imaginima

Investment Thesis

I maintain that MPLX LP (NYSE:MPLX) is the best-designed MLP to last and prosper in the future because of its focus on natural gas and diversification of storage, gathering, processing, and pipeline network. As I see it, MPLX is best set up for the co-existence of renewables and fossil fuels, with natural gas as the bridge fuel between these two. Marathon Petroleum’s (MPC) ownership of 64% of MPLX units is unique under MLP peers and represents pros and cons, which I will describe later. Regarding peers, MPLX beats all its competitors in most things, making it the best MLP to invest in right now. Additionally, the balance sheet is of high quality, and its financials are terrific, making it a very high-quality company, best suited for uncertain times like now.

All these things alone are good, but the icing on the cake is considering that you can get them cheap, with additional upside.

In this article, I will compare MPLX to its competitors, Energy Transfer (ET), Enterprise Products Partners (EPD), and Kinder Morgan (KMI), because MPLX is superior in nearly every case.

Business model

In general, MPLX does the gathering, processing, fractionating, transporting and storing of natural gas and natural gas liquids (NGLs). For crude oil and refined products, MPLX does the distribution (and connected services), transportation and storage.

MPLX’s business is wrapped around MPC, which formed it ten years ago to own, operate, develop and acquire midstream energy infrastructure assets. This is important because MPLX’s business suits MPC’s needs. For MPC, MPLX provides midstream services which include the gathering and transportation of feedstock for MPC’s refineries and their demand centres. They don’t only own 64% of all outstanding units, but they also account for 50% of MPLX’s revenue. MPC’s contracts with MPLX are fee-based and come with escalators connected to the FERC index, meaning they are hedging against inflation. As inflation increases, so do their fees and, therefore, the revenue.

This strategic relationship is crucial for MPLX’s success, considering MPC is one of the largest US-based refiners. They own 13 refineries between the golf coast and the west coast. MPC generated roughly $120 billion in revenue last year and is a severe heavyweight in the US. Especially if you consider that there won’t be many (if any) new refineries, the last one was built in 1976, 46 years ago. MPLX is a profiteer of this, as they are owned by nearly 2/3 of this untouchable player whose business is aligned with their midstream operations. That is a status no other MLP can provide.

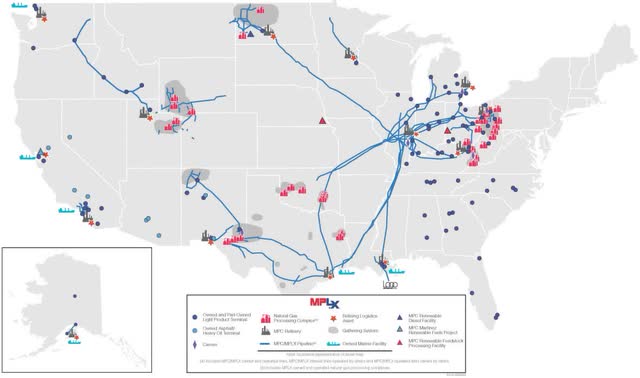

In numbers, all this means that MPLX operates nearly 16.000 miles of pipelines, widely connected to processing complexes, refineries, marine facilities and so on, as you can see below.

MPLX network (MPLX 2021 annual report)

When looking at North America’s basins, you can see that MPLX is advantageously positioned. They connect the biggest basins, ‘Bakken’, for example, with North America’s infrastructure and play a critical role in the energy system.

Financials

After explaining what they do, let’s get to the, at least for investors, more important part. How do they do financially?

In short: very good. MPLX management is the best in the Midstream sector in converting revenue into profits.

