RapidEye/E+ via Getty Images

Investment Overview

I last covered MindMed (NASDAQ:MNMD), a company developing “pharmaceutically optimized drug products derived from the psychedelic and empathogen drug classes”, for Seeking Alpha back in July.

In my last note, I discussed some of the difficulties facing drug developers working with psychedelic drugs – which include, besides MindMed, listed companies such as Compass Pathways (CMPS), Bright Minds Biosciences (DRUG), Atai Life Sciences (ATAI), Cybin Inc. (CYBN), and GH Research (GHRS).

The biggest stumbling block is the fact that psychedelic substances such as LSD and MDMA – the substances behind MindMed’s two lead products, MM-120, and MM-402 – are listed by the US’ Drug Enforcement Agency (“DEA”) as “controlled substances”, and fall into the “Schedule 1” category. Schedule 1 drugs are defined as follows:

Schedule I substances by definition have a high potential for abuse, have no currently “accepted medical use” in the United States, lack accepted safety for use under medical supervision, and may not be prescribed, marketed or sold in the United States.

That means that additional permissions to work with the drugs must be sought and obtained, and also that before LSD or MDMA could be marketed for commercial medical use they would have to be rescheduled, which requires the approval of both the DEA and FDA.

Another major issue is that it is hard to obtain patents for drugs like LSD, MDMA, or Psilocybin. According to an article from Harvard Law Review, there are several reasons for this.

Psychedelics, for example, are “products of nature that should remain affordable and widely available”. These drugs have also been used by indigenous communities for generations.

Another objection is that awarding patents to a handful of companies may restrict or stifle innovation, and restrict access to therapies. Further adding to the difficulties is the fact that, although scientists worked with psychedelics in the ’50s and ’60s, they became banned substances in the ’70s as a result of President Nixon’s War on Drugs.

In short, psychedelics is a tricky landscape to navigate, but it hasn’t stopped the above companies from attempting to prove their usefulness and trying to secure patents for their use (under certain prescribed conditions such as at a designated clinic under the supervision of a trained psychotherapist), and secure approval for commercial medical use.

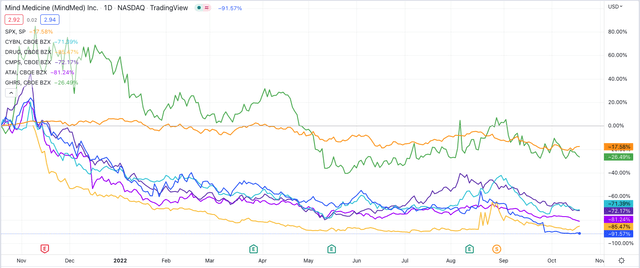

Share price performance of selected companies developing psychedelic drugs. (TradingView)

As we can see above, however, over the past year the falling share prices of these companies illustrates the difficulty of the mountainous task faced and the market’s fading belief that it can be scaled successfully.

MindMed’s share price has been the hardest hit. As I predicted they might be in my previous note, MindMed was forced to complete a 1-15 reverse stock split at the end of August in order to regain compliance with Nasdaq listing laws (which require share prices to trade >$1) although the share price has sunk from a price of $15 post split, to just $3 at the time of writing.

With the stock price currently so cheap, despite the headwinds listed above, is there still a case for investing in the company? In this post, I’ll examine recent progress in some more detail and speculate about whether there may be a case for an upside.

Market Overview

The use of psychedelics to treat depressive diseases certainly has its advocates and has always done so historically – in 21 studies prior to 1974, LSD use led to a 95% reduction in symptoms in a patient population of 512 patients with anxiety, depression, and neurotic illnesses, according to data shared in a recent MindMed investor presentation.

The hard part has been winning mainstream approval for the use of psychedelics to treat mainstream conditions, although there are signs that may be changing. The FDA has designated MDMA and Psilocybin as “Breakthrough Therapies – in 2017 and 2018 respectively – there are several non-profit organisations promoting their medical use and some representation within government.

Sports personalities – such as ice-hockey player Daniel Carcillo, who has founded a psilocybin startup, and NFL star Aaron Rodgers, who has spoken about using Ayahuasca to improve his performances -have helped to spread the message.

Psilocybin and Ayahuasca are also seen as a potential solution to the mental health crisis amongst veterans, illustrated by the emergence of the Heroic Hearts Project, which runs Ayahuasca retreats and is working with Imperial College London to study Psilocybin as a means of treating head trauma and post traumatic stress disorder (“PTSD”).

