Pietro S. D’Aprano/Getty Images Entertainment

Introduction

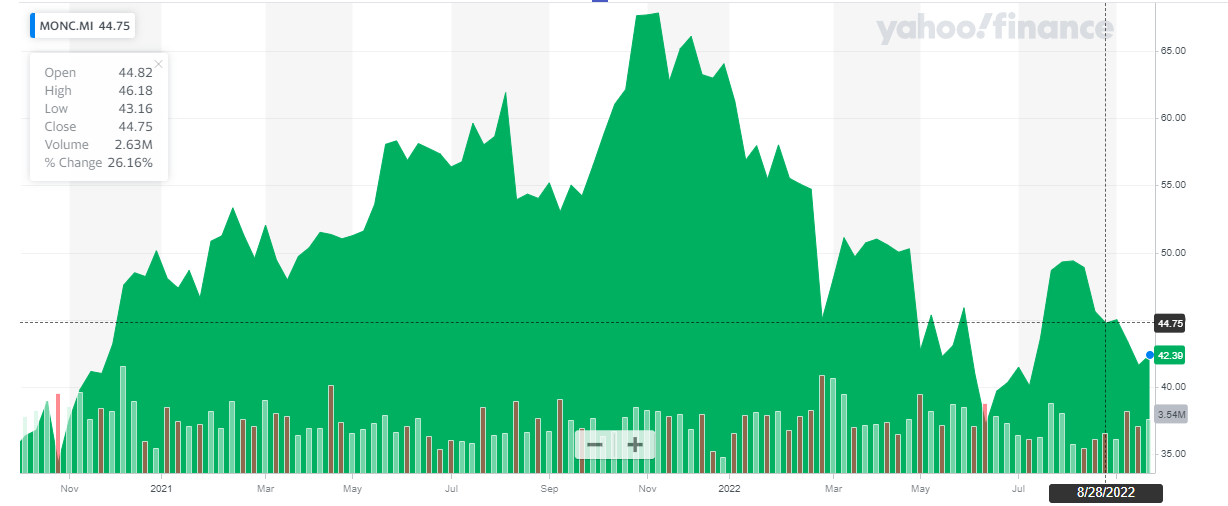

As it has been almost two years since I last looked at Moncler (OTCPK:MONRF) (OTCPK:MONRY), I figured this could be the right time to have another look at this Italian luxury clothing company. The share price initially performed well after my previous article but the company obviously was not immune to the recent market turmoil and the share price is currently trading about 10% lower than in January 2021 when I last discussed Moncler.

Yahoo Finance

Moncler has a primary listing on the Milan Stock Exchange, where it’s trading with MONC as ticker symbol. With an average daily volume of almost 600,000 shares, investors should clearly consider using this primary listing to trade in the shares of Moncler. There are currently approximately 269.5M shares outstanding.

The revenue and net income increased substantially in the first semester

As I will focus on Moncler’s recent financial performance in this article, I’d recommend you to re-read the older article to get a better understanding of Moncler’s business model.

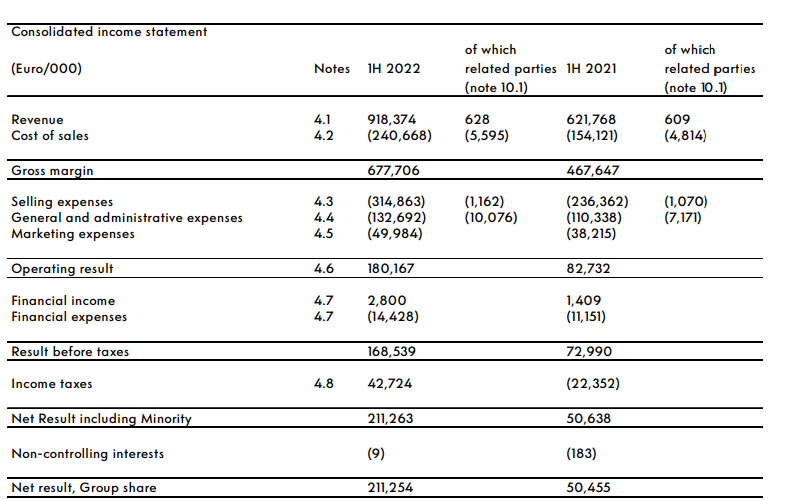

Moncler was able to boost its revenue from 622M EUR in the first half of 2021 to in excess of 900M EUR in the first half of the current financial year. Selling higher end clothes is still a very profitable business as the gross margin exceeds 73% as the operating costs of the products are pretty low.

