Andrii Yalanskyi

Apartment rents have soared throughout the country and the Orlando submarkets are no exception. Rising housing costs are a major contributor to the crushing inflation we are currently experiencing. The Fed will use interest rate hikes as a cudgel to slow the pace of price increases. State and local authorities will consider other measures to maintain housing affordability.

Earlier in August, the Orange County Florida board of commissioners moved to put a measure on the November ballot to let voters decide whether to limit how much landlords can increase apartment rents. This issue of rent control is contentious, and the referendum results will be closely followed by cities across the country that are facing the same housing issues. While the vote is months away, we might do well to see which multifamily REITs face the most exposure in Orlando.

Everyone wants to go to Disney World

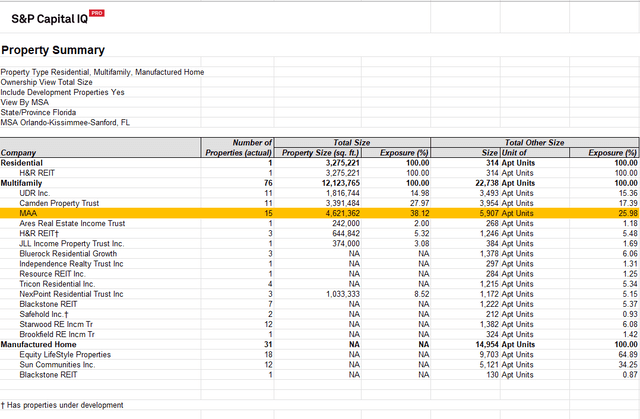

Orlando’s resurgent, post-pandemic tourism industry means jobs, which means in-migration and household formation, and that opportunity has not escaped the apartment REIT Sector. With a quick peek into Portfolio Income Solutions Property Directory, we can see who has exposure and how much.

Basically, any apartment REIT that wanted sunbelt exposure already owns property in Orlando. Mid-America Apartment Communities (NYSE:MAA), however, has the dominant position with ownership of 5,900 (26%) of the roughly 22,700 public company owned units in the Orlando MSA.

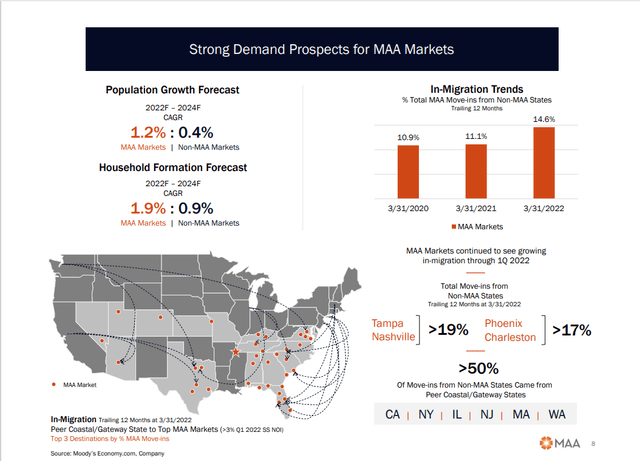

All REITs study economic and demographic trends in efforts to identify which markets will provide the most predictable success. They want to know which populations are growing the fastest, which markets are forecast to have the strongest pace of household formation, and they want to buy in cities that people are moving to and avoid the ones from which they are leaving.

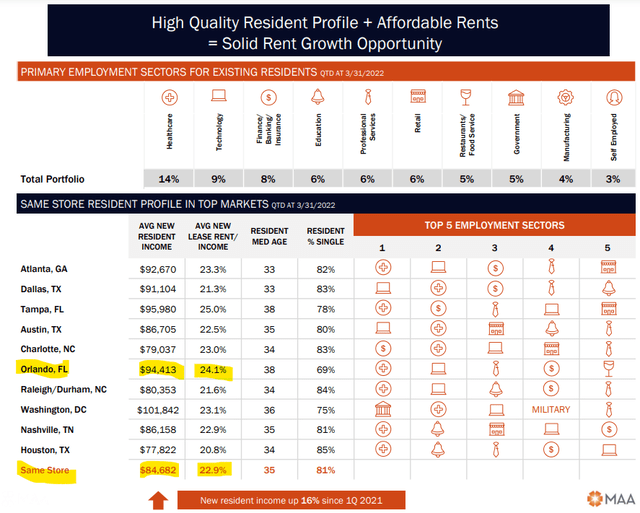

The chart above describes these factors for all of MAA’s submarkets, not Orlando specifically. Based on data out from Yardi Matrix, MAA management does believe that Orlando is in a relative sweet spot for growth.

So much so that, during the 2nd quarter, they purchased a 4-acre land parcel in Orlando upon which they will build 300 units in 2023, increasing their Orlando unit count by 5%. They choose to pursue new development in locations where it is anticipated demand is going to significantly outstrip supply.

