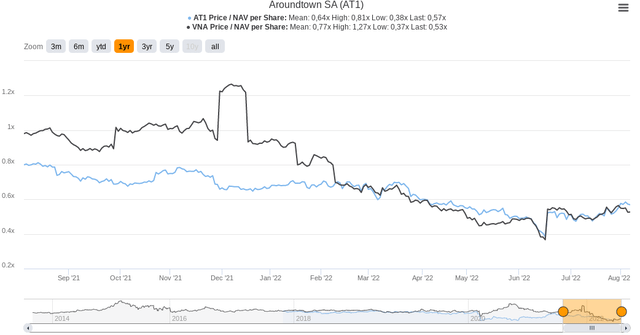

In July I added more capital to Aroundtown. Not much has changed since last month. The company owns properties in some of the best locations in both Germany and the Netherlands while it is a majority shareholder in Grand City Properties (OTCPK:GRNNF) (OTCPK:GRDDY) and a minority shareholder in Globalworth (OTCPK:GLWHF), the largest owner of office buildings in the Central Eastern Europe Region (their joint venture with CPI Properties has a majority stake). Besides buying positions in the aforementioned companies for bargain-basement prices, the company has also bought back a significant amount of its own shares, increasing the per-share value of the real estate that shareholders own. In the last quarterly call, the company estimated NTA per share at €10.30, making the current prices very attractive.

Aroundtown portfolio composition (Aroundtown)

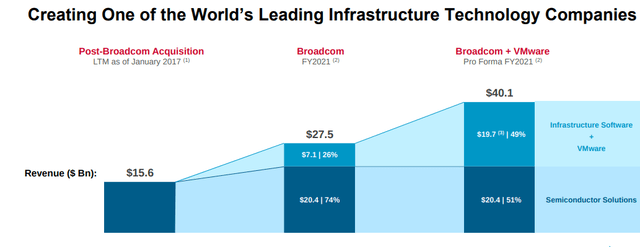

Broadcom (AVGO) – Bought 0.55 shares for $260.02:

Broadcom is one of the best stocks in the semiconductor industry. Through a combination of organic growth and acquisitions, the company has been able to rapidly expand its revenue and dividend over the past years. Despite this, the growth rates will most likely decline as the company has become very large. On that note, the acquisition of VMWare will be interesting as this could lead to higher growth rates in the coming years (due to synergies and knowledge). Nevertheless, Broadcom remains one of my smallest dividend growth positions as the company tends to trade above my estimated fair value (which is currently around $507).

Broadcom after VMware acquisition (Broadcom)

