Michael Buckner/Getty Images Entertainment

Broader markets have been on a downturn for the better part of the last two quarters as 2022 proves a troublesome year for investors. Issues surrounding surging inflation, an ongoing supply chain distribution, and upcoming rate hikes had many investors already worried, with the Russian invasion of Ukraine only serving to cause further chaos in the markets. As a result, money is being pulled out of stocks and moved into safer havens, including bonds, gold, silver, or simply the U.S. dollar.

Last year, on the back of the largest bull run in history which lasted almost thirteen years and saw the market return more than 400%, the arbitrage opportunity didn’t seem all that enticing to most investors. In such a bullish environment, even a passive investing approach was generating almost guaranteed double-digit returns, so most investors had no reason to trouble themselves with the regulatory scrutiny that is taking place.

However, the arbitrage opportunity that was born out of Microsoft’s (MSFT) acquisition of Activision Blizzard (NASDAQ:ATVI) is a true value generator and an investment opportunity that is proving increasingly more lucrative, especially given today’s uncertain market environment. The acquisition which is expected to close later next year is offering a seemingly brilliant 20% return as long as the deal gets by regulators.

What is behind the deal?

A year ago on the 20th of July, California’s Department of Fair Employment has filed a lawsuit against Activision Blizzard for collecting “numerous complaints about unlawful harassment, discrimination, and retaliation” at the company. Management of the company was claimed to be aware of the entire situation, trying to push things under the rug, according to various news reports.

This created a storm of negative media coverage for the company, with multiple reports warning about issues surrounding employee harassment, discrimination, retaliation, and the general existence of a “frat boy” culture within the company. As a result of the negative coverage and the subsequent backlash by the public, the company’s stock price has been hit hard in the markets. After hitting a high of almost $100 per share, Activision Blizzard stock has been sold for as low as $57 per share.

Acquired IPs (Microsoft Acquisition Presentation)

This opportunity was capitalized on by Microsoft, who have taken the business world by surprise last year with the sudden and unexpected announcement of the acquisition. The all-cash transaction is worth $68.7 billion, marking the greatest deal in the history of the gaming industry. With this deal, the company is looking to expand its library by bringing franchises such as Call of Duty, Warcraft, Overwatch, and others to its Game Pass subscription service.

Why is this a value generator?

The actual value proposition here is rather simple and works in two ways. First is the obvious opportunity with the merger arbitrage. Before the big announcement, Activision Blizzard has been trading at around $60 per share. After the news broke, it almost immediately jumped into the $80s for what the stock is selling for even now. If one believes that the fears about the regulatory scrutiny are overblown, parking his money in ATVI stock would yield a guaranteed 20% return upon the closure of the transaction considering that Microsoft is buying out Activision at $95 per share. Given the current sentiment in the markets, this would be an extraordinary result.

The second value proposition comes out of the significant downwards pressure caused by the press scrutiny last year. Many would agree that even without the acquisition, Activision Blizzard is still a company worth more than $80 per share. Other than some bad press, part of management leaving and some projects pushed further down the road, last year’s stock crash had little to do with business fundamentals. It is possible that the price would have been corrected sometime this year even without the announcement.

Activision Blizzard has a prestigious lineup of IPs and franchises that include names such as Call of Duty, World of Warcraft, Overwatch, Diablo, Candy Crush, and others who generate industry-leading 400 million MAU. As per the latest quarterly filing, we can see that the company is finding itself in a very favorable financial situation. As it stands, Activision Blizzard has only $3.6 billion total debt and has $6.39 billion of negative net debt, meaning that the company is sitting on a huge cash pile of $10 billion. The company ended the year with $8.80 billion in revenue and $3.42 billion in EBITDA. Even if the deal gets blocked, today’s price assumes a next twelve months P/E ratio of 22.14x and an EV/EBITDA ratio of 15.28x, which seems quite attractive considering the IP premium the company commands. The point being is, even with the 45% premium that Microsoft assigned to Activision, last year’s negative events create a specific situation in which most investors will end up well even if the deal falls apart.

Why did Microsoft target Activision?