Growth

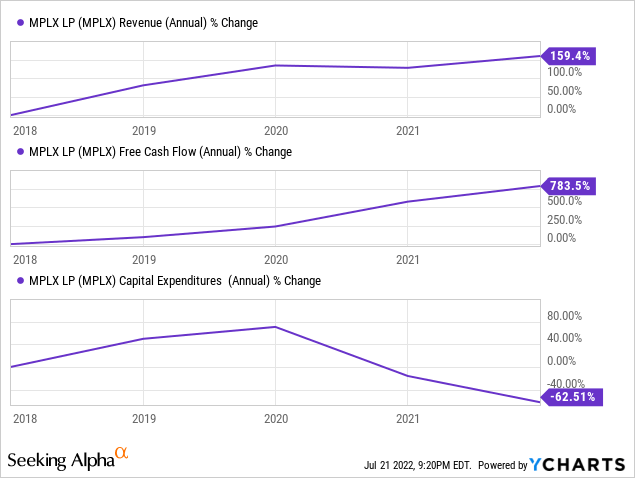

MPLX has grown tremendously since its formation in 2012 and, as you can see here, in the last five years too. Good to see is that EBITDA and Free Cash Flow grew way more than revenue, showing good scaling and management’s ability to improve profitability.

On a per-year basis, revenue grew by 32%, EBITDA by 37%, and FCF by 157%. The reason why FCF grew that much recently is the fact that MPLX management shifted its focus from growth to a more unitholder-friendly capital discipline. To achieve this, CAPEX was dramatically reduced since 2020 and reached -63% in the last five years and -78% since 2020. Before that, MPLX worked with an FCF deficit which now changed to a surplus. I like that development as it improves the distribution, which I, as a unitholder, want to see.

Profitability

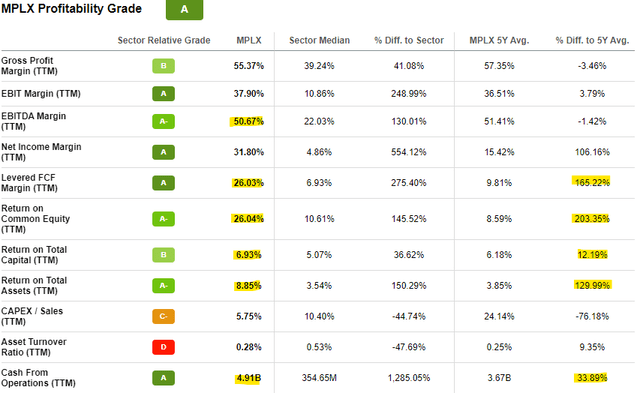

MPLX puts out above-average profitability.

MPLX profitability (seekingalpha.com)

As you can see, MPLX has very high margins, especially the ones I marked. Nice to see is that all of them, except EBITDA, are well above their 5-year averages. Compared to the sector median, you can easily see that MPLX has tremendous profitability. For unitholders, the FCF is the most important metric as it shows how much money there is to fund the distribution.

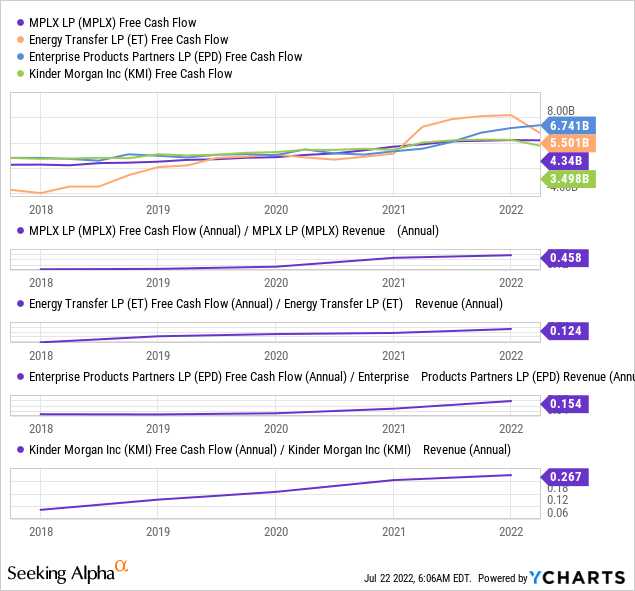

As you can see, MPLX is best at converting revenue to free cash flow. MPLX converts almost 46% (0.458) of its revenue in free cash flow, while ET, the biggest of these four on a revenue basis, only converts 12.4% (0.124) of its revenue in free cash flow. That shows the superiority of MPLX’s strategic partnership with MPC, which allows them to work very efficiently.

