M. Suhail/iStock Editorial via Getty Images

Shares of M&T Bank (NYSE:MTB) have been a very strong performer over the past year, bucking the weakness seen across most bank stocks. Its history as a strong credit underwriter has helped insulate it from some of the concerns around recession. However, in Q3, the bank did see some deposit attrition, which reduced interest-earning assets, sending shares down 5%. While M&T is a great operator, shares have a premium multiple to peers, and I would hesitate to buy on the dip yet.

In the company’s third quarter, earnings were $3.53, down about 4.5% from last year’s $3.69. This was a significant sequential increase from Q2’s $1.08. All of these figures though are impacted by one-time integration expenses, following the acquisition of People’s United Financial in April with a $0.22 impact just this quarter. As these should be one-time, excluding them provides a more accurate picture of the bank’s performance. Doing so, Q2 earnings rose 2% from last year’s $3.76 to $3.83. However, this was $0.43 below consensus estimates. The bank did still earn a solid return on assets of 1.44% and return on common equity of 17.89%.

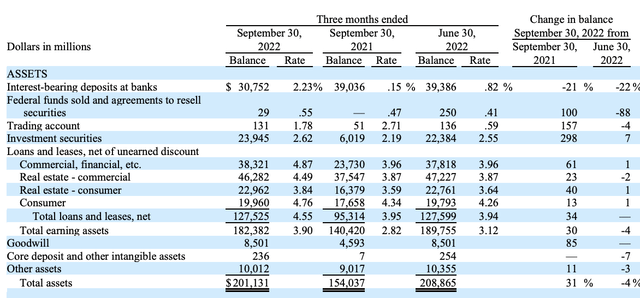

Now, a primary reason to own bank stocks during a Federal Reserve hiking cycle is that their interest margins should increase alongside higher rates. M&T delivered on this. Its net interest margin rose from 3.01% last quarter to 3.68% this quarter. That is also up 94bp from a year ago as MTB’s loan book benefits strongly from higher rates. The rate on its interest earning assets rose from 3.12% last quarter to 3.90% while the rate it paid out on deposits rose from 0.12% to 0.31%.

While I am happy at the rate performance on its assets and limited increase in deposit costs, there are several details to note. M&T had been spending down cash to buy securities over the past two quarters. Its securities holdings rose 7% from last quarter and 300% from last year (partly due to the Peoples acquisition). As these securities tend to have a fixed vs floating rate, this will reduce the bank’s interest rate sensitivity somewhat going forward.

Where M&T sees the most rate upside is on its loan book, with yields up 61bp in the quarter to 4.55%. However, average loans were flat QoQ at $127.5 billion. During a time when other banks are generating ongoing loan growth, the lack of growth at M&T stands out—in a bad way. Growing assets at a time of higher margins is what can lead to really strong net interest growth. I suspect a driving force of this subpar performance is that the bank’s deposits were down 4% sequentially to $164 billion.

With banks only raising rates a fraction as much as the Fed raises rates, there is likely to be some deposit flight, but this was a larger than anticipated declined. Shrinking deposits force a bank to reduce assets unless it increases funding from elsewhere, which is generally more expensive, and as such, M&T’s total assets were down $6 billion sequentially. This asset decline offsets some of the benefit of higher rates. For comparison, Truist (TFC) reported a 0.9% decline in deposits yesterday.

Now, there could be some merger-related noise to these results, or M&T could be reaching saturation point in some markets. Following its acquisition of People’s United in April, M&T Bank now has the second most branches in the Northeast behind only Bank of America (BAC) with lading operations in Buffalo and Rochester NY, Bridgeport CT, and Baltimore MD. In my view, its Northeast exposure is not ideal as population dynamics favor the Sunbelt. This quarter is a warning sign that M&T may need to start paying more to retain deposits, thereby reducing margins, or else face further attrition.

