Alex Wong/Getty Images News

A Story Of Market Irrationality

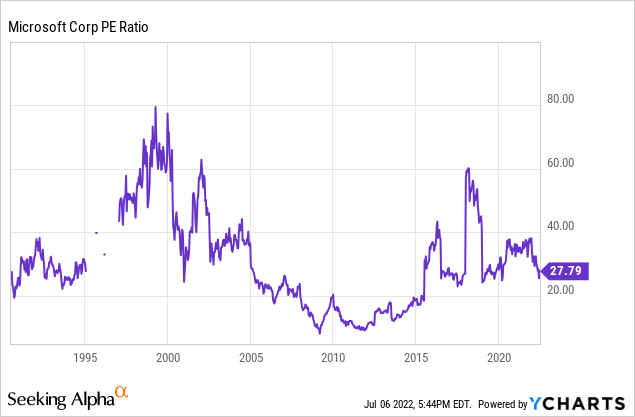

Microsoft’s (NASDAQ:MSFT) stock is a story of market irrationality. Despite its enormous tailwinds, talented management, and valuable software, Microsoft traded at a P/E of just 20 in 1990. This was not your typical, unprofitable tech company. Microsoft was an aggressive competitor that was about to monopolize the industry of computer operating systems, as well as internet browsing with its Internet Explorer. Looking back, the company was tremendously undervalued.

If we move forward 10 years to the dot-com bubble, Microsoft traded at 60x earnings. Despite its stretched valuation, Microsoft’s growth prospects were actually worse than they were 10 years earlier. This level of extreme enthusiasm proved to be unsustainable, and the bubble burst.

After a lost decade for U.S. equites, Microsoft was again on the bargain table. The company hovered around a P/E of 10 from 2009 to 2012. The market had no idea that cloud was coming to save the day, nor did it value the longevity and competitive strengths of Xbox and Microsoft Office. The rest is history as Microsoft exploded to the upside, reaching nearly 40x earnings in 2021. What happens next? Let’s dig in.

The Thesis

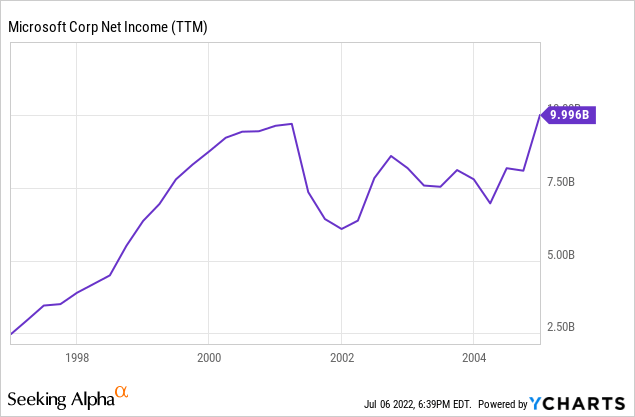

What many don’t remember about the dot-com bubble is that not only did tech stocks plummet, but their profits plummeted as well. A 2001 New York Times article read, “Microsoft Profits Fall 42%,” citing investment losses and slumping PC sales as the reason. Microsoft’s net income didn’t reach a trough until in 2002, and it took years to recover:

Are today’s tech titans immune to this kind of decline? We believe the answer is no. We can sit around extrapolating the past and plugging huge growth rates into our discounted cash flow models, but the reality is, the real world doesn’t work like that.

Earnings are cyclical in all countries, in all industries, in all things. The reason: Capitalism. When earnings boom on for many years, it attracts competition. Swarms of new entrants IPO’d in 1999 and 2021, grabbing large sums of investors’ cash. The problem is, those new entrants increase competition, which in turn decreases margins. Consumer spending is cyclical as well; when everyone buys a brand new car or laptop at the same time, there’s a hangover effect. They won’t be making another purchase for quite some time.

In the decade ahead, we project a return of 6% per annum for MSFT.

The Future Of Cloud

The global cloud market is forecasted to grow at 15.7% per annum through to 2030. We found numerous research teams that corroborated this forecast. We believe the cloud market will grow faster in Asia and emerging markets as it is still in the beginning stages of adoption. The United States has already experienced vast adoption of cloud computing, thus the enormous growth in Microsoft Azure and AWS over the past 5 years.

