Tempura/E+ via Getty Images

MSA’s Growth Prospect Will Reign

MSA Safety Incorporated (NYSE:MSA) rides on the powerful trend of pricing improvement for many of its products, which has resulted in margin stability in recent quarters. Backed by a robust order growth in the US fire service industry, gas detection, and similar products, the gross profit margin was healthy in Q1. The ongoing activity push in the energy sector came at a critical time when the company sought to break the barrier. To mitigate the margin pressure, it has resorted to pricing hikes.

However, the industrial production index weakened in recent months as the economy headed towards a recession. While this can slow down the top line growth, the supply chain challenges can offset the margin growth. The balance sheet is free from any near-term debt repayment load. The stock is relatively overvalued compared to peers. Given a choice between valuation concerns and robust demand drivers, I would suggest investors hold the stock for higher returns in the medium term.

End-Market Growth And Challenges

Product-wise, the firefighter safety products saw a strong level of incoming orders after a 5% top line growth in Q1. Also, during the quarter, it saw several US fire service orders for its G1 SCBA. Plus, there was robust demand for turnout gear. A wearable gas detector device – ALTAIR io 4 – has leveraged the company’s safety subscription service among the newly introduced products. Shipments to customers for ALTAIR io 4 will begin in early May. As the energy sector activity rises across the US, the company’s products that protect the health and safety of workers and facilities are rising, too. Generally, higher energy prices affect employment and expenditures positively. Because 25%-30% of its revenues are tied to the energy business, the current energy environment is a tailwind to the company’s performance.

On the other hand, supply chain constraint, particularly for the electronic components, remains a critical challenge for MSA, as I discussed in my previous article. The management expects the supply chain challenges to continue in the coming quarters. Despite the difficulties, the company has not experienced order cancellation, and the steadiness in backlog is likely to result in revenues over the new few quarters.

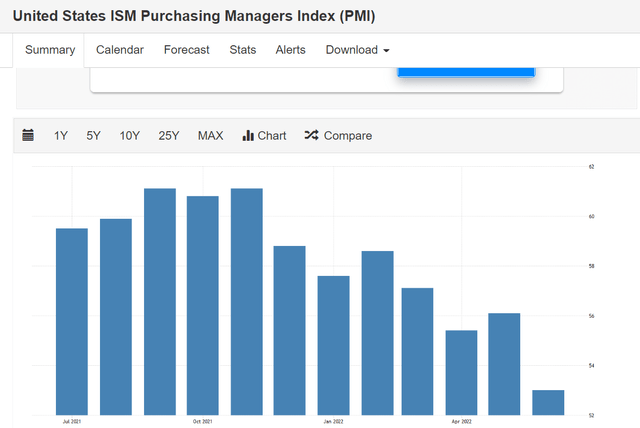

In June, the ISM Manufacturing PMI went down to 53 compared to 56.1 in May, indicating low growth in factory activity and low order contracts. The rising interest rates appear to be hurting demand while labor shortages in the supply chain affect the supply side. I expect consumer spending to remain uncertain in the next quarter or two with repeated pandemic waves.

Analyzing The Key Drivers In Q1

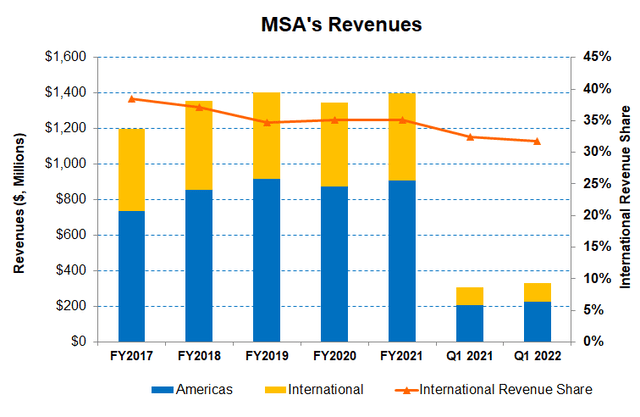

Year-over-year revenues in the Americas increased by 8%, while the growth was relatively modest in international territories (5% up). The book-to-bill was 1.2x for the quarter, which suggests a continued backlog build. The organic order growth was ~20%. Backed by a robust order growth in April, the gross profit margin was healthy. The incremental margins were 30% in Q1 following a pricing hike which mitigated the supply chain. The availability of electronic components and supplier allocations have remained challenging for the past few quarters. The strong pace of orders pushed the backlog from $60 million in Q4 to more than $150 million in Q1.

