JamesBrey/iStock via Getty Images

Investment thesis

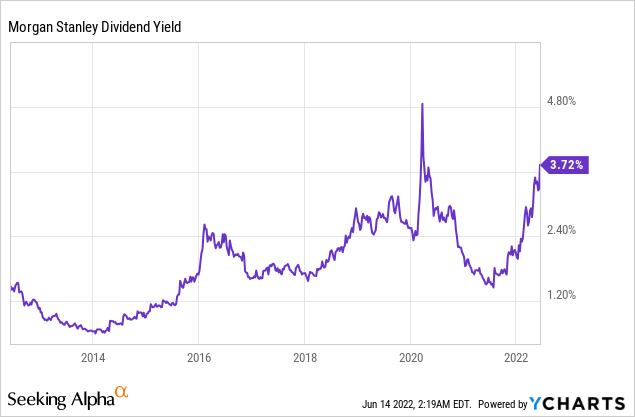

Morgan Stanley (NYSE:MS) is not only a world-leading investment bank but a great dividend payer company as well. It can easily become an income-seeking investor’s dream in the investment banking sector as it pays for the highest dividend among its peers with a sustainable payout ratio. In addition, analysts expect an 8.5% dividend increase in the third quarter which could increase its current dividend yield of 3.72% even higher. The company will be able to capitalize on asset management trends of 2022 and 2023 with newly issued ESG ETFs, crypto-related ETFs, and a new approach toward its workforce.

The main concern comes from an external factor: recession fears and the aggressive increase in interest rates in the next couple of months. Despite the short-term turbulence, MS is far the best investment bank among its peers in many categories with a solid dividend yield.

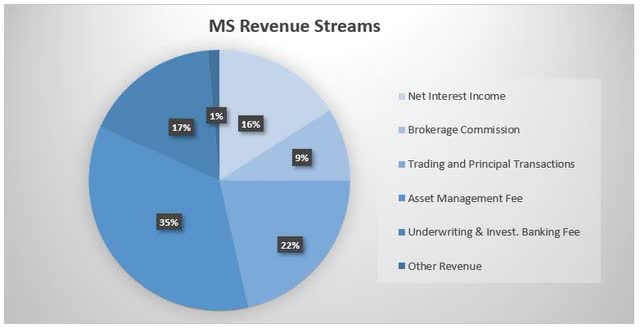

A third of their revenue comes from the asset management segment from fees, 22% of their revenue comes from trading and principal transactions and the NII is still a large part of the income pie. In addition, MS is a major ETF issuer and provider.

Asset management trends for 2022 and beyond

The largest part of MS’ revenue comes from the asset management segment, so it is a wise decision to analyze what we can expect to happen with the sector in 2022 and beyond. What are the major trends and how MS can fit into them?

ESG assets will continue to grow in the upcoming years. According to Bloomberg, ESG assets could hit a total of $53 trillion in the next 3 years which is the third of the global AUM. Calculating even with the worst-case scenario (because of recession fears) they expect an at least 15% growth in ESG ETFs. James P. Gorman – CEO of MS said: “At Morgan Stanley, we are focused on integrating ESG initiatives into our firm’s core competencies.”

It is not an empty statement luckily. The company truly focuses on this segment especially because of the enormous growth and profit potential in it. In May 2022 the company’s European subsidiary launched 6 different ESG funds. In addition, MS has ESG funds among the top 20 funds by AUM via one of its subsidiaries, Calvert Asset Management. Of course, Vanguard and Blackrock are still the biggest players in this field but they are solely asset managers. But MS is leading the ESG market and they are ahead of MS’ closest peers which matter to them the most.

Morgan Stanley became the first U.S. big bank to launch a crypto (bitcoin) ETF in the first half of 2021. Despite cryptocurrencies are not the best performing asset class at the moment, (quite far from that) they suggest the innovative side of MS. Cryptocurrencies are down for now, but the overall acceptance of digital currencies in the asset management sector is on the rise. 20% of family offices already keep part of their wealth in crypto-assets and MS is a leader in the crypto asset management world.

Despite the opportunities with ESG investing and crypto, asset managers’ fees will be under tremendous pressure. This is not a new trend since passive investment vehicles have been on the rise for years. ESG will likely drive the AUM growth in the upcoming years but the fees will be under pressure. MS is fighting this challenge in a different segment.

