vzphotos/iStock Editorial via Getty Images

Investment Thesis

Micron Technology, Inc. (NASDAQ:MU) topped consensus estimates in FQ2’22, despite the ongoing global supply chain issues. MU reported stellar YoY revenue growth of 24.8% and operating income of 380%, with excellent gross margins of 47.2% in the same quarter. Nonetheless, investors’ response has been rather lukewarm, with its shares gaining slightly by 4% to $85.51 on 29 March 2022, though resuming its decline by -10.9% to $76.18 on 1 April 2022.

In the past year, MU’s valuation has been down by over -37% to EV/NTM Revenue of 2.09x as of 1 April 2022, since its 52 weeks high of 3.33x in April 2021. We believe the bearish sentiment is still lingering, given that its peers, such as SK Hynix, Taiwan Semiconductor Manufacturing Company (TSM), and Intel (INTC), have also been lagging in the past year. Nonetheless, the fact remains that outperformers, such as Advanced Micro Devices (AMD) and Nvidia (NVDA), have weathered the market slightly better than MU. We shall discuss why.

Cash Cow With Robust Free Cash Flow & Massive Potential

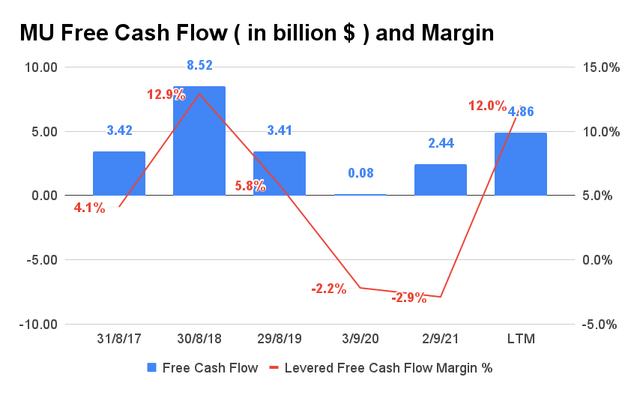

MU Free Cash Flow and Margin

S&P Capital IQ

MU has been generating robust Free Cash Flow (FCF) in recent years, discounting the effects of the COVID-19 pandemic in FY2020. In the last twelve months alone, the company reported an excellent FCF of $4.86B, representing a tremendous increase of 99.1% from FY2021 and 42.5% from FY2019. In addition, in FQ2’22, MU reported an FCF of $1.01B, representing an increase of 51% QoQ, 2607% YoY, and 1840% from FQ2’19. Assuming that the company continues on its growth trajectory, consensus estimates that MU will report impressive FCF of over $4.9B in FY2022 and $7.4B in FY2023, representing potential YoY growth of 200% and 51%, respectively.

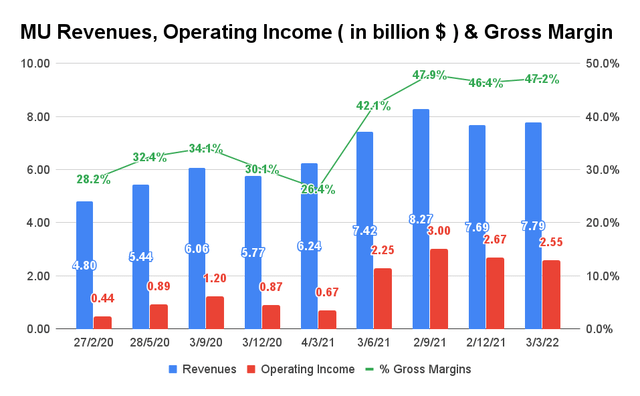

MU Revenue, Operating Income, and Gross Margin

S&P Capital IQ

Over the past five years, MU has also grown its revenue at an impressive CAGR of 17.46%. In FY2021, the company reported revenues of $27.7B, representing a remarkable YoY increase of 29.2%. In addition, MU reported revenues of $7.79B and operating income of $2.55B in FQ2’22, representing exceptional YoY increases of 24.8% and 380%, respectively. The recovery in its gross margins is also astounding, from 49.1% in FQ2’19 and 26.4% in FQ2’21 to 47.2% in FQ2’22.