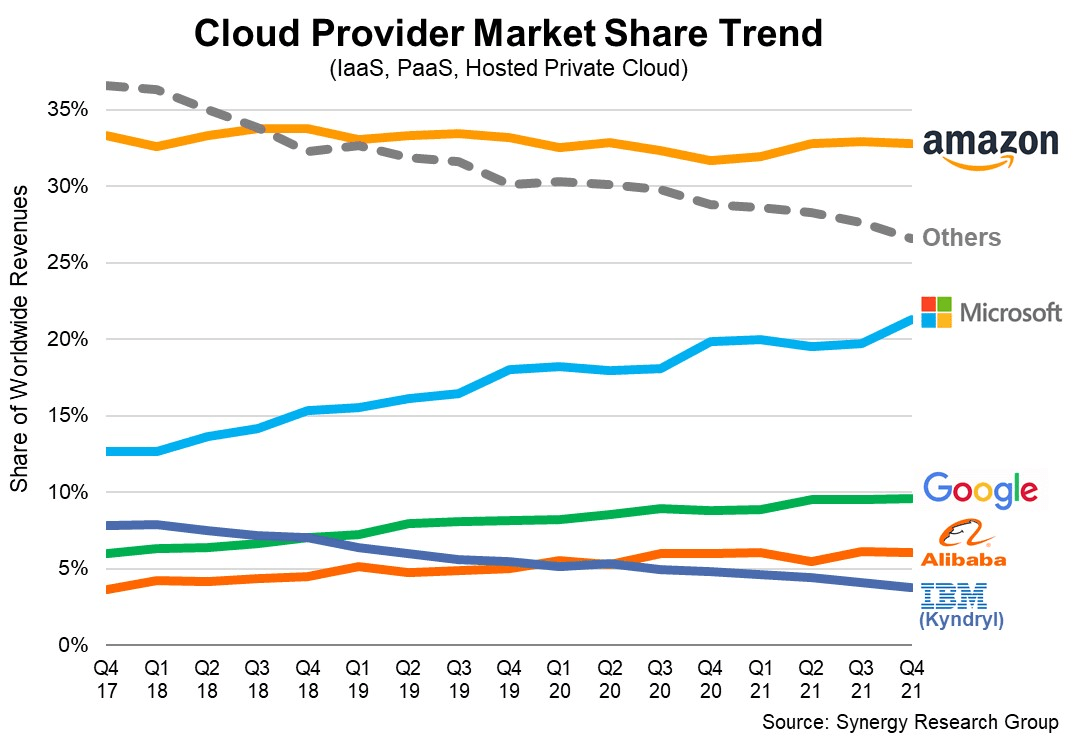

Microsoft has a very strong position in the market:

Market Share of Global Cloud Businesses (Synergy Resource Group )

Microsoft benefits from a stronger network effect than that of Amazon’s (AMZN) AWS. While AWS is often competing with the companies it sells cloud services to, Microsoft simply supports those companies. Microsoft is intertwined with businesses around the world, and can bundle its cloud services with Microsoft Office to present a very strong value proposition. Thus, Microsoft’s cloud share is growing, while Amazon’s is going nowhere.

Looking out 10 years, we believe the growth outlook is more favourable for cloud companies like Alibaba (BABA) and Tencent (OTCPK:TCEHY), which have a longer runway to gain global share, due to the under-adoption mentioned above. These companies are building their network throughout emerging Asia. Microsoft will have to fight to maintain share, because it is concentrated in slower growing regions. Margins could also decline for Azure as more competition enters, but the value proposition should prove durable.

Growth: The Past & The Future

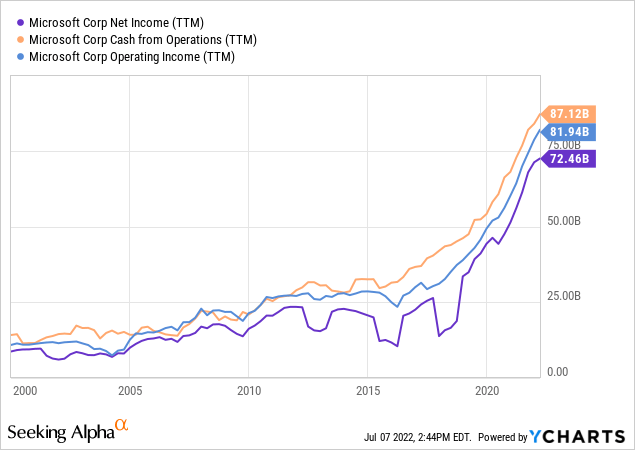

Microsoft has grown the combination of its income and operating cash flow at 9.5% per annum since 2000. The company has had periods of both rapid growth, like the past 5 years, as well stagnant growth. What caused the rapid growth over the past 5 years was cloud, but much like PC’s in the late 90’s, this growth can stall out. It is exceptionally difficult for large companies to grow faster than 10% per annum over an extended period.

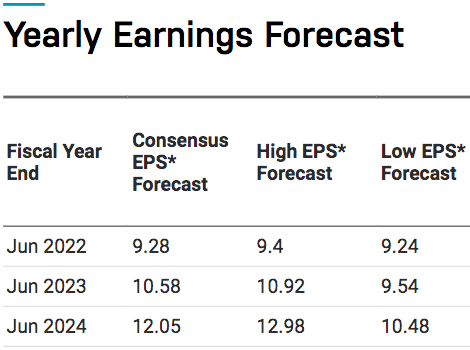

Analysts have Microsoft earning $12.05 per share in 2024:

Microsoft EPS Estimates (Nasdaq)

Long-term Returns

Our 2032 price target for MSFT is $438 per share, indicating a return of 6% per annum with dividends reinvested.

- After analyzing Microsoft’s growth engines, we believe it’s appropriately conservative to assume Microsoft’s growth reverts to its long-term average. If we grow Microsoft’s 2024 EPS at 9.5% per annum, we get 2032 earnings of $25 per share. We’ve applied a terminal multiple of 17.5 for a business that will compound slower as it balloons in size, but that has exceptionally durable competitive advantages.

Conclusion

A study of Microsoft’s history not only lays out the risk and reward for MSFT shareholders, but for the broader market. Earnings have proven to be cyclical in all countries and in all industries; it’s just the nature of capitalism and our modern economies. The market is incredibly irrational at times on both the high side and the low side. Microsoft has traded at a P/E of both 10x earnings and 60x earnings in the past. Cloud is the industry of the era, but Microsoft’s cloud growth will eventually slow. Despite this, we’ve projected a return of 6% per annum, using conservative assumptions. This return should both beat the treasury and match the market; therefore, we have a “hold” rating on the shares. Microsoft investors sleep well. MSFT has been a terrific investment over the years, and the company’s strong tailwinds and competitive advantages should lead it to compound for decades to come.

Be the first to comment