PonyWang

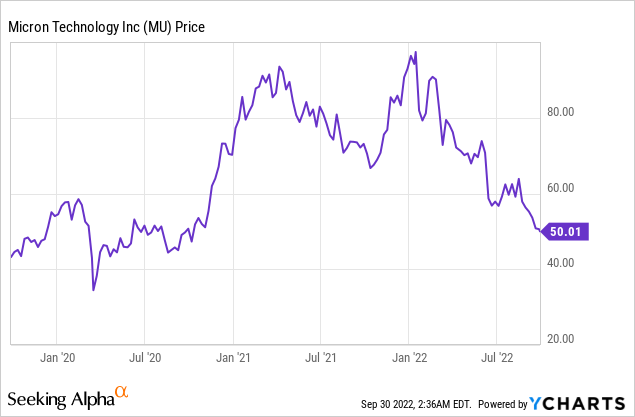

Micron (NASDAQ:MU) is the 5th largest semiconductor company in the world and one of the “big three” providers of DRAM (Dynamic Random Access Memory), which is commonly used in PCs and data centers. The company benefited massively from the economic reopening in 2021, which boosted semiconductor prices globally, as shortages for components were commonplace. However, the stock price peaked in January 2022 and since then it has been butchered by 48%. This has mainly been driven by a revenue miss last quarter (FQ3,22), which was driven by lower customer demand and an oversupply of semiconductors. Micron recently announced its financial results for FQ4, which again showed the company had beaten tepid earnings guidance but missed on revenue. If I had to sum it up in one phrase it would be “atrocious but there is hope”. In this post, I’m going to break down the recent financial results and reveal reasons why Micron’s valuation may be tasty at these levels, for the long-term investor, let’s dive in.

Financial Breakdown

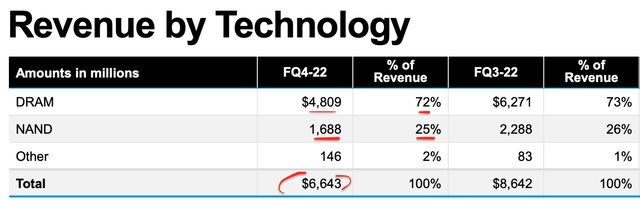

Micron generated mixed financial results for the fourth quarter of fiscal year 2022. Total Revenue for the quarter was $6.6 billion, down 23% Q/Q and 20% year over year which was atrocious. However, before we get too excited if we take a step back, total revenue for the full fiscal year of 2022, was $30.8 billion which is still up 11% year over year and a record for the company. As a reminder for you guys, Micron makes approximately 72% of its revenue from DRAM and 25% of its revenue from NAND (flash memory). In FQ4, DRAM revenue was $4.8 billion which declined by 23% Q/Q and 21% year over year. This was driven by ~10% lower bit shipments and a low teen reduction in average selling price. These metrics are classic for a cyclical downturn, lower-end market demand equals reduced volume and the oversupply equates to a lower price per unit overall. This effect is heightened in the Semiconductor industry as innovation and new technology are a key part of the equation. Thus manufacturers can’t really “hold out” for a higher price, when they have new and faster components being developed. Instead, they opt to clear out old inventories even if this means a lower price.

Micron Revenue by technology (FQ4 Earnings Report)

NAND revenue also declined by 26% sequentially and 14% year over year. Bit shipments plummeted by ~20% and the average selling price also declined. Again if we take a step back, for the full fiscal year 2022, revenue popped by 11% to $7.8 billion.

