Jeenah Moon/Getty Images News

Investment Thesis

Microsoft (NASDAQ:MSFT) provides products and services related to high tech devices, software, cloud computing, and AI. They have been a dominant leader in the technology sector for several decades now, yet somehow manage to grow like a growth company. Most recently, Bernstein picked Microsoft as one of the potential big winners for the metaverse transformation. Microsoft certainly has one of the widest economic moats in existence, combining technological superiority, network effects, switching costs, and brand image. I believe the recent market volatility is creating a great opportunity for an investor to buy Microsoft at a great price because:

- Microsoft will enjoy multiple tailwinds to accelerate their (already solid) revenue growth.

- Economic moat around their business is the widest I can think of. The economic moat provides great profitability, and profit margin is improving.

- Recent market volatility created a rare opportunity to buy Microsoft at a good price.

Revenue growth and multiple tailwinds

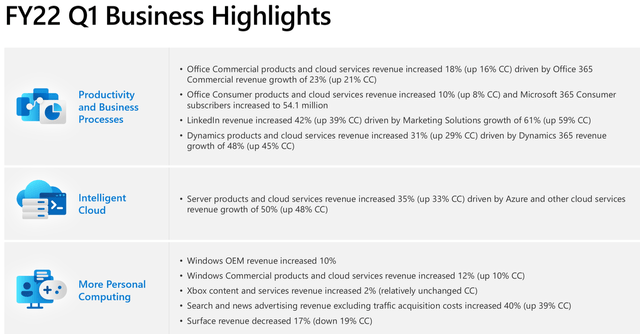

It’s hard to believe, but Microsoft is still a “growth play” 40 years after they released DOS. Fiscal Year 2022 Q1 (3Q 2021 for the rest of us) delivered strong growth from all three business segments. Revenue from their Productivity and Business Processes grew 22% overall, mainly driven by Office 365 related products (18% YoY), Dynamics (31% YoY), and LinkedIn (42% YoY). More notably, the operating margin expanded as operating income grew 33%, compared to the revenue growth of 22%.

Revenue from Intelligent Cloud business grew 31%, mainly driven by Azure and other cloud services. The operating margin of this segment also grew. The operating income of the segment grew 39%, compared to revenue growth of 31%.

Revenue from More Personal Computing segment grew at the more modest pace of 12%, driven by Search and news advertising, Windows, and gaming hardware. This segment actually experienced operating margin compression, due to increased expenses from gaming and Windows marketing. Overall, all segments of their business are growing nicely.

Recently, Bernstein picked Microsoft as a potential big winner for metaverse, and I completely agree with that. Microsoft can provide the whole package for a metaverse transformation. They have hardware like HoloLens and virtual reality devices (e.g., camera, controller, etc.), platforms (e.g., Azure and LinkedIn), and technology (e.g., AI, Graph, and Mesh). Every product they sell can be applied to metaverse, and I expect a large and multi-faceted tailwind for Microsoft from the metaverse transformation. This comes on top of other existing tailwinds, namely the ever-increasing computer and electronic device usage across all aspects of our life.

Microsoft HoloLens

FY2022 Q1 Highlights

Widest Economic Moat

Microsoft has the widest economic moat of any company that I can think of. They clearly have technological superiority and dominance, which has been proven over several decades at this point. Given that they have been spending over $10 B on R&D since 2013 ($21 B in 2021), I don’t think their technological superiority will fall off. Also, Microsoft has a huge pile of cash, and have been acquiring key technology and businesses along the way (14 companies in 2021 alone including Xandr, Two Hat, and Peer5).

They also are protected by a network effect and switching cost. When is the last time you turned on a computer and saw something other than the Windows logo? Their current market share is 73% on desktops. For corporations, switching away from the Microsoft operating system and Office Suite would be cost prohibitive and waste a lot of time in training employees on the new system.

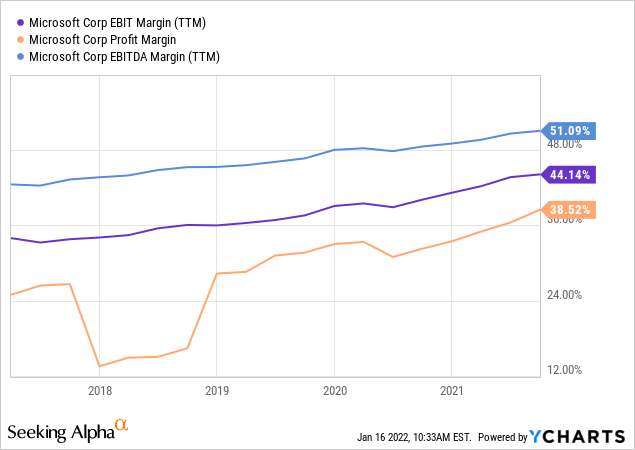

Thanks to this wide economic moat, they have been enjoying outstanding profitability for a while. Combining their technological superiority and dominance in the market, the customer has to pay whatever Microsoft decides (more or less). Their profitability metrics (EBIT margin, EBITDA margin, and Net Income margin) are off the chart. Additionally, their revenue is increasingly coming from higher-margin market segments (cloud computing, productivity services, and business solutions), so their profit margins have been steadily improving since 2018. The trend will likely continue for a while.

