peshkov/iStock via Getty Images

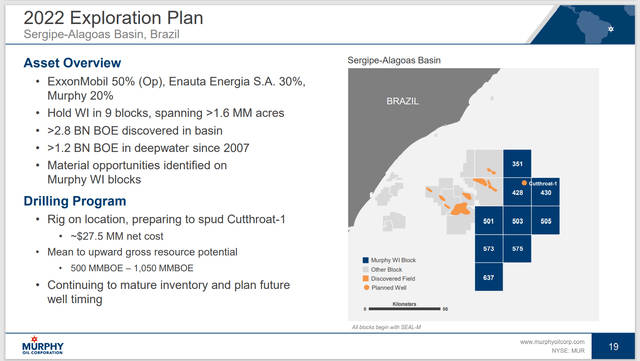

Murphy Oil (NYSE:MUR) attracted some attention with its year end announcement of generally upbeat results and a dividend increase. There was also some news of some significant production coming online in the Gulf Of Mexico. All of this is good news coming from a very solid performer. The added attraction of this potential investment is the partnership with Exxon Mobil (XOM) that is going elephant hunting off the coast of Brazil. That partnership has the potential to be a game changer for this company as it is a good deal smaller than Exxon Mobil and those offshore discoveries tend to be large projects.

Murphy Oil Presentation Of Partnership With Exxon Mobil Off The Coast Of Brazil (Murphy Oil Fourth Quarter 2021, Earnings Conference Call Slides)

Basically, these kinds of projects are looking for a whole lot of oil or natural gas. One commercial well does not justify a commercial platform and associating producing structure unless you are near a large project that you can piggyback.

The caveat of course is that the whole thing could be written off as a failure or that they find something that is not commercial to produce. The offshore coast of Brazil appears to be as prolific as several places in the Gulf of Mexico. So, this particular venture appears to have some decent odds.

The first well came up dry. That is not all that unusual. It could take a year or two to find reserves or decide these blocks are not worth the effort. Any kind of success will likely take years to get to production. But generally, that success means a lot of production growth in the future for a company the size of Murphy.

The other big caution is that the time from first oil to actual production is often 5 to 7 years. So even if there is a commercial find, it will take a while for the cash to begin rolling in. Any investor hoping for success in Brazil has to be patient.

There is always a risk that the stock price does not respond to a discovery because the benefits of that discovery are years away. With all the warnings shown above, a discovery could eventually make Murphy an acquisition candidate or allow growth at a rate that is clearly above the typical growth rate for a company the size of Murphy.

Current Prospects

Murphy not only has a long-term game changer prospect. But current operations are making decent advances as well. Therefore, the company has a way to show improvements each year until a major game-changing elephant has a material effect on results.

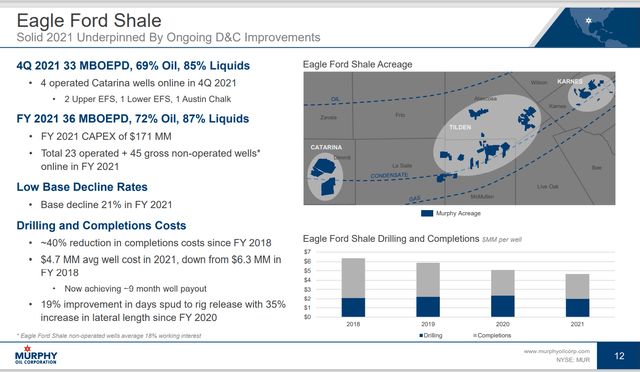

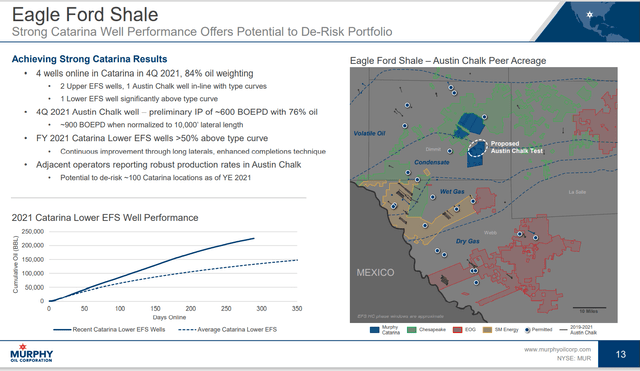

Murphy Oil Eagle Ford Key Well Performance Characteristics (Murphy Oil Fourth Quarter 2021, Earnings Conference Call Slides) Murphy Oil Eagle Ford Well Production History Curves (Murphy Oil Fourth Quarter 2021, Earnings Slide Presentation)

The company has some of the best Eagle Ford acreage in the business. Oftentimes this Eagle Ford acreage has production and pricing advantages over the competing Permian Basin acreage. The Eagle Ford production often receives premium pricing for the production whereas the Permian production often gets caught in bottleneck takeaway issues that result in selling price discounts. At this point in the recovery, there appears to be plenty of takeaway capacity in both basins.

