Mohammed Haneefa Nizamudeen/iStock via Getty Images

Milestone Scientific (NYSE:MLSS) has two divisions which are each based on the same core pressure sensing technology for injections. Their cash-generating mature business is in dental, where their devices are used for precision anesthetics.

The company has made significant investments in developing the CompuFlow, which uses the same technology, enabling doctors to give precision epidurals before child delivery, and the CathCheck for real-time monitoring of catheter position.

The company has been buffeted by the pandemic as late as Q1 this year as many pregnant women opted out of vaccination which prevented their salespeople from entering the operatories, limiting their ability to demonstrate and trial the CompuFlow.

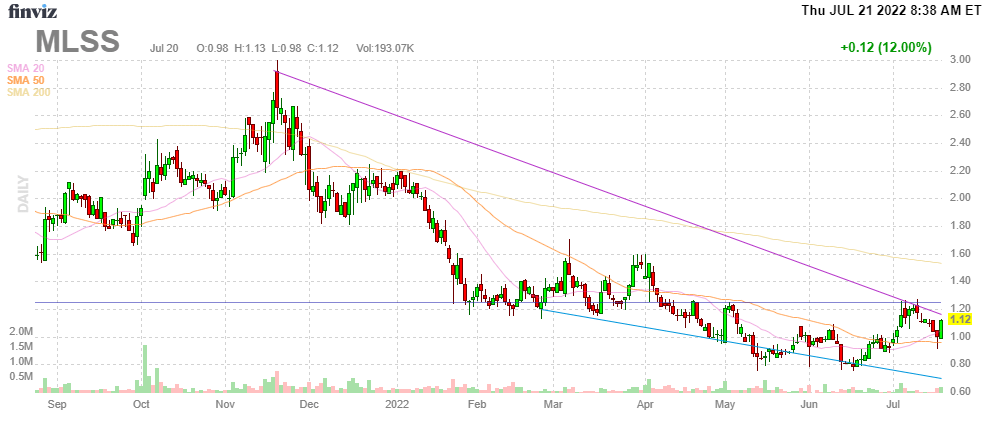

FinVIz

Dental business

Management is making renewed efforts to grow their dental business as there are significant opportunities here and the business is cash generating. They have adopted what they call a decentralized, multi-channel distribution approach.

One new plank of that is working through large DSOs (dental service organizations). These DSOs already service like 30% of the market, and this is expected to significantly increase to 75%-80% in the next 10 years.

The company has added DSOs like Keystone Dental Group (with 60+ sales reps), the American Independent Dental Alliance (US’ premier DSO network of private practice dentists, supporting 1000+ dental practices) and they also added a new global distributor.

Q1/22 results were a little disappointing with revenue declining by $106K to $2.7M in relation to Q1/21 as the latter was a quarter where dental practices were opening up after the pandemic plagued FY2020.

Medical business

Revenues collapsed to just $7.5K (from $71K in Q1/21) but this was on the Omicron wave, as explained above. Their sales strategy is focused on:

- A few key regions like Florida, Texas, and the tri-state New York areas

- Tier 1 university teaching hospitals, in order to gain credibility, reduce the sell-cycle elsewhere.

The CompuFlow has been approved for a major Northeast teaching hospital, but we’ll have to see when the sale actually materializes.

With 11M epidurals a year, pain management has 2x the market size of child delivery and (Q1CC):

not only includes hospitals, but also specialty centers, outpatient centers, and sports medicine centers.

They have some success with pain management practices like the Cypress Surgery Center and the Galileo Surgery Center, California, as well as Dr. Miguel de la Garza and Surgery Partners, one of the largest surgical services businesses in the country, for use across their network.

Thoracic epidurals are already approved in the EU. Management has filed for FDA approval in the VS where it constitutes 30% of epidurals in the US, so it’s a significant market.