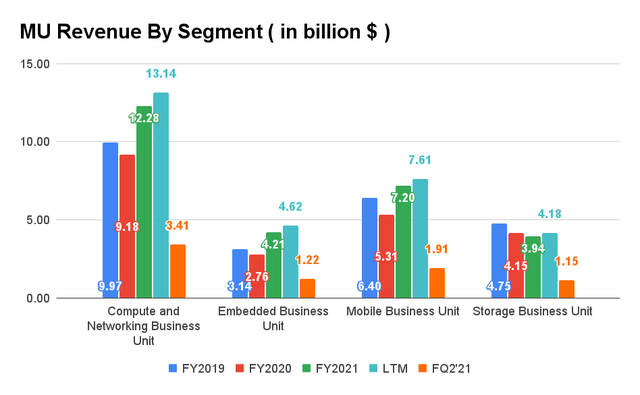

MU Revenue By Segment

S&P Capital IQ

The recent growth in MU’s revenue is mainly attributed to the robust demand for its DRAM and SSD segments in the compute and networking unit, accounting for 43% of its revenue in FQ2’22. The company recorded revenues of $3.41B for the segment in F2’22, representing 31.2% YoY growth. Given that MU launched the reportedly most advanced 176-layer vertically integrated data center NVMe SSD in March 2022, the Micron 7450 SSD, we may expect the company to achieve a potential YoY doubling of data center SSD revenues in FY2022, due to the “enthusiastic demand from its existing customers.”

Moving forward, we expect MU’s cloud and computing segment to report excellent revenues, given how 2021 saw record-breaking YoY growth of 44.3% of net absorption of data center space in the US. The growth was led by large cloud providers, including Alphabet (GOOG), Amazon (AMZN), and Meta (FB), which invested over $146B in capital expenditure in 2021, representing an astounding increase of 32% YoY. In addition, Allied Market Research expected the global data center market to grow from $187.35B in 2020 to $517.17B by 2030, at a CAGR of 10.5%. Given how MU forms a unique “tri-poly” with its competitors, including SK Hynix and Samsung (OTC:SSNLF), we expect the memory makers, especially MU, given its geographical advantage in the US, to report robust growth indeed.

Though MU’s mobile unit reported lackluster growth of 4% YoY in FQ2’22, we expect the segment to perform better moving forward, given how the telecoms, such as AT&T (T) and Verizon (VZ), are gearing up its 5G networks within the US. With Market Research Future expecting 5G expansion spending to increase from $24.5B in 2021 to $249.2B in 2030, at a CAGR of 29.4%, more smartphones maker will likely accelerate their transition from 4G to 5G handsets, further driving MU’s DRAM/ NAND content and technology improvement moving forward. In FY2022 alone, the company expected 5G smartphone sales to grow to 700M units, increasing 40% YoY. In addition, MU guided that NAND sales will grow faster at approximately 30% in FY2022, compared to “mid-to-high teens” for the DRAM segment.

MU’s embedded unit also reported excellent YoY growth of 37% in FQ2’22 at $1.3B, due to the sustained demand from the automotive and industrial markets. Despite the existing constraints on the global supply chain, MU guided the segment as the fastest growing end-market for memory and storage solutions over the next decade. It could be partly attributed to more consumers switching to EVs, due to the rising oil prices from the Ukraine war and the global goal for reduced greenhouse emissions by 2030, with the US leading the way with 50% of cars sold to be zero-emission by then.

Based on Allied Market Research, the global EV market is expected to grow from $163B in 2020 to $823.7B in 2030, at a CAGR of 18.2%. The growth is led by Tesla (TSLA) and Volkswagen (OTCPK:VWAGY), establishing multiple EV gigafactories for EVs production globally. Given that there is over 1.4B of cars in the world in 2022, with EVs accounting for only 8.57% of the market share, there is massive room for EVs adoption and growth indeed. Furthermore, with EVs generally featuring 15 fold more memory and storage content than conventional automotive, we expect memory makers, such as MU, to perform very well as the EV adoption rates increase exponentially in the next few years.

