Bartosz Luczak/iStock via Getty Images

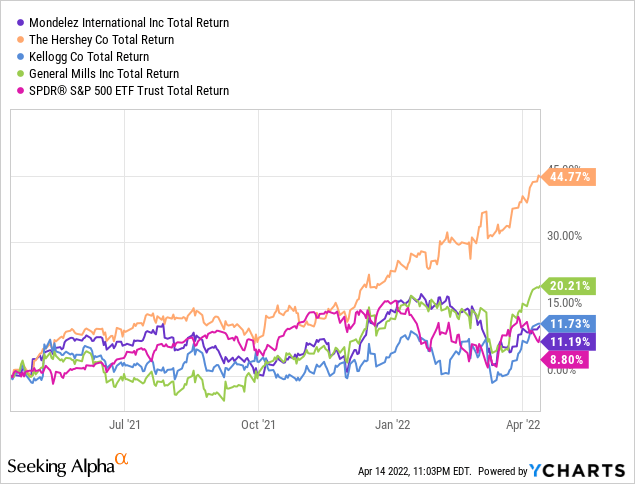

Over the last twelve months, consumer powerhouse Mondelez (NASDAQ:MDLZ) has performed slightly better than the S&P 500 at 11% and in-line with Kellogg (K). While no one can complain of this return after strong gains during a pandemic, the stock underperformed General Mills’ (GIS) return of 20% and Hershey’s (HSY) 45%. All around, consumer defensive stocks have held up quite well. At 19.6x forward earnings, Mondelez isn’t necessarily cheap with operating margins of 15.7% vs. 15.8x for Kellogg and 17.8x General Mills. Add in the evolution of shopping to more virtual options like Instacart, and heightened competition, more generally, in the snacking category, and you got a situation in which Mondelez may be exposed to more downside than its strong brand name suggests. In my view, however, there’s more to like about the stock, as management zeros into improving productivity, investing in the cash cow brands, and expanding internationally.

According to Seeking Alpha data, the Street is highly bullish on the stock. 20 of 24 analysts rate the stock in the “buy” territory, and a full 12 of them are a “strong buy”. This bullish sentiment has generally remained constant over the past three years even as the stock surged from $37 back at the start of 2019 to around $65 today, reflecting management’s strong execution and focus around pruning non-core assets and shifting towards high returning brands. At this point, however, it’s a fair question to ask whether the stock’s premium to Kellogg and General Mills is warranted. The company’s gross margins of 45.2% vs. 33.4% for General Mills and 31.7% for Kellogg reflects the value of the company’s brands, but its sales volumes are meaningfully below peers… so how much room is there for further value creation?

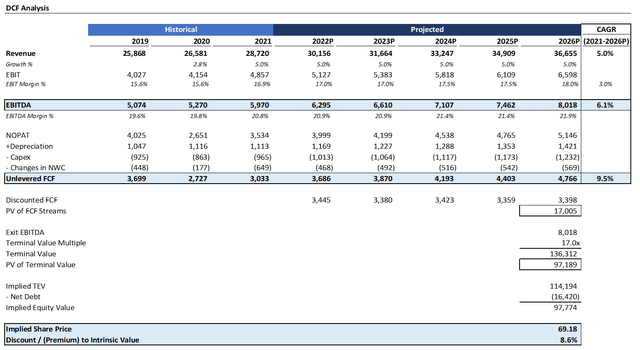

DCF Analysis Indicates Meaningful Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecast revenue growing at a slow 5% rate into 2026. I assumed margins expanding by 200 bps into 2026 to 18.0%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at $8.0 billion.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 17x and a discount rate of 7%, the stock is ~9% below intrinsic value. Historically, Mondelez has traded in the 16-20x range over the past ten years, so I believe my estimate is on the conservative side, especially in light of minimal growth and margin expansion. Importantly, as is the case for consumer defensive stocks, the beta is low at 0.71, so, if anything, I should be applying a lower discount rate to account for the relative safety. With a dividend yield of 2.2% and a shareholder friendly capital allocation policy, the downside is further minimized.

