pichet_w/iStock via Getty Images

In my last article about Moody’s Corporation (NYSE:MCO), I finished the article with the following conclusion:

So, I am a bit cautious, and Moody’s will stay on my watchlist although it could be fairly valued right now.

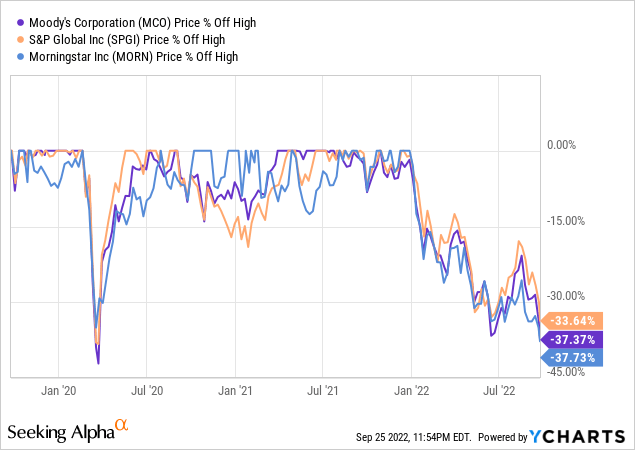

At that point Moody’s Corporation was trading for $391 (and extremely close to its all-time high of $408). In the meantime, the stock lost about 35% of its value. But not only Moody’s Corporation declined. The other major rating agencies – including companies like S&P Global (SPGI) and Morningstar (MORN) – also declined about 35% in value since the previous highs.

And losing about one third of its value can usually be seen as a solid correction and a level where stocks are getting interesting again. In my last article, I put some question marks behind the valuation of Moody’s. Now, about 10 months later, let’s look at the company and stock once again and try to determine if the stock is a good investment right now.

Quarterly Results

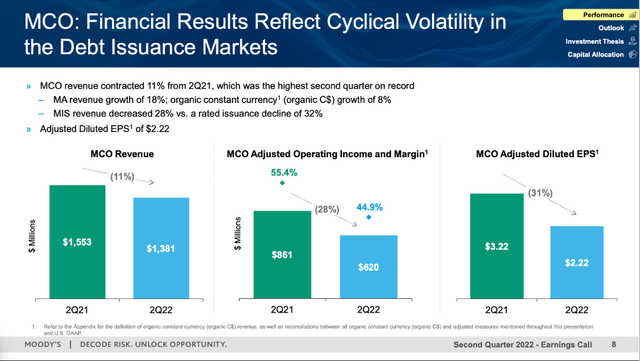

And a first piece of information if Moody’s is a good investment right now comes from the second quarter results, which were not great. While many other businesses can grow revenue still with a solid pace, Moody’s Corporation had to report a 11.1% year-over-year decline for the top line (from $1,553 million in the same quarter last year to $1,381 million this quarter). Operating income also declined rather steep from $801 million in Q2/21 to $508 million in Q2/22 – resulting in 36.6% YoY decline. And diluted earnings per share declined even 42.3% YoY from $3.07 in the same quarter last year to $1.77 this quarter.

Moody’s Corporation Q2/22 Presentation

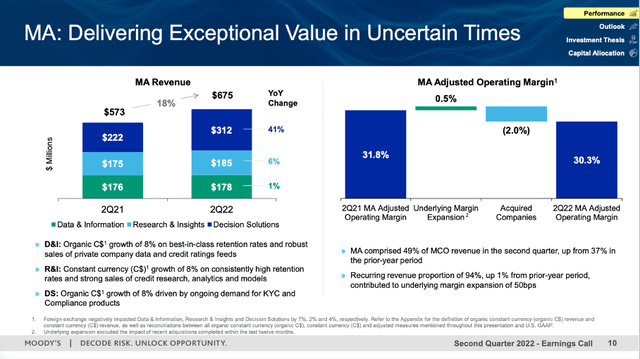

When looking for a reason of the bad performance of Moody’s Corporation, the answer can be found by looking at the two different business segments. We start by looking at Moody’s Analytics (often referred to as MA). When looking at these results we hardly see any problem. MA revenue increased from $573 million in Q2/21 to $675 million – with growth stemming from all sub-segments (especially decision solutions increased revenue 41% YoY). And the fact that 94% of revenue is recurring is leading to stability and consistency for Moody’s revenue (growth) in this segment. The multi-year shift to subscription-based products seems to pay off for the company.