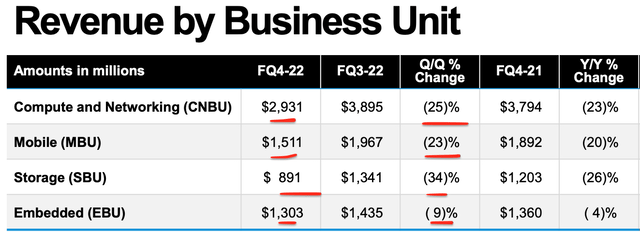

If we analyze by business unit, we can observe a more granular financial overview. The Compute and Networking unit generated $2.9 billion, which plummeted by 25% quarter over quarter and declined by 23% year-over-year. This was mostly driven by lower consumer demand for PCs, while server and graphics demand also wasn’t great. A decline in PC/Gaming revenue is a common industry trend that I have seen across the board in the earnings reports of companies such as Nvidia (NVDA) (graphics cards) to Microsoft (MSFT) (Xbox), thus this plays into my thesis that this is just a cyclical downturn. For example, if the “Xbox” was a business in itself and not part of Microsoft, would long-term investors sell off the stock just because of one year of lower demand, unlikely if all consoles have the same negative trend. The semiconductor industry is a game of market share, thus the real worry is when one competitor is eating market share and another is losing it, in this case, the decline is secular in nature.

Revenue by business segment (created by author Ben at Motivation 2 Invest)

Revenue by Mobile Business Unit was ~$1.5 billion, which declined by 23% sequentially and declined by a further 20% year over year. The Storage business generated $891 million which declined by 34% Q/Q and 26% year over year. For the full year, NAND revenue was a record high and margin share gains have been achieved across client and data center SSDs. I am not surprised by the cyclical decline in mobile and PCs but I am surprised that Data Center revenue hasn’t offset more of the declines. As from my recent studies of the earnings results by Amazon (AMZN), which owns AWS the world’s largest cloud infrastructure provider, they are still growing rapidly. In addition, Microsoft Azure and Google (GOOGL) (GOOG) Cloud are also the fastest growing parts of each business respectively. In the words of hedge fund manager Mohnish Pabrai [Pabrai Funds] who has the majority of his US portfolio in Micron stock, “Micron is like a tax on data centers”. Even in Micron’s own earnings report management states;

“Cloud end demand remains healthy, driven by secular growth in AI and the digital economy”

Thus these poor results may be partly due to the timing of orders. In addition, “supply constraints” are expected to be limiting the speed of server builds. Then if we combine this will macroeconomic uncertainty, we may just be seeing a minor pause in the freight train that is digital transformation.

Micron’s Embedded Business unit generated revenue of $1.3 billion which declined by 9% Q/Q and just 4% year over year. This business unit has been kept afloat by strong automotive and industrial demand.

Profitability and Margins

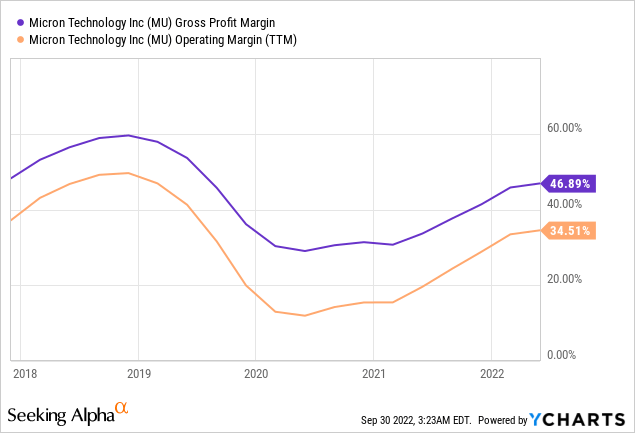

Micron generated a “consolidated” gross margin of 40.3% in FQ4,22. This declined by ~7% sequentially, with lower pricing driving the decline. The good news is for the full fiscal year 2022, the gross margin was up 6% year over year, to 45.9%.

Micron had operating expenses of ~$1 billion, in fiscal Q4 which was slightly lower than the guidance range which was partly driven by lower compensation for the variable part. Operating expenses, popped by $60 million which was mainly driven by the timing of technology spend, which I don’t think is a bad sign long term. The same can be said for R&D investment which drove a $500 million increase in operating expenses to $3.8 billion for the fiscal year 2022. I don’t deem this to be a negative overall and as companies that invest a larger portion of revenues into R&D tend to produce greater shareholder value long term, think of Amazon, Google, Meta (META), etc.

