Abstract Aerial Art

In 2009, I first began switching to dividend growth investing. At the time, I was looking for a strategy that would remove the sense of doom and despair that accompanied both the dot com crash and the GFC. Of course, until this year, we hadn’t had a real bear market to test my thesis.

I can now resoundingly say that I am excited to be a dividend growth investor in a bear market. True, we haven’t approached anywhere near the drops seen in 2008-2009, but I am only excited about the possibilities if we do!

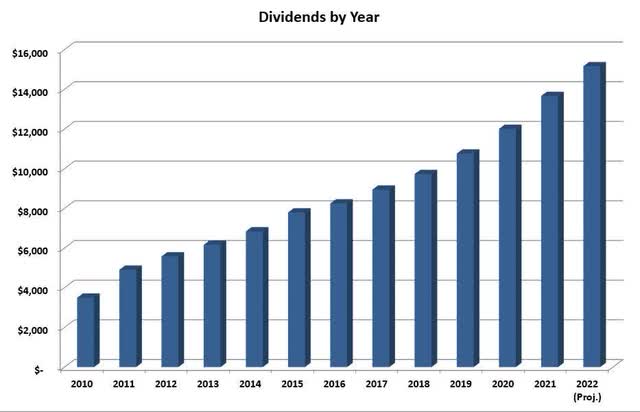

Only one metric matters to me anymore – watching my income grow! In my first year of dividend growth investing, I collected $3,500 in dividends. This year I will collect over $15,000. Even better, as I wrote about here, the income growth has been incredibly predictable. I know that I can reasonably expect my income to double every seven years, and that’s without adding new capital to the portfolio. The chart below shows how my income has grown over time.

Wyo Investments

I have simple goals with this portfolio: Grow the income by 10% annually with dividends reinvested and 7% without reinvesting. It’s essential that the distributions continue to grow without reinvestment as, at some point, I expect to pay the bills with the income. It’s important to know that this portfolio has been closed to new capital since 2016, so all income growth is internal.

The guidelines I have set to achieve these goals are simple:

- Target investment is a 3% yield with an expectation of 7% dividend growth.

- I prefer companies with a 15-year plus dividend growth streak.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not.

- I like to see a reasonable expectation for at least high single-digit growth in long-range estimates, for what they are worth.

It’s important to remember that these are just guidelines. These are in place to help me meet my 10%/7% income growth goals. In addition, I do maintain a portion of the portfolio in high yield, which I buy under a completely different set of rules.

How is 2022 Shaping Up?

The year’s first half is in the books, and it looks fantastic for dividend growth! At the end of June, my income projection stands at $15,162, or a growth of 11% over last year. This total exceeds my goal and will only increase for the remainder of the year as I reinvest dividends.

One important thing to remember about my results is that all the growth is organic through dividend raises and reinvestment. No new capital has been added to this portfolio since 2016. Closing the portfolio to new money allows me to track the strategy’s performance and overall goals easier.

While the portfolio only has income-based goals, many readers are interested in total returns. To be clear, I don’t worry about or manage for total returns. What is important to me is that the income grows by 10% annually. However, the portfolio is down 11% through the end of June, handily beating the S&P 500.

June’s dividend increases

The summer tends to be slow for dividend increases. No increases were expected for June. However, Ladder Capital (LADR) announced a surprise increase of 10% in the middle of the month.

Ladder Capital is a high-yield position in the portfolio. I don’t typically project any dividend growth for high-yield companies unless they have a long growth history. I consider a position as a high yield position if it was purchased specifically for yield and has reasonable expectations of flat or meager dividend growth.

Ladder was first added to the portfolio in January 2016, and the position was expanded in March 2020 when the forward yield was over 40%. However, a cut did set this back to the high 20’s. Presently LADR accounts for 2.1% of the portfolio income and 0.9% of the total value.

July’s expected increases

As I mentioned, the summer months are light for dividend increases. This month has several expected raises, but in terms of dollars, they are small. There is one exception, however. This month will bring another increase from Blackstone (BX). Blackstone killed it with the increases last year and has been doing it again this year.

Blackstone

In 2021, the company increased dividends by a whopping 87%! So far in 2022, increases have averaged 55% on a quarterly comparison basis. Because of the variable nature of the dividend, I find comparing 2021Q1 vs. 2022Q1 more useful than comparing consecutive quarters.

Blackstone was first purchased in 2014 when it was an MLP and consistently had much higher yields than it tends to today. Additional shares were added in 2015 and 2016.

Currently, BX is the second largest holding at nearly 11% of the portfolio and accounts for just under 9% of the total income. I expect the percentage of income to increase after this month’s announcement, which I am predicting at a 50% increase vs. 2021Q3.

