Chip Somodevilla/Getty Images News

Investment Thesis

“What’s in a name? That which we call a rose by any other name would smell as sweet”

I think Juliet might have been onto something here, although she probably didn’t have Mark Zuckerberg in mind – and the recent name change to Meta (NASDAQ:META) hasn’t done much to shift the not-so-sweet smell of Facebook. In fact, whilst the metaverse has certainly been hyped up over the past year (particularly following this name change), I believe the Ready Player One version of the metaverse is decades away, and may not even happen at all.

As such, I hope you’ll humor me slightly in this article, as I’ll be looking at Meta excluding the metaverse – which I believe to be a view much more grounded in reality.

Business Overview

Meta’s mission is ‘to give people the power to build community and bring the world closer together’, and whilst the latter is somewhat debatable, the company has certainly changed the way we interact and connect forever.

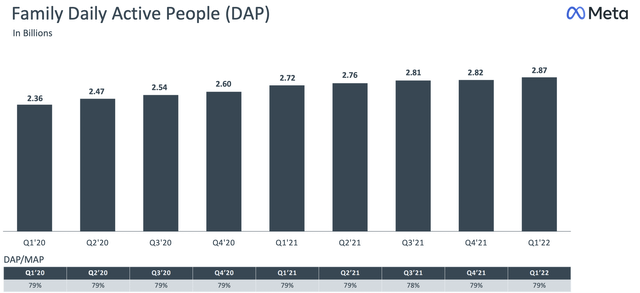

Meta’s main offerings include its family of four apps: Facebook, Instagram, Messenger, and WhatsApp, which have a combined 2.87 billion daily active people – that is, approximately 36% of the world’s population use at least one of these apps on a daily basis, which I find both mind blowing but also completely unsurprising.

Meta Q1’22 Earnings Presentation

The business model of Meta is fairly easy to understand, as they generate the majority of their income through advertising. Marketers can purchase ads that appear in multiple places including on Facebook, Instagram, Messenger, and third-party application websites. Given the 2.87 billion eyes on their Family of Apps every single day, it’s no surprise to see the number of advertisers looking to use Meta’s platforms to get their brand out there.

The Good

Meta’s business model clearly has some core strengths that has helped propel it to its current behemoth level, and we’ll start with the network effect. I think Facebook itself has to be the quintessential network effect business, as it couldn’t be more obvious. If one person signs up to Facebook, they’ll convince family and friends to join, who will then go and convince their family and friends to join, and this is how Facebook has historically been able to grow so rapidly. Given that the company already has 36% of the globe looking at its apps, this specific network effect is going to ease up – but if anyone wants to connect with family and friends, there is really only one place for them to go.

Yet there is still one very strong network that exists with Meta, which is virtually unmatched. The Facebook platform has 1.96 billion daily active users as of Q1’22, and the number of users across Meta’s apps has been in the billions for years. These users provide enormous amounts of data for Meta to use when deciding where to place adverts to ensure the optimum ROI for advertisers. Each time an ad is placed anywhere in Meta’s universe, the company is able to analyze the data and figure out the best place to target the most appropriate users for each specific advert

The network effect? Meta is one of the largest ad companies in the world, and so they have a huge number of adverts posted every second. Each advert results in more data for Meta to learn from, and more data leads to improved ad placements and more optimal ROI for advertisers, and improved advertising results and higher ROIs will lead to more advertisers using Meta, and therefore even more adverts for Meta to learn from. A virtuous cycle that has served the company extremely well so far.

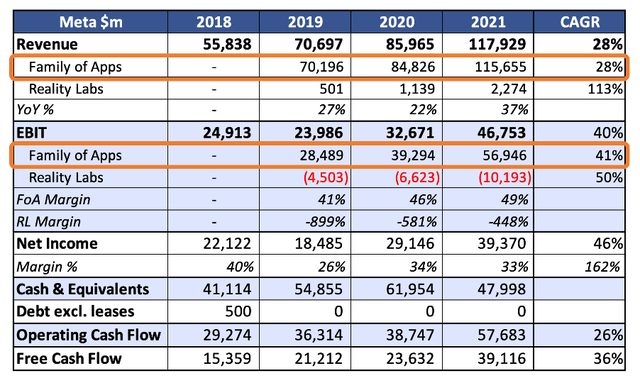

Meta also has extremely impressive financial fortitude.

