Editor’s note: Seeking Alpha is proud to welcome GS Investing as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

filadendron/E+ via Getty Images

Description

I believe MTY Food Group (TSX:MTY:CA) is worth $86.26, representing 42% upside from the date of writing (Sep 19, 2022) this article. I believe this opportunity exists as the market does not appreciate MTY’s ability to continue its acquisition strategy, but focuses on its history of poor organic growth, which I expect to turn for the better under the guidance of its new CEO. In my view, the market should reflect MTY’s true value as long as it continues to show that it can repeat its strategy and turn around dying brands to improve organic growth.

Company overview

MTY is a Canadian-American-International restaurant company that franchises and operates around 80 different brands of fast food, fast casual, and casual dining restaurants across Canada, the United States, and internationally. The company has 2,595 Canadian locations, 3,599 American locations, and 466 international locations as of 2Q22. MTY makes revenue in primarily from three ways:

- Revenue for franchises comes primarily from royalties, franchise fees, rent, supplier contributions, etc.

- Revenue from corporate-owned stores

- Revenues from food processing operations. Plants owned by MTY produce a wide variety of goods, from raw materials used in the food industry to finished goods for sale in grocery stores. The plants’ primary source of revenue comes from sales to wholesalers, retailers, and franchisees.

Management has been great capital allocators

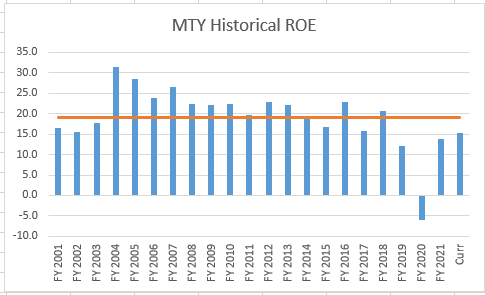

Management has a proven track record of increasing earnings at high rates. Over the last two decades, EPS has increased from CAD0.05 to CAD3.61 primarily through acquisitions, with an average ROE of 19%. This is a remarkable achievement because it demonstrates that management has been astute in identifying acquisition targets only when they are value accretive.

Author’s estimates, MTY historicals

True, the focus on disciplined acquisitions and efficient operations is the underlying reason for this successful track record. Management waits for an asset to be attractively priced, which is usually more mature assets that are perceived as “less attractive” and “low growth.” But this fits right into MTY’s growth strategy, as it seeks to acquire targets with high visibility of sales and profitability, targets that can be easily modeled to determine how much synergies can be extracted if the brand is brought under the MTY umbrella of brands. Because the targets are typically mature, they trade at lower multiples.

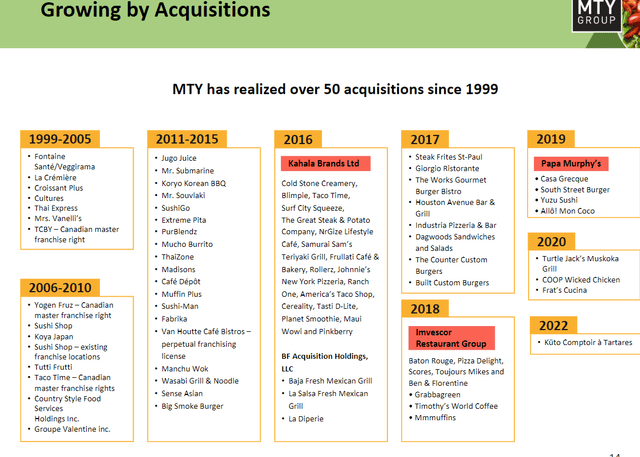

What follows is the standard process of acquiring a less efficient brand, eliminating unnecessary operations, and increasing scale to improve efficiency. Cost savings are typically realized through scaled procurement, lower rent (MTY has greater customer bargaining power), the closure of ineffective HQ offices, and shared back-office services (i.e., customer service). This formula is not new; it has been used numerous times in the quick-service restaurant [QSR] industry and by private equity firms. That being said, knowing it and doing it are two entirely different things. As management has repeated this exercise numerous times, they have become very experienced acquirers in this space (purchasing assets as well as integrating them within their system). In order to give a sense of how many times have management executed this strategy, MTY has conducted >50 acquisitions over the past 2 decades. That is at least 2 acquisitions every year.