The market for psychedelic drugs has been estimated to be ~$3.2bn, rising to $6.3bn by 2026 as their value becomes increasingly recognised for treatment of different types of depressive treatments, such as bi-polar, suicidal ideation, drug and alcohol dependence, and anxiety.

Johnson & Johnson’s (JNJ) nasal spray Spravato – chemically similar to the party drug ketamine – was approved for commercialisation in 2019, although JNJ has not been sharing sales figures and the market has apparently been sceptical. Relmada’s depression candidate REL-1017 – which has a similar mechanism of action to Spravato – failed to meet endpoints in a pivotal study last week.

To summarise, treating depressive disorders is big business for Big Pharmas – Eli Lilly’s (LLY) Zyprexa, indicated for schizophrenia is a >$400m per annum seller, and AbbVie’s (ABBV) Vraylar earned revenues of >$1.7bn in 2021 for example – and for smaller commercial-stage biotechs – Vanda Pharmaceuticals (VNDA) Fanapt, and Intra-Cellular’s (ITCI) Caplyta, both generate >$100m revenues per annum.

If psychedelic drug developers could find a way to prove its drugs work, win an FDA approval, and have the drug reclassified from Schedule 1 to Schedule 2 (or 3, 4, or 5) there is a market ready to exploit, given that, despite their ability to drive sales, most approved depressive condition drugs have a very limited clinical benefit – the bar for approval is therefore set low.

Pharmas have generally been uninterested in developing psychedelic drugs since they are difficult to obtain patents for, meaning the return on investment is much lower, but companies such as MindMed and Compass Pathways are finding creative ways to patent the overall treatment experience, rather than the drug itself, although many of MindMed’s 26 pending US applications are in traditional areas such as compositions of matter, methods of treatment, as well as diagnostic devices and analytics related to psychedelics.

MindMed’s Potential Path To Approval

On its Q222 earnings call, MindMed advised analysts that after a review of its pipeline assets it had decided to focus resources specifically on just two assets – MM120 – LSD D-tartrate – and MM402 – MDMA. That means that development of MM-110 – Zolunicant hydrochloride, a derivative of ibogaine – indicated for opioid withdrawal – has been halted for the time being.

MM-110 had returned positive data from a Phase 1 placebo controlled study of 108 healthy volunteers, but the FDA subsequently requested additional preclinical characterisation of the drug, which must be completed before a Phase 2a study can begin.

MM120 – a proprietary pharmaceutically optimized form of lysergic acid diethylamide (“LSD”) – is being developed for both Generalized Anxiety Disorder (“GAD”) and Attention Deficit Hyperactivity Disorder (“ADHD”).

In GAD, a Phase 2b study has been initiated which uses doses of 25mg, 50mg, 100mg, and 200mg over a 4-week period, with follow-ups at 8 and 12 weeks. Enrollment target is 200 patients, and primary endpoint is the Hamilton Anxiety Rating Scale (HAM-A), with secondary endpoints being other depression rating scales such as the Montgomery-Åsberg Depression Rating Scale (“MADRS”).

In ADHD the dose level will be 20mg q3d over a 6-week period, with a follow up at 10 weeks. The Primary Endpoint will be Adult ADHD Investigator Symptom Rating Scale (“AISRS”). Results from each trial are not expected until late 2023, however, presumably due to the difficulty of enrolling patients.

The conditions of administration are almost as important as the drug itself, with continual monitoring of the patients through pre-treatment, treatment, and post-treatment, plus professional psychological support if necessary, remote monitoring, and monitored sessions.

In collaboration with the University Hospital Basel, MindMed has been carrying out a Phase 2, placebo controlled, investigator initiated clinical trial of LSD and the treatment of anxiety disorders at London’s PSYCH Symposium. On the Q222 earnings call, MindMed management reported that:

The study drug was well tolerated and then a dose of 200 micrograms resulted in significant and strong reductions of Global State-Trait Anxiety Inventory, or STAI-G 16-weeks after treatment in the between subjects analysis, with a statistically significant improvement from baseline compared to placebo.

This is important because it shows that LSD can have a positive effect and suggests that the two ongoing clinical trials can deliver the required results to make a push for FDA authorisation a genuine possibility. Compass Pathways has also returned positive data from a Phase 2 trial of its psilocybin formulation, using a similar “monitored sessions” approach, even providing music, soft furnishings and a psychologist on hand at all times.

In summary, MindMed ought to have a good chance of success in these trials, but in the meantime, the company must deal with more severe headwinds that threaten to overwhelm the company.