Following the enormous success that Netflix (NFLX) had as an early adopter of the video subscription model, or the success Spotify (SPOT) achieved as an early adopter music subscription model, Microsoft was early to realize the true potential that games as a subscription model would have. Microsoft’s pitch to become “the Netflix of gaming” was simply titled “Game Pass”. The platform proved a huge success since its inception back in 2017, attracting more than 25 million subscribers. For a flat monthly fee of $10 or $15, the subscribers have access to a huge cross-platform library of more than 300 titles, including features such as day one releases and backward compatibility.

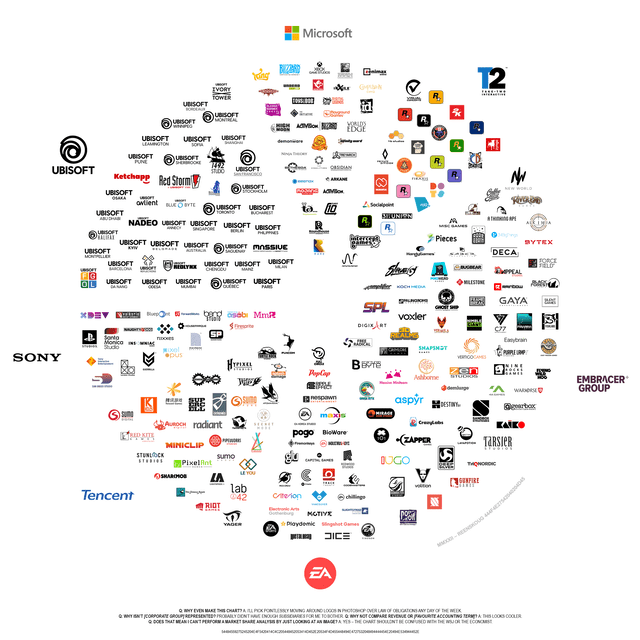

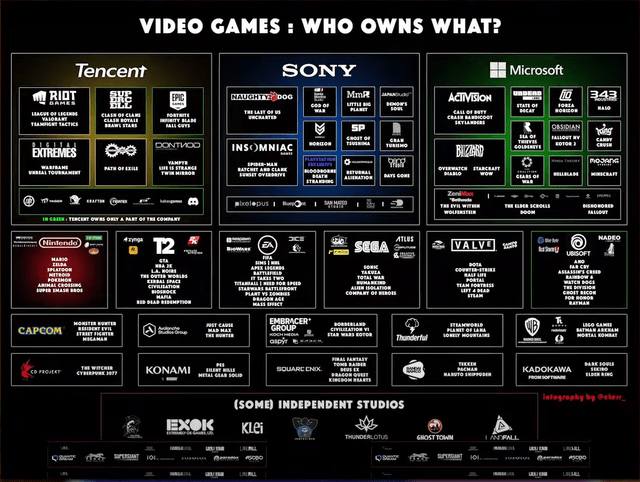

Game Pass Platform (Microsoft and Activision Merger Presentation) As the industry prepares for the wider adoption of subscription-based business models, acquisitions of gaming studios have been heating up over the course of the last couple of years. Studio acquisitions are a key aspect of the new subscription model strategy as they allow the companies to expand their existing library of game titles, but also more importantly allow exclusive access to the future pipeline of those studios’ products. Microsoft already has a series of well-known studios under its umbrella, but the effort has been pushed in the last couple of years. The Activision Blizzard deal is not the first major deal the company has done lately. Just last year, Microsoft acquired ZeniMax Media for $7.5 billion, bringing eight different game studios under its umbrella. All the game titles acquired, including the likes of Elder Scrolls, Fallout, Dishonored, Doom, Quake, and others can already be found on Game Pass. Microsoft currently owns 23 game studios, while adding 9 more with the latest deal. The studio acquisitions create value for Microsoft in two different ways. First, they enable the company to push out games directly to its subscription service. This is a huge incentive for the average gamer. Instead of paying for tens of different games per year, it is much easier to simply maintain a subscription. The logic is simple here, the more studios and IPs they own, the lower is the incentive for the average gamer to look at anyone else other than Game Pass and Microsoft. The second value generator is the contribution to the console wars, that is by significantly boosting console sales through the use of “exclusive titles”. In a similar manner in which movies and TV shows could be made exclusively available on certain streaming platforms, games are often made “Xbox” or “PlayStation” exclusives, meaning the developer enters a deal with a hardware company for the product to be available to purchase only on their platforms. So this deal does not generate value only in terms of the subscription service revenue and game sales but indirectly adds to the console sales as well. Not everyone is so sure about the deal going through. Given that the rather significant 20% spread is not getting closed, we can see that the market is telling us that there is a good chance of this deal falling apart along the way. In fact, spreads have been widening in many other M&A deals as the Biden administration is promising a tighter grip on M&A activity. With the changes in the US political landscape that have taken place since the takeover from the new administration, regulators have toughened up their stance on antitrust matters, especially as far as big tech is concerned. The core of the new administration surrounding Biden is generally more oriented towards the center and was usually considered “business-friendly”. However, there is also a more left-leaning branch of the Democratic party which is led by figureheads such as Bernie Sanders or Elizabeth Warren. The latter has been advocating for years for a tougher stance on big business and more specifically