SafakOguz/iStock via Getty Images

Whether it’s for the construction industry, for engaging in repairs, or something else, one guarantee is that many activities require a wide range of physical products in order to be completed successfully. Examples include copper tubing and fittings, plastic tubes, aluminum and brass forgings, and more. One company dedicated to providing these types of offerings is none other than Mueller Industries (NYSE:MLI). Recently, financial performance achieved by the company has been incredibly impressive. Given where shares are priced today, I can understand why investors would flock to the enterprise. Having said that, the picture is a little less certain than what it initially appears to be. With the firm’s fortunes tied heavily to commodity prices, and most of its recent performance driven by a surge in pricing as opposed to stronger demand, it’s not hard to imagine a reversal of fortunes pushing revenue and profits down materially. If pricing does remain elevated for a long enough period of time, the amount of value the company could create between now and then could be significant enough to make it a worthwhile investment. But only investors who don’t mind significant amounts of uncertainty that are created by forces outside the firm’s own control should view this as a great prospect.

A multi-faceted business

As I mentioned already, Mueller Industries has its hands in a lot of things, such as the creation and sale of copper tubes and fittings, plastic tubes, aluminum and brass forgings, and more. Its portfolio of offerings is rather extensive, extending to compressed gas valves, aluminum impact extrusions, malleable iron fittings, faucets, plumbing specialty products, and so on. To best understand the company though, we should dig into each of its different segments. First and foremost, we have the Piping Systems segment. This unit is composed of the company’s Domestic Piping Systems Group, Great Lakes Copper, Pexcor Manufacturing Company, And a variety of other subsidiaries. Each one has its own area of concentration. For instance, under the Domestic Piping Systems Group, the company provides copper tubes, fittings, line sets, and more, while under the Great Lakes Copper unit, it produces copper tube and line sets that it sells in Canada. During the company’s 2021 fiscal year, this segment accounted for 68.4% of the firm’s revenue and for 74% of its profits.

The next segment to pay attention to is the Industrial Metals segment. Through this, the company operates a number of subsidiaries like Brass Rod, Impacts & Micro Gauge, and Brass Value-Added Products. Just like the other segment, this one sells a variety of offerings, including brass rods and other shapes, code form aluminum and copper products for the automotive, industrial, and recreational components categories, and brass and aluminum forgings and similar offerings. Last year, this segment accounted for 18.5% to the company’s revenue and for 13% of its profits. And finally, we have the Climate segment. This unit is responsible for controlling the Refrigeration Products, Westermeyer Industries, Turbotec Products, Flex Duct, and Linesets Subsidiaries of the company, selling a variety of items like protection devices and brass fittings for the HVAC market, and accessories for both the air conditioning and refrigeration spaces. Last year, this segment was responsible for 13.1% of the company’s revenue and for 13% of its profits.

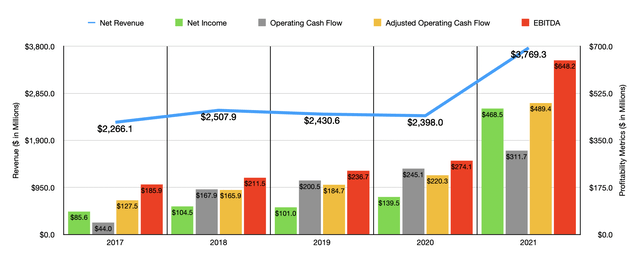

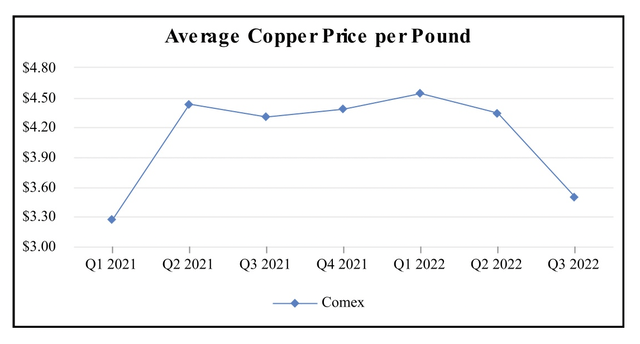

Over the past few years, Mueller Industries has experienced a great deal of volatility. Between 2017 and 2020, sales bounced around with no clear trend, with a low point of $2.27 billion and a high point of $2.51 billion. Then, in 2021, revenue skyrocketed to $3.77 billion. Fortunately, management has been very clear as to what the cause of this increase was. Although the company benefited to the tune of 6.4% from unit sales volumes rising and core product lines and 8.6% from acquisitions, most of the growth came from net selling price increases in its core product lines. Growth from that amounted to 37% year over year, or roughly $886.5 million. As I alluded to already, commodity prices have a significant role to play in the success of Mueller Industries. And in the 2021 fiscal year, we saw the price of copper average $4.24 per pound. That compared to the $2.80 per pound experienced in 2020.

