Natee Meepian/iStock via Getty Images

As 2022 closes, it’s time to review the changes to my dividend growth portfolio over the past year. While the year brought record dividends, it was certainly a bumpy ride in the market and the portfolio. At the end of the day, though, dividends were at all-time highs, and the portfolio value is sitting near all-time highs.

When I first switched to dividend growth investing at the tail of the Great Recession, I floundered for a bit as I refined my strategy. I went through a period of chasing high dividends, wanting “exotic” foreign companies, and trying to pick the next dividend champion. Eventually, I settled on the philosophy that I use today.

The overall goal of my portfolio is to grow the income by 10% annually with dividends reinvested and to achieve a 7% growth rate without reinvesting. Basically, this means that reinvestment needs to be in stocks averaging a 3% yield with a 7% dividend growth rate. Of course, not every company can meet these criteria; some will offer a higher yield and a lower growth rate, and others a lower yield and higher growth. But, in the end, I shoot for an average.

It’s important to note that this portfolio has been closed to new capital since 2016. This was done to evaluate how well I was meeting my goal. Note that the goal is strictly income-based, and the portfolio value has no bearing.

To achieve my goal, I use a series of guidelines. I prefer guidelines over rules, as guidelines imply some flexibility, whereas rules are hard and fast.

- Invest in companies from the Champions and Contenders list with at least 15 years of dividend growth.

- Look for companies with a 3% starting yield and the potential to maintain a 7% dividend growth for decades. The growth is critical as it’s impossible to continue growing income at 7% without reinvesting unless companies raise distributions by at least that amount.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this usually means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not. I want companies to grow the dividend with earnings, not by increasing the payout ratio.

- Unless it is well-diversified across industries, no single sector should account for more than 20% of the income. I was burned by this in 2016 when several energy companies cut dividends.

Again, these are just guidelines and are flexible to accommodate what makes sense to achieve my overall goals. I follow a few other items but don’t see them as integral to my investing. Instead, these tend to be more personal preferences. They include avoiding foreign companies because I don’t enjoy accounting for the taxes and FX rates causing fluctuating dividends.

Portfolio Holdings

At the end of the year, the portfolio contains 45 positions – an increase of several positions from the start. The change is primarily due to proceeds from sales that were split into multiple new holdings, as explained in the sales section. The table below shows the complete holdings, their relative size, and the percent of income produced. (Note: Regular special dividends from CME and DHIL are not included in % of income.)

