Maja Hitij/Getty Images News

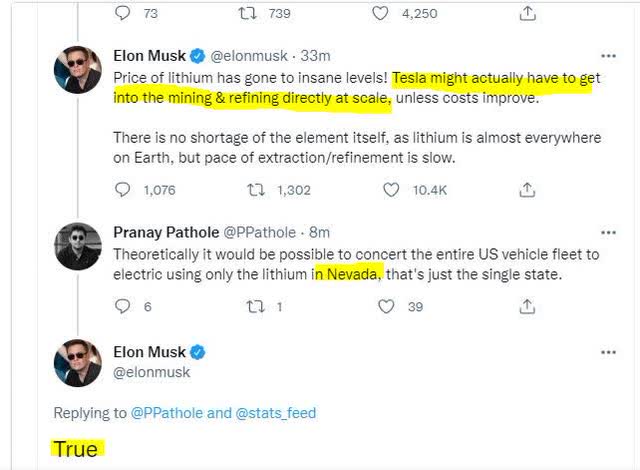

Elon Musk made some rather interesting comments today via Twitter (TWTR) in reference to Tesla (TSLA) possibility entering the lithium market AND the lithium refining market.

Elon Musk comments on lithium (Yellow highlights are the authors) (Elon Musk via Twitter)

Now of course the most logical choices are lithium projects near the Gigafactory near Reno, Nevada. That leaves us with a few contenders for Musk to possibly buyout or team up with in some fashion. Remember the projects have to have water rights and be somewhat close to receiving permits or already have them.

I’m also excluding any that have existing partnerships and / or problems with permits due to endangered plants. This excludes various contenders. I am only going to list the most logical choices. This leaves us with Cypress Development (OTCQB:CYDVF) and Lithium Americas (NYSE:LAC).

Rumors of Tesla Trying to Buy Cypress Development

First, we need to remember that Elon Musk had previously commented during the 2019 shareholders meeting about getting into lithium:

|

Then in 2020, Tesla was rumored to have been looking to acquire Cypress Development but the deal was never consummated. Per Businessinsider.com:

|

Rumors of 10,000 Acres of Tesla Land

Since the rumored deal above fell apart, we saw rumor #2 in 2020. This rumor consisted of Elon Musk acquiring 10,000 acres somewhere in Nevada.

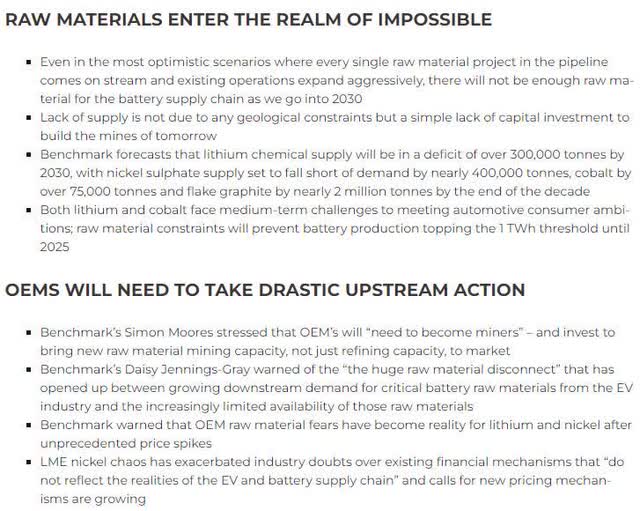

While this might have just been posturing or it could be true; the permitting process is rather lengthy. It took LAC’s Thacker Pass roughly 10+ years to get all of its ducks in a row and they are now having to defend Federally granted land rights in court. Hence, it would make some logical sense to buy an operation that is closer to permitting than starting fresh. Then again, may-hap you take both paths for maximum long-term efficiency. Buy something closer to production and on the side, as a long-term play, push forward with your rumored 10,000 acres. Do note that Elon is not alone in thinking of acquiring a lithium play. Per Benchmark Intelligence:

Lithium supply challenges (Benchmark Intelligence)