Moody’s Corporation Q2/22 Presentation

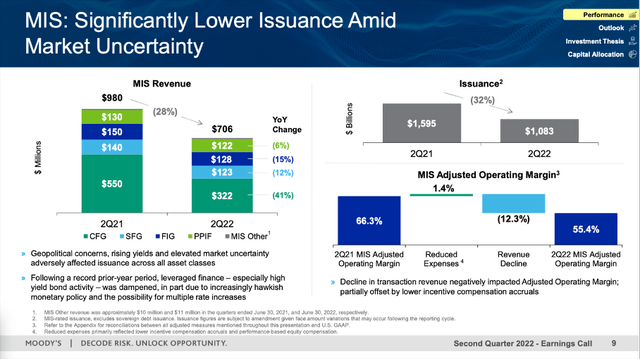

The picture gets completely different when looking at the second segment – Moody’s Investor Services (often referred to as MIS). Revenue for the segment declined 28.0% YoY from $980 million in the same quarter last year to $706 million right now. And the issuance of new bonds declined from $1,595 billion in Q2/21 to only $1,083 billion in Q2/22 – a decline of 32%.

Moody’s Corporation Q2/22 Presentation

Especially issuance for leveraged loans and high yield bonds was much lower due to volatile market conditions. Issued volume for high-yield bonds declined 71% and issuance for leveraged loans declined 42%. But investment grade activity also decreased due to lower opportunistic refinancing.

Moody’s Corporation Q2/22 Presentation

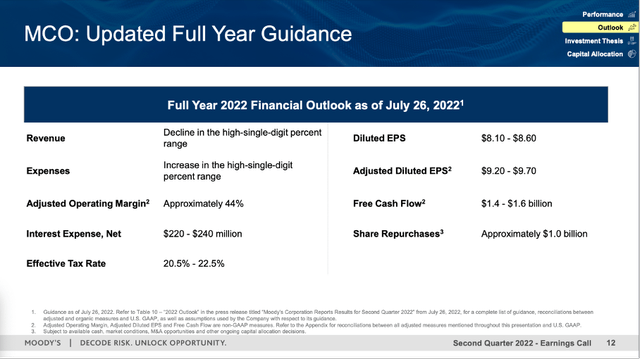

And as a result, Moody’s Corporation also had to update its guidance for the full-year fiscal 2022. Revenue is now expected to decline in the high-single digit percentage range and diluted earnings per share are expected to be only between $8.10 and $8.60 (instead of $9.85 to $10.35 in a previous guidance). And free cash flow is expected to be between $1.4 billion and $1.6 billion (instead of $1.8 billion to $2.0 billion in a previous guidance). And – not surprisingly – Moody’s Analytics is expected to increase in the mid-teen percentage range while Moody’s Investor Services is expected to decrease revenue in the low-twenties percentage range.

Short-term Headwinds

While it is difficult to whitewash the current quarterly results as well as the guidance for fiscal 2022 – Moody’s Corporation is negative affected by the beginning economic downturn and bear market. But the important question remains: Is this rather a short-term problem that will be resolved in a few quarters or years from now or are we dealing with a structural change. Management certainly remained optimistic during its last earnings call – not only for Moody’s Analytics but also for Moody’s Investor Services:

MIS’s medium- to long-term business fundamentals remain intact. And that’s, again, based on our view that the current market disruption in issuance is cyclical rather than structural in nature.

But despite being optimistic about the business model of MIS, CEO Robert Fauber is seeing two big shocks to the market right now:

First of all, there are 2, not 1 but 2, big shocks that are impacting the markets at the same time right now. And the first is what I think we all understand is the inevitable monetary tightening after a period of historically low interest rates. And now we’ve got the Fed aggressively addressing inflation. And that has caused a lot of uncertainty in regards to both the trajectory and the pace of rate increases versus what I think the market had both assumed and was hoping for would be a kind of slow and steady and well understood trajectory of rate increases during a period of tightening.

But the second shock that we’ve got is the uncertainty around the duration and the severity of the Russian-Ukraine crisis, and that’s obviously led to a spike in energy prices that’s further contributed to inflation, and it’s also just eroded, I think, global confidence in general. So — and not to mention, we are still dealing with COVID-19 and the knock-on impacts of supply chain disruptions.