However, both Exxon Mobil (XOM) and Chevron (CVX) plan decent production increases in their Permian acreage. It won’t take too many producers to follow that lead for another takeaway bottleneck to cause discounted prices in the Permian during the current industry recovery cycle.

As shown above, Murphy has decreased well costs and increased the production from the wells. Anytime a well produces 200,000 barrels of oil, that producer has an extremely profitable well. The best part is that usually Eagle Ford acreage costs far less than premium Permian acreage. So the location cost of each well is lower as well (on average).

At current prices, the Eagle Ford production is likely to increase during the current fiscal year. Many companies are reporting disciplined growth. But those same companies are reporting production growth due to improved technology while stating it was unexpected. Restraint in the industry is remarkably weak because it is in each company’s benefit to increase production even though the industry as a whole needs some discipline. This is the big reason why the cure for high prices is high prices.

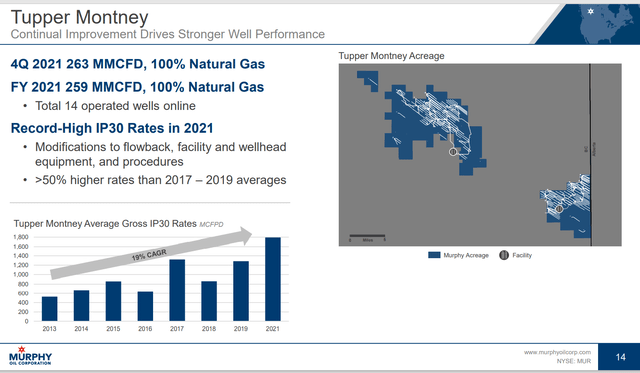

Murphy Oil Improvements To Tupper Montney Natural Gas Production (Murphy Oil Fourth Quarter 2021, Earnings Slide Presentation)

Murphy is one of many producers reporting a production advance in the form of much higher initial flow rates. This has made the Canadian dry gas production far more profitable than it has been in years. Improvements like this will likely reach other basins with mixed results. However, those mixed results still mean that the technology continues to improve so that production costs decrease. This makes the ability to export natural gas very important so that the North American market does not endure years of price decreases in the future as was the case in the past.

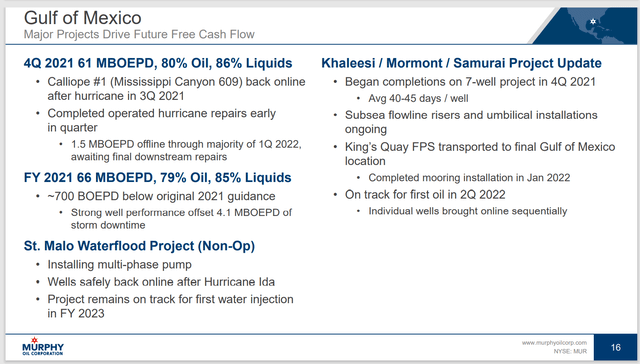

Murphy Oil Gulf Of Mexico Update (Murphy Oil Fourth Quarter 2021, Earnings Slide Presentation)

Out of all the current projects, the Gulf of Mexico is likely to be the source of a significant (and usually very profitable) production increase. Offshore wells tend to have large (and long-lived) production. Murphy is bringing quite a few offshore wells on production this fiscal year.

The current strong commodity pricing atmosphere will probably entice more than a few producers to “inch-up” the capital budget. That is likely to result in more production than was originally the case. Much of the industry, including Murphy, is anxious to repay some debt first. However, fiscal year 2023 is likely to find many companies far more optimistic about production increases than is the case this year.

Typically, an industry downturn begins when lenders who have little to no experience in the industry enter the market to provide some very optimistic takeovers or fund some projects with unrealistic long-term parameters. These lenders usually get the assets back in the next downturn due to bankruptcy or other financial events only to find they will be losing money. Right now, those lenders are nowhere close to investing money in this industry. Therefore, the industry is likely to have some years of decent commodity prices ahead. However, greed is a strong motivator. Sooner or later there will be that speculative money in the industry (which will be a sign that the next downturn is on the way and it’s time to take profits).

In the meantime, Murphy Oil offers investors some excellent current prospects while participating in a potential game-changing partnership with Exxon Mobil off the coast of Brazil. The company is a solid investment proposal for long term investors even without the Brazil partnership. Management keeps the company focused on some relatively cheap and highly profitable areas of the industry. As an upstream investment, this is one of the better deals in the industry.

Be the first to comment