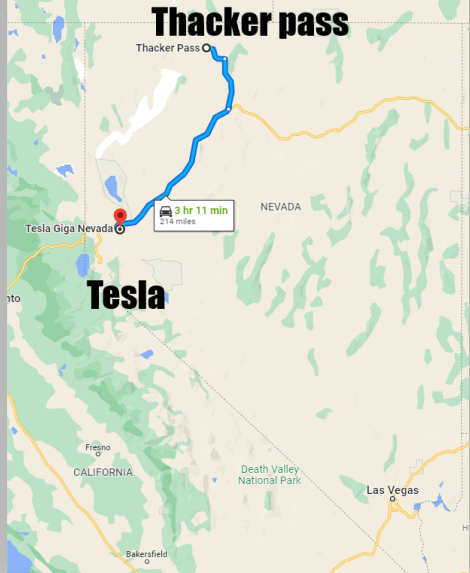

Thacker Pass & Tesla

Lithium Americas CEO Jonathan Evans has talked about how the company might split in two. In our opinion, it would make quite a bit of sense for Tesla to fund Thacker Pass, once the court case is wrapped up in Q3. Rather than reinvent the wheel you can read my LAC article for further details on Lithium Americas. Do note the distance is rather close for both companies and hence this lowers logistics costs.

Thacker Pass to TSLA Gigafactory (Google Maps)

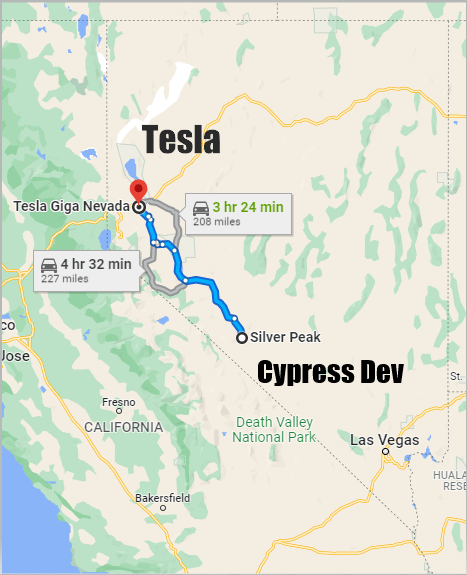

Cypress Development & Tesla

Cypress Development has a lithium project located in southern Nevada with fully secured water rights and no protestors unlike LAC. I view Cypress as a top contender. Factor in previous buyout rumors and either they get in bed with Tesla or maybe someone else. The take away is someone is going to pair up with Cypress given time. The overwhelming demand, constrained supply, prices blasting off, along with the Biden administration supporting lithium efforts all bode well. Let’s explore Cypress in a bit of deeper detail.

Cypress to TSLA Gigafactory (Google Maps)

Cypress Pilot Plant Results

Before we begin, realize the purpose of a pilot plant is to prove the science of the lab works at scale. While things might work in a 500ml beaker will they work when you are scaling to a ton or more? In our last article, we took a rather broad view of lithium supply and demand along with how this would impact Cypress Development (OTCQB:CYDVF). In this article we are going to get into the weeds a bit and glance at recent pilot plant results. We will also be studying the recent property acquisition and how this might impact operations and the total NPV (net present value) of the project.

The initial purpose of a pilot plant is to prove things work. Once you run the initial test and receive back the results you can start additional experiments or make tweaks to try to optimize the process to gain efficiencies. To try to push a pilot plant to make so called “battery grade” at these early stages makes no sense.

Sure, highly purified lithium is the desired end result, but you have to increase efficiency to maximize profit and thus shareholder value. It would make little sense to try to get to “battery grade” when the initial focus is efficiency of operations. The initial results of 83%-85% lithium extraction of clay is good. However, with time, Cypress could increase that to at least 85% or 90% plus.

A potential partner wants to see an efficient process rather than just concentrating some lithium and saying bingo slap me that money. No, this process will take time. Process efficiency will come and with time so will the so called “battery grade”.

Now looking at today’s favorable results we see the following:

1. Insignificant impurities. The remaining sodium and potassium are inconsequential to the final process.

2. Lithium extraction via ion exchange of 98%

3. Overall impurity removal of 99%+. Continued R&D on the process to optimize efficiency. Hence today’s pilot plant results verify the process works at pilot plant scale. Give it time and it will improve.