Although the trend for revenue has been a bit volatile, the same cannot be said of profitability. Between 2017 and 2020, net income of the company rose almost every year, climbing from $85.6 million to $139.5 million. Then, in 2021, profits shot up to $468.5 million thanks to the surge in revenue and management’s ability to push on certain costs to its customers. Other profitability metrics largely followed suit. Over the past five years, operating cash flow went from $44 million to $311.7 million. If we adjust for changes in working capital, it would have risen from $127.5 million to $489.4 million. Meanwhile, EBITDA generated by the firm also rose nicely, climbing from $185.9 million to $648.2 million.

Author – SEC EDGAR Data Author – SEC EDGAR Data

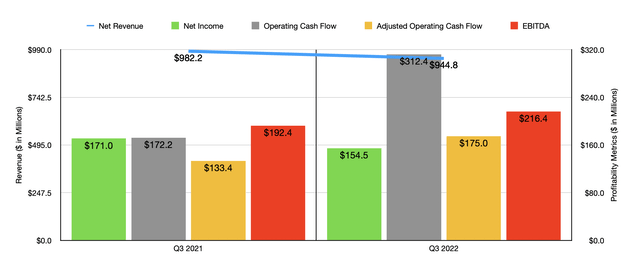

So far, the 2022 fiscal year is also looking up for the company. Revenue of $3.11 billion beat out the $2.81 billion reported the same time last year. This came even as financial results in the third quarter of 2022 showed signs of weakening. Revenue of $944.8 million came in lower than the $982.2 million reported in the third quarter of 2021. This decrease was driven by two key factors. One was a 2.1% hit caused by asset sales. But the larger was a 9.5% decline experienced by lower unit volumes in core product lines. The company also saw pricing weaken as well, dropping total sales by 0.4% year over year. On the pricing side, it is worth noting that copper has already seen a rather significant decline. During the third quarter of this year, for instance, copper pricing had fallen back under $3.60 per pound.

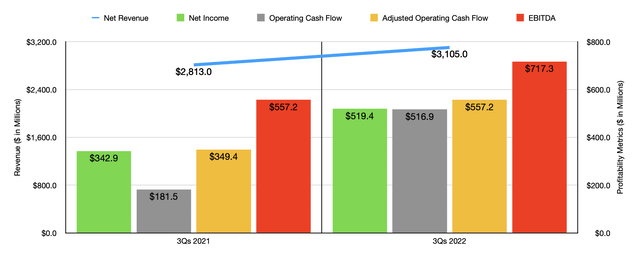

As can be expected, bottom line results so far this year have also been volatile. For the first three quarters of 2022 as a whole, net income of $519.4 million dwarfed the $342.9 million reported the same time last year. Operating cash flow rose from $181.5 million to $516.9 million, while the adjusted figure for this jumped from $349.4 million to $557.2 million. Even EBITDA improved, rising from $466.3 million to $717.3 million. With the exception of net income, which fell from $171 million to $154.5 million in the third quarter of this year, bottom line results have also been positive in the latest quarter. This shows some resiliency even in the face of declining pricing. And investors should view that in a favorable light.

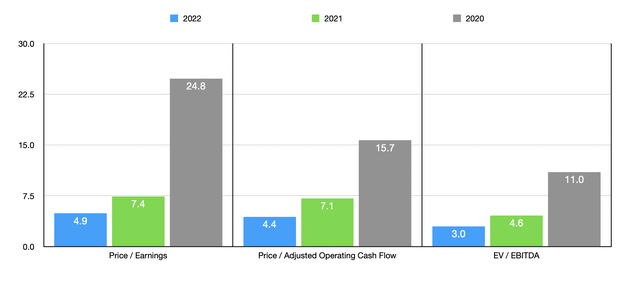

Unfortunately, this does not mean that we know what to expect moving forward. In the event that the economy truly is going to suffer, it wouldn’t be a surprise for certain commodity prices to plunge. If we simply annualize results experienced so far for 2022, we should anticipate net income of $709.6 million, adjusted operating cash flow of $780.5 million, and EBITDA of $997.1 million. This would give us a price-to-earnings multiple for the company of 4.9, a price to adjusted operating cash flow multiple of 4.4, and an EV to EBITDA multiple of 3. But given the uncertainty facing the economy, we would be wise to price the company based on data from prior years. In the chart above, you can see this for both the 2020 and 2021 fiscal years. I would argue that shares still look cheap using the data from 2021. But given the nature of the firm, I would argue that data from the 2020 fiscal year would translate it to being closer to fair value.

As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 14.6 to a high of 36. And using the EV to EBITDA approach, the range was between 9.4 and 22.1. In both cases, one of the five companies was cheaper than our prospect. Meanwhile, using the price to operating cash flow approach, the range was between 16.6 and 126.5. In this scenario, Mueller Industries was the cheapest of the group.

Takeaway

What data we have available today suggests to me that Mueller Industries is incredibly attractive from a purely valuation perspective. Having said that, we are seeing copper prices fall and it’s likely that other commodity prices will decline as well if economic conditions worsen. Those who believe that economic concerns are being overblown might see this as a great opportunity to buy into the stock. The same could be said of those who suspect that prices will still remain high enough to generate attractive returns for the company for a long enough period of time so as to create permanent value in the form of net cash inflows. But for anybody else, I do think a more neutral stance is warranted at this time.

Be the first to comment