The gross profit margin remained nearly unchanged from Q4 2021 to Q1 2022. Higher amortization from acquisitions and a less favorable mix affected the margin adversely. The company’s adjusted operating margin in the international operation was down 20 basis points from a year ago. Nonetheless, increased volumes and pricing actions will help offset the labor and materials cost rise for the electronic components in the near term.

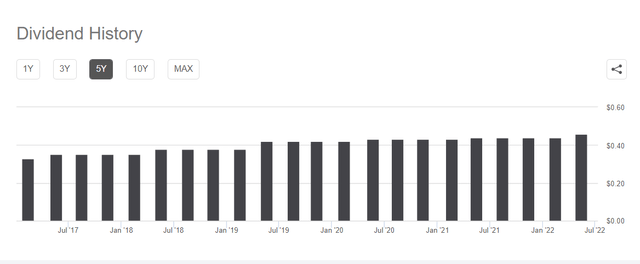

Dividend And Dividend Yield

In May, MSA increased its dividend by 4.5%. Its annual dividend of $1.84 per share amounts to a 1.5% forward dividend yield. In comparison, Brady Corporation (BRC) pays a dividend of $0.90, which amounts to a forward dividend yield of 1.93%.

Cash Flows And Debt Level

In Q1 2022, MSA’s cash flow from operations (or CFO) was $24.5 million, or nearly 46% lower than a year ago. Despite a 7% revenue rise, working capital deterioration following investment in inventory to secure scarce components led to the CFO fall in the past year. So, free cash flow (or FCF) decreased by 54% in the past year.

MSA’s leverage is much higher (0.9x) than some competitors (GRC, BRC, TNC). Its liquidity totaled $187 million as of March 31, 2022. Approximately $327 million in revolving credit facilities will mature in 2026, while its long-term debts are not scheduled to mature before 2031. So, the short-term financial risks are nearly absent. However, the cash flow weakness during the current economic uncertainty can raise worries for investors.

Linear Regression Based Forecast

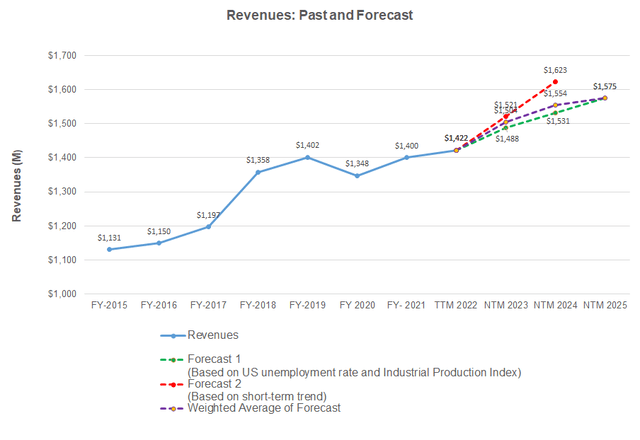

Author created, Seeking Alpha and FRED Economic Research

Based on the US unemployment rate, the industrial production index, and MSA’s revenues for the past seven years and the previous eight-quarters, I expect revenues to increase in the next twelve months (or NTM). However, I expect the top line growth to decelerate in the following two years.

