Nattakorn Maneerat/iStock via Getty Images

Investors took an interest in MicroStrategy Incorporated (MSTR) after HSBC Holdings (HSBC) banned its customers from trading the stock on their online platforms early in April 2021. The bank’s reason was that MSTR was trading as a “virtual currency product” after it opted to sell its bonds to purchase Bitcoins (BTC).

Since April 1, 2021, HSBC has added 3% to its share price while MSTR is up 40.13% (Y/Y) almost similar to BTC at +46.90% in the same period. Notable, also is the fact that Bitcoin is 13 years old since it was first mined by Satoshi and its market value has already hit the trillion mark.

Thesis

MicroStrategy’s status as a publicly listed stock in the US offering Bitcoin exposure will prove essential for the growth of its enterprise analytics business in the long term. While the two entities may not be linked, thousands of online-based businesses are adopting the use of Bitcoins for investments, operational and transactional purposes. Growth investors will find this stock worthwhile in the long-term as the company seeks to diversify its demographic outlook by seeking a cutting-edge clientele through decentralized systems such as the BTC offers.

Corporate Growth Strategy

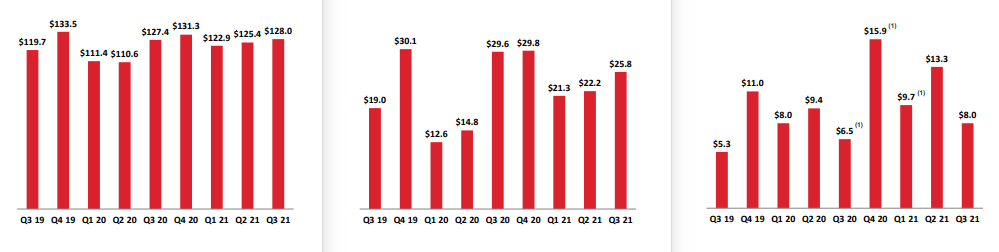

MicroStrategy’s revenue in Q3 2021 rose above the pre-Covid-19 level with a 7% margin to hit $128 million. It could have been higher into 2022 if it were not for the 13% decline in revenues from software product licenses that fell to $25.8 million. The quarterly decline in subscription billings in 2021 was offset by an increase in annual subscriptions.

Source: MicroStrategy

We note that product license revenues were highest in Q4 2019 at $30.1 million. At the time, quarterly revenues also registered the highest gain at $133.5 million representing an 11.5% increase from Q3 2019. In my view, an increase in product license will be directly proportional to a surge in total revenues in 2022.

Still, MicroStrategy’s productivity has increased 31% from 2020 to 2021 supplemented by an increase in investments in cloud, security, and original equipment manufacturer (OEM) parts. The company aims to augment its product leadership through open software. It will soon have a global reach in enterprise customers and OEMs.

We can expect product license registration to increase as the company transitions to enterprise and SaaS cloud. License revenues increased 36% from Q3 2019 to stand at $25.8 million.

Verified reviews from Gartner Peer Insights conducted in 2021 showed that IBM (IBM) was rated at 4.3 stars with 369 reviews against MSTR with 4.3 stars and 433 reviews. MicroStrategy was rated higher due to its complete BI suite package, ease of integration, and deployment.

Bitcoin Holdings

While HSBC as earlier on seen indicated that it had no appetite for direct exposure to digital currencies. Goldman Sachs (GS) was ready to offer its wealth management clients, BTC investments as well as other virtual assets. Morgan Stanley (MS) was reportedly the first large US bank to give its clients access to Bitcoin funds.

For someone like Michael Saylor, MSTR’s CEO; Bitcoin’s surging prices are an attractive venture due to the crypto’s dominance. After buying BTC at the price of $9,000 back in 2009, Michael now owns at least 17,732 tokens. At the price of $47,000 Michael’s holdings are worth $833 million and back in November 2021, it rose to a high of $1.2 billion.

