jiefeng jiang/iStock via Getty Images

Thesis

Micron (NASDAQ:MU) released an earnings report that indicated the cyclical semiconductor industry might be heading for a downturn. But at a single digit P/E with expectations for double digit cross-cycle growth, it’s difficult not to be excited about Micron’s long term potential.

Author’s Note: Investors who are unfamiliar with Micron can read my industry deep dive and my comparison of Micron and Nvidia (NVDA).

Micron Q3 Earnings Report

Micron reported earnings on Thursday, beating by 6% on EPS but missing by less than 1% on revenue. Revenue was up 11% sequentially and 16% year-over-year. The results sent Micron down 3% on Friday, and also sent shock waves through the industry, with heavyweights like ASML (ASML) falling 5%, TSMC (TSM) falling 6%, Nvidia falling 3%, and AMD (AMD) falling 4%.

As with many companies lately, the big concern was forward guidance. Other companies in the industry reported during the past couple months and with the exception of Nvidia were generally upbeat, as they all insisted that demand remained strong despite macro concerns. However, Micron was the first company in the semiconductor industry to really sound an alarm bell about the impact of macro issues:

Our expectations for calendar 2022 industry bit demand growth have moderated since our last earnings call. Near the end of fiscal Q3, we saw a significant reduction in near-term industry bit demand, primarily attributable to end demand weakness in consumer markets, including PC and smartphone. These consumer markets have been impacted by the weakness in consumer spending in China, the Russia-Ukraine war, and rising inflation around the world.

As a consequence, our forecast for calendar 2022 PC unit sales is now expected to decline by nearly 10% year-over-year from the very strong unit sales in calendar 2021. This compares to an industry and customer forecast of roughly flat calendar 2022 PC unit sales at the start of this calendar year. We are now projecting smartphone unit volume to decline by mid-single-digits percent range year-over-year in calendar 2022, well below the industry and customer expectation earlier in the year of mid-single-digit percentage growth.

We think that sometime in fiscal ‘23 is when — in our fiscal ‘23 is when demand will rebound.

It’s always disappointing to see negative growth, especially when expectations are for positive growth. That said, it’s well known at this point that the semiconductor industry is cyclical. So negative growth in one quarter (or a few) doesn’t mean that Micron is a declining business or will be a bad long term investment, especially since it comes against a weak macro backdrop.

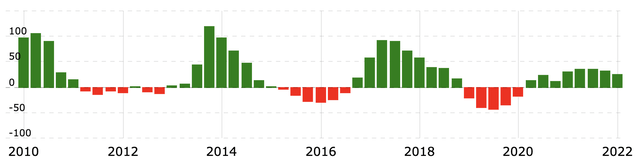

Micron has experienced 16 quarters of negative growth since 2010, but has nevertheless returned 698% in the last 10 years. The high double digit growth rates in good quarters have more than offset the bad quarters.

The macro issues Micron referenced are well known at this point and have been negatively impacting non-semiconductor companies’ earnings for the past couple months. After this earnings report, there’s no doubt that weakening demand could mean trouble for Micron in the coming quarters, and do the same to other members of the PC/smartphone supply chain like Apple (AAPL), ASML, and TSMC. However, Micron noted that server and cloud demand remained strong, so the cloud businesses of Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) may be less impacted.

The Silver Lining

Obviously it’s best for investors if Micron fires on all cylinders, but if there are segments that have to show weakness, PC and smartphone are good choices because they’re already slow growing. Presumably due in part to the negative growth of PC/smartphone in the coming quarters, Micron now projects that its high growth segments like data center, auto, industrial, networking, and graphics will rise from 45% of revenue today to 62% by 2025. That could position Micron to be a faster growing company once demand returns in the future.

Despite the near term weakness, Micron insisted that “secular demand trends remain strong” and cited their long term full cycle forecast for “CAGRs of mid-to-high-teens percentage for DRAM and high-20s percentage for NAND.”