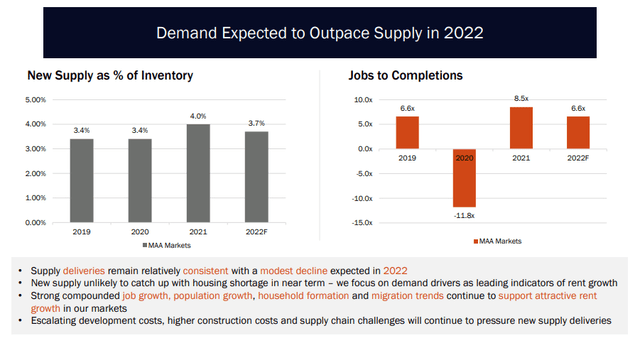

MAA obviously perceives that supply/demand imbalance in Orlando is very favorable, so they can build without cannibalizing their existing portfolio. And that brings us back to the issue of rent control.

Free Markets or Regulation?

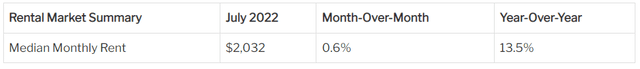

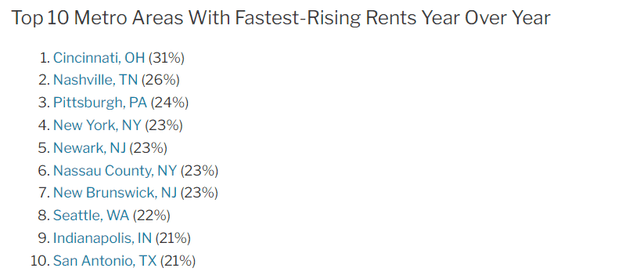

Late last week Redfin published their monthly Rental Market Tracker and detailed the July rent trends in all the major US metros.

The median monthly rent of $2,032 was 13.5% higher than July of 2021, but the pace of rent increases slowed for the second month in a row. Orlando’s median rent was $2,164 or 14.1% higher than the year prior. Orlando rents are higher and grew faster than the national median, but the pace of increase didn’t even approach the top 10.

So, while renters in Orlando are really feeling the pinch of inflation, how many more reports like this one will it take before officials in Cincinnati or Nashville feel the need to cap rent increases? New York City has had various forms of rent control in place for decades, but it didn’t prevent them from having the 4th fastest rent increases in July.

Last November, St. Paul, MN, voters approved a policy that caps rent increases at 3% annually. Since that vote, new construction has slowed, and many builders say the new policy has forced them to pause or re-evaluate new projects. Rents may have been capped, but the problem of housing availability remains or has worsened. Proposed changes to St. Paul’s rent control policy will be announced at a public hearing, today.

Inflation Hurts

Apartment rents rising at double digits are sure to strain budgets. The pain is compounded when the price of gasoline, groceries, interest rates, and energy are all rising simultaneously as well. Though consumers are being attacked on all sides, landlords of all types would argue that the rent increases are affordable and in line with what we’ve seen historically. MAA management joins the chorus.

In his 2Q earnings call opening remarks, MAA CEO Eric Bolton was quick to note that leasing traffic was up 11% year over year and that:

the rent-to-income ratio of the new leases executed in the second quarter was 22%.

Like every good management team, MAA knows a lot about its customers and the demand for their product.

This rent-to-income ratio is comfortably within historic norms. In other words, their apartments remain affordable within sustaining demand, not just for Orlando, but for their entire portfolio.

Supply and Demand

Though well-meaning, rent control proposals don’t solve the problem of availability of affordable housing. Rent controls can slow the pace of rent growth, but they do not address the need for more housing in communities that are rapidly growing jobs and household formation. As St. Paul is coming to understand, capping rents can serve as a financial disincentive to much-needed new housing development.

Today, Orlando is attempting to navigate what feels like the runaway cost of housing. Tomorrow it may be any of dozens of other markets that will need to address the same issue. It will happen in other MAA markets.

Throughout the nation, sustaining demand and limited supply continue to drive higher the cost of occupying an apartment. Increasing supply or demand dampening recession may combine to slow this inflationary trend. Rent controls will not.

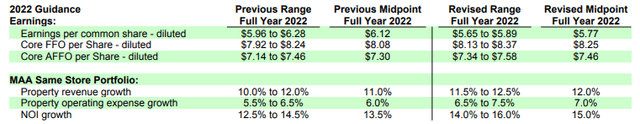

In its 2nd Quarter 2022 Earnings Release and Supplement, MAA significantly increased full year 2022 Guidance.

Contrasting this confident forecast with the -22% YTD decline in MAA’s share price makes me resolve to stay long. If the stock market presents the opportunity, I will get longer.

Be the first to comment