The Family of Apps EBIT margin nearing 50%? Almost $40 billion in free cash flow for 2021? Just under $50 billion in net cash and zero debt?!

Meta might constantly feel like it’s having to weather a storm, but it sure does have the financials to handle it. Unfortunately, it’s not going to be plain sailing just yet.

The Bad

If you invest in any social media platform, I’m sure you’re more than aware of the uproar surrounding Apple’s (AAPL) privacy changes. These new policies added a new level of opaqueness and difficulty for advertisers when it comes to obtaining data from their users, and as such it will damage Meta’s strong network effect that we just looked at – and this was highlighted by CFO Dave Wehner in their Q4’21 earnings call.

On iOS 14, you know, we saw the revenue impact with iOS 14 — sorry, iOS just in general, in Q4, and that was in line with our expectations and similar to the Q3 headwind.

But, obviously, as we go into 2022, we’re going to be lapping a period in which in Q1 and Q2, those headwinds were not in place in the year-ago period. So that definitely makes for a tough comp in the first half of the year. And, you know, we believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it’s a pretty significant headwind for our business. And, you know, we’re seeing that impact, you know, in a number of verticals.

So, a $10 billion headwind for 2022 is quite something, representing ~8.6% of 2021 revenue for Meta. Combine this with the fact that inflationary pressures and rising interest rates are giving a grim outlook for the economy (and advertising is likely to be heavily impacted), 2022 is shaping up to be a painful year for Meta.

The Ugly

I’m sure one of the main reasons for the name change from Facebook to Meta was to try and shift away from the negative PR surrounding Facebook – well, that hasn’t quite happened.

In fact, just yesterday headlines were plastered across the internet: ‘Meta settles lawsuit with Justice Department over ad-service algorithms’ – so, what happened this time? According to TechCrunch:

The lawsuit was the Justice Department’s first challenging algorithmic bias under the FHA, and it claimed that the algorithms Meta uses to determine which Facebook users receive housing ads relied in part on characteristics like race, color, religion, sex, disability, familial status and national origin — all of which are protected under the FHA. Outside investigations have provided evidence in support of the Justice Department’s claims, including a 2020 paper from Carnegie Mellon that showed that biases in Facebook’s ad tools exacerbated socioeconomic inequalities.

Meta said that, under the settlement with the Justice Department, it will stop using an advertising tool for housing ads, Special Ad Audience, which allegedly relied on a discriminatory algorithm to find users who “look like” other users based on FHA-protected characteristics. Meta also will develop a new system over the next six months to “address racial and other disparities caused by its use of personalization algorithms in its ad delivery system for housing ads,” according to a press release, and implement the system by December 31, 2022.

An independent, third-party reviewer will investigate and verify on an ongoing basis whether Meta’s new system meets the standards agreed to by the company and the Justice Department. If the Justice Department concludes that the new system doesn’t sufficiently address the discrimination, the settlement will be terminated.

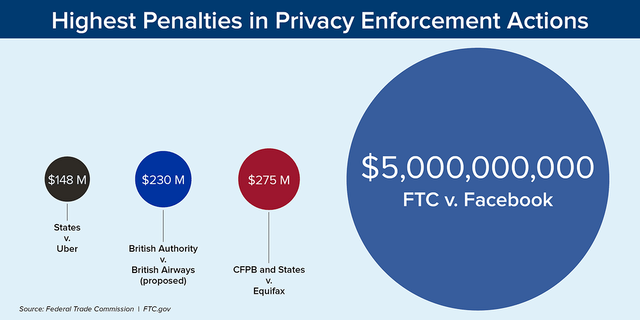

The good news for Meta shareholders is that the settlement amount is likely to be around $115,000, which for a company of Meta’s size is just loose change it can find down the back of the sofa. It certainly doesn’t compare to the $5 billion penalty dished out to Facebook in 2019 by the Federal Trade Commission for ‘deceiving users about their ability to control the privacy of their personal information’, which was almost 20 times greater than the largest privacy or data security penalty ever imposed worldwide.

Let’s also not forget about more recent negative PR, such as whistle-blower Frances Haugen’s revelations that Facebook’s algorithms promote content that gets the most engagement and reaction. Whilst this may not sound terrible (and even sounds like good business), the main issue is that this ‘engaging’ content is often controversial, untrue, and dangerous. This was highlighted yet again in a Netflix documentary that took the world by storm – The Social Dilemma.