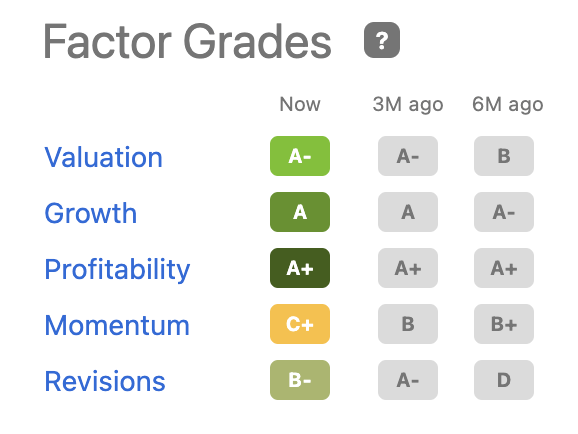

Seeking Alpha

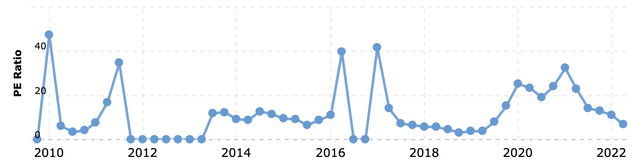

If Micron does maintain a cross-cycle CAGR around 20%, then its current P/E ratio of 6.75 and P/FCF ratio of 12.43 makes it one of the cheapest companies in the semiconductor industry and overall large cap universe, with a PEG of just 0.23. Micron’s other factor grades look very good as well. So it’s fair to argue that Micron’s poor forward guidance could already have been priced in.

Because of their cyclicality, semiconductor companies often trade at low P/E ratios, but Micron has consistently been one of the cheapest in the industry. Aside from a brief period in 2020-2021 and some cyclical spikes, Micron has rarely traded above 10 P/E, while other leaders have often traded above 20 P/E.

That discount to peers is because Micron has historically been a comparatively lower quality/narrower moat company, partly because it’s much smaller than memory giants like Samsung. Even today, Micron is still the only major semiconductor company besides Intel (INTC) to have an ROI metric below 20. However, the semiconductor industry as a whole is an embarrassment of riches, and it’s difficult to call any of the industry leaders low quality; even Micron has a strong balance sheet and lucrative 29% operating margin.

Micron has also made a lot of progress in improving its quality lately. The fact that it’s basically the first semiconductor company to warn of these macro issues having a larger-than-expected impact speaks volumes about their revenue visibility. Over the past few years, they’ve increased their collaboration with customers and started generating more revenue from longer term agreements in order to improve revenue visibility. As they mentioned during the earnings call’s guidance, that will allow them to cut manufacturing spend earlier, presumably improving long term operating margins and reducing oversupply.

If Micron can convince investors that it’s now as high quality as peers like ASML, Nvidia, TSMC, and AMD, then it could see substantial multiple expansion, perhaps more than doubling its share price due to multiple expansion alone. Combining that with double digit growth and aggressive buybacks could lead to very good returns for investors going forward.

I’d argue that Micron has more potential for multiple expansion than any other semiconductor company today, but it all depends on whether they can execute. Investors who want to own the highest quality semiconductor company can probably skip Micron in favor of companies with leading market share in their respective niche like ASML, TSMC, and Nvidia. But the best returns often come from the companies that improve their quality more than investors expect, not from the companies that are already fairly valued as best-in-class.

Management made it pretty clear that they view shares as undervalued in the earnings call:

We returned $1.1 billion to shareholders in fiscal Q3. Share repurchases will be both programmatic and opportunistic, and we expect to purchase more as the stock trades at bigger discounts to intrinsic value. Given our long-term financial outlook and the strength of our balance sheet, we see the current share price as very attractive and, at these levels, intend to repurchase shares more aggressively in fiscal Q4.

Micron traded below 4 P/E as recently as 2019, so don’t make the mistake of assuming that 7 P/E must be the bottom just because management sounds bullish, especially since the “E” might decrease in the coming quarters. But with a strong balance sheet, continued profitability, and opportunistic management, investors can be confident that Micron will make the most of further downturns to maximize shareholder value through buybacks. The current $12B in cash is very impressive for a $58B and is above Micron’s long term target.

Conclusion

For investors who can stomach the occasional quarters of negative growth, semiconductors have been a good long term investment, in part because their low valuations and high margins have allowed them to effectively utilize shareholder-friendly policies that combined with strong secular growth.

Micron’s quarterly report makes me more concerned about short term macro issues, which will remain difficult to predict. And how Micron’s short term stock price reacts to these issues will be even more difficult to predict. But in the long term I’m optimistic about Micron’s ability to continue beating the market. I believe that Micron has the most potential for multiple expansion of any semiconductor company.

Be the first to comment