The business generated operating income of $1.7 billion, which resulted in 25% operating margin, which was down 11% Q/Q. However, this is still solid overall given the average industry operating margin for a software company is ~23% and Micron is a hardware provider, thus its margins are spectacular. For the fiscal year 2022, its operating margin was an exceptional 33.4%, up 6% year over year.

Earnings per share (Non GAAP) was $1.45 in Q4, which declined massively from $2.59 in Q3, which missed analyst expectations and was driven by the aforementioned factors.

Cash Flow and Balance Sheet

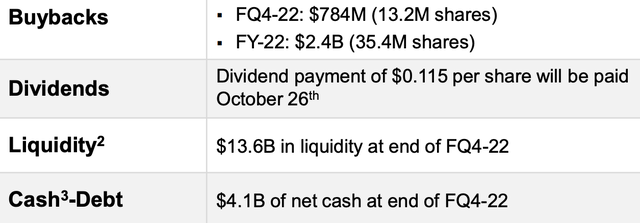

Micron generated solid cash from operations of $3.8 billion with substantial Capital expenditures of $3.6 billion in fiscal Q4. This left $196 million in free cash flow for the quarter. Management has deployed free cash flow well and is fully committed to returning “100%” of free cash flow to shareholders in the form of dividends and buybacks. In fiscal year 2022, the business bought back $2.4 billion in stock and paid a dividend yield of ~0.8%.

The company has a fortress balance sheet with $13.6 billion in liquidity, $4.1 billion in net cash and $6.9 billion in total debt.

MU Outlook and Cost Cutting

Moving forward, management expects further headwinds in the next few quarters. Micron expects shipments and pricing to continue declining in both DRAM and NAND, as per the current trend due to lower demand. In addition, they expect “inflationary pressure” will be a headwind to costs.

The good news is they expect volumes to recover in the second half of fiscal year 2023. In the meantime, inventory is expected to continue to remain high (valued at approximately $6.1 billion for Q4) before lessening as demand recovers.

Capital spending is expected to be ~$8 billion for the fiscal year 2023. This may seem incredibly high, but would actually represent a decline of 30% year over year, as less wafer fab equipment Capex is required to meet the lower demand. However, the Capex is expected to be weighted towards the first half of F23 and thus an eye-watering $1.5 billion in negative free cash flow is expected next quarter. The company also expects a higher tax rate, due to various tax rules, although this is expected to be temporary.

The good news is management is undergoing a strict cost-cutting program which includes lowering general expenses, reducing Capex and better managing working capital.

Giving this gloomy backdrop, revenue is expected to be $4.25 billion in Q1,23. With EPS of $0.04, plus or minus $0.10.

CHIPS Act Tailwinds

A positive for Micron is they are poised to benefit from the CHIPS Act recently announced by the Biden Administration to combat China in the semiconductor industry. This provides $52.7 billion for American semiconductor research, development, and workforce training. In addition, to $39 billion in manufacturing incentives and $13.2 billion in R&D incentives. Micron plans to invest ~$15 billion over the next decade to build out manufacturing fab sites in places such as Boise, Idaho. This will secure Micron, as a strategic US asset and offer greater diversification from the regions of Taiwan and China, which could be areas of political volatility.

