LPETTET/E+ via Getty Images

Whether we like to admit it or not, we live in a dangerous world. Fortunately, technology has made it possible to make the world a little bit safer. One company dedicated to producing and selling safety-oriented products in an effort to do well by doing good is MSA Safety (NYSE:MSA). In recent years, the enterprise has seen a generally positive trend from a financial perspective. Long term, I have no doubt that the business will continue to perform well for shareholders. Ultimately, this will create value for its investors and other stakeholders. But this does not mean that the company makes sense to buy into at this moment. All things considered, I would argue that shares are more or less fairly valued, leading me to rate the enterprise a solid ‘hold’ at this time.

Safety as a business

According to the management team at MSA Safety, the company operates as a global leader in the development, manufacturing, and supply of safety products. However, just leaving the description there leaves investors wondering precisely what the enterprise makes available for its customers. A deeper dive is definitely warranted. Under the core products category of offerings, MSA Safety produces a wide array of offerings centered around personal and facility safety. The first example would be its breathing apparatus products, with the primary example being the company’s SCBA (self-contained breathing apparatus). This device is used by first responders, petrochemical plant workers, and other individuals who are entering an environment that’s deemed immediately dangerous to life and health. If you have ever seen a firefighter with a face mask on as they rushed into a burning building, that is precisely what we are dealing with.

Another type of product that the company produces is referred to as a fixed gas and flame detection instrument. These types of offerings are used in oil, gas, petrochemical, wastewater, HVAC, and general industrial production facilities in order to detect the presence or absence of various gases in the air. The company can get rather advanced with these offerings, partially as a result of its 2019 acquisition of Sierra Monitor Corporation, a provider of fixed gas and flame detection instruments and industrial IoT (Internet of Things) solutions that connect and help protect high-value infrastructure assets. The company also produces industrial head protection gear, firefighter helmets and protective apparel, fall protection equipment like harnesses, lanyards, self-retracting lifelines, and more. Another offering that the company announced in late 2021 is MSA+. This is a new safety solutions platform that integrates safety hardware technology, cloud software solutions, and safety services. Using a prescription pricing model, the company will provide access to its solutions and facilitate the digital transformation of safety programs for its customers. All combined, these core products accounted for 89% of the company’s revenue in 2021. We also have non-core products. Examples here include air-purifying respirators, eye and face protection equipment, ballistic helmets, and gas masks. Collectively, these products make up around 11% of the company’s revenue.

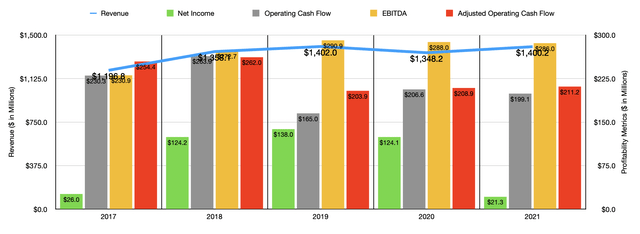

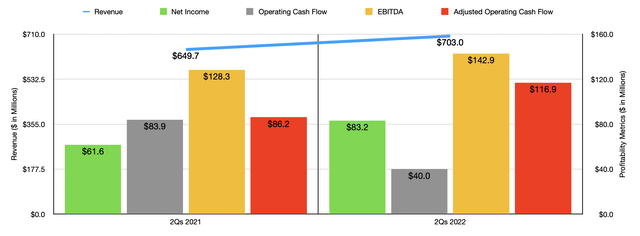

For the most part, the financial picture for MSA Safety has looked fairly sound. Between 2017 and 2019, revenue rose year after year, climbing from $1.20 billion to $1.40 billion. In 2020, the COVID-19 pandemic pushed revenue down slightly to $1.35 billion. But that decline was short-lived, with revenue rebounding to $1.40 billion in 2021. The company has continued its long-term growth so far this year, with sales in the first half of 2022 totaling $703 million. This represents an increase of 8.2% over the $649.7 million generated the same time one year earlier. Actual organic growth for the company year over year on a constant currency basis was 5.7%. Acquisitions helped to the tune of 5.1%. However, foreign currency translation negatively affected revenue by 2.6%. From the organic side of the equation, the company saw strength across most of its core products, but it also saw some weakness in protection and firefighter helmets and protective apparel.