J. M. Smucker (SJM)

With 24 years of dividend growth, J.M. Smucker is poised to become a dividend champion with the next raise. The position in Smucker was established in 2017 and has remained undersized. At present, the company accounts for 0.3% of the income.

Last year, Smucker surprised with a 10% increase. It’s hard to believe that the company will follow up with another significant increase. This is especially true given the expected dip in earnings. The current payout ratio is near the historical norm for the company, around 40%, but is looking to climb with an earnings dip. I expect this year’s increase to be more in line with the 5-year average of 5.9%, although I am expecting 4-6%.

Walgreens Boots Alliance (WBA)

Walgreens continues its march towards dividend king status, with an increase streak of 46 years. In recent years the company’s performance hasn’t been stellar, and the increases have reflected it. Last year, I was bullish the company was moving in the right direction, but now I’m not too sure. Fortunately, the position is small at less than 1% of the portfolio. I expect the company to announce another 2% raise this year. Note: On July 13th, the company announced a 0.5% increase or 1 cent per share per year.

Duke Energy (DUK)

Here is a position I look at once a year, and that’s to check the dividend increase. I was holding Duke before becoming a dividend growth investor. The company makes up 2.5% of the portfolio and accounts for 3.5% of the income. Duke might not be a fast dividend grower, but I don’t spend time thinking about it either.

Duke has 17 years of dividend growth. While the 10-year growth rate is 3%, recent years have been 2-2.5%, which is a reasonable expectation for this year’s increase. NOTE: On July 13th, the company announced a 2% increase.

Sales in June

I rarely make any sales. Companies are purchased with the intent to hold them forever. However, lower quality high-yield companies and significantly overvalued companies are always up for review. Last month there were no sales to report.

Regular Purchases

There continue to be many bargains in the market. While currently buying, I am still looking for better prices later this year. Too many companies are still overpriced. Fortunately, with dividend growth investing, a good buy is good enough in the long run; They don’t all need to be great buys. Below are the total purchases for the month. The totals and averages are shown as I purchase in single-share increments.

- 3 Shares of Medtronic (MDT) @ $95.09

- 3 Shares of Texas Instruments (TXN) @ $157.92

- 2 Shares of STORE Capital Corporation (STOR) @ $25.68

- 3 Shares of Best Buy (BBY) @ $69.86

What Else am I Looking At?

Because this is a closed portfolio, I can’t buy everything that looks interesting. I use this section to cover what I purchase and consider in my other dividend growth portfolios. The other portfolios have different rules but are also dividend growth portfolios.

I wasn’t buying as much during June as I was in May. Partly, this is because some of the best-looking bargains to me are in retail. Best Buy, Home Depot (HD), and Tractor Supply (TSCO) are all companies I want to own. While these look like decent bargains now, especially Best Buy, I think all three have the potential to fall much further by year’s end. Along those lines, I think Lowe’s (LOW) is a better buy than HD at the moment.

Texas Instruments and Broadcom (AVGO) are both priced to buy. I especially like TXN above a 3% yield and think Broadcom is the more expensive of the two right now.

If I didn’t have such an oversized position in Altria (MO), I would be adding at a 9% yield. The JUUL news is overblown regarding its effects, although management’s decisions in recent years have been disappointing. Still, 9% is a fantastic safety factor for such a company.

All across the board, banks and asset managers look like good long-term buys. I’m still adding some T. Rowe Price (TROW), Prudential (PRU), and Morgan Stanley (MS).

Schwab U.S. Dividend Equity ETF (SCHD) is now offering over a 3% yield. Although the fund has only been around for about ten years, it has a better than 10% dividend growth rate. This growth rate meets my overall investing goals. I have been adding small amounts on down days.

Finally, on the surface, Scott’s Miracle-Gro (SMG) looks like a deal. However, I’m holding off. The massive cut in estimates has me spooked and is creating a disconnect between what dividend yields are signaling and what PE ratios are saying. I expect this to occur with more companies as forecast cuts occur. These disconnects indicate potential dividend cuts, something dividend growth investors want to avoid! I’m trying to stick with companies that continued to raise or maintain dividends during the GFC.

Final Thoughts

I’m sticking with my prediction that the market will be significantly lower by the end of the year into early next year. But, I’m still cautiously buying the best buys that fit my portfolios because many high-quality dividend growth stocks are at valuations that would have been no-brainers the past few years. Market conditions have changed, however, and it’s worthwhile to be cautious.

Even if the market turns for some reason, the current deals won’t evaporate overnight. At this point, I’d rather keep some dry powder for better prices. Very few companies are priced at recession levels.

Be the first to comment