Advanced Valuation

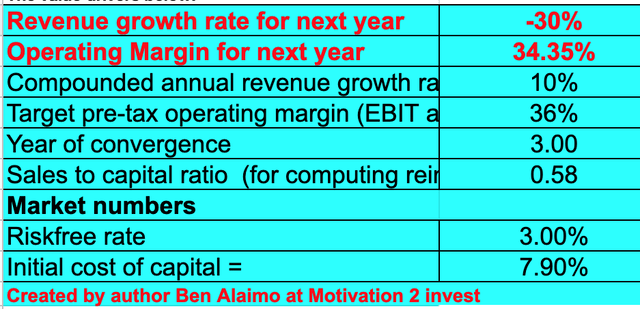

In order to value Micron, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted revenue to continue to decline by a substantial 30% next year, before rebounding by 10% per year for the next 2 to 5 years. I believe this is fairly conservative given annual revenue increased by a rapid 49% between 2017 and 2018, pre-pandemic.

Micron stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted its operating margin to increase by a couple of percentage points to 36% over the next 3 years, as market prices adjust. Note, this may look higher than the company’s base margin and that is because it includes an adjustment I have made for R&D.

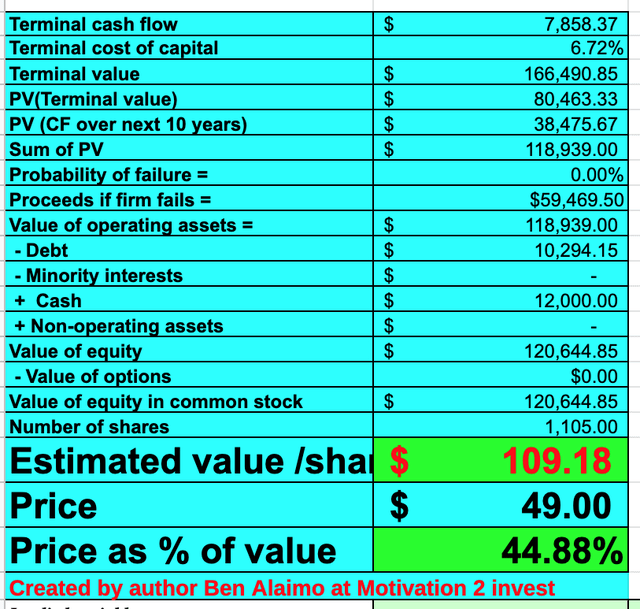

Micron stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $109 per share, the price at the time of writing is $49 per share and thus I think the stock is ~66% undervalued. Note: I do suspect, the stock price to drop further in the short term, as headline news and fear grips the average investor after the poor earnings report.

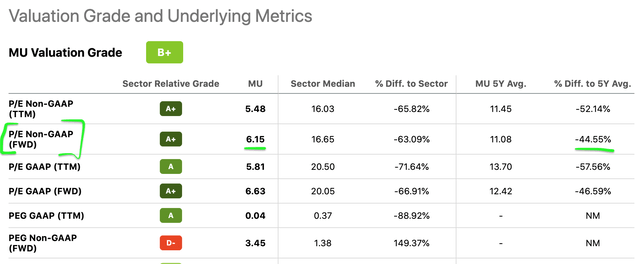

As an extra data point Micron, trades at a Price to earnings ratio = 6.15, which is 44% cheaper than its 5-year average.

Valuation (created by author Ben at Motivation 2 Invest)

Risks

Cyclical Downturn/Recession

The next couple of quarters is going to be difficult for Micron and investors. The low demand, prices and higher capex costs will continue to decimate revenues as forecasted. In addition, the macroeconomic environment of high inflation and rising interest is also not great for any business, especially those in manufacturing. The good news is this is a “cyclical downturn” in my eyes, and it is nothing Micron hasn’t been through before. Between 2014 and 2016, the stock price plummeted by 70% from its high to low point, before rebounding like a rocket.

Micron stock price historic decline (created by author Ben at Motivation 2 Invest)

Final Thoughts

Micron is a technological powerhouse and one of the three leaders in DRAM and NAND. The company is poised to benefit from secular trends across PCs, data centers, and even the automotive sector. After an unusually great 2021, the semiconductor industry is going through a cyclical downturn. But for long-term investors, I think this is just another opportunity to dollar cost into the stock and hold for at least the next 2 to 5 years.

Be the first to comment