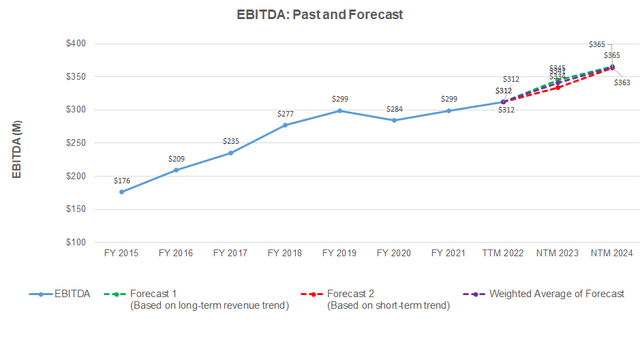

Author created and Seeking Alpha

Based on a regression model using the average forecast revenues, I expect the company’s EBITDA to increase modestly in NTM 2023 but see growth in NTM 2024.

Target Price And Relative Valuation

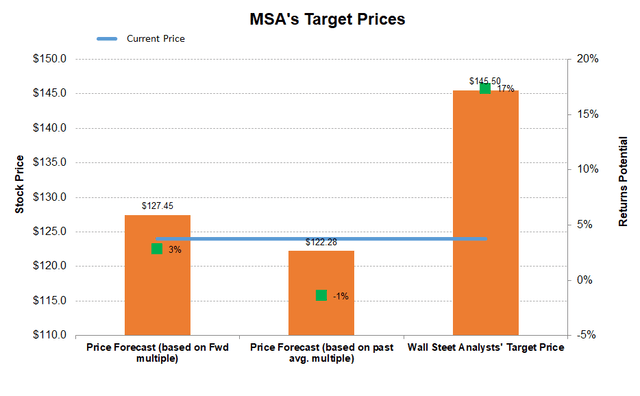

Author Created and Seeking Alpha

Returns potential using the forward multiple (16x) is higher (3% upside) than the returns potential using the past average multiple (1% downside). The sell-side analysts estimate much higher returns (17% upside).

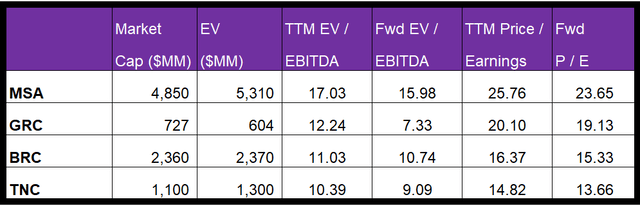

MSA Safety’s forward EV-to-EBITDA multiple expands versus the current EV/EBITDA. However, the expansion is less steep than its peers because its EBITDA is expected to increase less sharply. This typically reflects in a lower EV/EBITDA multiple than peers. However, its EV/EBITDA multiple (17x) is higher than its peers’ (GRC, BRC, and TNC) average of 11.2x. So, the stock is relatively overvalued.

What’s The Take On MSA?

Demand for MSA’s products has been high in the US fire service industry, including the turnout gear and a cloud-based wearable gas detector device. In the coming months, I expect health and safety products for the workers and facilities in the energy sector will rise. I expect the margin expansion to continue in the near term.

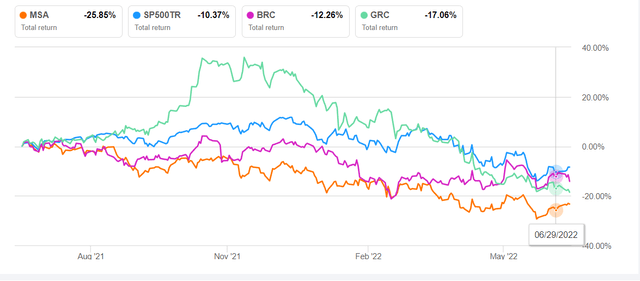

In recent months, the unemployment rate has remained low, but the industrial production index weakened. Plus, the supply chain challenges will remain in the near term. So, the stock price underperformed the SPDR S&P 500 Trust ETF (SPY) during the past year. Cash flows declined sharply at the beginning of 2022, although there is no near-term debt repayment load. At the current stock price, investors might want to hold it for better returns, given the steady fundamentals.

Be the first to comment