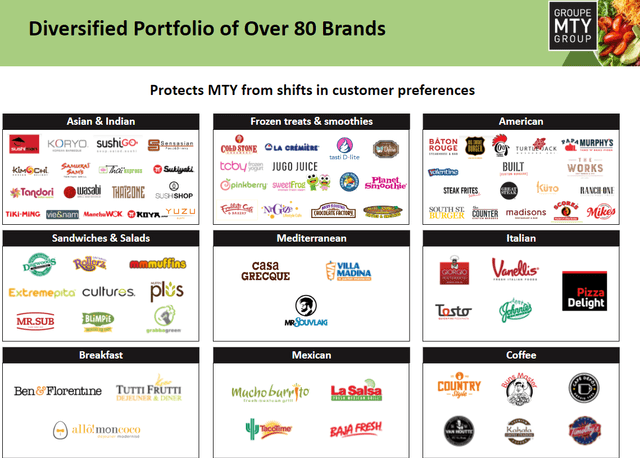

MTY July’22 investor’s presentation

Readers should be aware by now that MTY specializes in acquiring more mature restaurant brands at reasonable prices. Because of the nature of this strategy, the acquired brands are slow growers and trade at a much lower multiple than fast growing brands like Chipotle Mexican Grill (CMG), Shake Shack (SHAK), Domino’s Pizza (DPZ), Wingstop (WING) and other higher valued restaurant brands.

It appears to be a bad strategy – why buy a brand that isn’t growing as quickly? I believe this is a major reason why MTY is undervalued, as the market is unaware of the benefits of this strategy. I believe there are three major advantages.

- Significant bargaining power: Because the targeted brands are not growing as quickly, they are not in high demand. MTY is probably the only one fishing in that pond of fish, which gives it a lot of negotiating power (the ability to buy at low valuation).

- Predictability: This is arguably the most important factor in acquisition because it allows management to conduct extensive due diligence on historical data to identify potential future synergies and risks.

- Brand survivability: It is well known that brands (not just in QSR) face their most difficult climb (to survive) during their initial phase of launch. There is an entire graveyard of brands that died as a result of competition, poor execution, a lack of funding, and so on. Hence, buying a mature brand would reduce such risks.

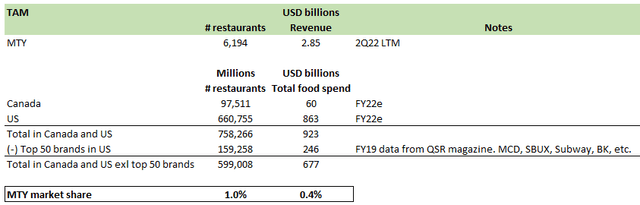

Given that MTY grows through acquisitions, one might wonder how much more MTY could buy. The answer is quite extensive. This TAM can be quantified in two ways.

- First, there are a total of 758,266 commercial food service units in Canada and fast-food outlets in the US, of which I assumed the top 50 brands such as McDonald’s (MCD), Starbucks (SBUX), Burger King (QSR), Subway, and others are not for sale because they are much larger than MTY. After removing the top 50 brands, there will be about 600,000 stores available for acquisition. MTY had 6,194 customers as of 2Q22, representing 1% of the market. This clearly suggests that MTY has a lot of opportunities to keep buying companies and growing.

- The second method is to size the dollar TAM. After deducting sales from the top 50 brands in the United States, total commercial foodservice sales in Canada and restaurant industry sales in the United States are approximately $680 billion. When you look at TAM from this angle, it looks like MTY has an even smaller share of the market, which means that MTY has a lot of chances to keep acquiring.

Author’s estimates, QSR magazine, MTY filings

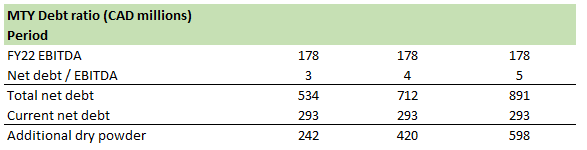

The next question is how much dry powder MTY has to keep acquiring companies. The answer is yes. Using the consensus FY22 EBITDA figure of CAD178 million and assuming various levels of net debt to EBITDA ratio, we can see that MTY can easily borrow an additional CAD200 to CAD400 million without exceeding 5 times net debt to EBITDA.

Author’s estimates

New CEO focuses on organic growth to supplement growth from acquisitions

MTY’s organic growth has historically been slow (commentaries can be found in quarterly earnings calls). This is not surprising given that MTY acquires mature brands, which is consistent with its growth strategy. Management’s strategy for creating shareholder value is to allocate capital to acquisitions as well as, as previously stated, a disciplined approach to cost and operational efficiency to extract post-acquisition synergies. The results of this strategy can be seen in the growth of EPS and ROE, but not in the organic growth of revenue.

Things began to change in 2018 with the arrival of the new CEO, Eric. By focusing on organic growth, which had been showing signs of success until the pandemic, Eric made significant changes to MTY’s growth strategies. One significant change implemented by Eric is that management compensation is now tied to EBITDA organic growth. This is a significant change because it immediately aligns MTY with organic growth. The immediate impact of this change was a portfolio refresh to identify dying brands and figure out how to revitalize them. Digital tools, for example, have been installed to improve data collection and analysis, and CRM tools have been implemented to better serve customers and increase loyalty. One key indicator of the impact of digitization is the percentage of digital sales as a percentage of total sales, which has increased from nearly non-existent to 17% in Canada and 22.5% in the United States as of 2Q22. The importance of digital sales was highlighted during the pandemic, when delivery orders skyrocketed; it would have been a disaster if Eric had not recognized the importance of digital channels. As a result, I believe Eric has been making sound decisions, and it is only a matter of time before we see organic growth begin to improve.