Cypress Secures Water Rights

Cypress Development announced that water rights are fully secure on 4/11/2022. This is a major de-risking announcement and bodes well for the company. If Cypress were to have lost the water rights this would have been a massive blow to the company which would have placed them in the category like most of Clayton Valley. No water = no production. Hence, like everyone else with no water you would be at the mercy of hoping that Albemarle buys you out. With water Albemarle can still buy you out potentially but at the same time you can take the project to production now as water gives you the ability to process lithium clay in Clayton Valley.

Cypress Development – Clay & Tailings

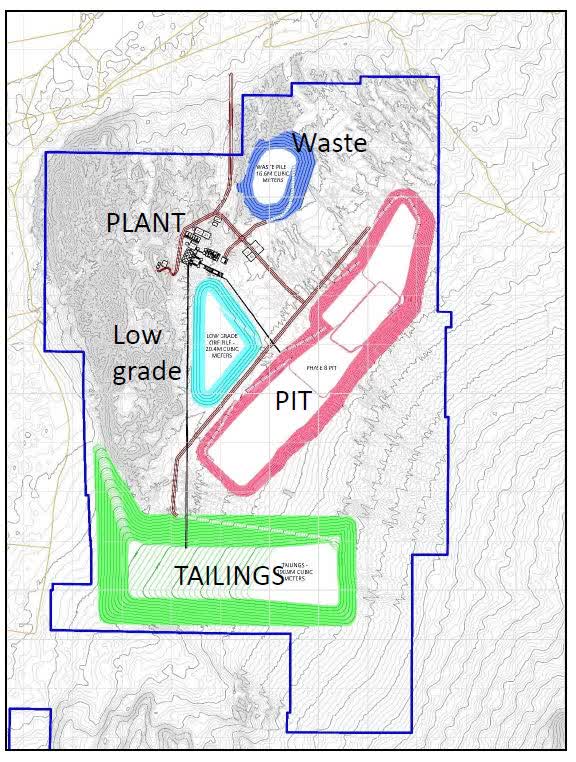

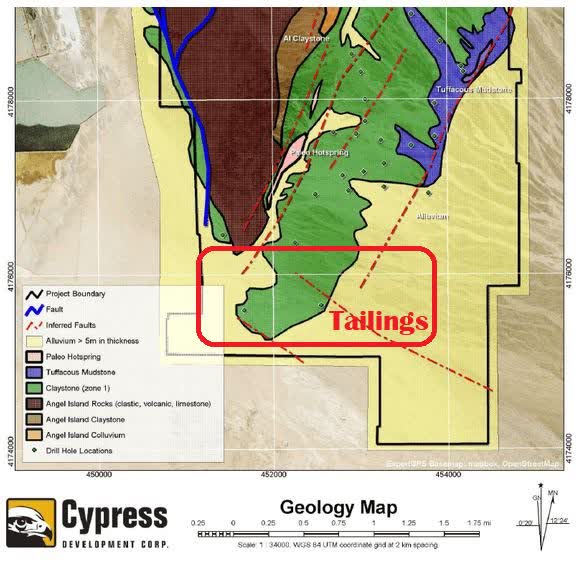

I have been wanting to see Cypress Development transfer its tailings plant to a less valuable location (as the present tailings plant is situated on top of valuable lithium). Note the location of the tailing plant then we can see in the below second graphic that a range of lithium rich clay (in green) extends into the proposed tailings planned area in the south west. Looking at the proposed tailings plant we can see this is on valuable land (per the 2nd below image) via the 43-103 technical report by Cypress Development.

Proposed tailings pit (Cypress Development 43-103)

Green Lithium Rich Clay & Tailings area (Cypress Development 43-103 Report)

