MF3d/E+ via Getty Images

I once described Microvast (NASDAQ:MVST) as a pick-and-shovel play on electrification. With the company producing li-ion batteries for use in commercial and passenger vehicles, it provides direct exposure to the decarbonization of transport. This forms one of the most significant macro trends of our time. Indeed, the EU just recently endorsed a push to end new internal combustion engine vehicle sales by 2035. This will place the bloc on a list that includes California, the United Kingdom, and South Korea.

The phase-out of fossil fuel vehicles is a tangible trend that in theory should drive demand for Microvast’s batteries and form a multi-year tailwind. So while the competition seems abundant with recently public companies like FREYR Battery (FREY), Romeo Power (RMO), and QuantumScape (QS) all pushing for market share, the sheer scale of the opportunity likely means that most of these can be supported if they execute properly.

It’s not hard to see why the rise of EVs has produced so much hype and unrestrained euphoria. There’s undeniably a structural shift toward EVs happening, one that looks set to create a decarbonization wave and a TAM set for a nearly pertinent growth.

So why then has Microvast collapsed?

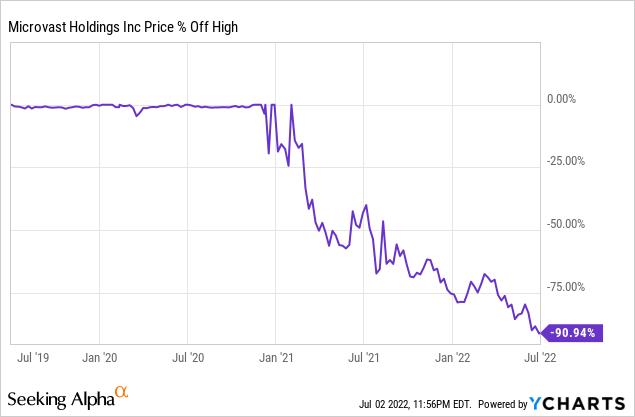

The company is down 91% from its all-time highs, a material move that has seen its market capitalization fall to $672 million from a go-public equity value of $3 billion. For many Microvast bulls, it should have not been this way. The company was seen as a relatively prudent choice in a space characterized by experimental battery startups and pre-revenue companies. For bears, this was always going to be the outcome as Microvast went public at a significant multiple to revenues forecasted years down the line. This was always bound to increase the susceptibility of the stock to downside swings.

Financials Tilt The Narrative Towards The Bears

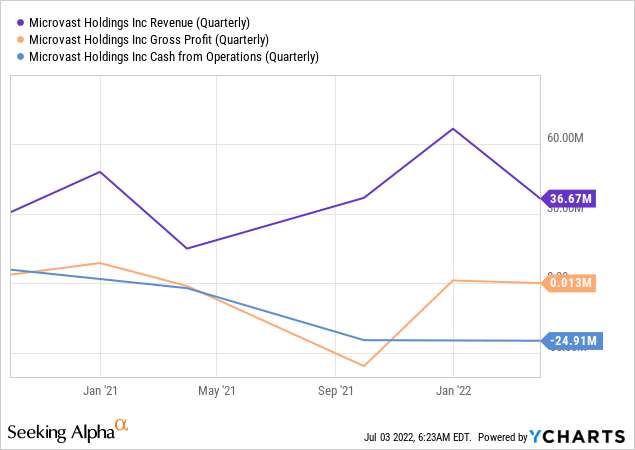

Microvast last reported earnings for its fiscal 2022 first quarter which saw revenue come in at $36.7 million, a 146% year-over-year increase. Management stated that this was driven by growth in the Asia Pacific region with India especially showing a strong performance. With Microvast’s order backlog growing to $120.8 million, an 85.6% increase compared to the previous year, the company likely looks set to realize consecutive quarters of strong revenue growth. Hence, with gross profit positive at $13,000 compared to a loss of $1.2 million in the year-ago quarter, this could be done with marginally less cash burn than in past quarters.

Operating expenses were exceptionally high, increasing to $43.4 million, up by 277% from $11.5 million in the year-ago period. While a large portion of this was a large non-cash share compensation expense, the company’s cash loss from operations still rose significantly to reach $24.9 million. With cash loss from operations in the comparable year-ago period at $2.2 million, this quarter represented an 11.3x increase from the year-ago figure despite corresponding revenues increasing by a fraction of this.

Capex was at $41 million with Microvast guiding for total capex for 2022 to be between $300 million to $350 million as the company expands its battery manufacturing capacity in China and the US. Both of these factories are expected to be fully online by the end of 2023.

With revenue guided to grow by 35% to 45% from its fiscal 2021, Microvast is set to realize revenue of $213 million in the middle of this range. This would place its forward price to revenue multiple at 3.15x. This seems low for a company growing revenue at triple digits but has to be compared against the viscousness of current unprofitability. The company held cash and equivalents of $416 million at the end of its last reported quarter which should be enough for its capex needs, but not enough for a heightened capex spend in 2023 especially if operational cash burn remains constant for the next three quarters.

The Electrification Of Transport

Microvast went public when the market was high on collective hopium on the expected opportunity from the rise of electrified vehicles. This was a period when there was an almost daily announcement of new companies going public via SPACs. They were all doing so on $1 billion valuations despite the majority of them being pre-revenue or chasing complex technical solutions that were still many years away from commercialization.

But even against the capital destruction seen over the last year, the shift to zero-emission vehicles continues to pick up pace and as more countries announce bans on the sale of new ICE vehicles beyond certain future dates. This has caused a great scramble among traditional automobile companies and a plethora of startups to fully realize the opportunities held by the fast-expanding market. Microvast could be a buy on further gross margin expansion and on financing plans being announced for fiscal 2023.

Be the first to comment