The advantages of the CompuFlow in thoracic are considerably higher as the optimal space for an epidural is much smaller higher up the spine, resulting in a morbidity rate of 17% (versus 5% for child delivery) and a host of risks (Q1CC):

include epidural hemorrhage or abscess, subarachnoid block, spinal cord root injury leading to permanent motor visits, TEA-associated cardiovascular respiratory collapse, and local anesthetic toxicity. We believe our technology platform can address many of these risk factors, but thoracic is just one of many potential indications we plan to pursue.

So progress is still very tentative, but as we argued above, it doesn’t take much in terms of device sales to put the company on a sustainable financial path.

Finances

Some basic metrics

- Revenue $2.7M versus $2.9M in Q1/21

- Dental revenue declined by $106K to $2.7M as Q1/21 was boosted by the reopening of dental practices

- Medical revenues collapsed to $7.5K versus $71K in Q1/21 on Omicron restrictions

- Gross profits $1.7M or 62% vs $1.8M and 62% in Q1/21

- OpEx loss $1.9M vs $1M in Q1/21

- Net loss $1.9M vs $1M in Q1/21

- Cash $13.3M

Management believes that there will be a ramp-up in sales in Q3.

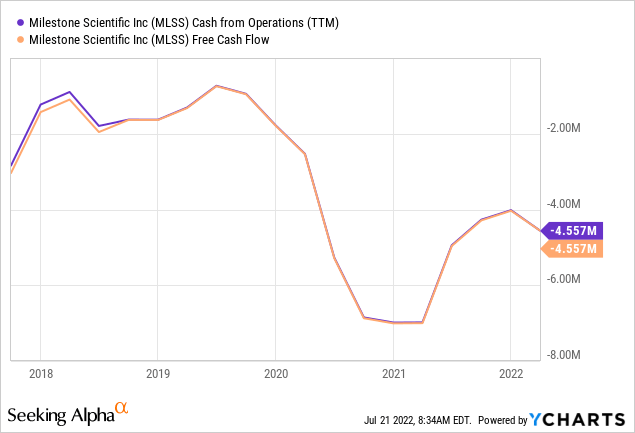

With $13.2M in cash and equivalents, the company has ample resources to keep going at these levels of cash burn.

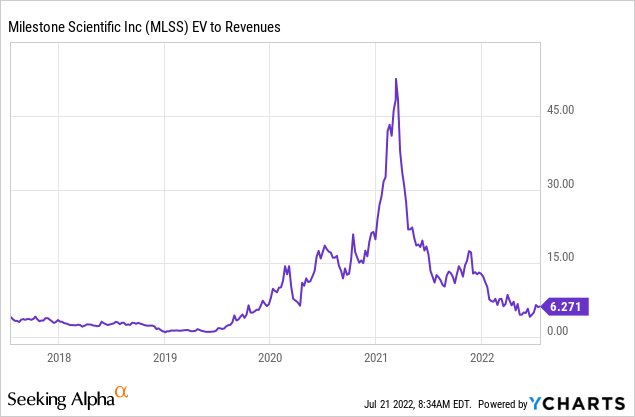

Valuation

Some relevant data:

- 68.4M shares out

- 7.5M warrants RSA and options so 76M shares fully diluted

- Market cap $85M

- Cash $13.2M

- EV $72M

- FY22 Revenue $11.3M

The shares sell at 6.3x EV/S. Analysts expect an EPS of -$0.12 this year, rising to -$0.10 next year.

Discussion

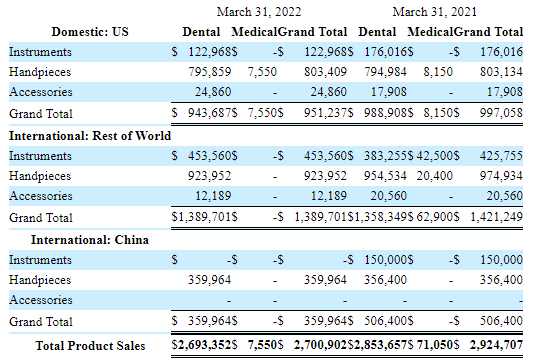

Here is why we like the shares, look at what we consider perhaps the most insightful table of the 10-Q:

MLSS 10-Q

The main takeaway is that out of a total $2.7M in product sales (dental only), $2.1M or a whopping 78% come from handpieces (a fraction of which, or some 37K inf accessories).

