Maddie Meyer

Moderna (NASDAQ:MRNA) beat both the top and bottom line in Q2, but upon further inspection of their earnings report, there are too many holes to be ignored.

COVID-19

It’s no surprise that COVID-19, or Spikevax, sales are no longer putting up the massive numbers they once were. For the second straight quarter, revenues declined to $4.75B from their $7.21B Q4 peak due to demand fatigue.

While this may seem irrelevant as the company guided for $21B in sales for FY22, representing 16% growth from FY21, there’s strong evidence to support that management is overpromising and underdelivering.

With everything beyond the first booster becoming optional, vaccinations have plummeted. Just 4% of those 50+ that CDC recommends get a second booster have received it, showing that Americans and even those worldwide are over the pandemic.

Even scientists are saying that receiving too many boosters would be counter-productive. In a recent interview with NPR, Dr. Paul Offit, Head of the Vaccine Education Center at Children’s Hospital of Philadelphia, said that:

The goal of this vaccine is to protect against serious illness. If we’re going to try to protect again mild illness for years then we’re going to have boost a couple times a year and that doesn’t make sense from a public health standpoint.

But even if their lofty expectations are met, President Stephen Hoge acknowledged that revenues will fall dramatically next year saying:

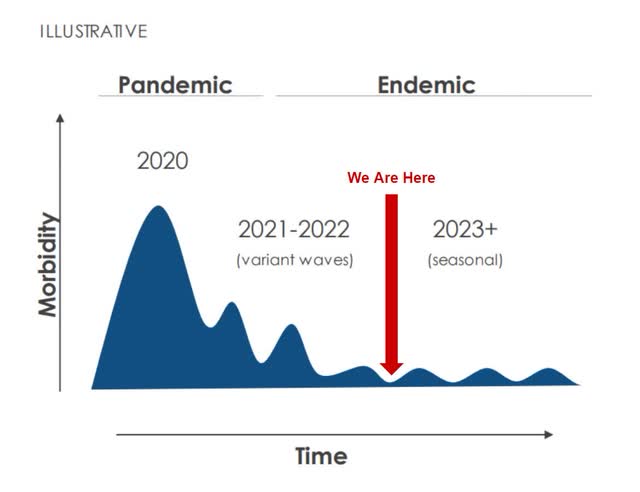

[COVID-19] will become a seasonal market where boosting and elevating neutralizing protection to prevent breakthrough infections will happen annually in a large population and they will benefit from it, just like they do for flu, or they would for endemic human coronaviruses.

Management predicts that the disease will flare up in smaller waves every winter, with new boosters having to be produced annually. However, given the current vaccination rate for approved age ranges and high-risk individuals, these additional boosters will be meaningless if optional.

So as vaccine sales are due to rapidly slow, the question for Moderna becomes “How soon can its deep pipeline generate another blockbuster treatment to spur growth.”

Pipeline

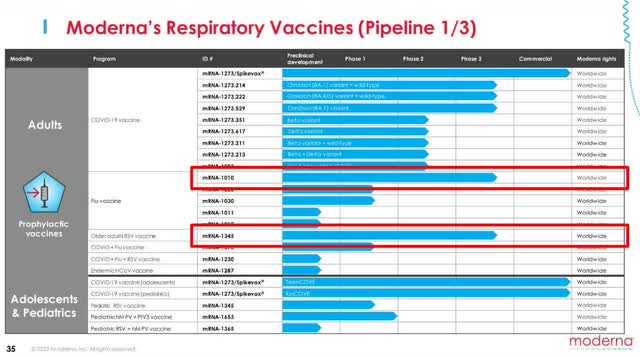

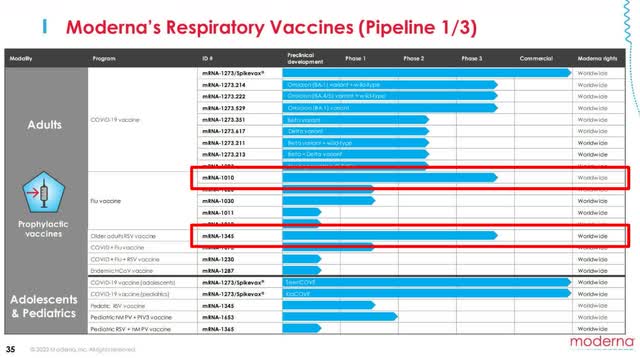

The company currently has 3 drugs, excluding COVID-19 vaccines, in phase 3 trials, but each has numerous problems.