Mid-July

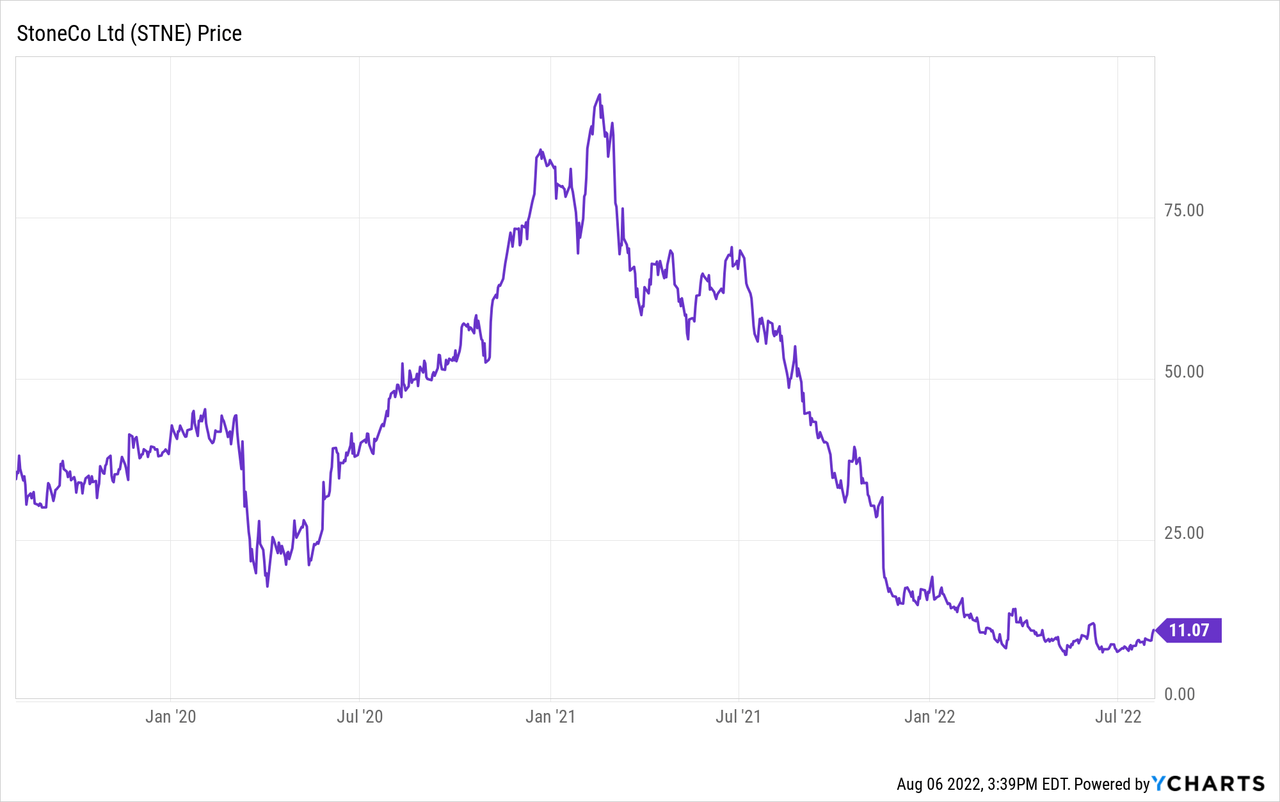

StoneCo (STNE) – Bought 17.5 shares for $8.63 each:

StoneCo is a position that I started in 2018, which was at the beginning of my investment career. At the time I noticed that Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) started a position in the stock and after doing some very basic calculations I was interested. Since then I could have sold it at $7 and $94, which gives you an idea of how volatile the stock is. The company itself hasn’t changed much since that time and is still growing rapidly. Nevertheless, other economic factors such as the strength of the USD compared to the BRL and the high-interest rate in Brazil have certainly been weighing down the stock. Given the rapid growth of the company, I think that the current share price is way too low and my current fair value estimate is approximately $20, which gives an upside of over 80% at the current share price.

CTP NV – bought 27 shares for €11.14 each:

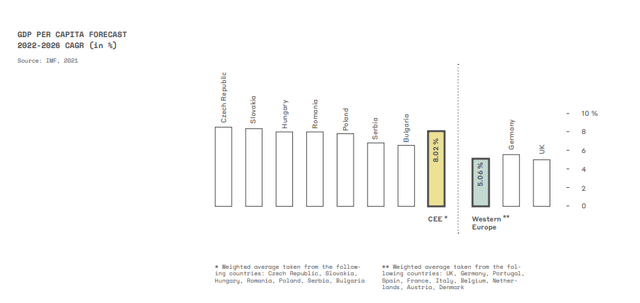

CTP NV is another European real estate company. It focuses on logistics properties, mainly in the CEE region. In my opinion, this is the most interesting region in Europe as they are growing rapidly and multiple countries have joined the European Union, which could unlock more growth in the coming years. The two most interesting countries, in my opinion – Poland and Romania – are two of the largest markets for CTP NV. If Romania is allowed to join Schengen this could significantly increase the importance and size of the Harbor in Constanța, which will most likely increase the value of the real estate in that region. The company has estimated its NTA to be €12.33, but I estimate the company’s fair value to be slightly higher (€14.96).