Moncler Investor Relations

This also had an immediate positive effect on the operating income. Although the G&A expenses and especially the selling expenses increased quite substantially, the operating income more than doubled to 180M EUR. And as the net financial expenses barely increased, the pre-tax income came in at 168.5M EUR. A good result, but the net income was boosted by a massive tax credit of almost 43M EUR. So rather than having to pay taxes on the result Moncler reported a net income of 211.3M EUR resulting in a net income of 0.78 EUR per share.

This tax benefit is entirely related to how the 2021 acquisition of the Stone Island brand is now treated for accounting purposes. According to the footnotes to the financial statements, the tax value of the Stone Island brand was realigned with the statutory value which allowed Moncler to activate a specific Italian tax credit. This is obviously non-recurring and unfortunately the company did not disclose the normalized earnings but I would assume the normalized net income was approximately 40-45% lower than the reported net income.

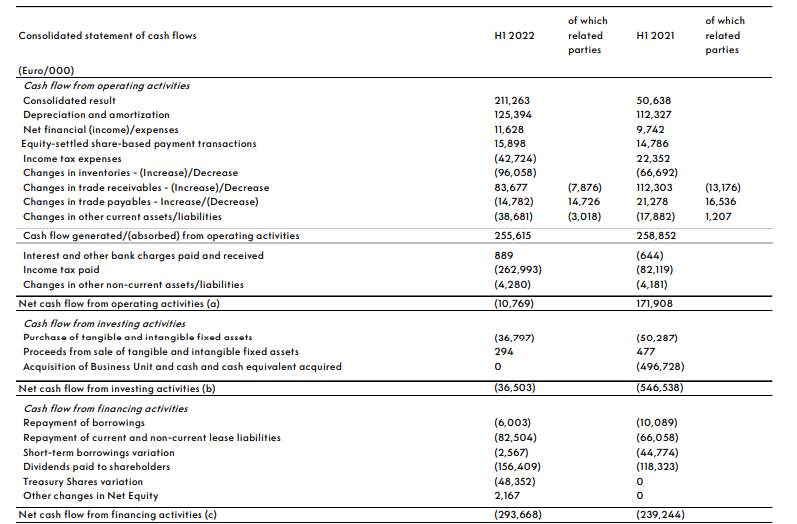

These non-recurring elements make it difficult to put a fair value on a company and it is an important reason why I always like to have a look at a company’s cash flow statements as the special elements are usually non-cash items.

Looking at Moncler’s financial statements, the company reported a negative operating cash flow of 10.8M EUR. A surprise, but when digging into these cash flow results we clearly see more non-recurring items. During the first half of the year, Moncler paid just under 263M EUR in cash taxes. This did not just include the taxes due based on the financial performance in the first half of the year, but also included in Moncler paying off deferred tax liabilities.

The reported operating cash flow also includes a net investment of approximately 65M EUR in the working capital elements but excludes the 82.5M EUR in lease payments.

So on an adjusted basis, the operating cash flow was approximately minus 28M EUR but if I would apply a tax rate of 28% for Italian companies, the normalized tax payment would have been 47.2M EUR which means Moncler’s effective cash tax payment of 263M EUR is quite obviously way too much. On a normalized basis, the adjusted operating cash flow would have been 188M EUR.

Moncler Investor Relations

As the capital expenditures are pretty low (at just 36.8M EUR), the adjusted free cash flow result in the first half of the year was approximately 151M EUR which translates into a free cash flow of 0.56 EUR per share.