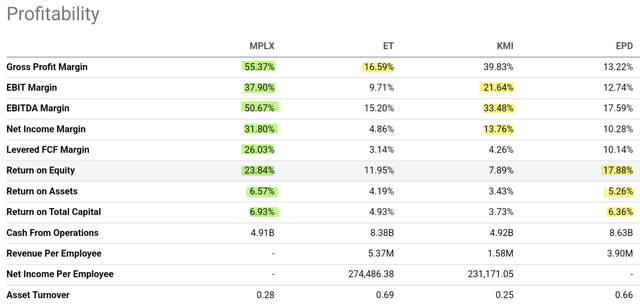

Peer comparison profitability (seekingalpha.com)

As seen above, MPLX dominates the profitability metrics, with the edge in every one of them. EPD comes second in all three return metrics, while KMI is second regarding margins. ET has the worst profitability out of these 4.

Balance sheet

Debt

In times of rate hikes, the amount of debt is directly influencing the earnings. Therefore, I wanted to check the debt structure and the development.

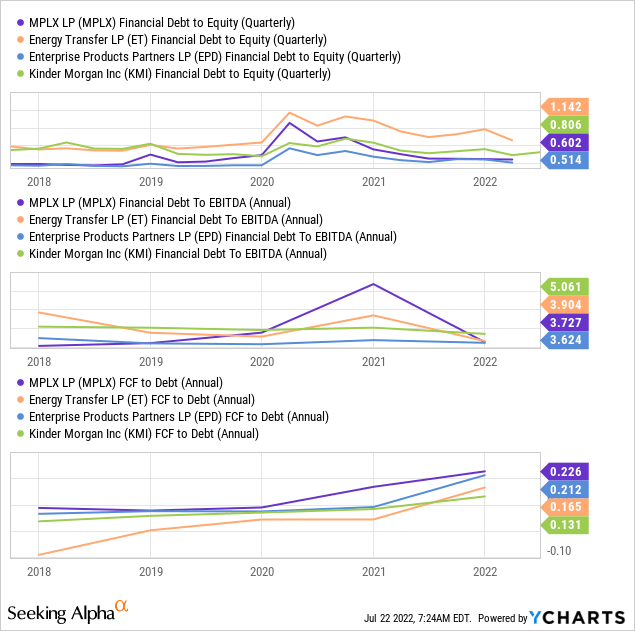

MPLX has the second lowest debt to equity and debt to EBITDA ratio but the highest FCF to debt ratio. That shows that only EPD has a better debt structure as of now. But as you can see, MPLX dramatically reduced debt since 2020, way more than its competitors. Since the management changed its focus from growth to more capital discipline, I predict that debt will be reduced further.

Shareholder returns

Distribution – 9%

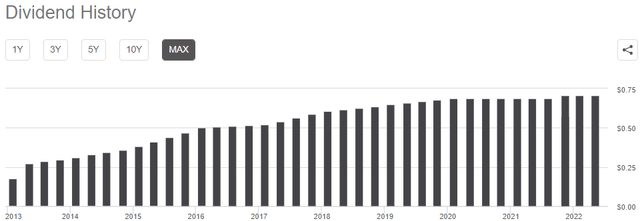

MPLX has an excellent track record of distribution payment and growth.

Distribution history (seekingalpha.com)

Since Q1 2013, MPLX has paid and grown a distribution every quarter/year. Starting at $0.18 quarterly, the distribution rose by 294.4% or roughly 33% annually to $0.71 last quarter. At the time of writing, $0.71 represents a yield of 9%Exceptionally stable, growing, and high distribution makes MPLX attractive to income investors. The icing on the cake is that the dividend is covered and can therefore be considered safe.

