Liia Galimzianova/iStock via Getty Images

Investment Thesis

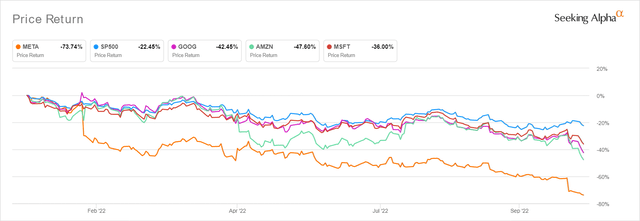

Big Tech YTD Stock Price

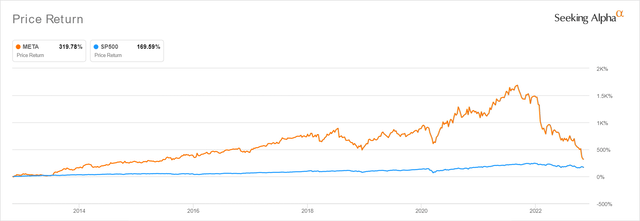

Meta Platforms, Inc. (NASDAQ:META) continued to be slaughtered after its FQ3’22 earnings call, with a -73.74% plunge YTD against the wider market destruction of -22.48% in the S&P 500 Index. Though others such as Amazon (AMZN), Alphabet (GOOG)(GOOGL), and Microsoft (MSFT) may have suffered relatively tamer discounts thus far, the rampage is not over, with Apple (AAPL) similarly losing -23.70% of its value at the same time. The time of maximum pain is not here yet.

Nonetheless, we posit that Meta’s long-term trajectory remains robust, given the promising signs we are seeing thus far. We will discuss further below.

1. Monetization Is Improving By Leaps And Bounds

Meta continues to report improving monetization in its Instagram Reels, with over $1B in annual revenue thus far. Its Facebook platform is performing excellently as well, given the combined run-rate of $3B. The company has also been growing its Reels consumption with an impressive 50% growth compared to six months ago, with 140B reels played across Facebook and Instagram on the daily.

Furthermore, Meta has partnered with Salesforce (CRM) to include WhatsApp/ Messenger/ Instagram Direct as paid messaging/ click-to-messaging ads for online businesses. WhatsApp alone boasted an impressive 80% YoY growth to $1.5B in run rate, while growing a total of $9B in annual revenue from the three messaging platforms. Furthermore, we expect its JioMart on WhatsApp model to be quickly replicated globally as well, with a massive potential into building an all-encompassing business communication/ e-commerce/ payment ecosystem in WhatsApp/ Family of Apps over the next few years. Why not?

Furthermore, Family of Apps’ engagement remains robust, with 3.7B monthly users. WhatsApp alone boasts 2B active daily users, while Facebook nearly hits 2B daily users and Instagram reports over 2B monthly users. We do not need a crystal ball to surmise that Meta’s monetization will be very successful indeed, combined with the departure effect from Twitter (TWTR) and TikTok’s potential ban in the US.