Tech sell-off created an opportunity

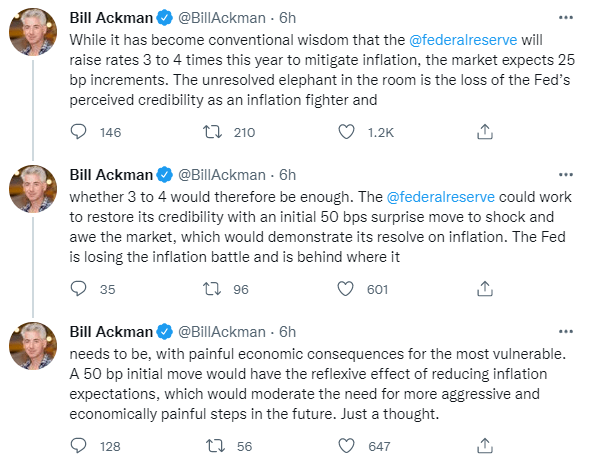

The recent market volatility created by the Omicron variant and Federal Reserve interest rate hike has been dragging down the overall market. Some Wall Street leaders have started questioning the Fed over their inconsistency in monetary policy and losing credibility (Bill Ackman took to Twitter to speak his mind).

Bill Ackman on Twitter

Especially, the Technology sector has taken the largest hit from the fear of interest rate hikes since rate increases will hurt growth companies the most. This market-wide sell off created a rare opportunity to buy Microsoft at a great price. The intrinsic value of Microsoft is 15-25% higher than its current price (calculation shown in the next section of the article).

Market volatility will likely continue for the next couple of months, but, in the end, we have signs of a strongly recovering economy. FactSet is expecting revenue growth and EPS growth of S&P 500 companies in 4Q 2021 to be 12.9% and 21.7% YoY. Companies are actually making tons of money. With these strong fundamentals in the economy, I expect the bull market to re-remerge later this year.

Intrinsic Value Estimation

I used DCF model to estimate the intrinsic value of Microsoft. For the estimation, I utilized EBITDA ($85.7 B) as a cash flow proxy and current WACC of 7.5% as the discount rate. For the base case, I assumed EBITDA growth of 20% (Seeking Alpha Consensus) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 25% and 30%, respectively, for the next 5 years and zero growth afterwards. Given their rapid growth from existing tailwinds and additional growth from metaverse transformation, I think EBITDA growth of 25-30% is well within reason. Also, their margin expansions will positively contribute to EBITDA growth.

The estimation revealed that the current stock price presents 15-25% upside. Given their wide economic moat and ever increasing demand for their products and services, I expect them to achieve this upside easily.

|

Price Target |

Upside |

|

|

Base Case |

$302.25 |

-3% |

|

Bullish Case |

$362.74 |

17% |

|

Very Bullish Case |

$433.23 |

40% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 7.5%

- EBITDA Growth Rate: 20% (Base Case), 25% (Bullish Case), 30% (Very Bullish Case)

- Current EBITDA: $85.7 B

- Current Stock Price: $310.20 (01/14/2022)

- Tax rate: 15%

Risk

Federal Reserve’s inconsistency in monetary policy is the biggest wild card for Microsoft’s stock price at this point. Federal Reserve has changed their stance on inflation from “transitory” to “more persistent” to “we need 3-4 interest rate hikes” within a 12 month span. These changes in stance are making investors nervous and creating market volatility. However, even with 3-4 separate hikes, we will still be in a historically low interest rate environment, which favors the stock market. Also, as I mentioned before, the economy is strong, and premier companies like Microsoft always come out strong at the end of volatility. This is a rare opportunity to buy Microsoft at a great price.

Conclusion

Microsoft doesn’t need any introduction. Since the introduction of DOS in 1981, they have been a technology leader and provided essential software for personal and corporate computers. All three segments of their business are growing nicely, and their profit margins are expanding as the product mix is getting more favorable. The market volatility and sell-off has created a rare opportunity for an investor to buy Microsoft at a great price. The Federal Reserve’s interest rate hike will continue to cause market tremors for a while; but backed by a strong economy and many profitable companies, I expect the market volatility to subdue in the next several month. I expect 15-25% upside for Microsoft from the current level.

Be the first to comment