| Company | % of Portfolio | % of Income |

| Ameriprise (AMP) | 7.2% | 3.5% |

| AbbVie (ABBV) | 5.2% | 5.5% |

| Philip Morris (PM) | 5.2% | 7.5% |

| Microsoft (MSFT) | 5.0% | 1.7% |

| Lockheed Martin (LMT) | 4.9% | 3.5% |

| Blackstone (BX) | 4.8% | 8.1% |

| Altria (MO) | 4.7% | 11.2% |

| Visa (V) | 4.2% | 1.1% |

| Texas Instruments (TXN) | 4.0% | 3.5% |

| Cincinnati Financial (CINF) | 3.4% | 2.7% |

| Apple (AAPL) | 3.3% | 0.7% |

| Enterprise Products Partners (EPD) | 2.8% | 6.6% |

| Broadcom (AVGO) | 2.8% | 2.7% |

| Medtronic (MDT) | 2.7% | 2.8% |

| BlackRock (BLK) | 2.7% | 2.2% |

| Aflac (AFL) | 2.6% | 1.8% |

| PepsiCo (PEP) | 2.4% | 1.8% |

| Duke Energy (DUK) | 2.4% | 2.7% |

| Johnson & Johnson (JNJ) | 2.3% | 1.8% |

| Starbucks (SBUX) | 2.0% | 1.2% |

| MSA Safety (MSA) | 2.0% | 0.7% |

| Phillips 66 (PSX) | 1.8% | 2.0% |

| Abbott Laboratories (ABT) | 1.6% | 0.9% |

| J. M. Smucker (SJM) | 1.5% | 1.1% |

| Automatic Data Processing (ADP) | 1.4% | 0.8% |

| A. O. Smith Corp (AOS) | 1.2% | 0.7% |

| Omega Healthcare Investors (OHI) | 1.1% | 3.0% |

| Simon Property Group (SPG) | 1.1% | 2.0% |

| Intel (INTC) | 1.1% | 1.8% |

| Prudential Financial (PRU) | 1.1% | 1.6% |

| Home Depot (HD) | 1.1% | 0.8% |

| Unilever (UL) | 1.0% | 1.0% |

| Best Buy (BBY) | 1.0% | 1.3% |

| CME Group (CME) | 1.0% | 0.7% |

| Intercontinental Exchange (ICE) | 1.0% | 0.4% |

| CVS Health (CVS) | 1.0% | 0.7% |

| Walgreens Boots Alliance (WBA) | 0.9% | 1.3% |

| Fortune Brands Innovations (FBIN) | 0.9% | 0.4% |

| Ladder Capital (LADR) | 0.8% | 2.1% |

| Realty Income (O) | 0.6% | 0.7% |

| Honeywell (HON) | 0.5% | 0.3% |

| National Retail Properties (NNN) | 0.5% | 0.7% |

| Cardinal Health (CAH) | 0.5% | 0.4% |

| Diamond Hill Investment Group (DHIL) | 0.4% | 0.4% |

| Snap-on (SNA) | 0.4% | 0.3% |

2022 Income and Performance

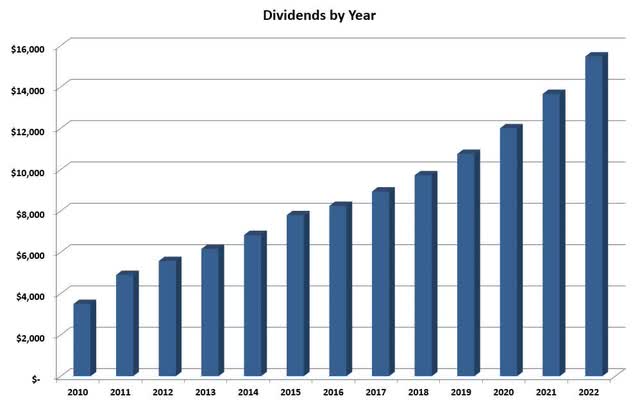

For 2022, the income increased by 13.3% to $15,476. The percentage increase nearly matches the gains of 2021, making the last two years some of the best yet for income growth. The chart below shows how the income has grown over time.

As with the market, the portfolio value fluctuated widely throughout the year. At the low point, the portfolio was down nearly 15%, but along with the rest of the market, it bounced strongly in the fourth quarter. The portfolio finished the year down 3.7%, crushing the return of the S&P 500. While I have no goals regarding the portfolio’s market value, I report it as many readers ask. Keep in mind, however, that my goals are entirely income oriented.

Summary of Sales and Replacements

There are three reasons why I sell companies:

- An acquisition offer – I almost always sell on an offer because of the chance the acquisition will fall through, and the company’s price will fall back down.

- Overvaluation – If I feel a company is overvalued to the point that similar quality companies at better yields can be found, I will sell or trim the position. Often, I will do this through the use of covered calls.

- Mixed factors – As dividend growth can be chunky, I can accept a few years of low dividend growth. Sometimes, I allow micro-positions to exist (positions at less than half a percent) when I’m waiting for valuations to come down so I can buy more shares. I even tolerate a few years of poor estimates for a quality company if I’m convinced about long-term prospects. But when there is a combination of these factors, sometimes, it’s easier to eliminate the position.

I often basket purchases with the proceeds from a sale to spread risk around, particularly if it was a high-yield position.

This last year was unusual, with much more selling than at any time over the previous 13 years. Below I will cover each sale and how the funds were reinvested. I was uncomfortable with the selling level as I go into every company I purchase with the intent to hold forever. However, many of the sales were driven by acquisitions. Below, I discuss each sale and the redistribution of the funds generated.

Preferred Apartments

In February, Blackstone offered to purchase Preferred Apartments. I usually sell immediately on a purchase offer, as there is always a chance of a deal falling through and the company’s price dropping back down.

I was already looking at replacing this company. I had purchased it as a high-yield position, and the yield had fallen enough that many high-quality names were available at similar or better yields. I used the proceeds from the sale to start positions in O, NNN, STOR, and DHIL. This combination increased the overall income while also (in my opinion) raising the overall quality. DHIL was added as a bit of speculation and is a micro position in the portfolio.

As I’m sure many of you know, STORE Capital (STOR) was eventually taken over as well. This leads us to…

STORE Capital

In September, one of my newly acquired positions, STORE Capital, was made a takeover offer by Oak Street (OSH). I must admit this was a bit of a frustration, however, it was a quick gain in a down market.

After seeing two small REITs taken out quickly, I decided to invest more money in the sharks. STOR was replaced promptly with more Blackstone. Buying more BX was a difficult decision as it is one of the most significant holdings in the portfolio, and one of the largest income contributors. However, adding in the low $80s seemed like a steal.

Annaly Capital (NLY)

In 2014, I purchased 180 shares of Annaly for a total of $2091 and change. At the time, I was on a bit of a high-yield kick, but fortunately, I was also buying quality companies like Aflac (AFL) and Visa (V). Most of 2014 and early 2015 were definitely a low point for my dividend growth investing as I was chasing yield.

Annaly is what I now consider an income destroyer. The longer you hold it, the fewer dividends you will collect. Unlike a dividend growth stock, the yield on cost actually shrinks with time. This means the highest income you will ever see on an income destroyer is the day you purchase it.