And these two shocks will certainly have a negative impact on Moody’s business in the next few quarters. The high interest rates will lower the number of businesses issuing debt as merger and acquisitions or large projects will rather be postponed (we are already seeing first signs of lower M&A activity and businesses cutting costs). Of course, we should keep in mind that interest rates are not unreasonably high right now. When looking at the last few decades, current interest rates can still be described as rather low. But rates are much higher than they have been a few quarters ago and this will most likely have a negative effect. And management is clearly seeing headwinds right now:

In terms of headwinds, it’s a little bit of the converse, right? But it’s worth mentioning in a recession scenario, that’s when we’d see defaults likely start to tick up and spreads widen, that would be a headwind. So we’re keeping — really kind of keeping an eye on that.

For the next few quarters, we must assume Moody’s business being hit – not only MIS but also MA might be affected.

Long-term Growth

But when looking at the long-term picture, we can be quite optimistic for Moody’s Analytics. The business remains strong and resilient with almost 60 quarters of consecutive growth. The sticky nature of the business (high switching costs combined with a subscription-based model) will lead to consistent revenue. Of course, it is possible (and seems likely) that revenue from MA will also decline in case of a recession and severe bear market, but the business might rebound quickly and the long streak of solid growth rates will most likely continue after a potential recession.

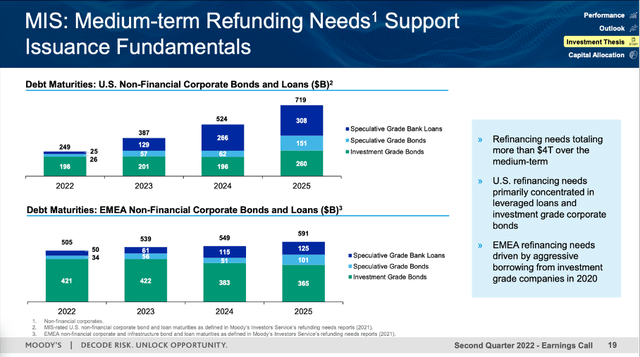

And when talking about mid-to-long-term trends we can also be optimistic for Moody’s Investor Service. First, Moody’s sees high refunding needs in the next few years. Until 2025, refinancing needs are totaling more than $4 trillion with refinancing needs primarily concentrated in leveraged loans and investment grade corporate bonds.

Moody’s Corporation Q2/22 Presentation

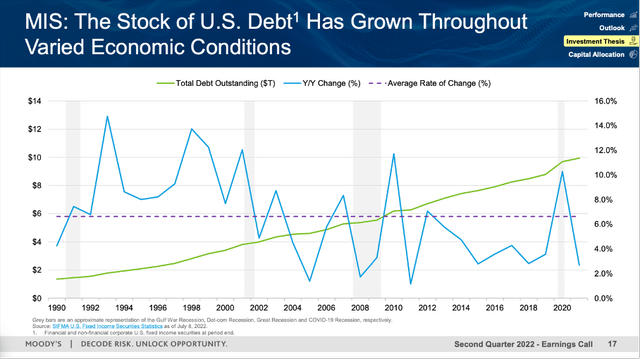

And when looking at the past performance since 1990, recessions led to lower growth rates for total debt outstanding. But over the long run, total debt outstanding constantly increased and even during recessions we saw growth. And since 1990, the average growth rate for total debt outstanding was about 7%.

Moody’s Corporation Q2/22 Presentation

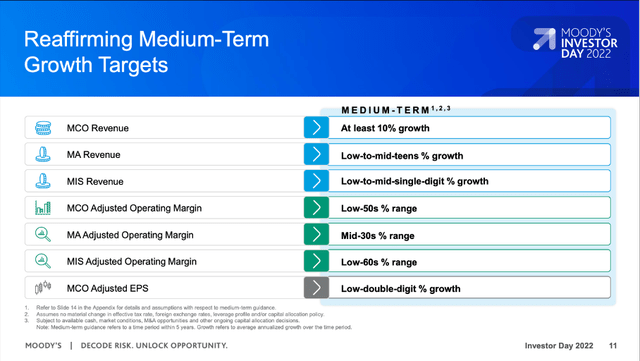

Overall, Moody’s is optimistic about its mid-term performance and during the 2022 Investor Day, Moody’s reaffirmed its medium-term growth targets. Revenue is expected to grow at least with a CAGR of 10% in the years to come and adjusted earnings per share are expected to grow in the low-double digits.