GDP per capita forecast CEE region (CTPNV IR / IMF)

End of July

Small-cap REITs:

At the end of July, I compared my small-cap REITs with other small-cap REITs that I thought were interesting. Most other small-cap REITs were either not as strong as the company that I owned, were overpriced or were riskier than what I like to see. I did make one change as I sold my position in Power REIT (PW). The reason that I sold Power REIT was that the company’s tenants and governance left some things to be desired. As an example the company’s largest tenant is Millennium Sustainable Ventures Corp. (OTCPK:MILC), which is led by the same CEO, barely has any revenue, and only recently switched to cultivating Cannabis. For this reason, I decided to sell out of Power REIT and put the money in the two other small-cap REITs that I own, Armada Hoffler (AHH) and Netstreit (NTST).

Insurance stocks:

I also finished evaluating my insurance stocks and, to be honest, there was no clear winner between Reinsurance Group of America (RGA) and Prudential Financial (PRU). In the metrics that I use the companies ended in a draw. So it was down to which company I thought would do better. Due to the fact that Prudential is larger, pays a larger dividend, and has a more diversified business model that also includes a significant asset management arm I decided to keep that one. Nevertheless, as I mentioned before this came down to personal preference more than anything else. Part of the proceeds from the sale of RGA I used to increase my position in PRU. However, as I did not want to put the entire proceeds in PRU (due to the fact that it would make it my largest position and that the market is very volatile), I also added to two other stocks.

Brookfield Asset Management (BAM) – bought 15.6 shares for $49.65 each:

Brookfield Asset Management is one of the largest alternative asset managers and its stock has done very well over the past few years. It has also spun off multiple subsidiaries and is planning to spin off its asset management business, which should lead to more value being unlocked and makes BAM an asset-light business. As the majority of the company’s other subsidiaries have performed well since their spin-offs I am confident that this spin-off will be successful as well. The valuation of BAM is also still very attractive as I estimate the company’s fair value at approximately $60.10 based on its future cash flows.

Morgan Stanley (MS) – Bought 5.4 shares for $84.05 each:

The remainder of the proceeds I used to increase my stake in Morgan Stanley. Morgan Stanley is one of the banks that did well during the stress test and subsequently raised its dividends by 11% at the end of June. Unfortunately, the company’s Q2 results were below consensus but were to be expected given the horrible performance of the market during the quarter. Personally, I remain confident that in the long run, the company will be a good performer as it is one of the best-run banks in the US, as indicated by its return on tangible common equity of 20% during FY 2021. The company’s valuation is also still attractive as I estimate its fair value to be $105.21.

|

Company |

Shares |

Total price |

Effects on dividend pre-tax |

|

Aroundtown |

83 |

€249.75 ($254.43) |

€19.09 ($19.45) |

|

Broadcom |

0.55 |

$260.02 |

$9.02 |

|

StoneCo |

17.5 |

$150.94 |

$0 |

|

CTP NV |

27 |

€300.78 ($306.42) |

€9.45 ($9.63) |

|

Power REIT |

-25 |

$377.50 |

-$0 |

|

Armada Hoffler |

16.4 |

$221.07 |

$12.46 |

|

Netstreit |

8 |

$163.84 |

$6.40 |

|

Reinsurance Group of America |

-18.1 |

$2087.47 |

-$52.85 |

|

Prudential Financial |

8.15 |

$812.15 |

$39.12 |

|

Brookfield Asset Management |

15.6 |

$774.54 |

$8.74 |

|

Morgan Stanley |

5.4 |

$453.87 |

$16.74 |

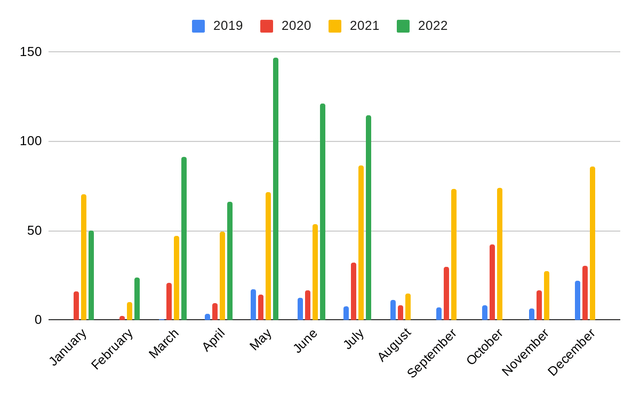

Dividends

During the month of July I received a total of $134.92 in dividends, only trailing the past two months. The reason why July was such a good month in terms of dividends is that I received the dividends of Aroundtown, which pays annually. However, this could have been even higher if the EUR was as strong as last year.