They can fight the price pressure in different segments such as the advisory fees and wealth management segment of the business. After years of decline, this segment could not only grow in nominal numbers but in fees as well. Because the workforce expenses are one of the biggest expenses, the management wants to capitalize on work-from-home trends and gives employees greater freedom than their peers. In July 2022 the management set up 90 days of remote work per year for its 16 000 brokers.

Valuation

MS is fairly valued in my opinion but income investors can open a position in it without much hesitation. The bank has an efficiency ratio of 63.1%, slightly worse than its peers. The Charles Schwab Corporation (SCHW) has an efficiency ratio of 58.69% while The Goldman Sachs Group, Inc. (GS) has an efficiency ratio of 61.36%, calculated with total revenue. MS’ forward P/E ratio is 10.25 slightly lower than its 5-year average of 11.18.

Only GS is trading at a better earnings multiple than MS. In terms of total return, Morgan Stanley is the best among its peers for 2022 YTD because the company had approximately 2% better price return than its peers. The most impressive part is MS’ current dividend yield. You can buy MS with its best dividend yield in the last 10 years not calculating in the approximately 2-months period of extreme pandemic yield spike. That is why I think on the current levels MS is a bargain not to be missed for income investors.

Company-specific Risks

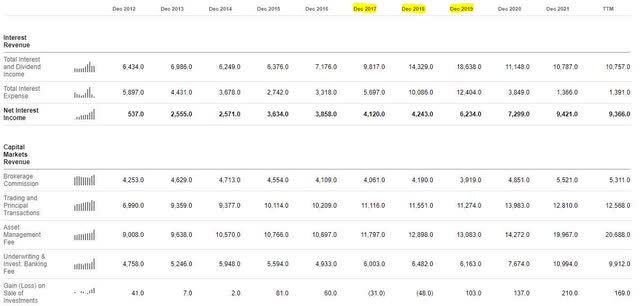

There are some minor risks and a bigger risk to MS in the upcoming months and years. The biggest risk factor is the recession. In the last days, we saw a major downturn in the markets due to the fear of recession and the 175bp hike until September by the federal reserve to tackle inflation. This will affect not only MS but all the banks. According to analysts the NII will increase in 2022 by 2% on average but fall by 1% in 2023. The fee is income is also expected to fall due to top weaker economic activity. This means that MS’ AUM will slightly decline not only because of the bear market but because of slower economic activity. This might mean despite the fair valuation that the stock price might fall further to the $68-70 territory in the upcoming months.

This might also be caused by the increase in interest expense following the aggressive interest rate hikes of the Fed. If we take a look back to the previous rate hike cycle, we can see that the interest expense grew significantly in those years and I expect the same for 2022 and 2023. In the short term (for 2022 and the beginning of 2023) this will lower MS’ profit margin until the other revenue streams can adjust to the changing rate environment and the asset management segment can capitalize on the next bull market.

My take on MS’s dividend

MS has a great dividend history and is a primary target in the investment banking and brokerage industry for income seeking-investors. The company not only pays consecutive dividends for 24 years but also has the highest dividend payout among its peers. The closest dividend yield to its 3.72% is GS’ 2.79% which is almost a percent lower. The management made a massive dividend increase in Q2 2021 when they doubled the dividend to the current $0.7 per share quarterly.

“With our transformed business model providing more stable and durable earnings, we have doubled our dividend and announced a $12 billion buyback as we move to return our excess capital to shareholders.” – James P. Gorman, Chairman, and CEO.

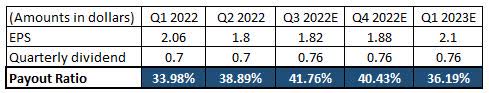

The dividend coverage is great; it has a payout ratio of 35-40%. Even with recession and major earnings miss the management can maintain the current payments without any disruption. MS usually increased its dividend in the third quarter and analysts expect an 8.5% raise for 2022.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

Morgan Stanley is a confident buy in my opinion. The business model and its 4 major income segments are performing well and the bank is prepared for the asset management sector’s changes in the future. The company will be able to successfully capitalize on asset management trends of 2022 and 2023.

I expect short-term turbulence in the stock price due to the aggressive rate hikes and because of this, the interest expense will rise for MS. However, this is only a short-term cyclical movement that allows investors to take advantage of the great dividend yield with a potential dividend increase in the next quarter.

Be the first to comment