On the MM-402 front, management discusses some positive preclinical data on its last earnings call, and adds that:

In addition to our collaboration with University Hospital Basel, we expect to initiate a comparative Phase 1 pharmacokinetics and pharmacodynamics trial of RS and recite MDMA and healthy volunteers in the third quarter of 2022.

Objections to MindMed’s Approach From Former CMO

So far in this post, we have dealt mainly with the positive aspects of MindMed’s business – and actually, there is a further positive in the fact that management says it has a cash runway that ought to last until 2025, taking in the clinical readouts in the GAD and ADHD studies with MM-120.

What, then is the reason for the rapidly declining share price? Most of all, in my view, it relates to two things – the market’s lack of belief that the FDA – or overseas governments – will permit psychedelic drugs to be approved and rescheduled, and the market’s lack of faith in MindMed’s management.

I have already covered the former objection – although there is evidence that psychedelics can work, and there is a groundswell of support for their use, it is not yet substantial enough or significantly well-funded to persuade governments to seriously consider change. Plus, the Big Pharma industry is unlikely to throw its weight behind the psychedelic movement on grounds of profitability, and may in fact oppose a changing of the regulations.

In regards to the latter, MindMed’s original co-founder Dr. Scott Freeman appears to no longer be with the company. Instead, he was a co-signee of a letter sent to MindMed ahead of its Q222 earnings announcement expressing concern at the way the company was being run, and attempting to have Freeman added to the Board of Directors.

The letter was from FCM MM Holdings, who “together hold approximately 5.6% of the total shares outstanding”, the letter states. Amongst the complaints are the fact that:

In FY 2021 per MindMed’s SEC 10-K, MindMed spent $4.24 million in “external R&D collaborations” and an additional $6.107 million in payments to third-party companies for research and development of non-key drugs and just $11.590 million on payments to third-party companies with respect to the key drugs.

The letter also outlines a new development plan summarised as follows:

We believe that MindMed could significantly reduce the development time of MM-120 (LSD) and MM-110 (18-MC) and have a marketable drug within four years while reducing cash-burn by approximately fifty percent … The punchline of the strategic plan is simple: drastically cut development time of MindMed’s two original drugs and slash annual cash burn from forty-five million dollars to twenty-four million dollars.

It also states that MindMed will struggle to complete its “5-arm” study of MM-120 in less than four years, and suggests the compensation plan for Senior Management to be changed in order to provide greater incentivisation.

Under our proposed plan, cash executive compensation would be significantly reduced. Executives received a total of over two million dollars in salary and bonuses as the stock price dropped approximately 60% from February 10, 2022, to August 9, 2022.

Although MindMed promised to respond to this letter in time in its Q322 earnings call, it does not seem to have done so. The overall impression is of a company that is unsure of its path forward, and that the ship may have been blown too far off course to find its way back to calmer waters.

The company made a ~$27.5m acquisition of HeathMode Inc in 2021 in order to create a more digitally savvy, holistic approach to the overall treatment process – another move criticised in the FCM MM Holdings letter.

There may be some synergies between a tech-enabled platform to monitor patients’ thoughts and feelings and a successful treatment regime, but equally, when trials are at such an early stage, it could be considered an unnecessary luxury, as could the investments into non-core drugs, that do not seem to have borne fruit.

Management controversially opted to raise ~$30m by pricing 7.06m shares plus warrants at $4.25 per share at the end of September, which seems an odd decision given its claims to have had sufficient funding to meet its trial goals. The raise damaged the share price which now seems to be heading back below $1 again despite the recent 1-15 reverse stock split.

Conclusion – Struggling MindMed Needs To Play Long Game But Short-Term Headwinds Threaten Survival

In my last note on MindMed, I suggested that if the company was still in existence in 2025, then its shareholders could well make a substantial return on their investment, given there are strong signs that psychedelics can successfully treat patients – but that there was a significant chance of the company failing to survive that long.

On the face of it, the two trials of MM-120 represent an opportunity to establish proof-of-concept to treating depression with LSD whilst the MDMA opportunity is intriguing, but equally, it seems highly doubtful that the FDA will be swayed by such a small data set.

In summary then, although we can be respectful towards the trials being conducted with MM-120, we likely can’t ignore the fact that data is not being collected quickly enough or in large enough quantities for the company to drag itself out of its share price slump.

I will maintain a Hold rating on the company, as I would like to see management stretch its funding out to 2025 and be a part of the psychedelic story, but I do not think MindMed is the horse to back in this particular race. Perhaps the company does not need to be publicly listed at this time, and perhaps, in a few more months, it won’t be.

Be the first to comment