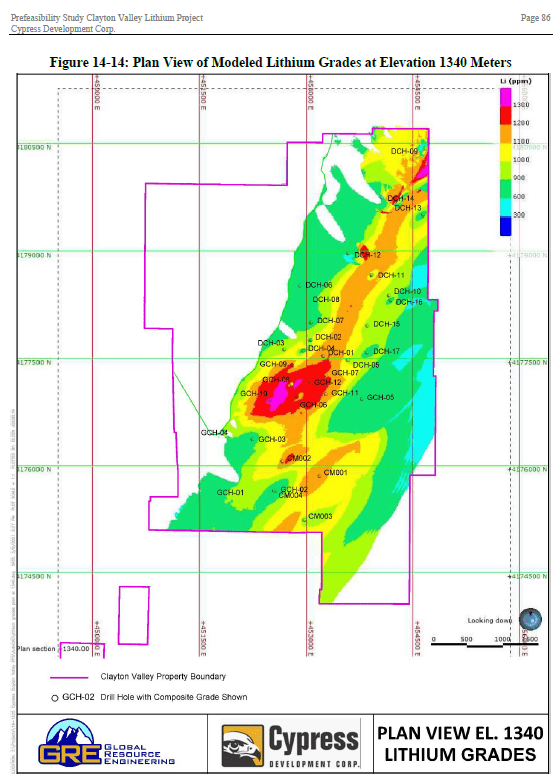

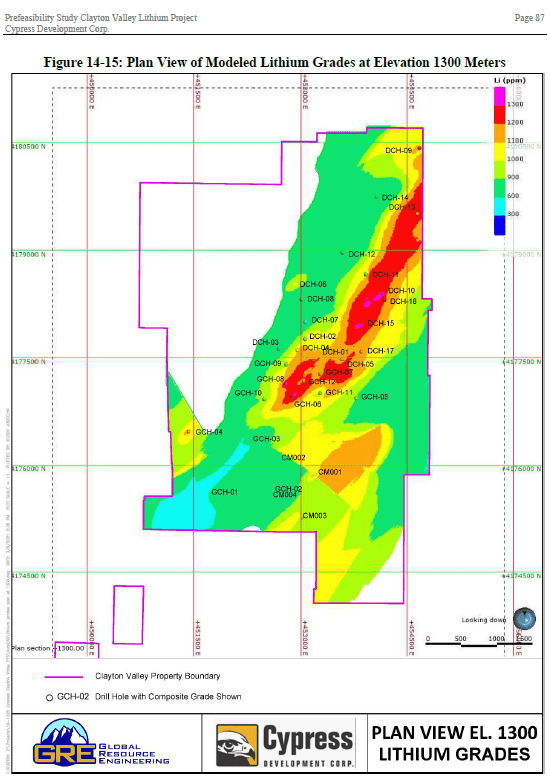

Looking at the map below we can see what the lithium is estimated to look like at various elevations.

Lithium at 1340 meters (Cypress Development 43-103)

Lithium at 1300 meters (Cypress Development 43-103)

Per the 43-103 on page 41, Cypress lists this clay as “This unit is 60 to 120 meters in thickness, and lithium content averages 1,060 ppm.” Of course this is just a surface view. More detailed cross section views exist in the 43-103 document. The takeaway is the tailings area, in a perfect world, could be moved IF Cypress could acquire some lithium poor soil elsewhere.

Cypress Expands – Land Acquisition

Cypress Development announced they are in the process of acquiring a small neighbor’s land. For Enertopia, 160-acres was too small to work on in Clayton Valley due to both their need for a tailings area and the fact that they lacked water rights. Then again, the intent of Enertopia was never to get the project to completion; rather it was to prove the ground was viable and then sell it. Of course, this is the goal of the majority of prospects in Clayton Valley, as only three holders of water rights exist: Albemarle, Cypress, and Scorpio Gold (OTCPK:SRCRF).

Enertopia 160-acres (Enertopia 43-103 Report)

The selling of this land is a win for Enertopia as it gives them capital to expand other projects or keep exploring for new properties to resell down the road. Note per the author’s below graphic, the red arrow points to the 160-acres that are pending a shareholder vote on April 29th. Hence, we should know shortly after the meeting if the deal goes though. In all likelihood it will pass.

Enertopia’s 160-acres to the east (Ameriwest 43-103 DME Project)

The acquisition of this property will allow Cypress Development to expand the lithium pit to the right some and will obviously expand the resource size / NPV. Speaking of the NPV, looking at the Enertopia 43-103 report:

|

The result of the mineral resource estimate returned approximately 82 million tonnes at a grade of 1121 ppm Li for the indicated mineral resource and 18 million tonnes at a grade of 1131 ppm Li for the inferred mineral resource, both at a cutoff grade of 400 ppm Li. The last assays at the bottoms of all 4 of the drill holes used in the model were greater than 1000 ppm Li, so there is room for expansion of the resource at depth. |

“Ridiculous” Lithium Prices Could Pressure More Acquisitions

Chinese auto makers have called recent lithium spikes in prices “ridiculous”. Has it risen a lot? Sure. Could it break 100k? Yeah sure, why not. All of this will put additional pressure on existing lithium producers like Albemarle (ALB) to speed up plants to expand lithium production. It might also compel CATL to keep searching for a lithium project to acquire after passing on Neo Lithium or being outbid by Lithium Americas (LAC) concerning Millennial Lithium.