Moderna Q2 2022 Earnings Moderna Q2 2022 Earnings

Moderna’s seasonal flu vaccine (mRNA-1010) kicked off its study in early June, dosing 6,000 adults, and is expected to have results by September. This would mean a commercial launch is just a few quarters away, barring any setbacks.

However, upon entry into global markets, it will face stiff competition from Sanofi (SNY) and GSK (GSK), which dominate the current landscape. Some familiar competitors, Pfizer (PFE) and BioNTech (BNTX), have also joined forces on an influenza vaccine that should be commercially launched by 2024-2025. This will make it difficult for mRNA-1010 to gain a strong foothold in flu vaccines and become a high-profile drug.

The RSV vaccine (mRNA-1345), specifically for older age individuals, is slated for a study completion date of November 30, 2024, meaning a commercial launch would come in late 2025 to early 2026. Here too, Pfizer is right on their tails with an RSV candidate in phase 3 that was proven to be 100% effective for adults over 50, the one age range that Moderna was targeting. And with other companies like Enanta Pharmaceuticals (ENTA) and Merck (MRK) in the race, it will be a tough area to dominate.

Moderna’s CMV vaccine (mRNA-1647) is its best chance for a blockbuster drug. Not only are there no current CMV vaccines, but Moderna’s treatment has reached the furthest out of any company. The only catch is that “furthest” means a study completion date of July 29, 2025, and a commercial launch in 2026-2027.

While the company could establish a strong foothold in the CMV market, this is almost 5 years away, leaving a big question for investors. CEO Stéphane Bancel is overstating that their “robust Phase 3 pipeline could lead to three respiratory commercial launches over the next two to three years,” which isn’t possible, even on an FDA fast track. Without another big launch and COVID-19 sales slowing, Moderna is beginning to find itself in a boatload of trouble.

Even More Problems

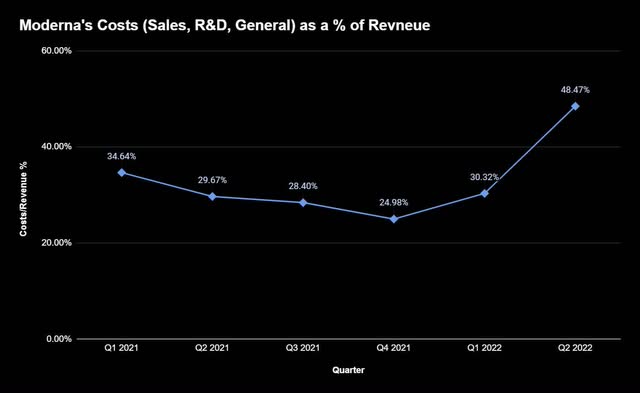

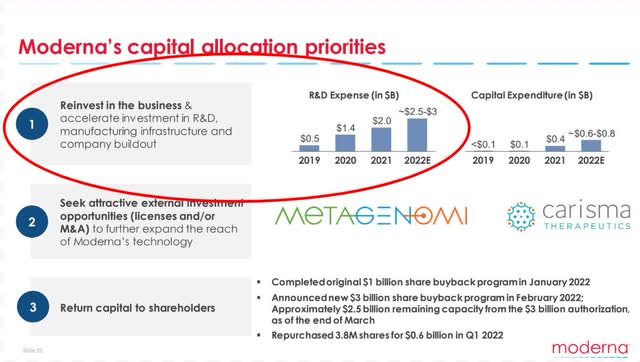

In addition to being behind schedule, the company’s deep pipeline of products, while great for the long term, is adding tons of costs in the present.