Here is the total breakdown of my Annaly purchase:

$2091 initial investment

$1429 collected dividends

$1266 sale price of the position

For a total gain of $604 over seven and a half years. During one of the greatest bull markets in history. The return works out to about 3.5% annually. While the capital destruction is disappointing, when coupled with the ever-shrinking dividend, I should have sold this one a long time ago.

No purchase was made to offset the lost income from this sale. The increased dividends from the new positions from the sale of Preferred Apartments more than offset the lost income from selling NLY. However, I did start a position in Home Depot (HD) about this time, so in a sense, it could be said I replaced NLY with HD; But this would be an off-the-charts jump in quality.

Apple (AAPL)

After Apple’s lackluster dividend increase, I discussed my thoughts on whether it still fits my portfolio and if it would continue to command an excessive valuation with my April Portfolio Update. Then, when I felt Apple was well ahead of the rest of the market in August, I began selling covered calls against part of my position. I was called out at the end of August at $167.50 and $170, which I discussed in my September Portfolio Update.

To be clear, I still hold Apple as a top 10 holding and think the future is bright for the company. It is one company I never thought I would sell, but the 0.5% yield and 5% dividend growth weren’t helping meet the portfolio’s goals.

Trying to match Apple’s quality with replacements is nearly impossible. There are a few that I consider up there; Microsoft (MSFT), Visa, and Mastercard (MA) are the first ones that come to mind. However, most of these are equally overvalued, although nearly any quality company offers a higher yield and more dividend growth than Apple.

The core basket I chose to offset the income lost from Apple was anchored with BlackRock (BLK) and included CME, ICE, and Fortune Brand Home and Security, which has since split into FBIN and MasterBrand (MBC). I consider BlackRock nearly as high in quality as Apple, with a much better dividend and dividend growth. I have always liked the exchange businesses, but S&P Global (SPGI) is at a nosebleed valuation, so I settled for CME and ICE. Finally, this portfolio is light on industrials, so I added significantly undervalued Fortune Brands Home & Security, which is considerably lower in quality than the others.

While I still haven’t put all of the capital generated to work, I have also used some of the proceeds to add to my positions in Visa, Home Depot, and Broadcom (AVGO).

Healthcare Services Group (HCSG)

In January 2011, HCSG became one of the earliest positions added to the portfolio. By mid-2017, the company had become one of the three largest positions, along with Apple and Altria (MO). I used its massive overvaluation at that time to sell about a third of the position. If only I could go back and sell it all! In November 2022, I closed the position at a slight loss over my 2011 purchase price.

Selling was an easy decision. The position had fallen in value enough that it was a micro position in the portfolio. The abysmal dividend growth had been a concern for years, but there were some potential opportunities for accelerated growth. However, its recent earnings have been so bad that dumping the company was the right option. I’m worried about the sustainability of the distribution, although the company continues its quarterly increases of 1/8 of a cent.

The funds from the sale were primarily used to add to Simon Property Group (SPG), with smaller purchases of Realty Income, NNN, and Enterprise Products Partners (EPD) made as well. I rate all of these as higher quality than HCSG, and all offer better dividend growth potential.

Regular Purchases in 2022

The purchases I make by reinvesting dividends are considered regular purchases. For the last few years, I have been staying fully invested, buying the best available company showing a fair to bargain price. However, in 2022, I began only buying clear bargains. Currently, the portfolio holds a higher cash position than it has at any time since entering the flash crash of 2020.

Below is a summary of all the regular purchases made in 2022. Note that the prices shown are average prices.

| Shares | Avg. Price | |

| Aflac | 2 | $ 52.25 |

| Broadcom | 5 | $ 439.76 |

| Best Buy | 38 | $ 88.07 |

| BlackRock | 3 | $ 535.28 |

| CME | 6 | $ 172.54 |

| Diamond Hill Investment | 1 | $ 173.26 |

| Home Depot | 12 | $ 305.24 |

| Intercontinental Exchange | 1 | $ 90.85 |

| Medtronic | 10 | $ 88.19 |

| Prudential | 10 | $ 94.60 |

| Texas Instruments | 15 | $ 160.70 |

| Visa | 1 | $ 179.60 |

Final Notes

It always tests my patience waiting for Broadcom to announce its dividend raise in late December, representing the year’s final raise. Although this year was such a great one for dividend growth, it wasn’t critical to meeting any goals. The 12% dividend raise was worth the wait and a fantastic early present!

It’s exciting to go through a year with so much volatility and come out with a much higher income, beat the S&P 500 by a wide margin, and have a strong cash position. It was indeed a great year to be a dividend growth investor!

I hope everyone hits their investing goals for the year and has a great 2023!

Be the first to comment