MicroStrategy’s BTC holdings are at 122,478 (worth almost $6 billion) with the company sharing the same beliefs as the CEO- that this is not the time to sell. Many investors would wonder why the company did not cash in on the crypto boom after its price hit a record high of $69,000 back in November 2021. However, if we can consider the depletable status of the tokens as well as BTC’s identity as a store of value during high inflation, then it will be understood that BTC will continue surging into 2022.

Like MicroStrategy, Tesla (TSLA) also embarked on acquiring Bitcoins spending up to $1.5 billion of its almost $20 billion in corporate cash (back in Q2 2021) to buy the tokens. In June 2021, Elon Musk confirmed that the electric vehicle company had sold 10% of its holdings to test its ability to move the market. In my view, the institutional liquidation of BTC plays a huge role in maintaining BTC prices with a stronger impact than ETFs.

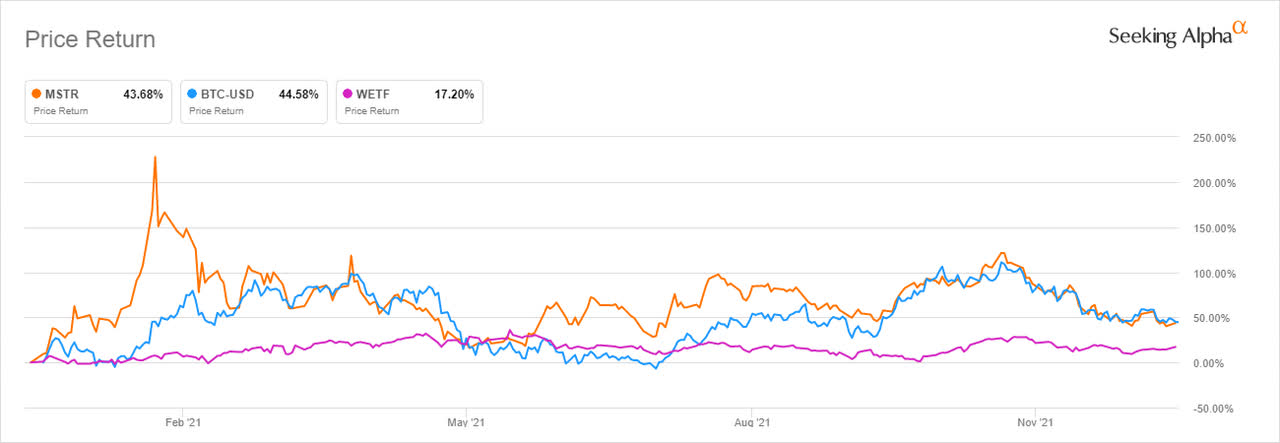

Source: Seeking Alpha

In the past year, MSTR did well to track Bitcoin’s prices better than WisdomTree (WETF) ETF slightly trailing the giant crypto by 0.9%.

By the look of things, MicroStrategy has a stronger management capacity of its Bitcoins as compared to related ETFs. MSTR is not just a finance company but an operating entity made possible by the enterprise software business.

Payment firm, Square Inc. (SQ) also joined the fray and had in its store close to 8,027 Bitcoins by October 2021. Square’s BTC was valued at $220 million and was bought at an average price of $27,407. In contrast with MSTR, Square does not intend to add more BTC to its wallet with its attention now focused on the mining process.

Square’s CEO and former Twitter (TWTR) boss Jack Dorsey said that his fintech firm was working to build a BTC mining system. This project would be based on silicon and open source. The overall goal would be to make the crypto’s mining process less complex or limited to a few companies.

In the contemporary world, companies handling Bitcoin mining need to have multiple application-specific integrated circuits (ASIC) and a stable power source. In my opinion, if Square manages to decentralize the mining process from the large-scale players, then MicroStrategy will quickly need to sell. The current supply constraints have worked to shore up demand and push prices.