2. Investments Are Well Balanced & Promising

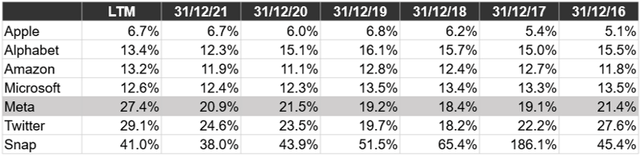

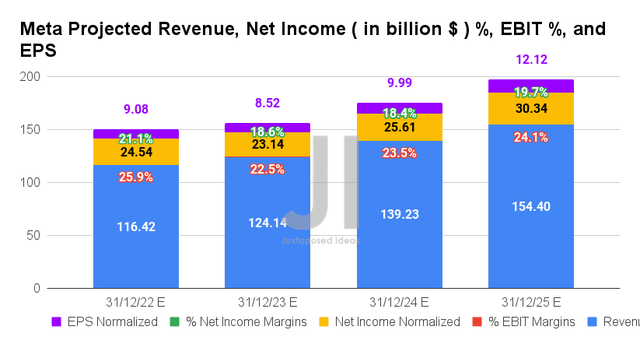

R&D Expenditure To Revenue

Over the LTM, Meta spent 27.4% of its revenues on R&D efforts, indicating a growing focus on hiring across the board for Family of Apps, Reality Labs, and marketing/sales/G&A, instead of the false perception of simply the Metaverse. The company is obviously aggressively developing its AI capabilities, advertising, click-to-messaging ads, and Reels against TikTok. The aggression in R&D efforts is obviously of utmost importance, due to the catastrophic $10B headwinds from AAPL privacy changes. In addition, 82% of its FQ3’22 expenses are focused on the development and operation of the Family of Apps. Based on the table above, it is evident that Meta is not overspending on its R&D efforts, in comparison to other social media companies such as TWTR and Snap (SNAP).

While Meta has also guided incremental growth in Reality of Labs expenses for FY2023, this will be money well spent, since it ensures Meta’s leadership in the intensely competitive market. You may refer to our previous analysis here: Apple Vs. Meta: Battle Of The Mixed Reality. Even Nvidia (NVDA) is heavily investing in the Omniverse, pouring easily 21.22% of its revenues into R&D efforts thus far. We continue to believe in Zuckerberg’s passion and Metaverse vision, especially after witnessing the highly promising photorealistic avatars and face tracking that the company recently presented in Connect 2022. We are starting to see the fruit of its investments, whose market enthusiasm peaked last year during Meta’s unveiling of Metaverse and, consequently, died a tragic death during these peak recessionary fears.

The application in Metaverse is much wider than simply for online gaming and world-building, such as Roblox (RBLX) or Horizon World. As more big tech companies embrace remote work post-pandemic, we expect these capabilities to grow as B2B applications for virtual AI training, hologram video calls, large-scale industrial/ design/ engineering/ architectural simulations, revolutionizing scientific discoveries, and enhancing 3D workflows globally. Meta will get there sooner than expected, given its expanding partnerships with MSFT, Adobe (ADBE), Autodesk (ADSK), Zoom (ZM), Accenture (ACN), and others. Do not be as short-sighted as Mr. Market.

Capital Expenditure To Cash From Operations

Furthermore, Meta’s capital expenditure investments in data centers and Reality Labs are still relatively moderate thus far, compared to other Cloud/ e-commerce peers such as AMZN, though naturally elevated compared to GOOG and MSFT.

In the meantime, we are not concerned about this level of investment at all, since the company continues to report a robust FCF generation of $26.4B in the LTM, against AMZN’s -$26.32B, GOOG’s $62.54B, and MSFT’s $63.33B at the same time. Even with such impressive numbers, the latter two could not escape the ongoing massacre with a -42.45% and -36% stock plunge YTD, respectively. Tragic, since we expect Meta’s ambitious expansion during the recession to pay off tremendously well, once macroeconomics recover and market sentiments improve.

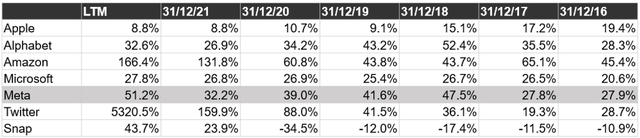

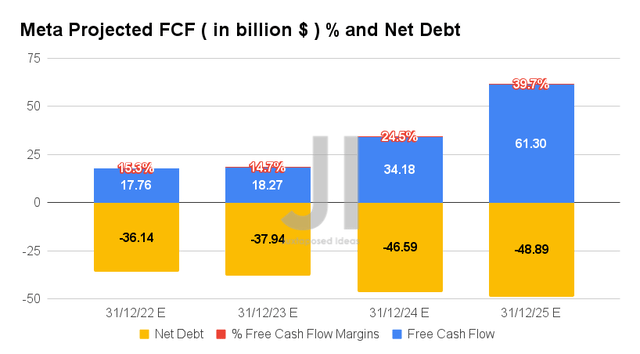

3. Its FCF Profitability Will Improve

Meta is expected to report adj. revenue and adj. net income growth at a CAGR of 13.9% and 3.6%, respectively, between FY2019 and FY2025. And as seen by the destruction of its stock price, the company’s forward execution has also been massively downgraded by -22.35% now. I suppose some of the discounts are warranted, since its EBIT/ net income margins are expected to deteriorate further, from 41%/34.8% in FY2019, 39.6%/33.4% in FY2021, and to 24.1%/19.7% in FY2025.