On the bottom line, the picture for the company has been a little more volatile. Take net income as an example. Between 2017 and 2019, profits for the business rose from $26 million to $138 million. Profits then dipped slightly to $124.1 million in 2020 before dropping significantly to $21.3 million last year. Operating cash flow has been even more volatile, going from $230.3 million in 2017 to $263.9 million in 2018. In 2019, it dropped to $165 million before popping up slightly to $206.6 million in 2020. And then, in 2021, it came in at $199.1 million. If we adjust for changes in working capital, the picture looks more stable. After rising from $254.4 million in 2017 to $262 million in 2018, the metric then dropped to $203.9 million in 2019. After that, it rose consistently, hitting $211.2 million in 2021. Even more stable has been EBITDA, with the metric rising between 2017 and 2019, climbing from $230.9 million to $290.9 million. In 2020, it totaled $288 million, while in 2021 it dipped slightly to $286 million.

So far, the 2022 fiscal year has been particularly appealing from a profitability perspective. Net income in the first half, for instance, totaled $83.2 million. That compares favorably to the $61.6 million January did the same time just one year earlier. Operating cash flow did decline, dropping from $83.9 million to $40 million. But if we adjust for changes in working capital, it would have risen from $86.2 million to $116.9 million. And finally, EBITDA for the business rose nicely, going from $128.3 million to $142.9 million over the same window of time.

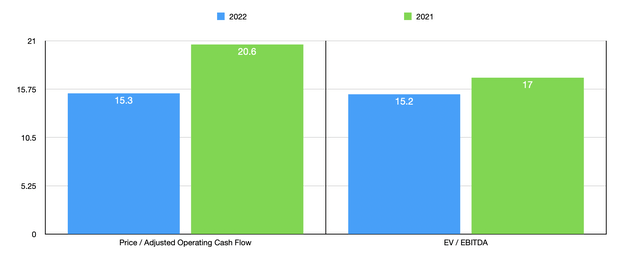

When it comes to the 2022 fiscal year as a whole, management has not really provided any detailed guidance. But if we were to annualize results seen so far this year, then we should expect adjusted operating cash flow of $284.4 million and EBITDA of $318.5 million. Based on these figures, the company would be trading at a forward price to adjusted operating cash flow multiple of 15.3 and at an EV to EBITDA multiple of 15.2. These numbers compare favorably to the 20.6 and 17 readings that we get, respectively, compared to the 2021 fiscal year data. As part of my analysis, I also compared the company to five firms that are of the same sector that MSA Safety operates in and that are of a similar size. On a price to operating cash flow basis, these companies ranged from a low of 4.3 to a high of 149. Two of the five were cheaper than MSA Safety. When it comes to the EV to EBITDA approach, the range was from 6 to 12.7. In this scenario, our prospect was the most expensive of the group.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| MSA Safety Incorporated | 15.3 | 15.2 |

| MillerKnoll (MLKN) | 149.0 | 12.7 |

| HNI Corp. (HNI) | 17.3 | 8.3 |

| Steelcase (SCS) | N/A | 10.0 |

| Interface (TILE) | 14.2 | 6.0 |

| ACCO Brands (ACCO) | 4.3 | 6.0 |

Takeaway

The data shown right now suggests to me that MSA Safety is a fairly solid company that continues to grow over the long haul. I was particularly surprised with how well the enterprise held up during the COVID-19 pandemic. But of course, safety is something that always needs to be addressed no matter what else is going on in the economy. This could make the company a solid prospect for those worried about current market conditions. But given how shares are priced, I don’t believe that it offers a large amount of upside relative to what the broader market should achieve.

Be the first to comment