They are disproportionately increasing compared to revenue, making up nearly 50% of what Moderna raked in last quarter and hitting profits hard. Seeing this, management decided it was a great time to ramp up its investments.

As the percentage continues to rise, two options will emerge:

- Keep increasing R&D and operating expenses (mostly the cost of drugs in trials), leading to a trickle-down effect on the income statement and balance sheet. With declining sales, a greater portion would go to reinvesting in the business, leaving less money to pay off debt or conduct share repurchases.

- Decrease R&D and operating expenses according to sales, which would also have a myriad of impacts. Without cash to sustain their current pipeline, management would likely go to debt markets to push a drug through FDA trials, and any new treatments or collaborations would be discouraged.

Regardless, both present a lose-lose situation that Moderna will eventually have to face. Its wildly successful COVID-19 vaccine overlooked the absence of not having another major drug, leaving a grey area of 3-4 years where they will have more costs and no revenue growth.

Some Hope

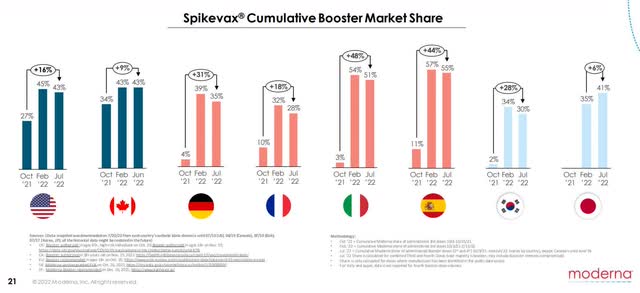

While we paint a dreary picture for this big biotech player, all is not lost. Recently, they announced a $1.74B contract with the US Army to supply boosters, and agreements like this will be pivotal for keeping market share in major countries.

Only if Spikevax establishes staying power will Moderna be able to squeeze out max revenues during endemic phases of the virus. Look for Bancel to be publicly aggressive in trying to secure contracts with governments for 2023 and beyond.

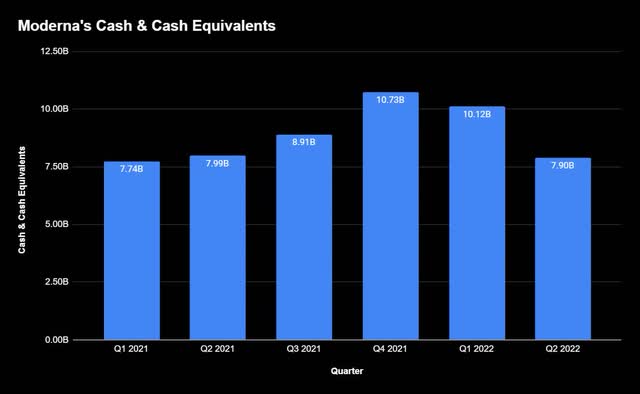

As the company rides the last of COVID-19 momentum, it’s no secret that the vaccine has been a cash cow, something they’ve used to become financially healthy.

With cash at record levels in Q4 and Q1, management flexed its muscles this quarter, announcing a $3B buyback and expanded manufacturing capabilities. Enhancing their global infrastructure now should pay dividends later as more and more drugs get approval.

Even more impressive is their ability to avoid the young biotech trap of getting stuck in too much debt. A debt-to-equity ratio of 0.04 and debt reduction across the board in Q2 reflect a prudent capital structure, allowing them to return value back into the business as well as shareholders in the short term.

Both market share growth and a strong balance sheet are allowing Moderna to beat analyst expectations and ride small momentum swings like it currently is. But 3-4 quarters from now, when problems begin to be exposed, it will start raining and then pouring.

Conclusion

A slowdown was not expected for a youthful company looking to bring advanced mRNA technologies to the medical field, but that’s exactly what is to come. Overpromising on unrealistic timelines is leading to a dilemma of spending more while earning less, a certain recipe for disaster. As Moderna’s stock faces a reckoning, it will be one to look back upon when they prepare for the commercial release of their CMV vaccine, that too assuming everything goes right.

Be the first to comment