|

Company |

Dividend 2021 |

Dividend 2022 |

Difference |

|

Uniti Group (UNIT) |

$4.77 |

$0 |

-$4.77 |

|

VICI Properties (VICI) |

$7.10 |

$26.38 |

$19.28 |

|

Altria (MO) |

$18.06 |

$0 |

-$18.06 |

|

W. P. Carey (WPC) |

$18.90 |

$0 |

-$18.90 |

|

AvalonBay (AVB) |

$6.36 |

$0 |

-$6.36 |

|

Aroundtown (OTCPK:AANNF) |

€38.28 ($45.47) |

€86.25 ($87.72) |

€47.97 ($42.25) |

|

Boston Properties (BXP) |

$7.84 |

$0 |

-$7.84 |

|

Brookfield Asset Management* |

$0 |

$2.38 |

$2.38 |

|

Broadcom |

$0 |

$8.20 |

$8.20 |

|

Total |

$108.50 |

$134.92 |

$26.42 |

* Last year BAM’s dividend was paid in June (which was in line with the dividend that I received from my other broker).

Dividends per month (Author)

In July Armada Hoffler announced an increase in quarterly dividend of $0.02 per share. My new forward dividend is €1,021.37, which means that I finally passed €1,000. I am very happy with this amount but hope to have at least €1,200 at the end of the year as this would mean that on average I get €100 per month in dividends.

|

Company |

Increase in dividend quarterly |

Dividend per share pre-raise |

Dividend per share post-raise |

|

Armada Hoffler |

$0.02 |

$0.68 |

$0.76 |

Sector Overview

Sector overview (Author)

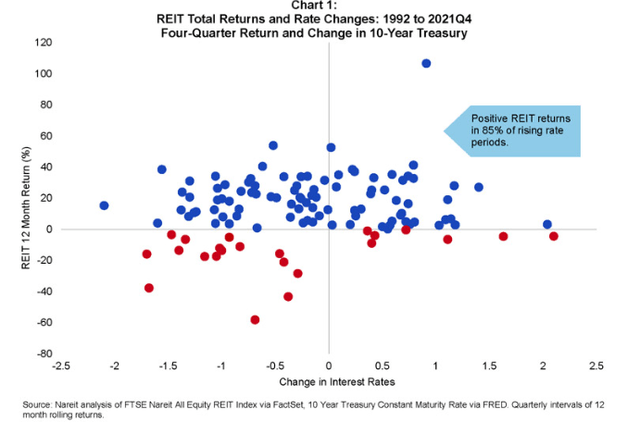

Compared to last month we see a significant increase in REITs. This is due to the fact that I continue to add to my European real estate stocks that are significantly undervalued in my opinion. Furthermore, real estate tends to perform well after rate hikes, which could give a boost to my portfolio in the coming year(s).

REIT returns after rate hikes (NAREIT)

Secondly, IT is no longer my second largest sector. This was mainly due to performance as I didn’t add new capital to my financial stocks (I did use the proceeds of RGA to add to PRU, MS, and BAM but all of those are financial stocks).