a more strong-handed approach to M&A. A part of that was the attempt to introduce “The Prohibiting Anticompetitive Mergers Act of 2022”, which is a relatively controversial bill designed to block, limit, and even roll-back major M&A activity. Even though most experts agree that the bill will have a tough time getting through Congress, the centrist leaning branch is still going to have to somehow appease the left-leaning branch. In a very clear statement that the regulatory crackdown is a reality, Lockheed Martin (LMT) was forced to terminate its $4.4 billion deal to acquire Aerojet Rocketdyne (AJRD) “in the light of FTC’s actions”. In another sign of the crackdown, the Dept. of Justice filed a lawsuit to block UnitedHealth’s (UNH) planned $13B purchase of Change Healthcare (CHNG). A possibly brighter outlook on the state of things is that some of the big deals still manage to get through, even under the new administration. One of the latest major deals that have gone through has been the AT&T (T) and Discovery (DISCA) (DISCK) reverse Morris trust concerning the Warner Media spin-off. This particular deal is interesting in the sense that the streaming space faces a relatively similar level of industry consolidation. Studio Ownership (Reenskoug) I will attempt to outline several key reasons why I believe the deal might not be getting blocked after all. The gaming industry is an industry that carries little moat in terms of capital entry requirements, especially when compared to something like railroads, plane manufacturing, or even media and streaming. New studios and publishers are emerging almost daily and often end up being quite successful. Further to the point, even if it remains true that there are a couple of “big players” in the space, the industry at large is significantly more fragmented. The effect of this merger even if significant to Microsoft is nothing even close to the Warner Bros Discovery deal mentioned above. Industry Ownership After The Deal (eterr_) There are two major gaming companies in the space, Tencent (OTCPK:TCEHY), which is a Chinese conglomerate, and Sony (SONY), which is a Japanese tech giant. This deal would solidify Microsoft’s position as one of the three big industry-leading names. This is a very important point that can easily be overlooked by most investors, especially US-based investors who do not have a tendency to view things from this aspect. Simply put, Microsoft is an American company and this deal getting through is in the best interest of the United States. The deal allows the company to be better positioned in order to compete with larger and more successful foreign-owned entities. This is becoming more important by the day considering the emergence of technologies such as VR or projects such as Meta’s (FB) metaverse which are bound to create issues in terms of both privacy and national security. In my opinion, any administration with the best interest of its country in mind would allow the deal to go through simply on that basis.

Is the deal getting through?

What is the outlook for the industry?

It remains difficult to understand the true potential of Activision Blizzard without understanding the course the gaming industry is taking. The video game industry is simply evolving. The old days were the video game companies based their financial strength and potential almost solely on the brick and mortar sales of their pipeline of game releases are long gone. The introduction of various new business models such as games as a service, games as a subscription, downloadable content, microtransactions, and others are changing the landscape of the industry. Game culture is simply living through a significant shift and is becoming more mainstream by the day. The acceptance of gaming as a normal and no longer looked down upon trend is evidenced in data. In such an environment, this deal makes even more sense.