Lithium Stampede!

What would other car producers do if Tesla were to open Pandora’s box and buy a lithium company? Would other car producers stand idly by if Tesla acquired or partnered with a lithium company? Could we see the dreaded lithium Stampede as car producers fight over the choice lithium cuts? Time is of the essence after all. Getting back on topic.

Cypress Upcoming Catalysts / Actions

Some potential catalysts are in the hopper concerning Cypress. These events might have an impact upon the stock.

1. Enertopia 160-acre land acquisition – April 29th or shortly afterward

2. Feasibility study – Time frame is unknown

3. Government Loans – Dependent upon the feasibility study completion

4. Company name change – Unknown but of minor importance

5. Pilot plant optimization – Continuous

6. TSX Uplifting – Dependent upon #2 being completed.

Risk

Risks would be a general contraction in the markets brought on by inflation and / or interest rates rising and hence causing the economy to contract.

Granted I do not see any extreme interest rate rises before the mid-term elections. Concerning Lithium Americas, it appears they will win the Thacker Pass case concerning rights that were granted to them. This case should be wrapped up in Q3 per the courts. I would place odds of success at 95%, but that is just my biased opinion and black swan events can and do happen. If they were to lose the case the impact on the stock would be very negative.

Conclusion

No one can say for certain that Tesla is going to buy a lithium company or work with its rumored 10,000 acres. Maybe they do both, but I stand in the corner of Benchmark Mineral Intelligence when they say that car makers need to secure supply (via acquiring lithium miners).

I’ve had people tell me that it makes more sense to just sign an off-take agreement (much like Lake Resources (OTCQB:LLKKF) has started with its MoU with Ford (F).

I would argue that if I were in the position of large automakers, I would want 100% vertical integration if possible. This is not 100% a matter of having cost advantage but rather it is 100% a guarantee that you have supply of a critical element because you own the mine and the entire process. Hence if any lurking problems are cropping up, you will be fully aware of it rather than relying on a 3rd party for supply.

Concerning today’s tweet, we are being offered a glimpse into the thoughts of Elon Musk. Do you think that other car makers will idly sit by and let Musk just stroll around taking his time to pick the cream of the crop? If I were a Volkswagen, you can bet I would have my guys poking around to secure deals now. Let’s say though that no car maker actually enters the lithium (and refining) market directly? So what; the lithium has to come from somewhere.

With prices of lithium at historic highs, a partnership or buyout will likely come to Cypress Development given time. Thacker Pass in all likelihood will break out into a public company and that would offer Tesla a cheaper option to pair up with them as opposed to wanting to digest all of LAC. Frankly digesting all of LAC might be difficult as the Chinese own 51% of the South American project and it raises political questions too. Far better to own 100% of a project and avoid any sticky lithium politics.

How We Are Playing It

Our strategy is rather simple. Purchase lithium stocks for a sector play via Lithium Americas and Cypress development. This gives us exposure to potential Elon Musk rumors and at the same time big picture lithium movements.

Other lithium contenders we are playing are: Nano One (OTCPK:NNOMF), Standard Lithium (SLI), HeliosX Lithium (OTCQB:HXLTF), Jindalee Resources (JRL.ASX), and Arena Minerals (OTCPK:AMRZF) among others. A bit off topic but we are playing Cobalt via Electra Battery Materials (OTCQX:ELBMF), which we may write on once again soon. Our long-term strategy is to just buy and hold 90% of our lithium assets. The remaining 10% is subject to covered calls being sold against it for short term revenue from unlikely to be called away options.

Disclaimer: This is not financial advice. Consult a broker for licensed advice. Do not make investment decisions based on one stranger’s biased opinions. Please take the time to research and make educated decisions.

Be the first to comment