USD/MXN Analysis and Talking Points

- USD/MXN | Weakness Persists for the Peso

- Mexican Peso Downside Risks More Broadly Balanced After Bulls Exit

- USD/MXN Technical Levels

USD/MXN | Weakness Persists for the Peso

During the Coronavirus crisis, the Mexican Peso has been among the notable underperformers in currency markets, crashing as much as 37%. However, with the Federal Reserve announcing unlimited QE and with the US finally agreeing fiscal stimulus have seen a much-needed reprieve as vol eases to 3-week lows. Consequently, the modest improvement in risk appetite has seen the Mexican Peso gain from significantly depressed levels while a further improvement is contingent on financial market stability.

Recommended by Justin McQueen

Improve your trading with IG Client Sentiment Data

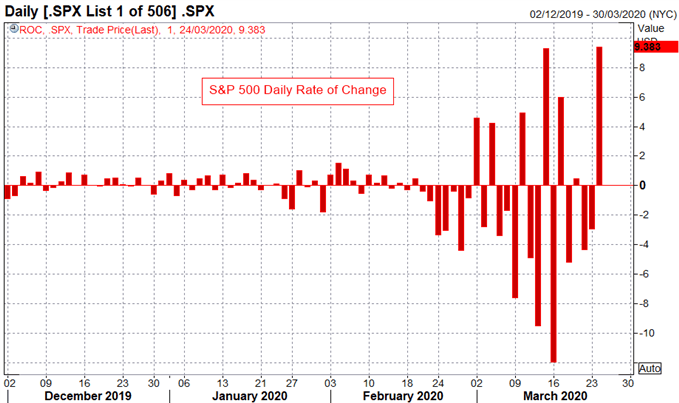

Although, we are mindful of the fact that even in bear markets, risk assets don’t simply fall in a straight line with large bounces in equities often occurring and proving to be somewhat temporary. As a reminder, the S&P 500 has yet to see back to back gains since February 5th (figure 1). As such, with the number of coronavirus cases likely to soar in the US, risks remain skewed to the downside for risk assets, therefore we see USD/MXN to remain elevated.

Figure 1: S&P 500 Has Yet to See Back to Back Gains Since Feb 5th

Source: Refinitiv

Market Positioning: Last month we highlighted that with investors holding near record longs in the Peso, the currency was at risk of a liquation in long bets amid the concerns pertaining to the spread of the coronavirus. That said, with the latest CFTC data showing a capitulation in bullish bets, risks to the Mexican Peso are more broadly balanced and thus Peso weakness may become more modest with USD/MXN approaching a possible top, given that another bout of aggressive selling could be met with currency intervention.

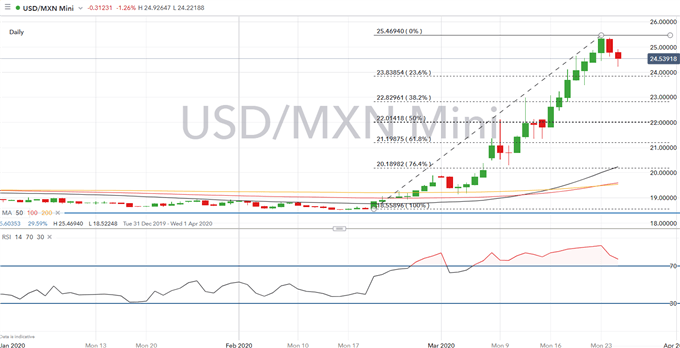

USD/MXN Technical Levels

While USD/MXN remains in a firm uptrend, resistance is situated at the record peak at 25.46, where a break above sets the pair on course for a test of the 26.00 handle. On the downside, near term support resides at the 23.6% Fibonacci retracement at 23.83. Failure to hold puts USD/MXN at risk of a move towards 23.00.

USD/MXN Price Chart: Daily Time Frame

Source: IG Charts

— Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX

Be the first to comment