Revenue Growth At A CAGR Of 16.93% Despite Macro Headwinds

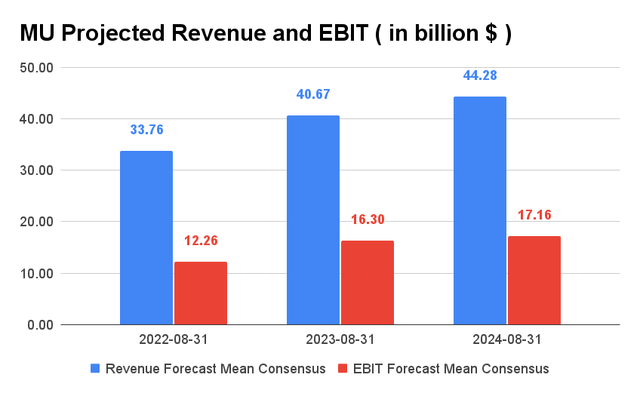

MU Projected Revenue and EBIT

S&P Capital IQ

Over the next three years, MU is expected to grow its revenue at an impressive CAGR of 16.93%. In FY2022, consensus estimates that the company will report excellent revenues of $33.76B and EBIT of $12.26B, representing YoY growth of 21.8% and 96%, respectively. In its latest earnings call, MU also guided FQ3’22 revenues in the range of $8.5B to $8.9B, with a gross margin in the range of 46% to 48%, representing an exceptional revenue increase of 11.8% QoQ and 17.2% YoY.

In its latest earnings call, MU also indicated that it is “ramping products” and “investing in technology leadership” for the next few quarters, potentially boosting its sales further. Given how MU guided robust demand from the data center market, 5G smartphone market, automotive, and industrial markets, we expect the company to exceed consensus estimates again for FY2022 revenues for the fourth consecutive year.

Despite the Ukraine war reducing half of the world’s supply for critical materials, the memory maker indicated that it has enough near-term supply from diversified sources. However, experts have also weighed that we may see a critical materials supply shortfall within the next six months, potentially affecting MU’s revenues from FY2023 onwards. In addition, we expect to see increased pricing and margin pressures, further exacerbated by the inflation, despite its best efforts in cost reductions.

Perhaps this is the reason for the market’s lukewarm reaction despite MU’s stellar performance in FQ2’22. Given that NVDA and AMD are chip designers, they have been less affected than MU. Nonetheless, NVDA has also said that their “sales were gated by supply” due to the ongoing crunch. In the event of a prolonged war in Ukraine, we can expect to see sustained negative impacts on the semiconductor market as a whole.

So, Is MU Stock A Buy, Sell, or Hold?

Despite its brilliant execution in FQ2’22, MU is relatively undervalued while trading at an EV/NTM Revenue of 2.09x, slightly lower than its 3Y mean of 2.56x. Consensus estimates also rate MU as a strong buy now, given its strong market position in the DRAM segment. The stock is also trading attractively at $76.18, down 22% from its 52 weeks high of $98.45.

However, it is essential to note that Apple (AAPL) is cutting its iPhone 13 range and SE production capacity due to the ongoing Ukraine war and inflation. Consequently, we expect certain headwinds for MU, given that the latter supplies DRAM to the former. In addition, due to the current zero-Covid stance from the Chinese government, there is no telling if there will be another lockdown in Xian moving forward, given how Shanghai is also facing prolonged lockdowns. Therefore, combined with the inflation and global supply chain issues, the stock could speculatively retrace further, which may prove to be a more attractive entry point for cautious investors.

Nonetheless, we still encourage aggressive investors to use this opportunity to add more exposure for this solid stock, given its undervaluation and massive potential.

Therefore, we rate MU stock as a Buy only for aggressive investors.

Be the first to comment