Thereby, naturally explaining the deceleration of Meta’s FY2025 EPS of $12.12 at a CAGR of -10.1% through the next four years, against FY2019 EPS of $8.56 at a pre-pandemic CAGR of 26.5% and FY2021 EPS of $13.77 at pandemic CAGR of 26.8%.

On the other hand, Meta is expected to report a massive YoY jump in FCF generation by 87.08% in FY2024, once expenses normalize and advertising dollars return in full drove. Investors should also note the sustained improvement in its FCF profitability, from margins of 30% in FY2019, 33.2% in FY2021, and finally to 39.7% in FY2025. Thereby, reducing the company’s need for debt reliance from FY2024 onwards.

And in case anyone forgot, AAPL recently reported an eye-watering sum of $98.95B in long-term debts and $2.93B in annual interest expenses during its recent FQ4’22 earnings call. These numbers have been growing by 7.78% and 6.15% since FQ3’19, while its net debts continue to increase by 62.57% to -$36.62B and cash/ short-term investments further decline by -51.96% at the same time. Thereby, indicating AAPL’s increased reliance on debts and declining liquidity over the past three years.

So really, why should anyone bash Meta’s measly sum of $10B debts reported in FQ3’22? Especially, given its impressive FCF adjusted CAGR of 19.3% between FY2019 and FY2025. In the meantime, we encourage you to read our previous article on Meta, which would help you better understand its position and market opportunities.

- Meta Platforms: Absolute Carnage – No Floor Visible

So, Is Meta Stock A Buy, Sell, or Hold?

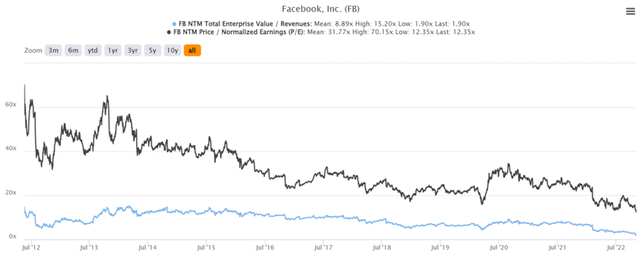

Meta 10Y EV/Revenue and P/E Valuations

Meta is currently trading at an EV/NTM Revenue of 1.90x and NTM P/E of 12.35x, at its all-time 10Y lows. The stock is also trading at $88.91, down -74.87% from its 52 weeks high of $353.83, nearing its 52 weeks low of $88.41. Nonetheless, consensus estimates remain bullish about Meta’s prospects, given their price target of $153.85 and a 73.04% upside from current prices.

Meta 10Y Stock Price

It is evident that there is no clear floor and support here. The Meta stock continued to plummet drastically by -31.51% after its FQ3’22 earnings call, significantly worsened by the pessimistic market sentiments.

The latter is attributed to the unfortunate hawkish reversal of Feds’ rumored pivot after Bank of Canada‘s earlier-than-expected 50 basis points hike. Early signs are already pointing to a similarly elevated inflation rate for October, triggering painful October and November CPI/PPI results ahead. As 48% of analysts expect another 75 basis points hike in the Fed’s December meeting, we can rest assured of more pain ahead. Terminal rates are already tentatively raised to 5.14% for June 2023, indicating another 50 basis point hike for the Feds’ February 2023 meeting.

Combined with the Meta management’s gloomy guidance through 2023, it is easy to surmise that Meta may further fall to $70s over the next two months. Bottom-fishing investors would be well advised to wait a little longer and load up at that time. However, we are choosing to nibble at these levels, since most of the pessimism is already baked in. Naturally, one should also be willing to weather some moderate volatility ahead, for the next decade’s portfolio growth.

Be the first to comment