knowlesgallery/iStock Editorial via Getty Images

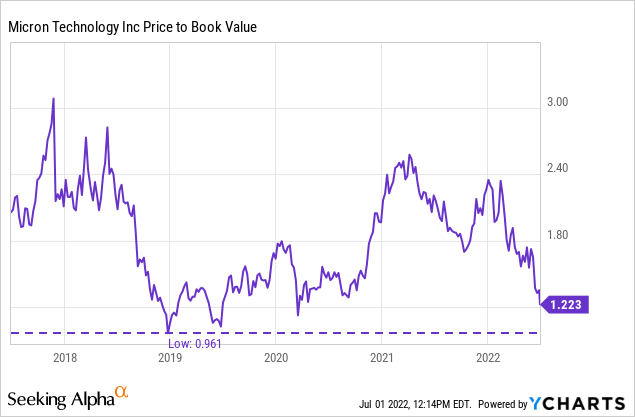

Leading up to Micron’s (NASDAQ:MU) FQ3 report, the stock had plummeted from $66 to $55. It seemed the market was getting ahead of some bad news. Then the last two weeks leading up to the report, analysts started an entourage of price target cuts and downgrades. At this point, the stock was hitting new 52-lows daily. Finally, the report is released, and we’re met with a good quarter but a dismal downside FQ4 guide. It’s all over. Micron is headed for a cycle bottom. But just a second. The market had been getting ahead of this news for weeks and months. With the report finally released, it’s within 15% of book value – a key valuation in determining the bottom of prior memory cycles. So, the downside risk has now compressed to nearly nothing at a known floor. Perhaps it’s time to step in after a long rollercoaster to $97 and back.

There’s no denying management’s guidance for its fiscal fourth quarter was anything but disappointing. It seems demand had fallen off steeply at the end of the reporting quarter. This is exemplified by the expected near 17% quarter-over-quarter sequential decline in revenue. The problem – investors are looking at the wrong reasons why while the valuation of the stock vs. its historical and reliable book value is at the bottom.

Let’s start with the why.

Memory Prices In Isolation

DRAM pricing has not been the issue, contrary to the many pundits who continue to opine DRAM “is down 12%” over the last several months. This is historical data, and while I understand the idea of extrapolating weak pricing into the future, it requires critical thinking to place it back into Micron’s business and understand the cause and effects.

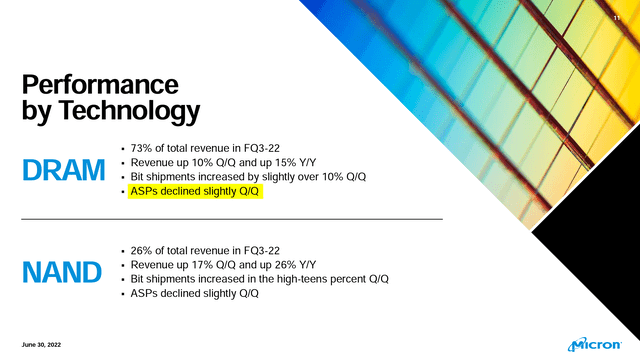

If DRAM pricing had been down 12% over the last three or four months, Micron would have already seen this headwind. But instead, the company reported in line with its revenue guidance and beat materially on the bottom line with a $2.59 print against the guidance top end of $2.56. The company reported DRAM ASPs declined “slightly” quarter-over-quarter, and bit shipments increased by just over 10%.

Performance of DRAM and NAND in FQ3 (Micron’s FQ3 Earnings Presentation)

That’s not a weak quarter. So, for all the hand wringing of memory prices dropping, it shows it doesn’t affect Micron the way a one-to-one correlation would; how some would portray it.

“Then explain the horrible FQ4 guidance, Joe.”

Sure, I’ll be happy to.

How FQ4 Will Be Materially Worse

The problem with pundits and some analysts is the hyperfixation on pricing and forgetting there’s another variable involved in calculating revenue: Bits shipped. Multiplying a $10 chip by no shipments is still zero. Moreover, multiplying a $0.00 chip by 5M units shipped is still zero. The model requires both price and quantity. So if pricing declined “slightly” in the quarter, but the number of units was up 10%, you get a quarter-over-quarter revenue growth rate of 11%. What good was making a big deal about DRAM pricing then?