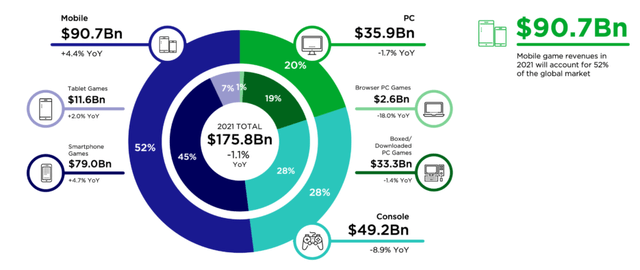

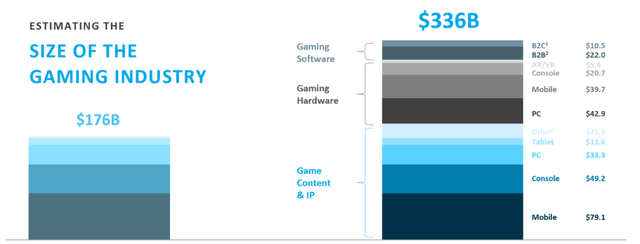

Global Games Market (NewZoo) In a report by Newzoo, it was reported that the global games market will generate close to $175 billion in 2021, and it is on a road to surpassing $200 billion in 2023. At that time, an estimated 2.9 billion players worldwide are expected. An important takeaway here is that the mobile gaming segment has already taken more than a 50% share of the market, a point that will come useful later in the article. Mobile gaming as of today is valued at $90.7 billion. The vast majority of mobile gamers are what can be considered “casual gamers”. Gaming Industry (Naavik) Naavik comes with a different view on things. They claim that NewZoo’s model ignores several key segments outside of gaming content and virtual goods purchases. Excluded categories include other forms of content and IP sales, but more importantly the sales of any gaming hardware and equipment as well as gaming software such as streaming services, gamer communication, game engines, and other items.

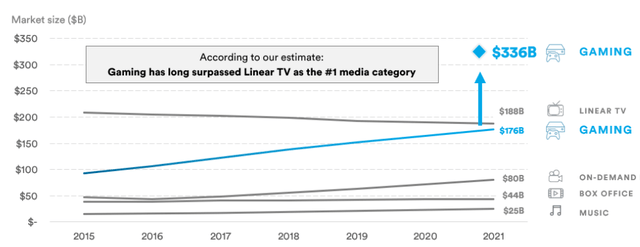

After incorporating gaming-specific hardware and software (development tools, engines, etc.) as well as complementary markets (streaming, esports, etc.), the total market size projection is set at $335.5 billion in 2021. Interestingly enough, both estimates are beating linear TV as a market segment.

State of the gaming market (Bitcraft)

Conclusion and final thoughts

The arbitrage opportunity that was born out of Microsoft’s acquisition of Activision Blizzard is a true value generator and an investment opportunity that is proving increasingly more lucrative by the day, especially given today’s uncertain market environment. If one believes that the greatest deal in the history of gaming is going to close next year, buying ATVI stock at $80 per share would yield a guaranteed 20% return upon the closure of the transaction. While not everyone is so confident that the deal is getting through, buying in at this price might not end up being a bad deal whatsoever as many would conclude that the company is worth much more.

Activision Blizzard is a true veteran of the industry and one of the greatest video game companies in existence that commands a lineup of prestigious IPs and franchises including names such as Call of Duty, World of Warcraft, Overwatch, Diablo, Candy Crush, and others who generate an industry-leading 400 million MAU. The announced deal creates value on the other side as well. Microsoft has been looking for ways to better establish its games as a subscription model for years and this is only the latest step towards the plan. The company made a huge step forward in becoming “the Netflix of gaming” with this deal. From a personal perspective, I am keeping a close eye on the development of the situation with a keen interest in allocating a portion of my portfolio to Activision Blizzard as I see long-term downside potential beyond the initial negative reaction to the deal falling apart.

Be the first to comment