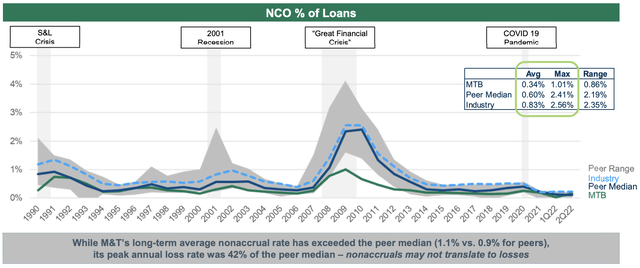

While net interest income is supposed to be a strength, it has become a question mark for M&T. Noninterest income fell less than 2% QoQ as mortgage banking revenues held flat (though they are still down nearly 50% from last year)—this was a bit better than peers. Notably, the credit concerns that have hit the sector continue to be a beacon of strength for M&T. It only took a $115 million provision for credit losses, which was up from $60 million in Q2 (excluding merger-related provisioning to standardize People’s loan loss policies with M&T’s). The bank had $63 million of charge-offs for a $52 million build. These are extremely low figures for a bank of M&T’s size and are supported by the fact nonaccrual loans declined from $2.63 billion last quarter to $2.43 billion this quarter. Just $477 million of these are more than 90 days past due.

Its allowance for credit losses is currently $1.88 billion which appears sufficient as not all nonaccruals default, and there is generally some recovery on defaults. As you can see below, MTB has historically experienced much lower losses than other banks. During periods of credit stress, its conservative underwriting saves shareholders from losses.

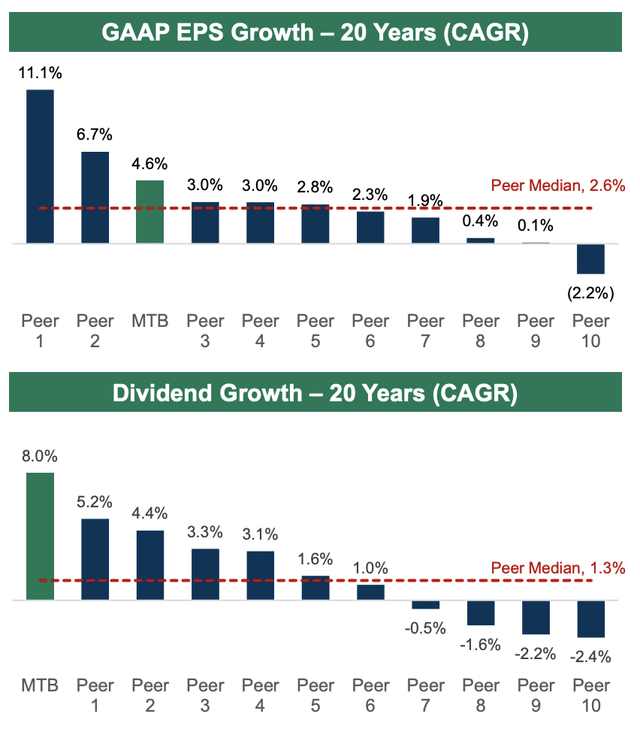

This strong credit performance and its ability to weather the financial crisis relatively well has led to strong long-term income and dividend growth, far outpacing the regional bank peer group. This strong operating history is a reason why M&T has been able to command a premium multiple. It is on track to earn at least $13 this year, so even with shares down to about $178, it has about a 13.6x multiple while many banks are trading below 10x earnings.

Now, if we experience a recession and have a significant default cycle, I expect M&T Bank to outperform peers as it likely will face lower losses. It also has a strong balance sheet with a CET1 capital ratio of 10.7%. This enables management to pay out all earnings to shareholders. During the quarter, it bought back $600 million of stock and has a $3 billion authorization. It also offers a 2.5% dividend yield. I would continue to expect $450-650 million in quarterly buybacks.

While M&T has less credit downside, this quarter makes me more concerned it has less interest rate upside. With credit quality holding in fairly well across banks that have reported earnings, interest rate sensitivity is the attribute I am most focused on, and M&T is coming up short. Trading at a premium to peers despite a less-than-ideal geographic footprint also provides little room for error.

Given its conservative nature, some premium multiple can be justified, and at 12x earnings, shares would be about $156, representing a further 10% downside from its post-earnings fall. As such, I would not buy this dip and would rotate holdings into Truist or JPMorgan (JPM), which both reported better quarters, or a company like Capital One (COF), which has yet to report but has a more attractive valuation.

Be the first to comment