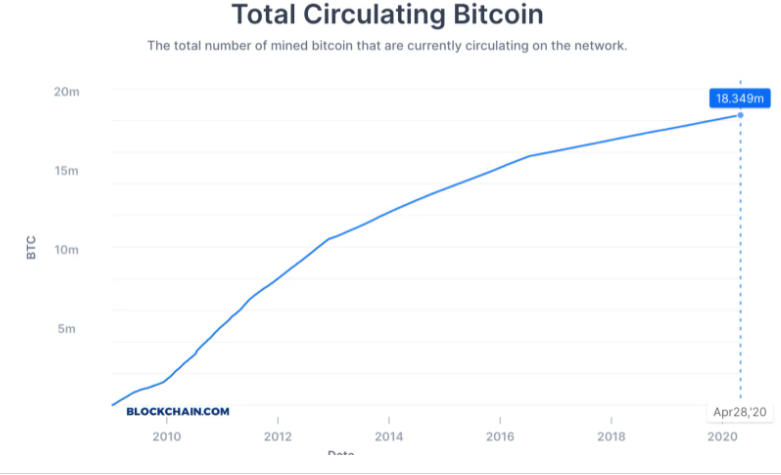

Still, on Bitcoin mining, approximately 90% of Bitcoin has been mined meaning that only 10% is left. It is expected that the mining fees for the tokens will disappear when all the BTC is mined.

Source: Coin Central

Satoshi reportedly designed Bitcoin to have a pool of 21 million tokens. At the moment, only 2.134 million coins remain with 18 million in circulation. It is expected that due to halving changes and mining difficulty, the last Bitcoin will be mined in 2140.

Miners that maintain the integrity of the network (through the creation of new blocks via source code) will be rewarded with the remaining Bitcoins. Through the Bitcoin halving process programmed in 2020, each block will yield 6.25 Bitcoins instead of 12.5. It is still seen that even if Square establishes a new mining system, prices may take a while to decline due to current supply constraints.

Bitcoin Lending

With more BTC being mined in the current era, MicroStrategy’s option of putting a mortgage against the coins or lending them to generate yields will shore up serious profits. Putting the ideal situation aside, MSTR is still able to have a long-term debt plan using Bitcoin.

With favorable conditions, MSTR could easily leverage up against Bitcoins and of course, lend it to a strong counterparty. At this point, Bitcoin will become a long-term asset, especially now that it is even offering senior notes to buy the coins.

Risks

MSTR’s net change in cash in Q3 2021 was $4.2 million. This minor gain was after a 214.44% decline to -$397.1 million from $347 million as of December 2020. The company used up close to $400 million mainly to buy Bitcoins. Quarterly gross profit gained stood at $442.84 million against a total debt of $2.24 billion.

It is left to be seen how the yield generation from BTC will be profitable to the company considering it is planning to lend out the cryptocurrency. A decline in BTC prices will mean lower profits for investors due to the direct correlation between yield and token prices.

MicroStrategy is yet to explain how it will incorporate blockchain technology in revenue generation. In essence, the company is using a lot of money to buy cryptocurrency unlike Square, which may soon embrace BTC mining.

Bottom Line

MicroStrategy Incorporated’s operating strategy of buying Bitcoins to the extent of borrowing billions of unsecured debts to finance the purchase will prove worthwhile in the long run. As an enterprise analytics company, MSTR stands to benefit from innovations especially since it is transitioning to a SaaS/cloud platform. Already, the demand for enterprise analytics is rising with the company offering proven solutions including the application of embedded OEM business.

However, the company is yet to show how it will incorporate blockchain technology in its business considering it is storing huge amounts of BTC. MSTR will soon offer leadership in the Bitcoin community despite the use of debt and equity to acquire the digital asset. In my view, MSTR is a buy and presents a solid way of tracking BTC.

Be the first to comment