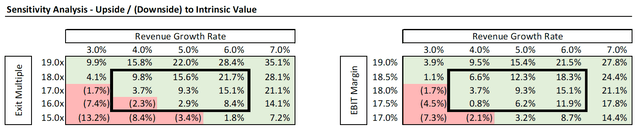

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, if we assume the stock expands to the high end of the historical multiple range – say if growth proves out – there is 22% upside here. On the flip side, even if growth were to amount to just inflation at 3%, and the multiple contracts to 15x, there is only 13% downside here, which is more than offset by the 7% annual returns implicit in the discount rate and 2.2% dividend yield. With a strong economic moat, well known brands, and commanding market share, Mondelez is a nice home for investors that want to shift away from a risky overvalued market. Moreover, as my analysis suggests, returns are not that sensitive to changes in margins: a 1% change in margin yields only a 6% change in return, so I wouldn’t worry too much about inflationary input pressure.

Upside Catalysts

There are several factors that will get Mondelez to outperform. Management needs to first work on channel expansion abroad. Towards that end, the company gained access to 300K stores in China and 200K stores in India in 2021 while digital commerce grew 29%. Digital is only 6% of revenue and is poised to further grow considering greater in-home snaking. While Mondelez brands are well known in the United States, there’s still plenty of untapped potential abroad that can be tapped to excite investors into what is an otherwise a mature business. Currently, emerging markets provide 35% of the company’s revenue and grew 12.2% y-o-y in 2021 versus just 1.6% in developed markets. Accordingly, the upside story will unquestionably hinge on whether Mondelez continues to demonstrate momentum in filling out geographical white space. In theory, it’s simple; but, divergent consumer tastes in different localities will make the actual execution challenging.

Product innovation provides another key upside, with high profile launches of Oreo Zero, Cadbury & Philadelphia Vegan, demonstrating traction and an ability for Mondelez to capture more health / planet-friendly conscious consumers. Similarly, acquisitions remain a highly viable path to value creation. The recent acquisitions of Grenade (UK), Tate’s, Chipita, Perfect Snacks, and Give & Go all have diversified the company’s brand portfolio and further expanded the geographical presence. The premium biscuit category, for instance, led by Tate’s, grew double-digits, setting an example for future acquisitions. As a marketing powerhouse with wide channel access, Mondelez is in a position to capture meaningful revenue synergies from acquisitions and will be a competitive player in any auction process.

Risks

The obvious concern with Mondelez is inflationary input pressure. Cost of cocoa, dairy, palm oil, wheat, and sugar at highs. However, gross margins have only contracted from 40% in 2019 to 39.2% currently, and reflect the pricing power of the company’s brands. With that said, gross margins have leveled off and suggest that upside from cost cutting can’t continue indefinitely. In short, Mondelez may be a victim of its own success, having set the bar too high for future outperformance. Rationalization of SKU count have yielded fruit, but past a certain point, management may struggle to further improve capital efficiency. A more likely risk, in my view, is supply chain volatility and labor shortages. Management is having to rely on added temp labor, for instance, which isn’t as reliable as a dedicated workforce. Finally, I am also concerned about the growing appeal of private label and store brands stealing share from Mondelez.

Conclusion

Mondelez is a blue chip name, and, while it trades at a relatively high valuation against peers, there’s material growth potential from emerging market momentum, M&A, and channel expansion. Consumers have demonstrated an increased proclivity to snaking post-pandemic, and I expect this trend to continue to deliver tailwinds for Mondelez over the foreseeable future. In light of its superior margins, I also believe that, if anything, it could attract investors from peers with more limited and less shareholder friendly capital allocation policies. Accordingly, I strongly recommend investing in Mondelez to protect yourself from any pullback to the economy.

Be the first to comment