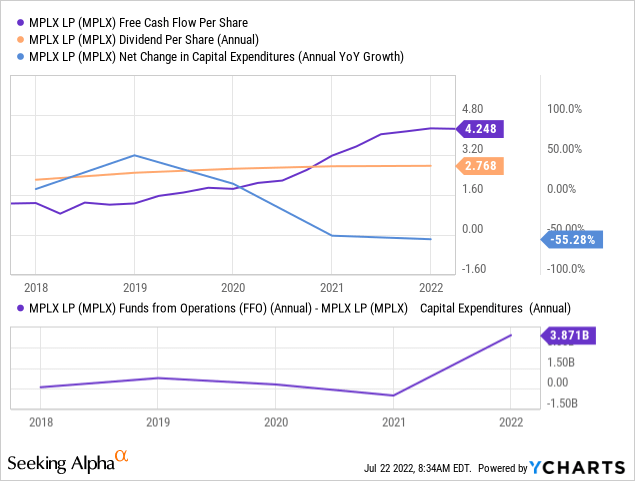

MPLX distributes $2.77 per unit annually with a free cash flow of $4.24.Meaning that the distribution is covered by 153%.A bit more meaningful is the coverage with distributable cash flow. The funds from operation are subtracted from capital expenditures, as seen in the last panel. With a distributable cash flow of $3.87 per unit, the coverage is 140%. As seen in the first panel, capital expenditure declined since 2019, while the free cash flow rose, resulting in a peak in distributable cash flow. I predict this development will continue, leading to an even higher distribution or better coverage.

Unit buybacks

MPLX bought back 5% of its units in the last two years and has still $172 million left from its latest $1 billion board authorization. At their current price of $30.53, MPLX could buy 5.633.803 units back. That would be another 0.56% of all outstanding units. Buybacks benefit unitholders directly and show the focus of MPLX management on more capital discipline.

Valuation

All the nice things I mentioned earlier are nothing if you can’t buy them for the right price. That is a problem we don’t have here with MPLX.

MPLX is undervalued compared to its historical multiples and peers.

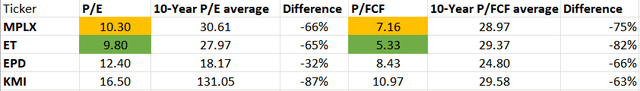

Valuation peer comparison (Author – data from YCharts)

ET is the cheapest of these four stocks, but its valuation is ridiculously low, way below what it should be. MPLX is in second place with a good discount on EPD and KMI. As you can see, all of them are valued very cheap compared to their 10-Year averages due to years of bashing fossil fuels. Fossil fuels had to give up their favourite rule as the source of energy and got replaced with renewables such as wind and solar. Since last year, this narrative has changed into the realistic assumption that fossil fuels will be there for decades, and MLPs have caught up with valuation again. But they are still undervalued, as seen below. If I use my DCF model with 15% revenue growth in the next two years and 10% revenue growth in the following three years, long-term growth rate of 3.5% and a WACC of 10.05%, I get a price target of $44, which would represent an upside of 45.85%.

Risks

Every MLP company faces a risk of damages to equipment like pipelines or storage facilities. For example, ET experienced this just a few weeks ago when one of their natural gas pipelines exploded in Houston, Texas.

These events don’t only lead to a loss in gas/oil and payment for the damages but bear the risk that large compensation payments need to be paid for severe damage to nature, for example BP p.l.c. (BP) was sentenced to pay $6.4 billion for the Deepwater Horizon disaster, which led to severe damage to nature after approximately 800 million litres of oil spilt out of a leak.

This is an extreme example, but even a minor catastrophe could lead to enormous compensation payments for MPLX.

Furthermore, there is the Risk that MPC wants to buy out MPLX and bring it entirely under its roof. A payment containing MPC shares for MPLX unitholders would lead to a loss of distribution since MPC pays just a 2.71% dividend as of now. Additionally, MPC is another investment that may not suit everyone now invested in MPLX.

A potential economic downturn could lead to reduced capital expenditure, depleted liquidity and bankruptcies, production shut-ins, and creates volumetric, contractual, and regulatory risk for US midstream operators. This is stated by the energy intelligence group Enverus. MPLX is better positioned to dodge these risks due to MPC as its partner. Of course, MPC could go bankrupt too, for example, but this is overly unlikely due to its size and financials. Less volume and production shut-ins are something MPLX could experience too, but nothing that would disturb my investment case.

Conclusion

MPLX is a high-quality MLP with superior profitability to its peers. Its strategic partnership with MPC gives it an edge against its competition and secures its business. The distribution of 9% is stable, safe and destined to grow further. In addition, there is a massive upside due to an undeserved undervaluation. If you like stocks with these characteristics or searched for an MLP in particular, you’ve found it in MPLX.

Be the first to comment