Moody’s Corporation Investor Day 2022 Presentation

Short-term Risk: Recession

When talking about the potential outlook in the next few quarters, management (who made the statement during the earnings call) is seeing the potential for a recession, but still seems to be optimistic such a scenario could be avoided:

So you’re asking kind of what could get maybe the market started. I think one of the keys that we’re going to look at is whether we continue with economic growth or whether we tip into recession. And I think one of the keys to that is inflation. If the Fed can get that under control, I think there’s the possibility that they pull back from more aggressive rate hikes towards the end of this year and into 2023.

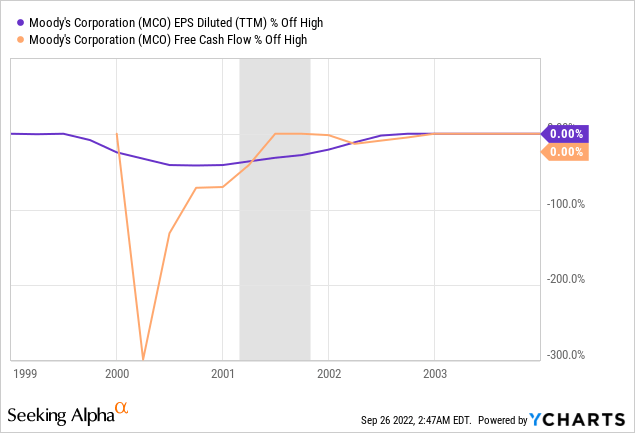

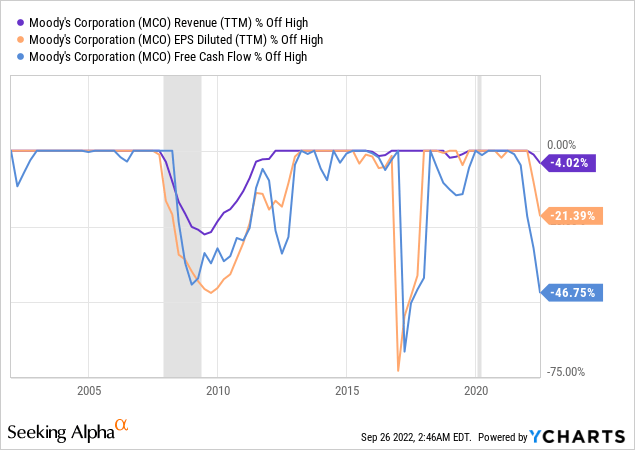

I would not be so optimistic but rather assume a severe recession for the United States (and many other countries around the world). And when looking at the performance during the last few recessions, we have little reason to be optimistic for Moody’s Corporation. When looking at the years following the Dotcom bubble for example, earnings per share and free cash flow declined extremely steep. However, a spin-off in 2000 might have distorted the picture in this case (the reason why I also excluded revenue in the chart).

But when looking at the Great Financial Crisis the picture is similar: Revenue, earnings per share and free cash flow all declined. And while revenue declined “only” about 25%, earnings per share and free cash flow declined between 40% and 50% and we must acknowledge that Moody’s Corporation is not resilient to recessions.

And there is not much reason to be optimistic for the upcoming recession: Moody’s Corporation will be hit hard again, and we are already seeing first signs as the numbers are already declining.

Major Long-Term Risk

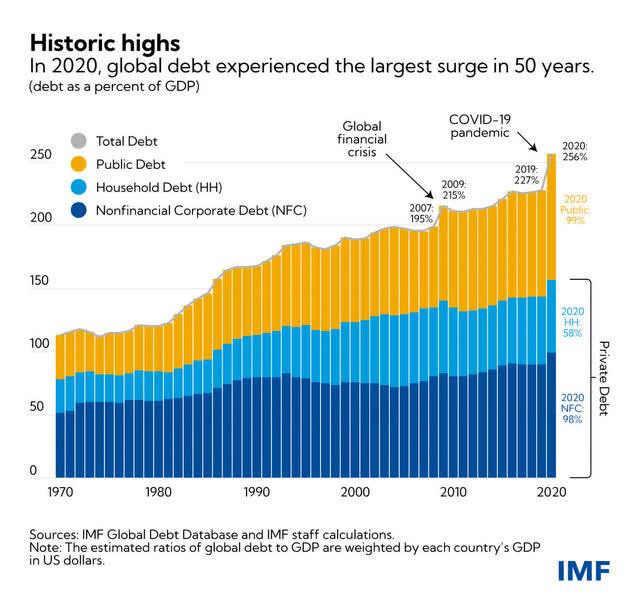

Aside from the risk of a recession in the next few quarters, Moody’s is also facing a bigger risk – but one that is hard to describe in an accurate way. In 2020, the global debt reached an amount of $226 trillion – and we must expect that amount to increase in the coming years. And not only that absolute number sounds scary. Even when comparing the total debt to GDP, the ratio constantly increased and we are looking at a debt-to-GDP ratio of 256% right now, which is scary.