We shouldn’t just extrapolate this result as Moncler has strong and weak quarters (as it has a higher exposure to winter-related clothes) and Q1 and Q4 are traditionally the strongest quarters for the company. However, the current economic situation makes me wonder if Q4 will be any good at all as inflation (worldwide) and high energy costs (mainly in Europe) may result in a lower consumer confidence level. That being said, Moncler obviously has set its sights on the upper class of society and could this be less impacted by a widespread economic crisis.

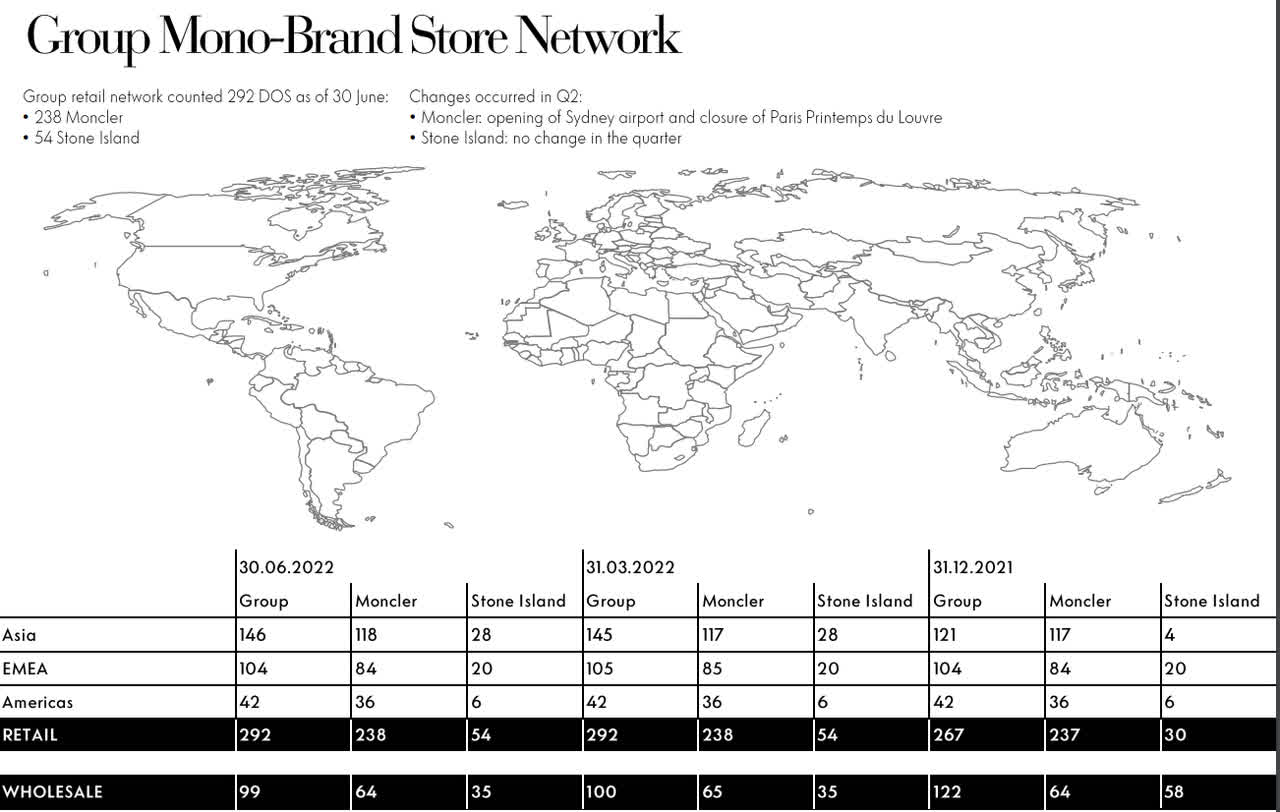

Moncler Investor Relations

Investment thesis

While Moncler has approved a share buyback plan, I’m not sure buying back stock at 30 to 40 times the normalized free cash flow is a good idea. That also is the main reason why I remain on the sidelines for the time being. Although I definitely appreciate how Moncler is run, and while I acknowledge the higher end luxury brands may not be impacted as hard by an economic crisis, I am not establishing a long position at this time.

I will keep an eye on the company and its financial position going forward but I remain on the sidelines right now.

Be the first to comment