However, if we move over to the bits shipped end of things, this is where FQ4 comes together (or doesn’t). CEO Sanjay Mehrotra commented on the key piece of this – demand – by saying, “Near the end of fiscal Q3, we saw a significant reduction in near-term industry bit demand, primarily attributable to end demand weakness in consumer markets, including PC and smartphone.” The wording “bit demand” is not by mistake. This correlates to bits shipped, specifically, and not pricing. Because he goes on to say, “To protect profitability, we will maintain pricing discipline, manage capacity utilization, and use inventory as a buffer to navigate through this period of demand weakness.” (FQ3 earnings call, emphasis mine)

This is how pricing doesn’t move, but bits shipped do, causing the issue. Figuring out bits shipped and demand is harder than watching some TrendForce reports about pricing. Pricing can stay the same because no transaction happened. The transactions that do happen when Micron is agreeable to the terms may occur at the same price or slightly lower, but there’s far less quantity involved. In this case, pricing appears stable, but the volume behind it could be half as much. This is how FQ3 went from great times, with no accurate indication of how bad it was, to FQ4 sneaking a massive cut to guidance.

This also is how gross margins become affected as the company begins storing what it doesn’t sell in inventory. This allows production to remain as close to 100% as possible to not see drastic operating margin deterioration. Folks will tell you this is the key to seeing the cycle. But the truth is, things are more complicated in 2022, with supply managed by only three companies and Micron having the technology lead in DRAM and NAND. So I urge you to stop looking at one metric intensely and not keeping the whole picture in mind.

To top this all off, it doesn’t look like there’s any near-term help on the way. Once things start moving downhill in demand, it generally takes two to three quarters to see the demand swing in the other direction. This means we won’t see the recent mid-$2 earnings of the last quarter for a bit. But it doesn’t mean we’ll see negative quarters, either. As much as the cycle narrative is being thrown around again, the oscillations are far less erratic and have smoothed out over the last several years.

The thing is, where’s the stock in relation to all these upcoming weak earnings?

But The Stock Is Already Near The Bottom

This is where things get interesting because investors have just gotten the news from the company, so the worst is just beginning. Right? Well, not exactly.

The market has been so ahead of any changes in Micron’s business that it began pricing this guidance as far back as February and as recently as the beginning of June. It wasn’t far off as Micron is “only” down five or so percent midday Friday with the magnitude of the downside guide as extensive as it was reported less than 24 hours ago. Because of this market anticipation, the stock is now within striking distance of its typical “cyclical” valuation: book value.

This has been a go-to valuation as the company’s capex-heavy industry has historically put it at liquidation levels if it were to fold under the pressure. Mind you, a one-time book value has been the level due to the level of stability of the company with its weak balance sheet and lagging technology.

Today, however, the company’s balance sheet is pristine, reaching a record $5B in net cash and having $14.5B in liquidity. This compares to the December 2018 valuation low with $3.07B in net cash and $9.7B in liquidity. So there’s no question the company is in a better position on the balance sheet.

Technologically, the company is now several quarters ahead of its competitors, with 1α in full production while 1β heads for production at the end of calendar 2022.

Our 1α (1-alpha) DRAM and 176-layer NAND ramps are several quarters ahead of the industry and progressing well as we continue to qualify new products that use these nodes.

This has been corroborated by other SA authors who have kept tabs on Micron’s competitors with great interest.

Future Earnings Will Be Bad, But The Stock Knew It Already

Micron will experience negative revenue and EPS growth over the next few quarters as it grapples with waning demand in consumer end markets. Graphics, industrial, auto, and cloud should hold the line for the medium term, but it depends on the pricing side of the equation. Keeping an eye on both is key to seeing if the environment will get materially worse than the material news we just got or if there is a buoying to come.

With the company forecasting a cut to FY23 capex, free cash flow will not be as hurt and allow the company to continue its buyback at depressed prices. The record-high net cash position should be maintained as high-quality inventory is stored for sale during the leaner capex times. From a company perspective, I have a sleep-well-at-night attitude with the balance sheet the way it is. Both buyback and dividend will continue to move along without concern.

Because the stock is within 15% of book value levels, the downside has a floor, helping the investor understand where things solidify and maintain risk-aversion. The industry took a relatively quick turn to the off-ramp to regroup, but the relative positioning of the stock has already lessened the blow. Don’t be surprised if the stock moves higher by the end of the year as the market begins to price in the other side of the story.

Be the first to comment