High debt levels can be problematic for the economy, for governments, for individuals – Moody’s on the other hand is profiting from constantly increasing debt levels as newly issued debt usually needs a rating and the more debt is issued the more ratings are necessary. In my opinion, we are close to the end of a major debt cycle that will end in the foreseeable future (could be in the next few quarters, could be in ten years or more). And here is the problem: We can assume that huge debt cycle (which lasted for several decades) will come to an end, but we don’t know that for sure and we don’t know when. This will also not be a single event, but rather a process taking place over several years – a process in which we will see major economic shifts happening (I am building here on the writings of Ray Dalio, which I highly recommend reading – especially his book “Principles for dealing with the changing world order”)

If the debt cycle should end in the next few years, it might have a huge effect on Moody’s Corporation. Like Moody’s Corporation profited from increasing debt levels in the last few decades, declining debt levels (no matter how that process is unfolding) has a reversed effect on the business model and revenue. Of course, the debt cycle will start again – but especially at the beginning fewer companies or governments will issue debt and they might issue lower amounts.

These are very vague predictions, and it is very difficult to make investment decisions based on these vague predictions, but it is something we should keep in mind when talking about Moody’s Corporation.

Intrinsic Value Calculation

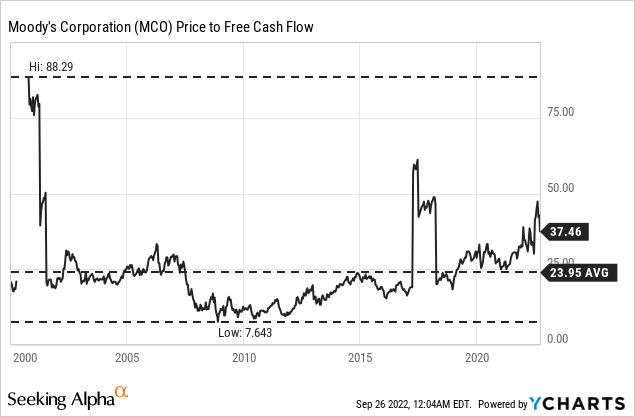

When looking at the price-free-cash-flow ratio, Moody’s Corporation is currently trading for 37.5 times free cash flow. The stock is certainly not cheap right now – it is actually trading for one of the highest multiples in the last 20 years (and clearly above the average P/FCF ratio of 24). Of course, we should take into account that free cash flow declined rather steep in the last few quarters, which led to the increasing P/FCF ratio while the stock price declined rather steep in the last few quarters.

In case of Moody’s, it probably makes much more sense to use a discount cash flow calculation to determine an intrinsic value for the stock. Free cash flow already declined pretty steep and the trailing twelve-month number is $1,268 million, which seems like a good basis for our calculation (and is actually below the company’s guidance for fiscal 2022). And to reflect the negative effect of a recession, we assume the same free cash flow for fiscal 2023. However, for fiscal 2024, I assume $1.5 billion in free cash flow and for fiscal 2025 I assume $2 billion in free cash flow. When looking at the past years, free cash flow was higher in the years 2018 till 2021 and capital expenditures are also rather high right now. So, we can assume capital expenditures to be lower again and cash from operations being higher again, which will lead to a higher free cash flow in the years to come. And for the years following 2025 we assume a reasonable growth rate of 9% (below the company’s medium-term growth targets) followed by 6% growth till perpetuity after 2032.

When calculating with these numbers (and a 10% discount rate as well as 184.9 million outstanding shares), we get an intrinsic value of $253.66 for Moody’s Corporation and the stock might be fairly valued right now. However, I still see downside potential for Moody’s Corporation and won’t buy the stock just yet. Similar to the overall stock market declining further, I also see downside risk for Moody’s Corporation.

Conclusion

Like I would not purchase many other stocks right now (although we saw steep declines for several stocks), I would also not purchase Moody’s Corporation right now. Although Moody’s Corporation is a great business with a wide economic moat around it is not resilient to a potential recession and as the stock is certainly not a bargain yet, I see further downside risk in the coming quarters.

Be the first to comment