Diversified brand model reduces business risk

In the United States (where MTY has the most opportunity), the majority of the largest restaurant operators follow a single brand strategy. This strategy makes sense as it allows the operator to reap synergies in the form of branding and marketing. However, if the brand is associated with a specific consumer preference (e.g., MCD = Burgers, DPZ = Pizzas, SBUX = Coffee, etc.), it will be difficult to change that association, especially if consumer preferences change. MTY utilizes the inverse of this strategy by acquiring a diverse pool of brands. While MTY does not have the same synergies as single-brand operators, this is alright because the acquired brands have already matured, implying a strong brand and reputation in the market. In short, this strategy is less vulnerable to changes in consumer trends.

MTY Jul’22 Investors presentation

Nature of industry and acquisition strategy cushions impacts from economic downturns

Over the last two decades, revenues have fallen only three times: in FY01, FY02, and FY20 (due to the pandemic), while earnings per share have fallen only once. Being a restaurant franchisor is an appealing business opportunity due to the low average amount of capital required for expansion as individual franchisees bear the majority of the costs. Another reason why MTY is recession-resistant in nature is because of its relatively cheaper meals than high-end restaurants, usually around $15.

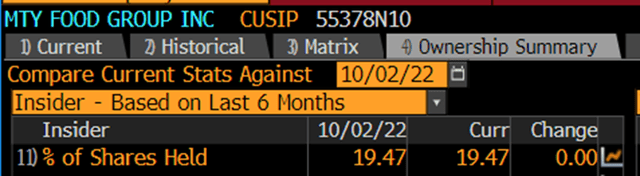

Management owns significant number of shares

Management owns 19.47% of the total shares outstanding based on Bloomberg’s data on October 2, 2022. This is a strong indicator that management’s interest is in line with shareholders. Of the 19.47%, Stanley Ma (President of MTY) holds the greatest number of shares (16.41%).

Valuation

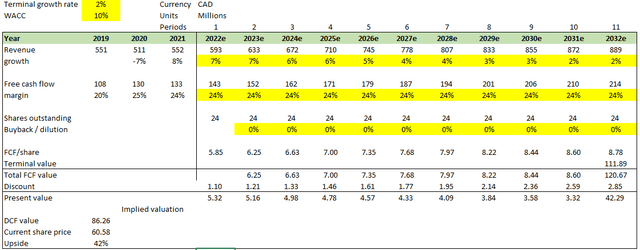

I believe MTY is worth CAD86.26 representing 42% upside from the date of writing this article. This value is derived from my DCF model based on the following assumptions:

- Revenue growth to slowly decline to 2% (long-term inflation rate), supported by both organic growth and acquisitions through the years. I did not model growth from acquisitions separately as it would give false precision

- FCF margins to remain flat throughout the years given that it has been the case historically

- No dilution in shares as acquisitions moving forward are mainly funded through operating cash flow or debt

- Terminal growth rate of 2% (long-term inflation rate)

- Discount rate of 10%. This is a debatable figure for investors, but personally I require a 10% return per year, especially since the S&P earnings yield is 7% as of the date of writing.

It is worth noting that MTY has a pending acquisition of BBQ Holdings, which was announced on August 9, 2022 and is expected to be completed by the end of 2022. BBQ Holdings is expected to generate $725 million in system wide sales in 2022 (approximately 26% of MTY’s LTM2Q22 system sales), implying that the revenue contribution to MTY could be significant in the future. I did not include this in my model because the transaction has not yet been completed; however, any profits from MTY should improve my expected upside.

Key risks

Acquisition risk

While management has proven to be excellent acquirers in this space, all acquisitions carry some risk, particularly when it comes to integration. Managing 80 brands and 200 brands are two entirely different things that greatly increase the complexity of efficiently managing resources. Also, while the TAM is massive, and I am sure there are numerous opportunities, management may be overconfident in their ability to reap synergies, resulting in overpayment.

Macroeconomic challenges

Labor shortages and supply-chain disruptions are expected to persist in the near term, and if they do, it could have a significant impact on MTY given the company’s lack of organic growth. If MTY is unable to acquire brands in the near term, growth may fall back to negative levels, which would be detrimental to the stock price.

Summary

MTY is undervalued at its current share price as of date of writing. The company is led by a fine management team that has demonstrated a strong track record of growing the business via its acquisition strategy, and has included an additional element – organic growth – to the equation, supported by performance incentives to align the organization. To top it up, management holds significant number of shares in MTY which aligns their interest with shareholders.

Be the first to comment