Current Holdings

|

Company |

Qty Held |

Portfolio % |

Days Since Latest Buy |

|

VICI Properties (VICI) |

73 |

6.55% |

174 |

|

Enbridge (ENB) |

55 |

6.29% |

267 |

|

AbbVie (ABBV) |

16 |

5.72% |

254 |

|

Prudential Financial (PRU) |

21 |

5.37% |

5 |

|

L3Harris (LHX) |

8 |

5.02% |

188 |

|

Brookfield Asset Management (BAM) |

38 |

4.81% |

2 |

|

CBOE (CBOE) |

16 |

4.80% |

183 |

|

Ahold (OTCQX:ADRNY) |

63 |

4.56% |

48 |

|

Visa (V) |

8 |

4.48% |

79 |

|

Morgan Stanley (MS) |

20 |

4.45% |

2 |

|

CTP NV (OTCPK:CTPVF) |

134 |

4.28% |

16 |

|

TJ Maxx (TJX) |

25 |

4.06% |

111 |

|

Aroundtown (OTCPK:AANNF) |

458 |

3.96% |

33 |

|

Netstreit (NTST) |

73 |

3.96% |

37 |

|

Vonovia (OTCPK:VONOY) |

46 |

3.87% |

84 |

|

Prosus (OTCPK:PROSY) |

23 |

3.84% |

79 |

|

Broadcom (AVGO) |

3 |

3.54% |

33 |

|

CVS Health (CVS) |

13 |

3.32% |

189 |

|

Inditex (OTCPK:IDEXY)(OTCPK:IDEXF) |

50 |

3.16% |

36 |

|

Armada Hoffler (AHH) |

86 |

3.13% |

8 |

|

Fresenius SE & Co. KGaA (OTCPK:FSNUF) |

40 |

2.57% |

124 |

|

Intel Corporation (INTC) |

20 |

1.91% |

188 |

|

CoreCard (CCRD) |

29 |

1.84% |

124 |

|

StoneCo (STNE) |

53 |

1.31% |

19 |

|

CareCloud (MTBC) |

126 |

1.30% |

79 |

|

Linkfire |

1121 |

0.83% |

163 |

|

Interactive brokers (IBKR) |

4 |

0.55% |

78 |

|

The Hut Group (OTCPK:THGHY) |

189 |

0.40% |

211 |

|

Tezos (XTZ-USD) |

50 |

0.23% |

524 |

|

Hedera Hashgraph (HBAR-USD) |

680 |

0.13% |

496 |

|

Bitcoin (BTC-USD) |

0 |

0.09% |

496 |

|

Binance (BNB-USD) |

0 |

0.02% |

524 |

Going Forward

During August I will try to add an additional €1,000 to my portfolio, although, if my vacation will be more expensive than I budgeted I will lower this amount. Nevertheless, I think that I have been very prudent with my budget and I should have no problems with adding this amount. In August I will also continue to evaluate my stocks. Thus, next month I will be looking at the following stocks/sectors:

European real estate

European real estate stocks have been a recurring theme in my monthly portfolio updates this year. The majority of the industry is trading at a significant discount compared to their NAV. Most of the companies trade for less than half of the estimated NAV. I already explained the reasons for buying additional shares in two of my European real estate stocks. The last European real estate stock that I own is Vonovia, which is the largest residential landlord in Europe. The company owns apartments in Germany, Austria and Sweden. It also has investments in owners of apartments in both France and the Netherlands. The company’s shares have sold off YTD due to the additional financing cost. This has also forced the company to switch its strategy from development-to-hold to development-to-sell, impacting future growth. Nevertheless, the company’s real estate is still worth over €60 per share, while shares are currently trading at around €30.

analyst P/NAV estimates (Tikr.com)