Whatever your views on whether Meta is acting appropriately, any potential investor has to view the continuous negative PR, lawsuits & hearings as a concern. Facebook has put itself in the firing line of lawmakers and regulators time and time again; the company has coped so far, but that’s not to say it won’t struggle in the future.

In a world that is scrutinizing big tech more and more, Facebook has successfully made itself public enemy number 1 for regulators.

Valuation

Meta’s shares have come crashing down in 2022, and given the financial strength of this business, how appealing does it look from a valuation point of view?

Well, a couple of things to consider:

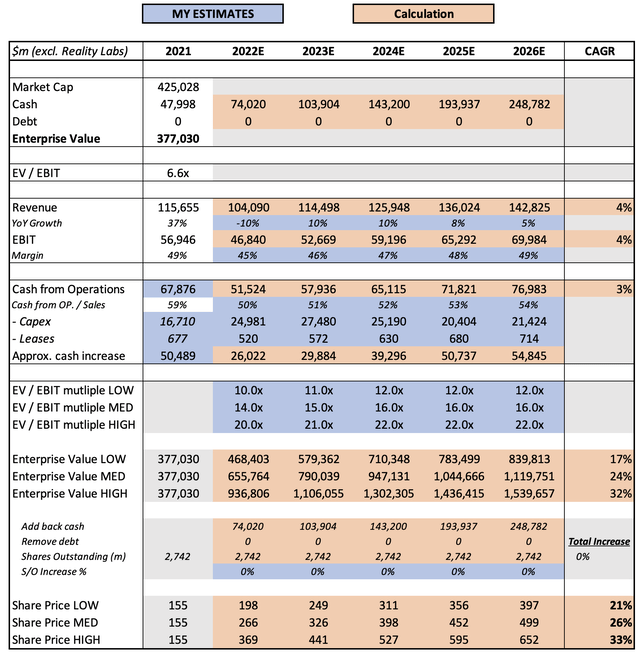

- I will only be including revenue and EBIT from the Family of Apps; I still see the Reality Labs investment as a speculative cash burner, which may or may not work out.

- Revenue will clearly struggle in 2022 due to macroeconomic conditions combined with the IOS privacy changes; this will be reflected in my forecast

With that said, here is my valuation model for Meta.

I have allowed for a 10% fall in revenue driven by poor macroeconomic conditions and Apple’s privacy changes. Following this fall, I have allowed for a gradual recovery that is slower than Facebook’s previous growth rates, again due to what I perceive to be increased risk across the board with IOS and regulators, as well as Meta’s size leaving less room for growth.

EBIT margins have remained fairly high, since Meta’s advertising business is mature and optimized for profitability – I don’t see these margins falling drastically anytime soon. I’ve also allowed for a substantial capex investment over this period, but even so Meta is likely to be raking in the cash.

I’ve not allowed for any share buybacks; this wouldn’t have much of an impact in my model, as the cash in reflected in Meta’s enterprise value.

Finally, I think that an EV/EBIT multiple of 16 is appropriate for a company such as Meta (despite the fact that their current EV/EBIT excluding reality labs is a meager 6!), but if this is a bit much you can see the share price growth at a 12x EV/EBIT multiple. For anyone curious, the forecasted share price at a 6x multiple is $224, representing a 9% CAGR.

All in all, this valuation model projects that Meta shares are capable of achieving a 26% CAGR through to 2026.

Bottom Line

Despite the attractive looking valuation, there are just far too many uncertainties surrounding Meta to convince me to invest in the company right now. There’s no telling how hard the company will be hit by a shifting macroeconomic environment, there’s no telling how hard the company will be hit by IOS changes in the long run, and there’s no telling if the negative press will eventually become too much to handle.

Plus, all this valuation is excluding Reality Labs. If you believe in Meta’s ability to truly create the metaverse, then shares today are currently looking like a no brainer. But, if you believe the metaverse talk to be the equivalent of a magician asking the audience to focus on the card he’s holding up, in the hopes that they don’t see his assistant quietly breaching privacy regulations, then perhaps Meta isn’t the company for you.

I may get splinters from sitting on the fence, but Meta is too difficult an investment for me to call. The financials say ‘duh, invest’, but the wider environment says ‘run and don’t look back’ – I’ll continue to keep my eyes on Meta from afar… or at least, through my Instagram account.

Be the first to comment