Kevork Djansezian/Getty Images News

Transaction Highlights

Microsoft (NASDAQ:MSFT) will acquire Activision Blizzard (NASDAQ:ATVI) for $95.00 per share, in an all-cash transaction valued at $68.7 billion, inclusive of Activision Blizzard’s net cash.

Merger Rationale

Both Activision and Microsoft had incentives to go ahead with the deal.

On the end of Activision, it has been plagued by a class action lawsuit over discrimination and sexual harassment. The lawsuit alleges how a ‘frat boy’ working environment emerged in Activision which encouraged over 700 acts of sexual harassment towards female employees by male employees. Worst of all, it has been alleged that CEO Robert Kotick had been aware of the situation since 2018. It is likely that if the deal were to be completed, Kotick would be leaving the company, along with other senior management. All in all, this has materially depressed the share price, increasing chatter over a possible buyout.

From the side of Microsoft, there are numerous considerable advantages of incorporating Activision’s business. Firstly, this will immediately be accretive to Microsoft’s earnings. Adding Activision will bring Call of Duty, World of Warcraft, Overwatch, Diablo, and Candy Crush to Microsoft’s portfolio of games, and vault Microsoft into third place among the globe’s game developers. Microsoft’s gaming business generated $15 billion in revenue in fiscal 2021, while Activision generated $9 billion. The addition of ATVI would mean Microsoft will control 14% of the industry. During the acquisition conference call, Microsoft CFO Amy Hood highlighted how Microsoft were going to go about monetization.

Key measures of our success include accelerated revenue growth from Activision Blizzard’s game portfolio as we extend content to more devices, resulting in increased engagement and monetization across the Xbox platform; as well as additional growth in Game Pass subscribers as we attract new players wherever they play and continue to build one of the most compelling and diverse lineups of AAA content available.

To better understand the scale of Activision’s advantages to Microsoft, gaming represented nearly 10.5% of Microsoft’s revenue in the latest quarter. Now consider that Activision’s revenue in 2021 was about 60% of that of Microsoft’s gaming business, and you get an idea of the accretive nature of the transaction.

Secondly, Activision’s portfolio of games will significantly boost the reception of xCloud, Microsoft’s up and coming cloud gaming platform, which allows for cross-platform gaming, without consoles, as long as users have a screen and an internet connection. Neither consoles nor PCs will be required for subscribers to access gaming content. This evolution in gaming will likely result in a recurring, stable subscription fee. CEO Satya Nadella had this to say about how Activision’s portfolio of games will aid in the promotion of xCloud.

Through the cloud, we’re extending the Xbox ecosystem and community to millions of new people, including in global markets where traditional PC and console gaming has long been a challenge. And when we look ahead and consider new possibilities, like offering Overwatch or Diablo, via streaming to anyone with a phone as part of Game Pass, you start to understand how exciting this acquisition will be.

Risks and Uncertainties

At the time of writing, there is a massive risk to the deal being completed, which is principally due to the FTC headed by Lina Khan’s probe into the deal after its announcement. Most recently, the FTC’s probe will take into account the access of the merged company to consumer data and whether or not it has resulted in a decreased competition for labour via non-competes. Overriding all this is whether or not Microsoft will end up disenfranchising the very workers at Activision that have spoken out on the company’s toxic work environment.

To give my two cents’ worth, I do not think that the FTC will end up blocking the deal, if Microsoft publicly announces a set of actions it will take to ensure that it can systemically change and improve the working environment at Activision. Even though the optics of a big tech company swooping in to buy a company that has been embroiled in scandals for cheap is not favorable, Microsoft can easily come up with many measures to help ameliorate the current situation at Activision.

More to the point on why the deal likely will not be blocked, Microsoft is essentially still an enterprise business at its core and even with revenues from consumer businesses such as gaming rising quickly, it still represents a minority of Microsoft’s revenue. By extension, it makes the significance of the access to consumer data argument weaker, as it is unlikely that data concerning gaming and entertainment can be used for Microsoft’s core enterprise business.

Implications for Big Tech Acquisitions Going Forward

The fact that Microsoft, a company that has been relatively untouched by antitrust regulation globally for the past 10 years, has suddenly come under scrutiny by Lina Khan’s FTC, really shows how the FTC has changed under the Biden administration. Under Lina Khan, it has already blocked two huge deals, namely the NVIDIA’s (NVDA) acquisition of Arm and Lockheed Martin’s (LMT) acquisition of Rocketdyne (AJRD).

When you dissect Lina Khan’s interviews at the likes of CNBC, it is clear how the FTC will examine deals going forward. Rather than looking at purely consumer benefit just as how it was in the past, the FTC now looks at ‘antitrust for antitrust’s sake’. She highlights in her interview at CNBC how monopolies need to prevented by going beyond the final deal that results in the monopoly, giving way to greater to greater scrutiny, especially at any future acquisitions done by Big Tech.

By extension, there are two key areas that Lina Khan is pursuing: labour market competition and monopsony power, and data privacy, all with regard to acquisitions. What this means for tech firms and their acquisitions boils down to two actionable ideas that they can use: dialing back stock based competition (SBC) as this is likely something the FTC will look at when it comes to labour market competition, and scaling back data tracking programs at the big tech firms.

Actionable Advice?

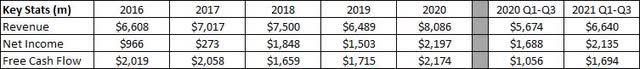

So what is Microsoft getting here? Well, as the press release details, this is all about getting a larger piece of the $200 billion plus gaming industry. 3 billion people play games today, and that number could jump another 50% by 2030. In the graphic below, you can see some of the key financial numbers for Activision over the past five years, with a comparison also of how the first nine months of 2021 fared against their prior year counterpart.

For the full year in 2021, Activision is expected to report revenues of about $8.74 billion. That number is expected to grow to more than $10.3 billion by 2023, with the potential for more growth down the road. This is also a very profitable business, with Activision reporting net profit margins of 32.15% for the first three quarters of 2021, up from 29.75% in the first nine months of 2020. This profitability level is a little below that of Microsoft currently, but I’m sure some expenses can be cut here, and there are plenty of companies out there that would love to have 30% plus net margins.

Now investors will point out that this deal isn’t going to impact Microsoft’s top line in a major way. That is true to a point, as the image below shows current estimates calling for about $196.5 billion in revenue during the current fiscal year that ends in June. However, the alternative in my opinion was buying back stock, which wouldn’t bring in any additional revenues. Also, Microsoft is paying about 6.6 times Activision’s December 2023 expected sales for the deal, which would be cheaper than buying back Microsoft stock at the below implied valuations. Overall, this is likely a win for Microsoft in the long term.

Seeking Alpha

Be the first to comment