Inditex

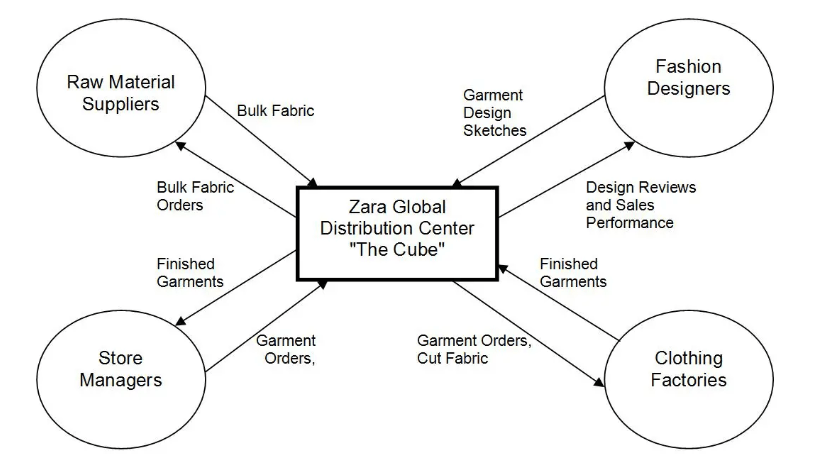

Last month I started a position in Inditex as it was one of the strongest companies in the fast-fashion sector. The company uses multiple brands to reach different target groups and price points, which gives them a large total addressable market. Another differentiator of the company is its supply chain. The company uses suppliers that are located relatively close to its distribution center and most suppliers can reach it within 5 days by road. Many parts within its supply chain are also highly automated and it has underground monorails from the DC to 11 of its factories. This gives them an edge over some other companies in the fast-fashion industry. The company’s valuation is also attractive as I estimate it to be undervalued by approximately 15%.

Simplified overview of Zara’s supply chain (SCM Globe)

Semiconductors

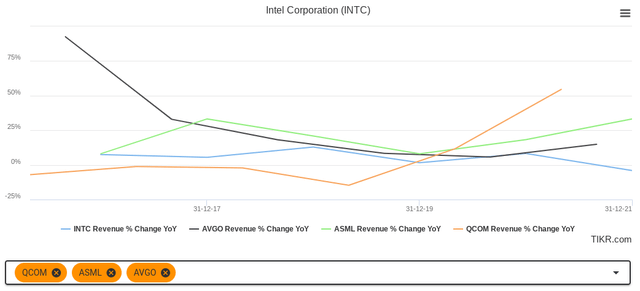

During August I will evaluate my stocks in the semiconductor industry. I currently own two stocks in this industry: Intel and Broadcom. After another horrendous quarter of Intel, I want to evaluate if it is worth to continue owning shares in both, if I should put all the money in one of the two or if I should start a position in another company such as Qualcomm (QCOM), Texas Instruments (TXN) or a company from my own country such as ASML (ASML). At the moment I feel like it would be best to at least sell Intel, but my due diligence might show something else.

Revenue growth rate semiconductor companies (Tikr.com)

Healthcare

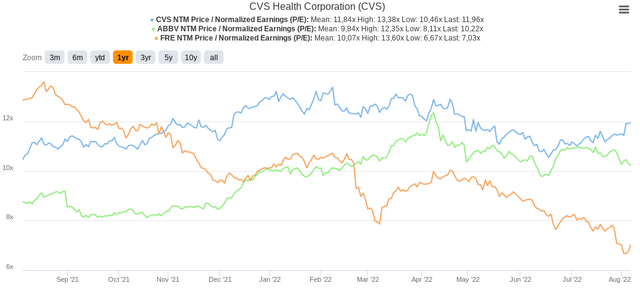

During August I will also evaluate my healthcare stocks. I currently have 3 different healthcare stocks AbbVie (ABBV), CVS Health (CVS) (although you could classify CVS under some other sectors as well), and Fresenius (OTCPK:FSNUF)(OTCPK:FSNUY). After another abysmal quarter of Fresenius, the stock has fallen even further. During the evaluation, I will compare the stocks to some of its peers which include Walgreens (WBA), Bristol-Myers (BMY), and Bayer (OTCPK:BAYZF) (OTCPK:BAYRY) and will determine if I should keep all, replace some, or sell out of the sector.

Valuation of my healthcare stocks (Tikr.com)

Conclusion

July was the best month since November 2020 in terms of stock market returns. It remains to be seen if this breaks the downward trend or if it is merely a bear market rally. For this reason I will continue to add money to my stock portfolio as time in the market beats timing the market. In July I also reached two personal milestones, first of all we won the investment competition and secondly my forward dividend is now over €1,000.

In the beginning of August I will be a little less active due to my vacation to Houston. After that I will have a substantial amount of time, which I will partly use to evaluate my stocks.

I hope you enjoyed the update about my progress, and I would love to hear your thoughts on my portfolio and what you would like to see in future updates.

Be the first to comment