While we’re sure they exist, we aren’t aware of any other company like it, this must be one of the ultimate razor and blade business models. Sell a device and the company is guaranteed a long stream of sales of handpieces.

While they’re not splitting cash flow figures out in the 10-Q, management argues that their dental business is generating cash. The dental business produced a modest $353K in net earnings in Q1 but that’s because they revived investment in S&M, and this is visible as net earnings in Q1/21 were $1.2M.

And this happens at a pretty modest scale of device sales. In Q1 they sold just $576K worth of dental instruments or $2M+ a year. That isn’t a whole lot. Now, they’ve been doing that for some time, so their installed base is multiple years of that.

And they have neglected their core dental business for years developing the CompuFlow, treating their dental business as a cash cow. They have amassed 19 US patents and 133 foreign patents.

We think the case for using their injection technology in medical settings is stronger than that in dental (which is the reason they neglected their dental business).

There are considerable risks attached to traditional epidurals. Some 5% of patients experienced accidental dural puncture using the traditional loss of resistance technique resulting in the leakage of cerebral spinal fluid. This is a large number as there are 3.6M hospital births in the U.S. with over 70% employing epidurals.

This can lead to complications like severe headaches, pain, the need for additional procedures, and transient or even permanent paralysis. So using the CompuFlow saves hospitals time, money, and embarrassment (litigation, readmission etc.) and saves patients considerable risks. There are numerous studies backing this up.

The economics are also pretty sound, saving hospitals some $508 per epidural, on average. There are signs of acceptance, like a hospital win in Italy, and a group purchasing agreement with Premier, a large purchasing organization for some 4000 hospitals, and some of these hospitals already purchased (see here, here, here, here and here).

There’s also recent news of a sale and new distributor in Greece. It is starting to add up. Perhaps it doesn’t look all that impressive, but one should keep in mind this was largely during a pandemic, selling new devices without a CTP code wasn’t the easiest business proposition.

We conclude from this that this slow start is deceptive and that the CompuFlow still has an opportunity to become the standard of care in epidurals and not just in childbirth, but in other several segments like pain management and thoracic) as it reduces morbidity (which is 5% in child delivery, up to 17% in thoracic) and associated cost and patient risk.

Some pain clinics already have included the CompuFlow in their pain management practice. There was even a first sale to a veterinary practice opening up a whole new market segment.

What helps considerably is the Category III CTP code that was issued by the American Medical Association and will go into effect on January 1, 2023. This improves reimbursement and hence the economics of adaptation for hospitals.

The development cost of the Focal One are now behind us, although there are considerable costs to be incurred in training and sales efforts.

We should also not forget that their dental business still generates cash and has significant expansion opportunities, which the company is now again pursuing, after treating the business as a cash cow for multiple years.

Conclusion

The CompuFlow is gaining traction. This has been a slow process but that’s largely the result of the pandemic and the lack of CTP code. One could look at this as a glass half-empty or half-full.

We prefer the latter as the CompuFlow actually has gained traction despite these considerable handicaps. With regard to their dental business this too is a glass half empty/full situation.

Can they revive growth in their dental business? The jury is still out, but the business generates a nice long tail in consumables already and it has been sort of neglected as management deemed opportunities in the medical field were larger and means were limited.

So considerable risks remain. The company isn’t profitable, and the jury on traction of the CompuFlow and renewed growth in dental is still out. But that’s why the shares are at $1. This is risk/reward.

We think the case for hospitals to adopt the CompuFlow are sound and the signs of the CompuFlow gaining traction are undeniable and promising. The data on a revival in dental is less convincing at this stage, but it’s early days yet.

If you’re willing to accept considerable risks, the rewards can be substantial. The company still has enough cash to last at least 6-8 quarters, and this is enough of a window of opportunity for the company’s fortunes to take a large leap forward.

Be the first to comment