golibtolibov

Not surprising at all

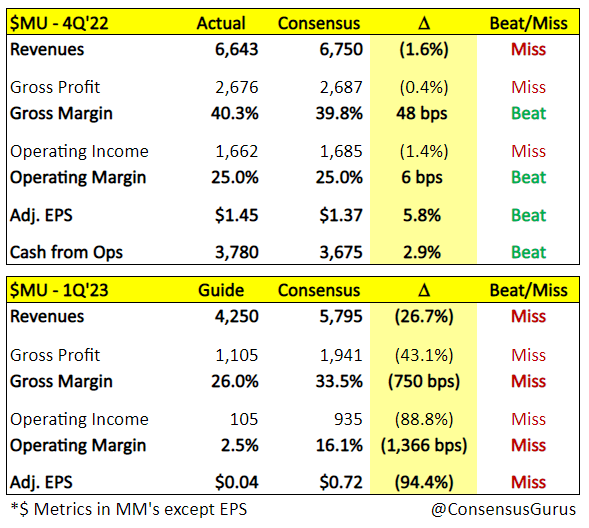

Micron (NASDAQ:MU) reported FQ4 results with revenue down 20% YoY to $6.6 billion while FY22 revenue of $30.8 billion represented just 11% of growth over the last year. On FQ3 earnings (analysis here), Micron guided F4Q revenue in the range of $6.8B to $7.2B (vs. $9.14B consensus), so things came in below the low end of management’s expectations. Perhaps what’s even more terrifying is that revenue for the current quarter is expected to come in significantly below Street estimates at just $4.25B (-45% YoY) vs. $5.8B consensus, while gross margin and operating margin are guided to disastrous territory with EPS being almost non-existent.

ConsensusGuru

The bad news is that things are looking pretty bleak as management pointed to a challenging macro, but the good news is shares didn’t react too negatively after the bell. Perhaps investors already anticipated that things would go from bad to worse, and everything that just happened was nothing out of the ordinary.

What’s the outlook?

Micron’s outlook for the current fiscal and calendar year is frankly not good. Here’s CEO Mehrotra to set the tone:

Turning to the market outlook. The memory and storage industry environment has deteriorated sharply since our last earnings call. – F4Q22 earnings call

Specifically, management expects C2022 industry DRAM bit growth of just 1% to 5% and NAND growth slightly above 10%, with supply outpacing demand leading to an “extremely aggressive pricing environment”. The key drivers of the slowdown include inventory adjustments, softening consumer demand, China Covid lockdowns and the Russia-Ukraine crisis.

In C2022, Micron forecasts PC unit sales to decline by mid teens (vs. 10% prior). Smartphone shipments are expected to see a high single digit decline. Again, this should surprise no one as PCs and smartphones experienced 2 years of extraordinary demand during the pandemic.

Though auto is a more secular story, Micron sees slowing demand in the next 2 quarters due to ongoing non-memory chip shortages. On the bright side, management thinks the long-term demand for auto memory chips could be 2x the market.

While many may think 2022 is the bottom for the memory business, 2023 is looking to be another difficult year. While DRAM (+ mid single digit %) and NAND supply growth is likely to fall below that of demand, industry profitability will likely remain challenged in 2023 given elevated inventory levels. Nevertheless, management sees longer-term DRAM demand growth in the mid-teens (vs. high teens prior due to lower PC sales) and high 20’s% NAND growth.

What is Micron doing to minimize the damage?

Given a challenging industry outlook, the most direct action Micron can take is to cut supply and wait for demand to pick up. For FY23, Micron is reducing Capex by over 30% YoY to $8B, including a 50% cut in wafer fab equipment (WFE) Capex. WFE Capex will be concentrated in technology development for new products. The read-through here is negative for equipment suppliers.

Micron will also cut utilization rates in both DRAM and NAND to address excess inventory and lower supply growth. While this will certainly come with much lower margins, management is doing the right thing.

Final thoughts

Memory is a cyclical business and Micron is managing through a down cycle just like many other semiconductor names from Nvidia (NVDA) to TSMC (TSM) (analysis here). One thing positive about this time is that Micron is in a much better financial position with a net cash position of $4B and no senior maturities until 2026. However, investors should brace for a few more quarters of ugly results, even though the majority of the negatives have been priced in.

Be the first to comment